In today's world, our lives depend on systems like this, yet no one knows how vulnerable we are to future attacks and malfunctions, writes Misha Glenny.

The Royal Bank of Scotland rode the storm of chronic financial mismanagement by drawing on the taxpayers' boundless generosity during the banking collapse of 2008. But what billions in bad loans couldn't do, an apparently tiny computer glitch might yet achieve.

Over the next couple of weeks, the bank's senior management will be biting their nails as they wait to see how many of their account holders at NatWest, RBS and Ulster Bank consider pulling their custom. A simple flaw in a routine upgrade seems to have knocked the bank's entire system off-kilter.

Already, there have been reports that doctors in Mexico threatened to turn off a dying girl's life-support because NatWest did not transfer money owed to the hospital looking after her. At least one couple claimed to have seen a house purchase collapse because payment did not go through. Studying my own account, I notice that while money owed to me has not been paid in, cash has still been going out with ruthless efficiency - although I haven't been able to establish whether it has reached its intended recipients.

For more than a decade, the banks have been encouraging us to carry out our business online because it saves them huge costs. If we do the work of administering our savings, they do not need so many branches, nor do they need to pay the tellers and bank managers who used to assist us in managing our money. But if that is the deal, then the banks have one unbreakable rule - they cannot allow their computer systems to fail. RBS just broke that rule, and may yet pay a heavy price.

It is, however, far from alone. In late 2011, and again in May this year, HSBC customers were unable to withdraw cash due to a computer malfunction. And the worrying truth is that almost all the basic infrastructure of our society is now controlled by computers. A similar glitch elsewhere could stop water flowing through our taps, food being delivered to supermarkets, electricity to our houses, or cash to our ATMs.

The NatWest fiasco demonstrates just how fragile this level of dependency on the web and computer networks makes us. It also highlights our lack of what security analysts refer to as "resilience": the ability to adapt to the consequences of a major systems breakdown. This is not just technological but psychological. Last year, I was visiting a major think tank in Washington DC on the same day that BlackBerry's email server went down. I observed an outbreak of collective neurosis as the staff, most of whom had some form of graduate degree, suffered minor breakdowns as a consequence of not being able to check their email every five minutes. Similar behaviour was reported worldwide last week, when Twitter went down for a few hours.

Why are we so vulnerable to such disruption? The very genius of the internet is the fact that it connects everything. But this is also its Achilles' heel. If a car breaks down, it will affect five or six people at most. Yet if the central computer controlling the traffic lights of London goes belly up, an entire city hits gridlock. And these networks are easier to break than you might think.

In 2008, a crackdown by the Pakistan Telecommunication Authority on YouTube, over anti-Islamic videos that were hosted there, resulted in much of the world losing access to the site. The censor had typed in the wrong instructions, and rather than blocking the site sent hundreds of millions of requests for it flooding to Pakistan Telecom's network. Two years later, in 2010, Waddell & Reed Financial of Kansas attempted to execute an algorithmic sale of 75,000 futures contracts on American stock markets, valued at $4.5 billion. Its poorly written instructions triggered havoc, with automated trading systems misinterpreting the trade and wiping 1,000 points off the Dow Jones Industrial Average within minutes.

The real potential for disaster, however, can be seen in three separate events, all of which took place in 2007. In the first, Los Angeles Airport, one of the biggest in the world, seized up after cables supplying the internet to the US Department of Homeland Security burnt out. Twenty thousand passengers were penned into an area between tarmac and immigration for almost 24 hours before technicians were able to identify the cause of the problem.

The same year, Scotland Yard uncovered an al-Qaeda plot to blow up Telehouse in Docklands. This is the main internet hub for the United Kingdom: had the terrorists succeeded, Britain would have suffered a technological heart attack. Indeed, in the third example, that is precisely what happened: hundreds of thousands of computers started "attacking" the network systems of Estonia. ATMs stopped working, along with the country's main media outlets and most of the country's administration. Estonia was in dispute with the Russian government at the time: Russia denied responsibility, even though the hostile computers were traced back there. In the end, Estonia had to cut off its entire internet from the outside world to contain the problem.

