To invest about Rs 100 crore in the segment in the next two years, sees 20% sales from retail entertainment in 3-5 years vs 4% now, to set up 45-60 screens in FY11.

Faced with a host of challenges like high real estate costs, taxes and the linearity in its bread-and-butter movie exhibition business, Ajay Bijli-promoted PVR Ltd has now set its sights on the retail entertainment business to push up its revenues.

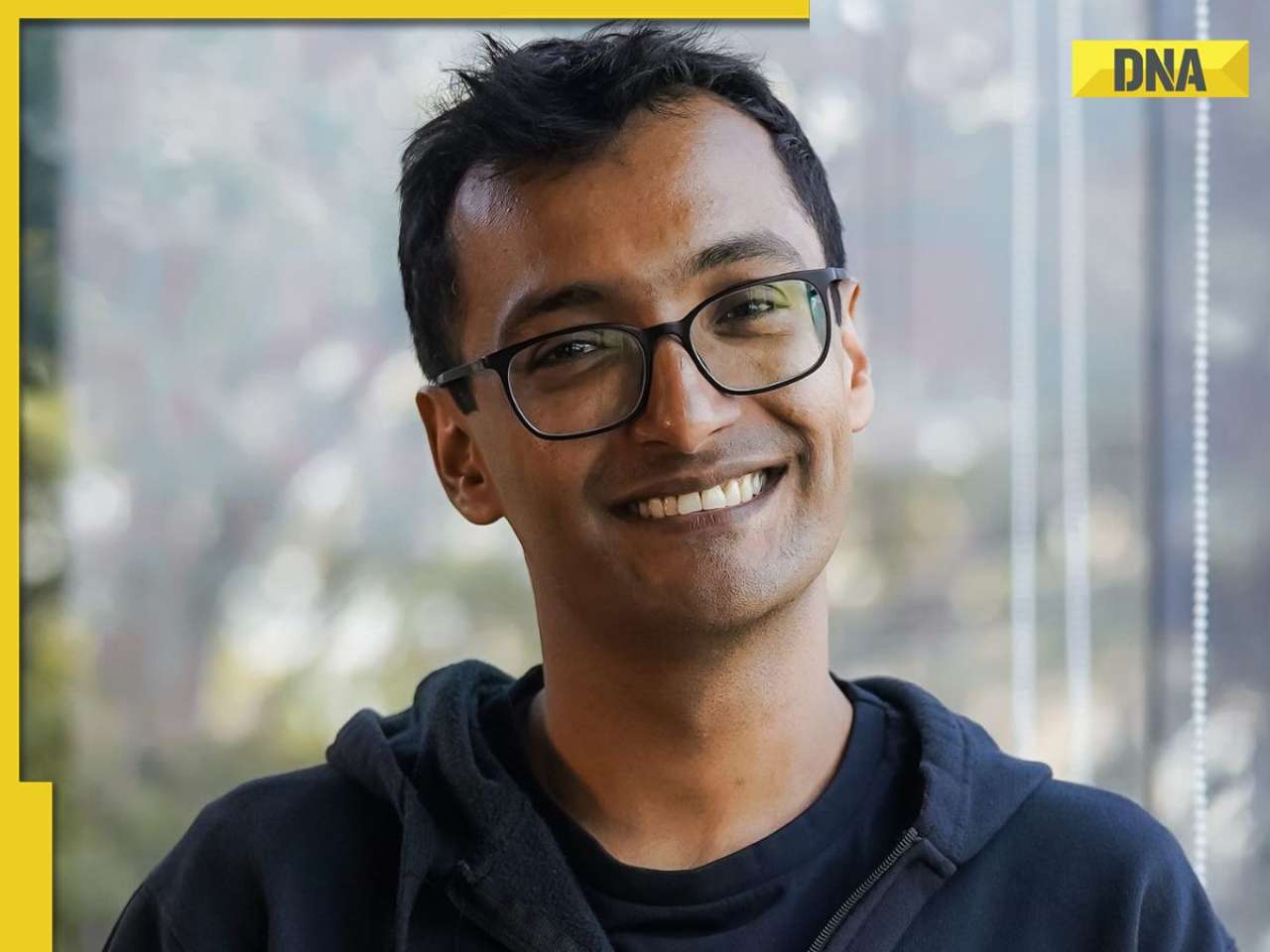

And driving this agenda is the company’s chief executive officer, Pramod Arora.

