CHARGING AHEAD: In fact, the company expects lubricants demand to peak over the next 20 years from now

Castrol India, the automotive lubricant manufacturing company, sees no threat from the electric vehicle (EV) segment to its growth, and expect lubricants demand to peak over the next 20 years from now.

"We believe EV adoption will be faster in some segments of buses, auto rickshaws and bikes. But, as per our estimates, even with the efforts that the government is undertaking it will take time to build up. In fact, based on our analysis, we believe the lubricants demand will continue to grow and it will peak after about 20 years from now," Castrol India vice president marketing Kedar Apte told DNA Money.

"There is enough opportunity to leverage brand Castrol to ensure we are relevant even in the EV world," said Apte.

We cater to the number of vehicles that are there on the roads, not what you see the number of vehicles sold, he said. "An average life of a vehicle is about 10 years and in some cases, even 15 years. So those vehicles are going to be there on the road anyway. We cater to the population of vehicles, not just new sales."

By 2040, there could be around 350 million electric vehicles on the road globally, according to estimates. The Indian government, along with the industry, is moving fast on the adoption of EVs across the country, due to alarming levels of pollution in major cities. According to a Niti Aayog report, India could realise EV sales penetration of 30% of private cars, 70% of commercial cars, 40% of buses and 80% of two and three-wheelers by 2030.

By 2040, there could be around 350 million electric vehicles on the road globally, according to estimates. The Indian government, along with the industry, is moving fast on the adoption of EVs across the country, due to alarming levels of pollution in major cities. According to a Niti Aayog report, India could realise EV sales penetration of 30% of private cars, 70% of commercial cars, 40% of buses and 80% of two and three-wheelers by 2030.

Castrol India is part of the UK-based firm BP. Globally, BP has invested in a slew of companies catering to EV infrastructure and new technologies.

"We are exploring opportunities in the EV segment to support the growth in demand. Central to this is the provision of a fast and convenient charging network. We are investing in new technologies and infrastructure solutions. Globally, the company has over 6,500 charging points across the UK," Apte added.

Globally, BP is looking at implications of EV in our industry and they have made some strategic investments already. BP has acquired the UK's largest electric charging network, which is run by BP Chargemaster. Besides, BP has also invested in Storedot to support their development of ultra-fast battery charging, which could reduce the time it takes to recharge an EV battery to five minutes, FreeWire whose mobile rapid EV charging technology was piloted successfully at a UK retail site and PowerShare, China's leading EV charging platforms.

BP is looking at several such projects including in India to ensure that we are ready, he said. Even hybrid vehicles need some fluids, and the complete electric vehicles also need some fluids like coolants in which we are already present in those categories. Also, EVs would need batteries, charging infrastructure.

In India, Castrol has about 19-20% market share in the lubricants market. It is seeing a faster growth in personal mobility segment -- two-wheelers and cars -- which is growing at 6-10%. While the commercial category is still growing, the lubricant consumption actually comes down when an old truck is replaced by a new one because of better technology, which is why that segment of the market is growing by 2-4%, he said.

![submenu-img]() DNA TV Show: What will UP CM Yogi Adityanath discuss with RSS chief Mohan Bhagwat in Gorakhpur?

DNA TV Show: What will UP CM Yogi Adityanath discuss with RSS chief Mohan Bhagwat in Gorakhpur?![submenu-img]() Actor Darshan case: Accused offered Rs 1 crore to officials to hide cause of death, wanted to prove...

Actor Darshan case: Accused offered Rs 1 crore to officials to hide cause of death, wanted to prove...![submenu-img]() This director never came to set, tore up script, fought crew, film was pulled from theatres after just one day because..

This director never came to set, tore up script, fought crew, film was pulled from theatres after just one day because..![submenu-img]() Former champions Pakistan crash out of T20 World Cup 2024, USA qualify for Super 8

Former champions Pakistan crash out of T20 World Cup 2024, USA qualify for Super 8![submenu-img]() Who is Darshan? Kannada star arrested for killing fan; called 'demigod' by fans, was earlier jailed for domestic abuse

Who is Darshan? Kannada star arrested for killing fan; called 'demigod' by fans, was earlier jailed for domestic abuse![submenu-img]() Meet woman who was once a sweeper, single mother, cleared civil services exam to become SDM, now arrested due to...

Meet woman who was once a sweeper, single mother, cleared civil services exam to become SDM, now arrested due to...![submenu-img]() Dr Vivek Bindra spoke in favor of NEET students, now the Supreme Court has also ordered a re-test

Dr Vivek Bindra spoke in favor of NEET students, now the Supreme Court has also ordered a re-test![submenu-img]() NEET 2024 re-exam notification released, exam to be conducted on...

NEET 2024 re-exam notification released, exam to be conducted on... ![submenu-img]() Bihar NET-UG Paper Leak: Burnt papers, post-dated cheques, Rs 32 lakh, why is NTA silent over these?

