The idea behind Shop-cum-Office (SCOs) is to make everything available under one roof. For eg- department stores, offices, restaurants, etc.

The idea behind SCOs is to make everything available under one roof. The presence of SCOs has increased public convenience by allowing people to access a variety of daily necessities like department stores, offices, restaurants, and retail establishments all in one location. A study demonstrated that the market has become the most alluring investment opportunity at the moment, with major real estate players launching numerous projects.

According to a research by Gurugram-based real estate advisory firm 360 Realtors, the number of new launches in the Shop-cum-Offices (SCOs) segment has increased by 30 to 40% over the past 12 years. SCOs are marketed as the only real estate class profitable even during the pandemic period.

Ankit Kansal, founder and MD, 360 Realtors, said that the segment is a big-ticket investment and its profitability can be gauged by the fact that the category is growing at a rate of 30-40% annually in terms of area.

The study stated that the investment in the segment can promise an annual appreciation yield of up to 25% which means in the next four years the capital value can double. The rental yield is also around 5-6% which can ensure an additional stream of recurrent income.

"Ensuring maximum utilisation of area whereas investors get elevated yields is the key,” Ankit said.

“The local public also loves the idea of SCOs as everything is available under one roof. One can access grocery stores & departmental stores, high street retail, fine dine, nightclubs, gadget stores, and so many facilities in a single space," he said. "Likewise, there are offices, banks, health & dental care, gyms, fitness studios, gyms, and other facilities available, which makes SCOs a very convenient proposition.”

SCOs plot sizes differ from 2.5 acres to 17 acres depending upon the type and demand of investors and have garnered considerable attention from the F&B sector.

Shop-cum-offices, according to Spaze Group director Harpal Singh Chawla, are the real estate markets' best bets right now. Having a benefit that serves two purposes is preferable to putting all of your eggs in one basket.

"SCOs are the most bankable form of investment which promises far better returns than single-commercial use buildings. It has fared well during the pandemic period and continues its golden run in the money markets," he said.

SCOs are developing in a number of Gurugram's economically viable and central locations, according to Robin Pahuja, director of Elite PRO, who also noted that the large-scale investments in the sector reflect the confidence of both investors and developers. Plots in SCOs are being introduced by developers for investments ranging from Rs 500 to Rs 2,000 crores.

The market will undoubtedly draw a sizable number of people and increase investor interest. Developers are being pushed to raise the stakes and break out in the new experimental real estate class due to the high investment potential and favourable returns.

![submenu-img]() Hansal Mehta reacts to Sahara Group calling his series Scam 2010 The Subrata Roy Saga 'abusive act, cheap publicity'

Hansal Mehta reacts to Sahara Group calling his series Scam 2010 The Subrata Roy Saga 'abusive act, cheap publicity'![submenu-img]() Meet actor, who was once Aamir, Shah Rukh's rival, never became superstar, worked as hotel manager, is now...

Meet actor, who was once Aamir, Shah Rukh's rival, never became superstar, worked as hotel manager, is now...![submenu-img]() 9 killed, 24 injured as bus catches fire in Haryana's Nuh

9 killed, 24 injured as bus catches fire in Haryana's Nuh![submenu-img]() Meet actress who started career with Ranveer, Deepika, is married to man with Rs 53,800 crore net worth, husband is..

Meet actress who started career with Ranveer, Deepika, is married to man with Rs 53,800 crore net worth, husband is..![submenu-img]() Taarak Mehta actor Gurucharan Singh returns home almost a month after going missing, says ‘left worldly life for...'

Taarak Mehta actor Gurucharan Singh returns home almost a month after going missing, says ‘left worldly life for...'![submenu-img]() Meet IIT graduates, three friends who were featured in Forbes 30 Under 30 Asia list, built AI startup, now…

Meet IIT graduates, three friends who were featured in Forbes 30 Under 30 Asia list, built AI startup, now…![submenu-img]() Meet woman who cracked UPSC in fourth attempt to become IAS officer, secured AIR...