Worryingly, rogue viruses and malicious software aimed at disrupting national infrastructures are set to become a standard tool in the military arsenal. Within the past month, US officials have admitted to having developed two major viruses, Stuxnet and Flame, in collaboration with Israel as part of a covert campaign to undermine Iran's nuclear programme. The capacities of criminal gangs and terrorists are less advanced - but having spent much of the past three years discussing computer security with online criminals for my latest book, I know that they still have the capacity to circumvent the cyber-defences of banks and other businesses with ease.

So while I have some sympathy with RBS - because it is incredibly challenging to manage such a complicated system - the bank's misfortune offers us all an important warning. One glaring issue is that the British Government, like all others around the world, has yet to introduce regulation requiring banks and large corporations to report serious failings in, or hacks of, their systems.

Although they may yield to public pressure, RBS's executives are not obliged to reveal the cause of this system meltdown. Indeed, industry and banking are resisting such compulsory reporting precisely because an admission of failure leads to a massive dent in a company's reputation.

One way around this is to insist on anonymous reporting of breaches, so that the government is able to form a much better picture of any problems afflicting our major computer systems in both the private and public sector. But that isn't all we need to be told about. Speaking as one of NatWest's customers, I also want to know whether the bank's IT system is serviced in-house or by an outside contractor. This is critically important, since the computer security industry now recognises that among the top cyber-threats to business is outside contractors maliciously or carelessly allowing viruses into networks, or even stealing data.

Government is already discussing what might happen in the event of an "Advanced Persistent Threat" succeeding - a computer attack or failure whose consequences inflict huge and widespread damage to our economy or infrastructure. But at the moment, neither the state nor the public really knows how vulnerable we are to the attacks or malfunctions to which large computer systems are subject on a daily basis.

This matters, because our lives have become so utterly dependent on such systems. Without a proper debate, we will be left floundering when the next NatWest takes place - and believe me, there will be another NatWest before very long.

Misha Glenny's DarkMarket: How Hackers Became the New Mafia'is published in paperback by Vintage on July 5

![submenu-img]() Three Indian nationals accused of killing Hardeep Singh Nijjar appear in Canadian court amid diplomatic crisis

Three Indian nationals accused of killing Hardeep Singh Nijjar appear in Canadian court amid diplomatic crisis![submenu-img]() Apple iPad Pro with M4 chip and AI capabilities launched in India, price starts at Rs 99900

Apple iPad Pro with M4 chip and AI capabilities launched in India, price starts at Rs 99900![submenu-img]() DNA Exclusive: Inside scoop of Congress' plan to defeat Smriti Irani, retain Amethi

DNA Exclusive: Inside scoop of Congress' plan to defeat Smriti Irani, retain Amethi![submenu-img]() This superstar was in love with Muslim actress, was about to marry her, relationship ruined after death threats from..

