As Jet Airways continue to face severe financial problems, Air India said Friday it would not accept any passengers that have got cancelled tickets of the former airline.

After Air India, now British airline Vistara has said that it will not accept Jet Airways flyers whose tickets have been cancelled. According to a report in Business Standard, Air India and Vistara have terminated ‘flight interruption manifest (FIM) agreement’ and interline ticketing agreement facility, respectively, with the airline.

An FIM is a document issued by an airline as a substitute ticket which allows a passenger to fly by another airline in case the original travel is disrupted by a schedule change, overbooking or cancellation.

As Jet Airways continue to face severe financial problems, Air India said Friday it would not accept any passengers that have got cancelled tickets of the former airline.

Generally, when an airline cancels a flight due to some exigencies, other airlines accommodate the former's passengers in their flights. The airline, which has got its flight cancelled, has to pay other airlines for passengers accommodated.

"With immediate effect and till further notice, Jet Airways (India) Limited and Jet Lite Limited documents (including FIM and endorsed/involuntary rerouted/rebooked/exchanged/reissuedocuments) are not to be accepted for travel on Air India flights," said an order of Air India dated March 1. FIM stands for Flight Interruption Manifest. Around 15 aircraft of Jet Airways have been grounded by the lessors due to non-payment.

Jet Airways is trying to raise funds for its operations as it has a debt of around Rs 8,200 crore currently.

Moreover, its pilots have been threatening action as there have been delays in salary payment.

Meanwhile, Jet Airways lenders are meeting on Thursday to vote on a resolution plan that will see lenders holding 51% stake in the airline as part of the debt gets converted into equity in the first stage of restructuring exercise to rescue the cash-strapped airline, a senior banker familiar with the development said.

In the second stage, the lenders' stake will come down to about 30% after the right issue of Rs 3,000 crore, which will see Etihad's stake going up to 40% and Naresh Goyal's shareholding falling to 22%. "But Goyal will also continue to have management control in the airline," said a banker.

The lenders' meet follows the extraordinary general meeting (EGM) of the airline on February 21, which discussed and passed resolutions allowing banks to acquire a majority stake. However, shareholders complain that the restructuring package was not discussed in detail.

![submenu-img]() Swara Bhasker reacts to Kangana Ranaut slap incident, says actress-politician used Twitter to 'justify violence'

Swara Bhasker reacts to Kangana Ranaut slap incident, says actress-politician used Twitter to 'justify violence'![submenu-img]() Wayanad or Raebareli? Congress Leader Rahul Gandhi likely to decide on Monday

Wayanad or Raebareli? Congress Leader Rahul Gandhi likely to decide on Monday![submenu-img]() PM Modi to flag off 2 new Vande Bharat trains on this date, check route, timetable, and other details

PM Modi to flag off 2 new Vande Bharat trains on this date, check route, timetable, and other details![submenu-img]() Manipur: Major fire breaks out in abandoned building near CM Biren Singh's residence

Manipur: Major fire breaks out in abandoned building near CM Biren Singh's residence![submenu-img]() Fixed deposits: Which bank is offering highest FD interest rates post RBI's new guidelines?

Fixed deposits: Which bank is offering highest FD interest rates post RBI's new guidelines?![submenu-img]() Meet MIT graduate who secured 42nd rank in UPSC, is now suspended due to..

Meet MIT graduate who secured 42nd rank in UPSC, is now suspended due to..![submenu-img]() Railway Recruitment 2024: Sarkari Naukri alert for 1104 posts, check eligibility and selection process

Railway Recruitment 2024: Sarkari Naukri alert for 1104 posts, check eligibility and selection process![submenu-img]() NEET-UG exam row: 'Transparent process will be...,' assures Education Minister Dharmendra Pradhan to students, parents

NEET-UG exam row: 'Transparent process will be...,' assures Education Minister Dharmendra Pradhan to students, parents![submenu-img]() Meet man, a tailor's son from Latur, who cracked four competitive exams, aims to become...

Meet man, a tailor's son from Latur, who cracked four competitive exams, aims to become...![submenu-img]() Meet woman who was once a sweeper, single mother, cleared civil services exam to become SDM, now arrested due to...