Meet woman who cracked UPSC in fourth attempt to become IAS officer, secured AIR...![submenu-img]() Meet IIT JEE 2024 all-India girls topper who scored 100 percentile; her rank is…

Meet IIT JEE 2024 all-India girls topper who scored 100 percentile; her rank is…![submenu-img]() Meet PhD wife of IIT graduate hired at Rs 100 crore salary package, was fired within a year, he is now…

Meet PhD wife of IIT graduate hired at Rs 100 crore salary package, was fired within a year, he is now…![submenu-img]() Meet woman not from IIT, IIM or NIT, cracked UPSC exam in first attempt with AIR...

Meet woman not from IIT, IIM or NIT, cracked UPSC exam in first attempt with AIR...![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Sunanda Sharma exudes royalty as she debuts at Cannes Film Festival in anarkali, calls it ‘Punjabi community's victory’

Sunanda Sharma exudes royalty as she debuts at Cannes Film Festival in anarkali, calls it ‘Punjabi community's victory’![submenu-img]() Aishwarya Rai walks Cannes red carpet in bizarre gown made of confetti, fans say 'is this the Met Gala'

Aishwarya Rai walks Cannes red carpet in bizarre gown made of confetti, fans say 'is this the Met Gala'![submenu-img]() In pics: Sobhita Dhulipala looks 'stunning hot' in plum cordelia jumpsuit at Cannes Film Festival, fans call her 'queen'

In pics: Sobhita Dhulipala looks 'stunning hot' in plum cordelia jumpsuit at Cannes Film Festival, fans call her 'queen'![submenu-img]() Udaariyaan takes 15-year leap, these actors join Sargun Mehta, Ravi Dubey-produced show

Udaariyaan takes 15-year leap, these actors join Sargun Mehta, Ravi Dubey-produced show![submenu-img]() In pics: Urvashi Rautela sizzles in red strapless gown at Cannes Film Festival, fans call her 'Disney princess'

In pics: Urvashi Rautela sizzles in red strapless gown at Cannes Film Festival, fans call her 'Disney princess'![submenu-img]() Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?

Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() Hansal Mehta reacts to Sahara Group calling his series Scam 2010 The Subrata Roy Saga 'abusive act, cheap publicity'

Hansal Mehta reacts to Sahara Group calling his series Scam 2010 The Subrata Roy Saga 'abusive act, cheap publicity'![submenu-img]() Meet actor, who was once Aamir, Shah Rukh's rival, never became superstar, worked as hotel manager, is now...

Meet actor, who was once Aamir, Shah Rukh's rival, never became superstar, worked as hotel manager, is now...![submenu-img]() Meet actress who started career with Ranveer, Deepika, is married to man with Rs 53,800 crore net worth, husband is..

Meet actress who started career with Ranveer, Deepika, is married to man with Rs 53,800 crore net worth, husband is..![submenu-img]() Taarak Mehta actor Gurucharan Singh returns home almost a month after going missing, says ‘left worldly life for...'

Taarak Mehta actor Gurucharan Singh returns home almost a month after going missing, says ‘left worldly life for...'![submenu-img]() Netflix's Baby Reindeer fake? Real-life Martha denies claims made in show, calls it 'obscene': ‘Richard Gadd is lying’

Netflix's Baby Reindeer fake? Real-life Martha denies claims made in show, calls it 'obscene': ‘Richard Gadd is lying’![submenu-img]() Do you know which God Parsis worship? Find out here