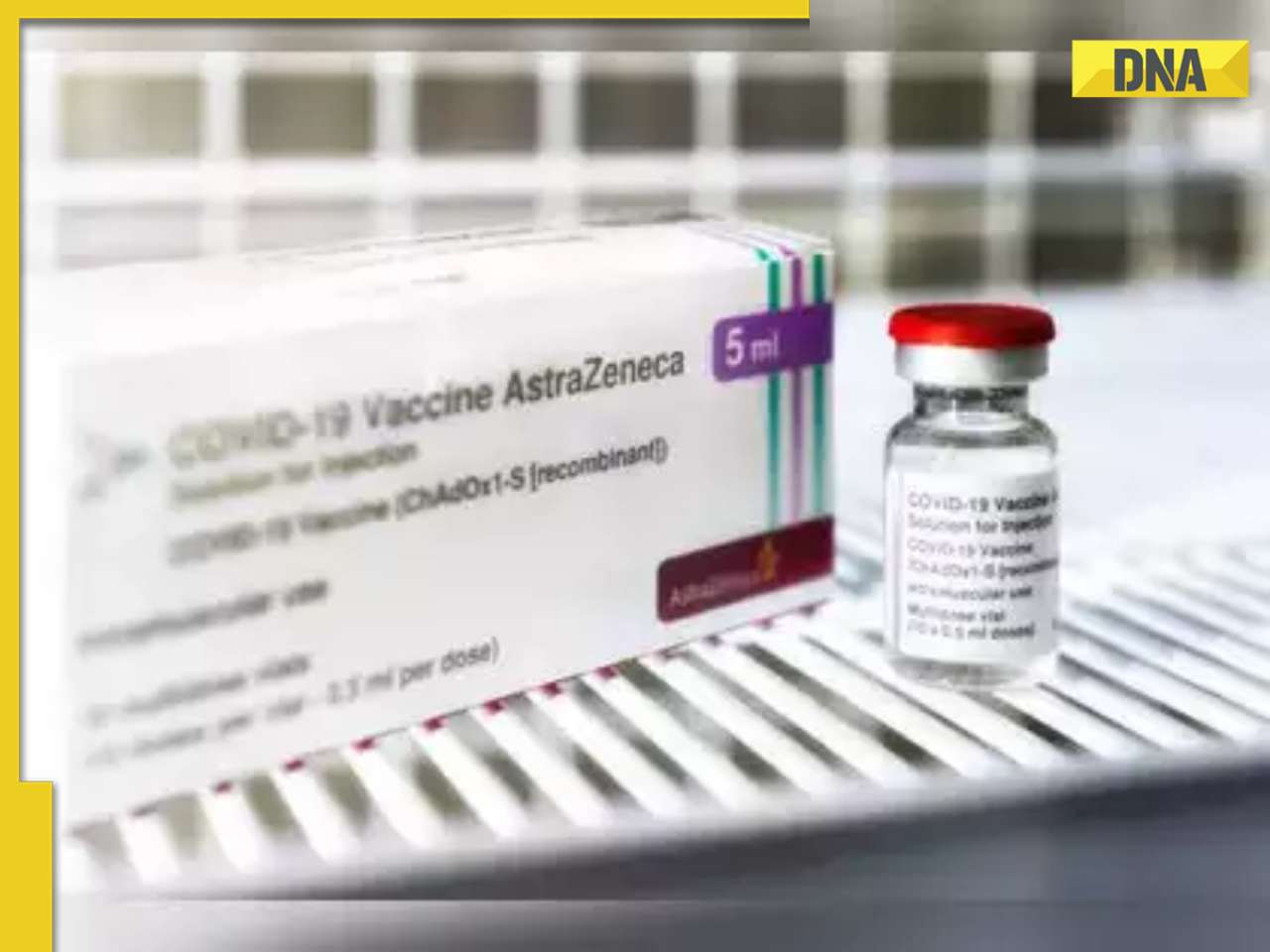

This superstar was in love with Muslim actress, was about to marry her, relationship ruined after death threats from..![submenu-img]() Covishield maker AstraZeneca to withdraw its COVID-19 vaccine globally due to...

Covishield maker AstraZeneca to withdraw its COVID-19 vaccine globally due to...![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

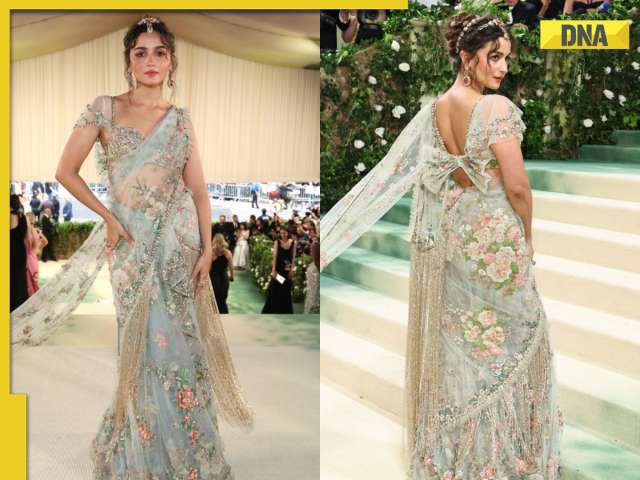

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Alia Bhatt wears elegant saree made by 163 people over 1965 hours to Met Gala 2024, fans call her ‘princess Jasmine’