Bihar NET-UG Paper Leak: Burnt papers, post-dated cheques, Rs 32 lakh, why is NTA silent over these?![submenu-img]() Meet woman, a Phd holder who cracked UPSC exam with AIR 6 without coaching in 2nd attempt, but didn’t became IAS due to…

Meet woman, a Phd holder who cracked UPSC exam with AIR 6 without coaching in 2nd attempt, but didn’t became IAS due to…![submenu-img]() DNA Verified: Did Kangana Ranaut party with gangster Abu Salem? Actress reveals who's with her in viral photo

DNA Verified: Did Kangana Ranaut party with gangster Abu Salem? Actress reveals who's with her in viral photo![submenu-img]() DNA Verified: New Delhi Railway Station to be closed for 4 years? Know the truth here

DNA Verified: New Delhi Railway Station to be closed for 4 years? Know the truth here![submenu-img]() DNA Verified: Did RSS chief Mohan Bhagwat praise Congress during Lok Sabha Elections 2024? Know the truth here

DNA Verified: Did RSS chief Mohan Bhagwat praise Congress during Lok Sabha Elections 2024? Know the truth here![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() How Kalki 2898 AD makers dared to dream pan-India with its unique promotional campaign for Prabhas-starrer

How Kalki 2898 AD makers dared to dream pan-India with its unique promotional campaign for Prabhas-starrer![submenu-img]() In pics: Prabhas' robotic car Bujji from Kalki 2898 AD takes over Mumbai streets, fans call it 'India's Batmobile'

In pics: Prabhas' robotic car Bujji from Kalki 2898 AD takes over Mumbai streets, fans call it 'India's Batmobile'![submenu-img]() Streaming This Week: Bade Miyan Chote Miyan, Maidaan, Gullak season 4, latest OTT releases to binge-watch

Streaming This Week: Bade Miyan Chote Miyan, Maidaan, Gullak season 4, latest OTT releases to binge-watch![submenu-img]() Lok Sabha Elections 2024 Result: From Smriti Irani to Mehbooba Mufti, these politicians are trailing in their seats

Lok Sabha Elections 2024 Result: From Smriti Irani to Mehbooba Mufti, these politicians are trailing in their seats![submenu-img]() Lok Sabha Elections 2024: 6 states with highest number of seats

Lok Sabha Elections 2024: 6 states with highest number of seats![submenu-img]() DNA Explainer: What is Kafala system that is prevalent in gulf countries? Why is it considered extremely brutal?

DNA Explainer: What is Kafala system that is prevalent in gulf countries? Why is it considered extremely brutal? ![submenu-img]() Lok Sabha Elections 2024: What are exit polls? When and how are they conducted?

Lok Sabha Elections 2024: What are exit polls? When and how are they conducted?![submenu-img]() DNA Explainer: Why was Iranian president Ebrahim Raisi seen as possible successor to Ayatollah Khamenei?

DNA Explainer: Why was Iranian president Ebrahim Raisi seen as possible successor to Ayatollah Khamenei?![submenu-img]() DNA Explainer: Why did deceased Iranian President Ebrahim Raisi wear black turban?

DNA Explainer: Why did deceased Iranian President Ebrahim Raisi wear black turban?![submenu-img]() Iran President Ebrahim Raisi's death: Will it impact gold, oil prices and stock markets?

Iran President Ebrahim Raisi's death: Will it impact gold, oil prices and stock markets?![submenu-img]() Actor Darshan case: Accused offered Rs 1 crore to officials to hide cause of death, wanted to prove...

Actor Darshan case: Accused offered Rs 1 crore to officials to hide cause of death, wanted to prove...![submenu-img]() This director never came to set, tore up script, fought crew, film was pulled from theatres after just one day because..

This director never came to set, tore up script, fought crew, film was pulled from theatres after just one day because..![submenu-img]() Who is Darshan? Kannada star arrested for killing fan; called 'demigod' by fans, was earlier jailed for domestic abuse

Who is Darshan? Kannada star arrested for killing fan; called 'demigod' by fans, was earlier jailed for domestic abuse![submenu-img]() Raveena Tandon sends defamation notice to man who shared her 'fake' road rage video

Raveena Tandon sends defamation notice to man who shared her 'fake' road rage video![submenu-img]() Drashti Dhami announces pregnancy after nine years of marriage, shares hilarious video with husband Niraj Khemka

Drashti Dhami announces pregnancy after nine years of marriage, shares hilarious video with husband Niraj Khemka![submenu-img]() In latest gaffe, US President Joe Biden salutes Italian PM Meloni at G7 Summit, watch viral video

In latest gaffe, US President Joe Biden salutes Italian PM Meloni at G7 Summit, watch viral video![submenu-img]() 'My tax is for the nation's development, not for free distribution': Why is this slogan trending on social media?

'My tax is for the nation's development, not for free distribution': Why is this slogan trending on social media?![submenu-img]() Mukesh Ambani's guest list for Anant-Radhika’s 2nd pre-wedding bash had family, friends and..