Meet woman who was once a sweeper, single mother, cleared civil services exam to become SDM, now arrested due to...![submenu-img]() DNA Verified: Did Kangana Ranaut party with gangster Abu Salem? Actress reveals who's with her in viral photo

DNA Verified: Did Kangana Ranaut party with gangster Abu Salem? Actress reveals who's with her in viral photo![submenu-img]() DNA Verified: New Delhi Railway Station to be closed for 4 years? Know the truth here

DNA Verified: New Delhi Railway Station to be closed for 4 years? Know the truth here![submenu-img]() DNA Verified: Did RSS chief Mohan Bhagwat praise Congress during Lok Sabha Elections 2024? Know the truth here

DNA Verified: Did RSS chief Mohan Bhagwat praise Congress during Lok Sabha Elections 2024? Know the truth here![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() In pics: Raghubir Yadav, Chandan Roy celebrate success of Panchayat season 3 with TVF founder Arunabh Kumar, cast, crew

In pics: Raghubir Yadav, Chandan Roy celebrate success of Panchayat season 3 with TVF founder Arunabh Kumar, cast, crew![submenu-img]() How Kalki 2898 AD makers dared to dream pan-India with its unique promotional campaign for Prabhas-starrer

How Kalki 2898 AD makers dared to dream pan-India with its unique promotional campaign for Prabhas-starrer![submenu-img]() In pics: Prabhas' robotic car Bujji from Kalki 2898 AD takes over Mumbai streets, fans call it 'India's Batmobile'

In pics: Prabhas' robotic car Bujji from Kalki 2898 AD takes over Mumbai streets, fans call it 'India's Batmobile'![submenu-img]() Streaming This Week: Bade Miyan Chote Miyan, Maidaan, Gullak season 4, latest OTT releases to binge-watch

Streaming This Week: Bade Miyan Chote Miyan, Maidaan, Gullak season 4, latest OTT releases to binge-watch![submenu-img]() Lok Sabha Elections 2024 Result: From Smriti Irani to Mehbooba Mufti, these politicians are trailing in their seats

Lok Sabha Elections 2024 Result: From Smriti Irani to Mehbooba Mufti, these politicians are trailing in their seats![submenu-img]() DNA Explainer: What is Kafala system that is prevalent in gulf countries? Why is it considered extremely brutal?

DNA Explainer: What is Kafala system that is prevalent in gulf countries? Why is it considered extremely brutal? ![submenu-img]() Lok Sabha Elections 2024: What are exit polls? When and how are they conducted?

Lok Sabha Elections 2024: What are exit polls? When and how are they conducted?![submenu-img]() DNA Explainer: Why was Iranian president Ebrahim Raisi seen as possible successor to Ayatollah Khamenei?

DNA Explainer: Why was Iranian president Ebrahim Raisi seen as possible successor to Ayatollah Khamenei?![submenu-img]() DNA Explainer: Why did deceased Iranian President Ebrahim Raisi wear black turban?

DNA Explainer: Why did deceased Iranian President Ebrahim Raisi wear black turban?![submenu-img]() Iran President Ebrahim Raisi's death: Will it impact gold, oil prices and stock markets?

Iran President Ebrahim Raisi's death: Will it impact gold, oil prices and stock markets?![submenu-img]() Swara Bhasker reacts to Kangana Ranaut slap incident, says actress-politician used Twitter to 'justify violence'

Swara Bhasker reacts to Kangana Ranaut slap incident, says actress-politician used Twitter to 'justify violence'![submenu-img]() Shah Rukh Khan took only Re 1 signing amount for this cult film, gave bulk dates to director, later rejected it for..

Shah Rukh Khan took only Re 1 signing amount for this cult film, gave bulk dates to director, later rejected it for..![submenu-img]() Made in Rs 9 crore, this film became blockbuster, was rejected by six actresses, won three National Awards, earned...

Made in Rs 9 crore, this film became blockbuster, was rejected by six actresses, won three National Awards, earned...![submenu-img]() 'Audience ko drama..': Shiv Shakti star Ram Yashvardhan on creative liberties taken in mythological series, films

'Audience ko drama..': Shiv Shakti star Ram Yashvardhan on creative liberties taken in mythological series, films![submenu-img]() Not Parveen Babi, Zeenat, Sharmila, Neetu, only Bollywood actress to attend Amitabh Bachchan-Jaya's wedding was...

Not Parveen Babi, Zeenat, Sharmila, Neetu, only Bollywood actress to attend Amitabh Bachchan-Jaya's wedding was...![submenu-img]() Stolen Titian Renaissance painting found at London bus stop, set to sell for up to..