Alia Bhatt wears elegant saree made by 163 people over 1965 hours to Met Gala 2024, fans call her ‘princess Jasmine’![submenu-img]() Jr NTR-Lakshmi Pranathi's 13th wedding anniversary: Here's how strangers became soulmates

Jr NTR-Lakshmi Pranathi's 13th wedding anniversary: Here's how strangers became soulmates![submenu-img]() Streaming This Week: Heeramandi, Shaitaan, Manjummel Boys, latest OTT releases to binge-watch

Streaming This Week: Heeramandi, Shaitaan, Manjummel Boys, latest OTT releases to binge-watch![submenu-img]() Remember Ayesha Kapur? Michelle from Black, here's how actress, nutrition coach, entrepreneur looks after 19 years

Remember Ayesha Kapur? Michelle from Black, here's how actress, nutrition coach, entrepreneur looks after 19 years![submenu-img]() Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'

Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'![submenu-img]() Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?

Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() This superstar was in love with Muslim actress, was about to marry her, relationship ruined after death threats from..

This superstar was in love with Muslim actress, was about to marry her, relationship ruined after death threats from..![submenu-img]() Meet Madhuri Dixit’s lookalike, who worked with Akshay Kumar, Govinda, quit films at peak of career, is married to…

Meet Madhuri Dixit’s lookalike, who worked with Akshay Kumar, Govinda, quit films at peak of career, is married to… ![submenu-img]() Meet former beauty queen who competed with Aishwarya, made debut with a superstar, quit acting to become monk, is now..