At present, this segment includes its bowling alley brand Blu-O and contributes only about 4% to its total revenue.

“Given the small base of this business right now, we will see this segment grow at over 300% on year to contribute about 20% of our revenues in the next three to five years,” Arora said in an interview.

However, this growth is expected to come only after three years, as PVR plans to invest an estimated Rs 100 crore in the segment during the next two years, he said.

“Our plans for opening a skating rink as well as our food court plans are on track, so that will give some traction to the revenues in this segment,” said Arora.

He said the company is also actively looking at foraying into the gaming market that will add to the company’s revenues.

The company’s new Entertainment City venture — comprising multi-screen theatres, a bowling alley, a skating rink and food plazas — will open to public at Noida’s Logix City Centre in two-and-a-half years.

The project is being developed at a cost of Rs 50 crore.

Spread across 1.2 million square feet, the entertainment city will be part of the shopping centre being developed at the Logix City Centre in the city bordering Delhi.

Arora said PVR is expecting better operating margins in the current quarter ending September on the back of cost rationalisation and management team restructuring initiatives that the company has undertaken.

“We managed a robust growth last quarter not only due to the low base effect because of the producers’ strike last year, but also due to our efforts towards cost optimisation and change in our management structure,” said Arora.

Explaining the strategies that were deployed from May, Arora said, the focus is now on better utilisation of resources.

For example, the number of staff members would vary according to the attendance for a show. A morning show would require lesser number of people than an evening show, given the occupancy rates, Arora said.

Arora said PVR has also re-evaluated its concession prices, its IT solutions and wastage levels in its food and beverage department to optimally utilise resources.

As part of its focus on resource utilisation, the company has empowered mid-level management and given each senior manager multiple roles to get better returns per employee.

“We expect better margins in the current quarter as we continue to realise the benefits of these efforts,” he said.

During April-June, the operating margin of the company was 15%.

The company had posted a loss at the operating level last year as it was hit by the standoff between multiplex owners and movie producers and distributors over revenue sharing. The tussle meant no new movie was released in the quarter.

Arora said he expected income during Jul-Sep to grow in line with the growth a quarter ago.

On a year-on-year basis, ticket prices were increased by Rs 25 during the June quarter, while they had risen by an average Rs 23 in the previous quarter. For the June quarter, PVR reported a consolidated net income of Rs 103 crore, up 131% on year, while net profit grew to Rs 5.07 crore compared to a loss of Rs 12.85 crore a year ago.

“In the multiplex business, success depends 70% on efficiencies while 30% is dependent on intellect. So, if we can improve our efficiencies, then our profit will be better. That’s what we are trying to do,” Arora said.

Post its failure to acquire DLF Ltd’s multiplex chain DT Cinemas Ltd, the company has become conservative in its approach to more acquisitions.

“While we are always on the lookout for acquisitions, there is no such plan in the near future. We are happy with our organic growth,” Arora said, refusing to say when this self-imposed moratorium on buyouts will end.

Commenting on reports that talks between the two multiplex owners could be revived, Arora said, “It is not being revived from our end. I do not know about them (DT Cinemas).”

“We will look at companies that will help increase not merely the topline of the company but also the bottomline. We will not acquire a company only to get more presence in the country through more screens, but will look at the profitability that it will get us,” Arora said.

PVR is looking to add 45-60 screens in the current financial year.

NewsWire18

![submenu-img]() Yodha OTT release: Sidharth Malhotra, Disha Patani's hostage rescue drama releases online, here's where you can watch

Yodha OTT release: Sidharth Malhotra, Disha Patani's hostage rescue drama releases online, here's where you can watch![submenu-img]() Haldiram may get Rs 425790000000 offer soon, world’s biggest PE firm planning to…

Haldiram may get Rs 425790000000 offer soon, world’s biggest PE firm planning to…![submenu-img]() Meet Aastha Shah, influencer with skin disorder, was bullied, set to break boundaries by walking Cannes red carpet

Meet Aastha Shah, influencer with skin disorder, was bullied, set to break boundaries by walking Cannes red carpet![submenu-img]() Meet actress who confirmed divorce, removed all photos with husband from Instagram, not Deepika Padukone

Meet actress who confirmed divorce, removed all photos with husband from Instagram, not Deepika Padukone![submenu-img]() TN SSLC 10th Result 2024: Tamil Nadu Class 10 results DECLARED @ tnresults.nic.in, here's direct link