Mukesh Ambani's guest list for Anant-Radhika’s 2nd pre-wedding bash had family, friends and..![submenu-img]() Viral video: Influencer faces backlash for dancing to Bollywood song at Kolkata airport, watch

Viral video: Influencer faces backlash for dancing to Bollywood song at Kolkata airport, watch![submenu-img]() Vet monitors lion's heart rate using Apple watch, video goes viral

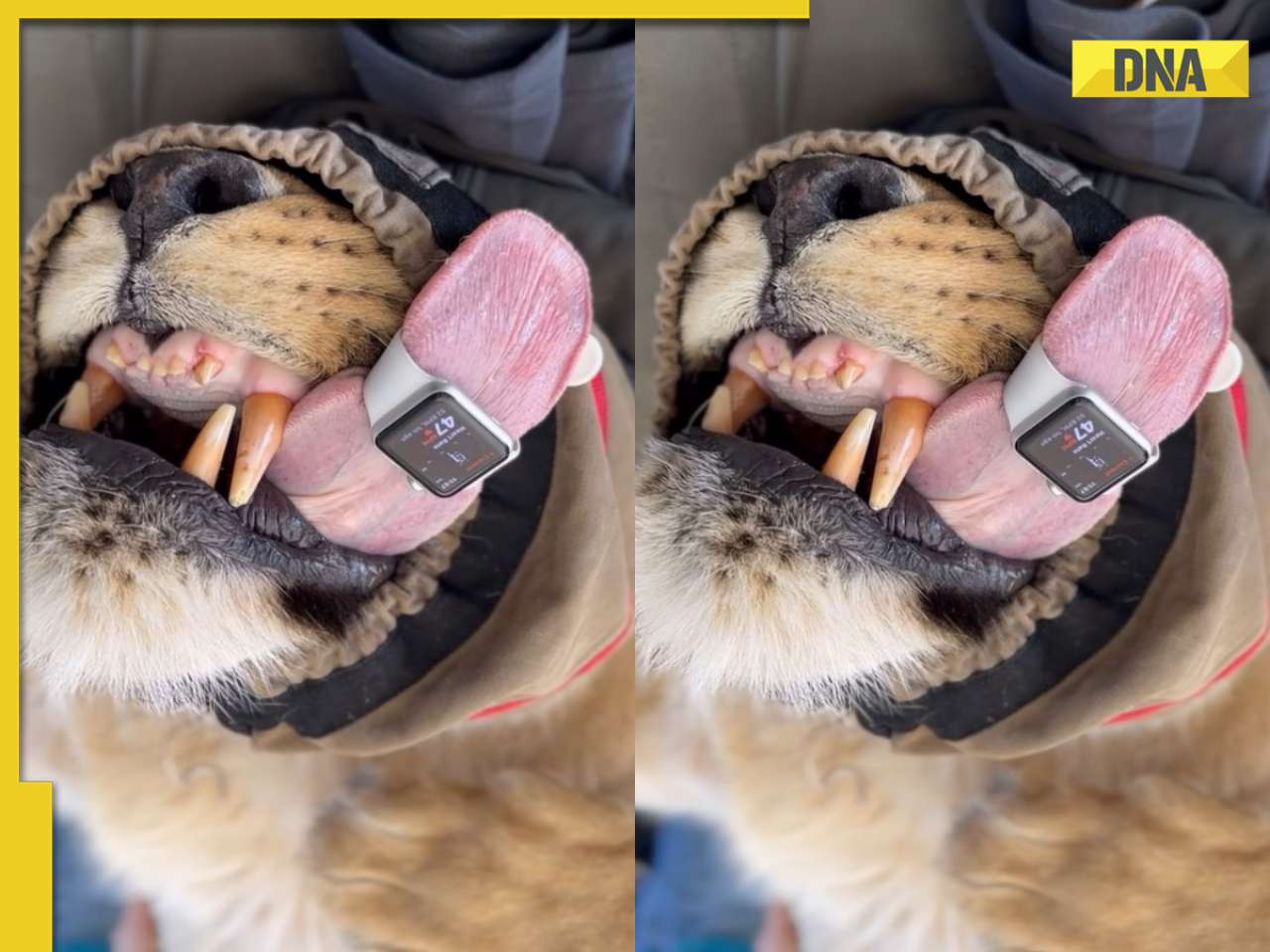

Vet monitors lion's heart rate using Apple watch, video goes viral

)

) By 2040, there could be around 350 million electric vehicles on the road globally, according to estimates. The Indian government, along with the industry, is moving fast on the adoption of EVs across the country, due to alarming levels of pollution in major cities. According to a Niti Aayog report, India could realise EV sales penetration of 30% of private cars, 70% of commercial cars, 40% of buses and 80% of two and three-wheelers by 2030.

By 2040, there could be around 350 million electric vehicles on the road globally, according to estimates. The Indian government, along with the industry, is moving fast on the adoption of EVs across the country, due to alarming levels of pollution in major cities. According to a Niti Aayog report, India could realise EV sales penetration of 30% of private cars, 70% of commercial cars, 40% of buses and 80% of two and three-wheelers by 2030.

)

)

)

)

)

)