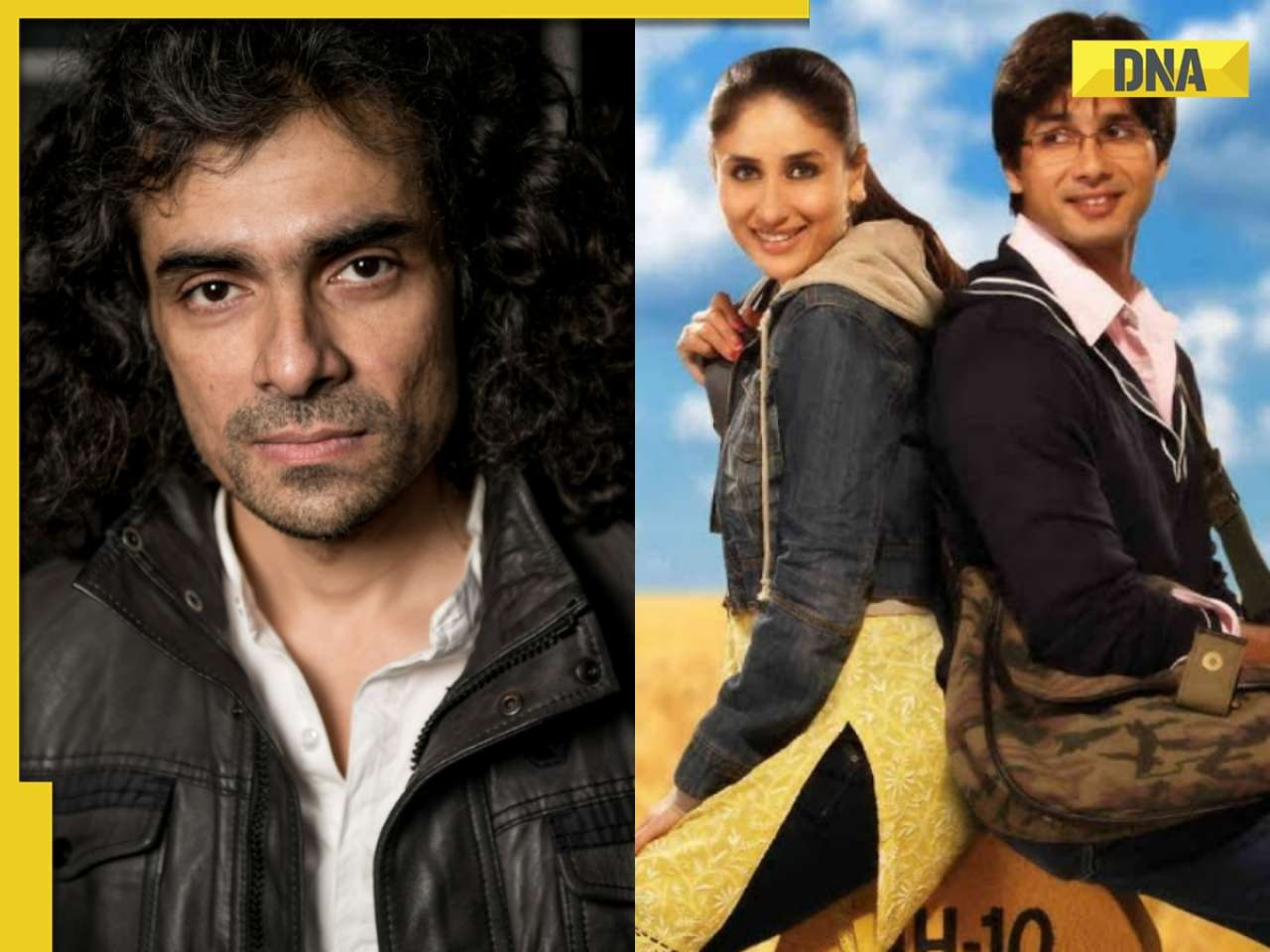

Meet former beauty queen who competed with Aishwarya, made debut with a superstar, quit acting to become monk, is now..![submenu-img]() Imtiaz Ali reveals if Shahid Kapoor, Kareena Kapoor Khan's breakup affected Jab We Met: 'They were...'

Imtiaz Ali reveals if Shahid Kapoor, Kareena Kapoor Khan's breakup affected Jab We Met: 'They were...'![submenu-img]() Meet actor, who was once thrown out of set, beat up cops, then became popular villain; starred in Rs 1000-crore film

Meet actor, who was once thrown out of set, beat up cops, then became popular villain; starred in Rs 1000-crore film![submenu-img]() IPL 2024: Jake Fraser-McGurk, Abishek Porel power DC to 20-run win over RR

IPL 2024: Jake Fraser-McGurk, Abishek Porel power DC to 20-run win over RR![submenu-img]() SRH vs LSG, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

SRH vs LSG, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() IPL 2024: Here’s why CSK star MS Dhoni batted at No.9 against PBKS

IPL 2024: Here’s why CSK star MS Dhoni batted at No.9 against PBKS![submenu-img]() SRH vs LSG IPL 2024 Dream11 prediction: Fantasy cricket tips for Sunrisers Hyderabad vs Lucknow Super Giants

SRH vs LSG IPL 2024 Dream11 prediction: Fantasy cricket tips for Sunrisers Hyderabad vs Lucknow Super Giants![submenu-img]() Watch: Kuldeep Yadav, Yuzvendra Chahal team up for hilarious RR meme, video goes viral

Watch: Kuldeep Yadav, Yuzvendra Chahal team up for hilarious RR meme, video goes viral![submenu-img]() Not Alia Bhatt or Isha Ambani but this Indian CEO made heads turn at Met Gala 2024, she is from...

Not Alia Bhatt or Isha Ambani but this Indian CEO made heads turn at Met Gala 2024, she is from...![submenu-img]() Man makes Lord Hanuman co-litigant in plea, Delhi High Court asks him to pay Rs 100000…

Man makes Lord Hanuman co-litigant in plea, Delhi High Court asks him to pay Rs 100000…![submenu-img]() Four big dangerous asteroids coming toward Earth, but the good news is…

Four big dangerous asteroids coming toward Earth, but the good news is…![submenu-img]() Isha Ambani's Met Gala 2024 saree gown was created in over 10,000 hours, see pics