TN SSLC 10th Result 2024: Tamil Nadu Class 10 results DECLARED @ tnresults.nic.in, here's direct link![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Alia Bhatt wears elegant saree made by 163 people over 1965 hours to Met Gala 2024, fans call her ‘princess Jasmine’

Alia Bhatt wears elegant saree made by 163 people over 1965 hours to Met Gala 2024, fans call her ‘princess Jasmine’![submenu-img]() Jr NTR-Lakshmi Pranathi's 13th wedding anniversary: Here's how strangers became soulmates

Jr NTR-Lakshmi Pranathi's 13th wedding anniversary: Here's how strangers became soulmates![submenu-img]() Streaming This Week: Heeramandi, Shaitaan, Manjummel Boys, latest OTT releases to binge-watch

Streaming This Week: Heeramandi, Shaitaan, Manjummel Boys, latest OTT releases to binge-watch![submenu-img]() Remember Ayesha Kapur? Michelle from Black, here's how actress, nutrition coach, entrepreneur looks after 19 years

Remember Ayesha Kapur? Michelle from Black, here's how actress, nutrition coach, entrepreneur looks after 19 years![submenu-img]() Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'

Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'![submenu-img]() Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?

Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() Yodha OTT release: Sidharth Malhotra, Disha Patani's hostage rescue drama releases online, here's where you can watch

Yodha OTT release: Sidharth Malhotra, Disha Patani's hostage rescue drama releases online, here's where you can watch![submenu-img]() Meet Aastha Shah, influencer with skin disorder, was bullied, set to break boundaries by walking Cannes red carpet

Meet Aastha Shah, influencer with skin disorder, was bullied, set to break boundaries by walking Cannes red carpet![submenu-img]() Meet actress who confirmed divorce, removed all photos with husband from Instagram, not Deepika Padukone

Meet actress who confirmed divorce, removed all photos with husband from Instagram, not Deepika Padukone![submenu-img]() Actress Laila Khan's step-father Parvez Tak found guilty of murdering her and five others

Actress Laila Khan's step-father Parvez Tak found guilty of murdering her and five others![submenu-img]() Justin Bieber announces wife Hailey's pregnancy, shows off her baby bump in heartwarming maternity shoot photos

Justin Bieber announces wife Hailey's pregnancy, shows off her baby bump in heartwarming maternity shoot photos![submenu-img]() IPL 2024: Punjab Kings knocked out of playoffs race after 60-run defeat to Royal Challengers Bengaluru

IPL 2024: Punjab Kings knocked out of playoffs race after 60-run defeat to Royal Challengers Bengaluru ![submenu-img]() PBKS vs RCB: Virat Kohli scripts history, becomes first batter to achieve this record in IPL

PBKS vs RCB: Virat Kohli scripts history, becomes first batter to achieve this record in IPL![submenu-img]() GT vs CSK IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

GT vs CSK IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() GT vs CSK IPL 2024 Dream11 prediction: Fantasy cricket tips for Gujarat Titans vs Chennai Super Kings

GT vs CSK IPL 2024 Dream11 prediction: Fantasy cricket tips for Gujarat Titans vs Chennai Super Kings![submenu-img]() ‘Ataichi leke baitha hua hai’: Virat Kohli, Mohammed Siraj troll RCB teammate during ad shoot, video goes viral

‘Ataichi leke baitha hua hai’: Virat Kohli, Mohammed Siraj troll RCB teammate during ad shoot, video goes viral![submenu-img]() Watch: Women's epic dance to Sapna Chaudhry's 'Teri Aakhya Ka Yo Kajal' on Amsterdam's street wins internet

Watch: Women's epic dance to Sapna Chaudhry's 'Teri Aakhya Ka Yo Kajal' on Amsterdam's street wins internet![submenu-img]() Ever seen bear climbing tree? If not, viral video will leave you stunned

Ever seen bear climbing tree? If not, viral video will leave you stunned![submenu-img]() This Indian King bought world's 10 most expensive cars and converted them into garbage trucks due to...

This Indian King bought world's 10 most expensive cars and converted them into garbage trucks due to...![submenu-img]() Pakistani college students recreate Anant Ambani, Radhika Merchant's pre-wedding festivities, video is viral

Pakistani college students recreate Anant Ambani, Radhika Merchant's pre-wedding festivities, video is viral![submenu-img]() Viral video: Brave mother hare battles hawk to protect her babies, watch

Viral video: Brave mother hare battles hawk to protect her babies, watch

)

)

)

)

)

)