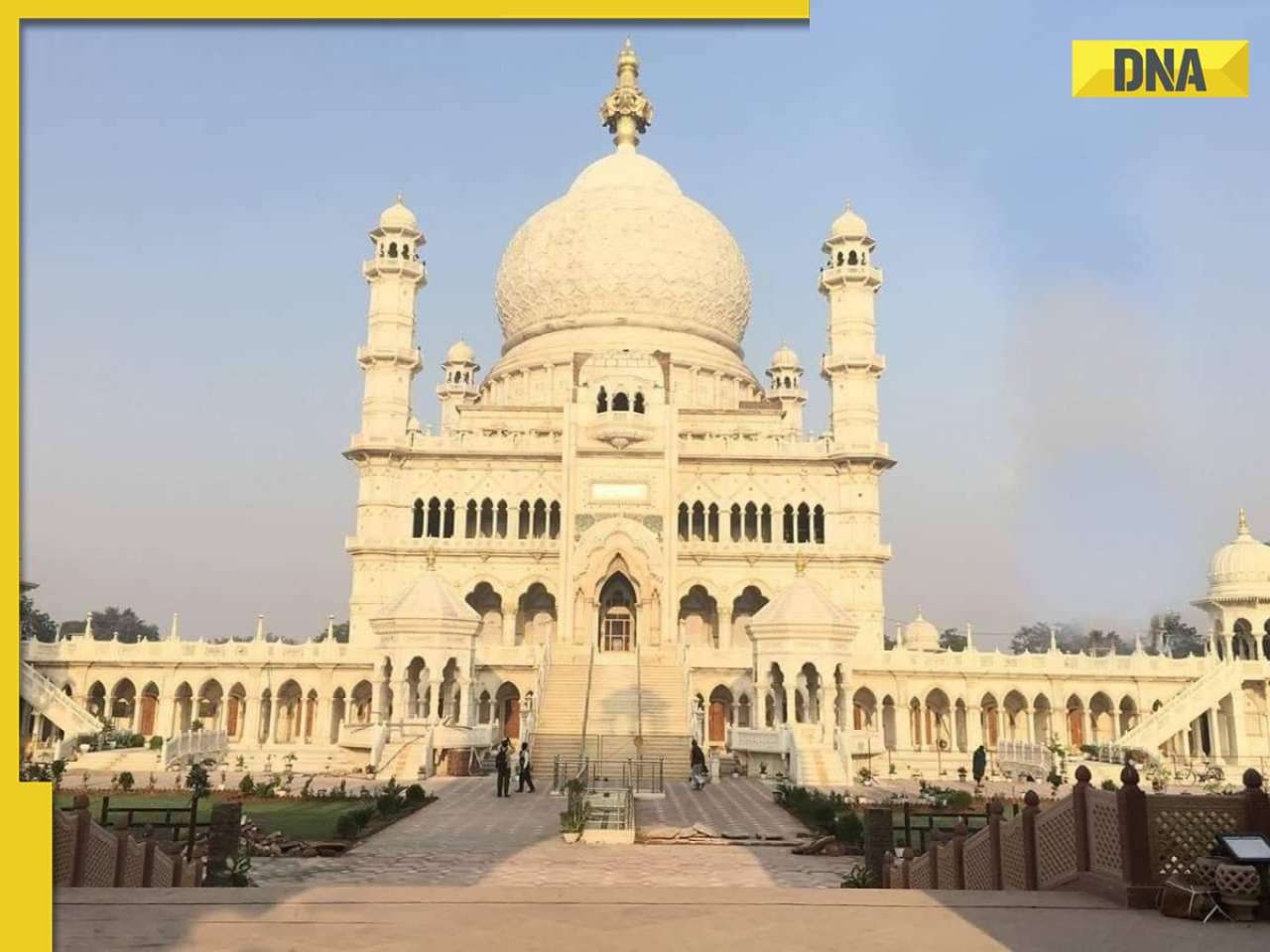

Do you know which God Parsis worship? Find out here![submenu-img]() This white marble structure in Agra, competing with Taj Mahal, took 104 years to complete

This white marble structure in Agra, competing with Taj Mahal, took 104 years to complete![submenu-img]() 'If only we are smart enough...': Narayana Murthy was asked how AI will hurt job prospects

'If only we are smart enough...': Narayana Murthy was asked how AI will hurt job prospects![submenu-img]() Viral video: Gujarat man converts Honda Civic into 'Lamborghini' for just Rs 12.5 lakh, watch

Viral video: Gujarat man converts Honda Civic into 'Lamborghini' for just Rs 12.5 lakh, watch![submenu-img]() Man who disappeared 26 years ago found in neighbour`s cellar, just 100 metres from home

Man who disappeared 26 years ago found in neighbour`s cellar, just 100 metres from home

)

)

)

)

)

)

)