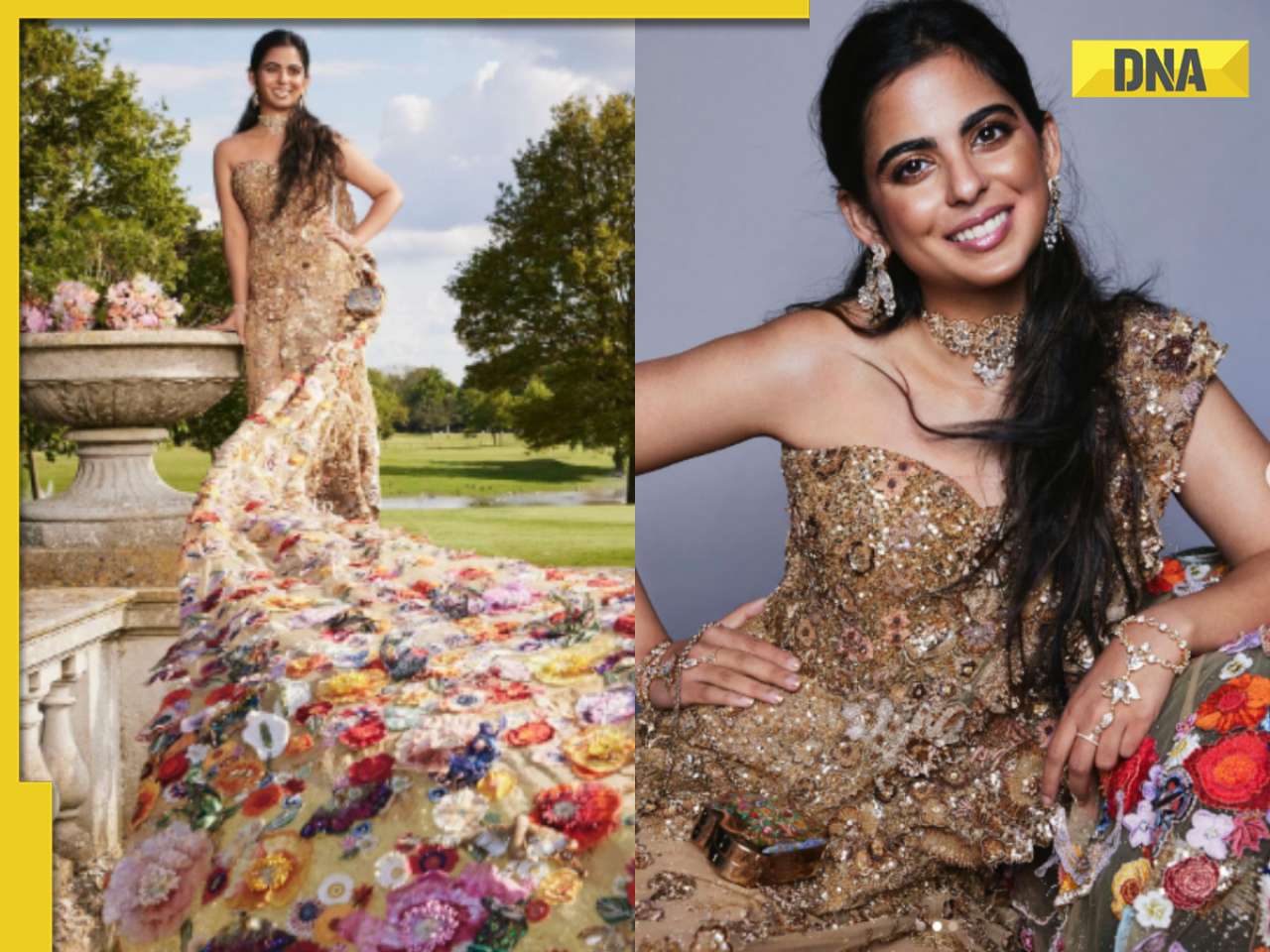

Isha Ambani's Met Gala 2024 saree gown was created in over 10,000 hours, see pics![submenu-img]() Indian-origin man says Apple CEO Tim Cook pushed him...

Indian-origin man says Apple CEO Tim Cook pushed him...

)

)

)

)

)

)