Stolen Titian Renaissance painting found at London bus stop, set to sell for up to..![submenu-img]() Student fails Physics, Chemistry in class 12th, tops NEET 2024 exam; candidate’s scorecard goes viral

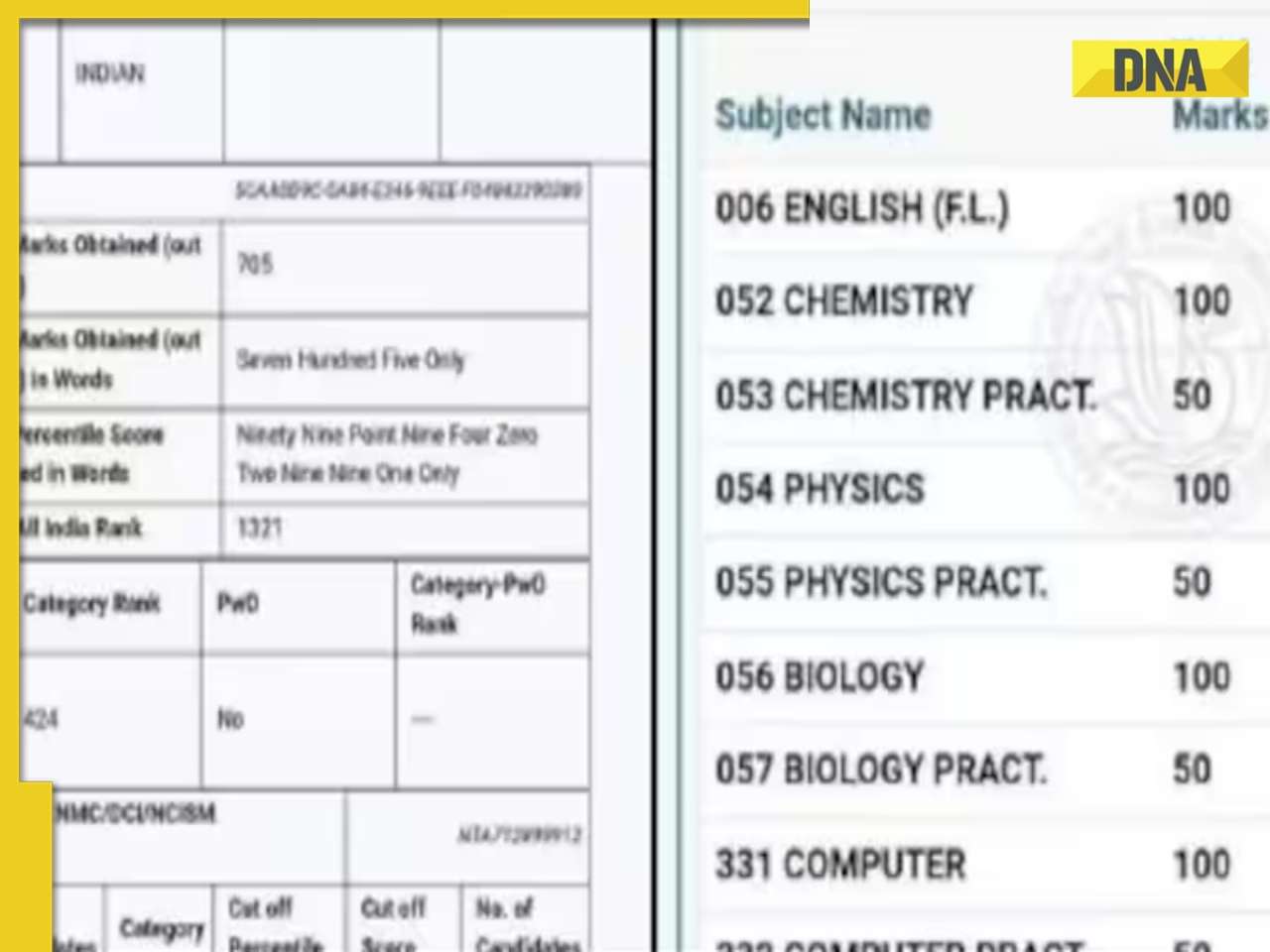

Student fails Physics, Chemistry in class 12th, tops NEET 2024 exam; candidate’s scorecard goes viral![submenu-img]() Watch viral video: Italy's PM Giorgia Meloni posts video with PM Modi with 'Melodi' reference

Watch viral video: Italy's PM Giorgia Meloni posts video with PM Modi with 'Melodi' reference![submenu-img]() Girl shocks internet by eating snake like snack in viral video, watch

Girl shocks internet by eating snake like snack in viral video, watch![submenu-img]() Brave or foolhardy? Woman bathes jaguar with pipe, video goes viral

Brave or foolhardy? Woman bathes jaguar with pipe, video goes viral

)

)

)

)

)

)

)