In its first action since the Hong Kong's Anti Money- Laundering Ordinance came into force in 2012, the Hong Kong Monetary Authority (HKMA) said the SBI branch between April 2012 and November 2013 failed to carry out customer due diligence before establishing business relationships.

The Hong Kong central bank on Friday penalised State Bank of India's Hong Kong branch US $1 million (Hong Kong dollar 7.5 million) for alleged violation of local anti-money laundering and counter-terror financing laws.

In its first action since the Hong Kong's Anti Money- Laundering Ordinance came into force in 2012, the Hong Kong Monetary Authority (HKMA) said the SBI branch between April 2012 and November 2013 failed to carry out customer due diligence before establishing business relationships.

The branch also failed to monitor business relationships with its customers and verify whether its customers were politically exposed persons, the HKMA said in a statement.

The HKMA "reprimanded" SBI's Hong Kong branch for the contraventions and ordered it to submit a report by an independent external advisor on sufficiency of remedial plan and effectiveness of its implementation.

This is the first action by the HKMA under Hong Kong's Anti Money-Laundering Ordinance, which came into force in 2012.

Meena Datwani, Director-General (Enforcement) of the HKMA, said, "This was a case of internal control failures" relating to anti-money laundering and counter-terrorist financing (AML/CFT) rules.

"The HKMA takes such failures seriously and wants to send a clear message to the industry that all authorised institutions should have effective AML/CFT systems," she said.

While SBI Hong Kong (SBIHK) said, "As a member of the Hong Kong banking community for over 35 years, SBIHK is committed to a policy of zero tolerance of non-compliance with regulatory guidelines supported by a robust compliance and risk function, while providing the products and services to our esteemed customers. We fully support the HKMA's efforts to ensure high standards of due diligence and monitoring among Hong Kong s financial institutions."

It said "neither the HKMA nor the external consultants found any instances of problem accounts or suspicious transactions during the period in question, or the years following."

"As noted by the HKMA, we have undertaken very positive and intensive remediation work to address their findings, which refer to procedures and policies in place during 2012 and 2013," it said in an emailed statement.

![submenu-img]() Yodha OTT release: Sidharth Malhotra, Disha Patani's hostage rescue drama releases online, here's where you can watch

Yodha OTT release: Sidharth Malhotra, Disha Patani's hostage rescue drama releases online, here's where you can watch![submenu-img]() Haldiram may get Rs 425790000000 offer soon, world’s biggest PE firm planning to…

Haldiram may get Rs 425790000000 offer soon, world’s biggest PE firm planning to…![submenu-img]() Meet Aastha Shah, influencer with skin disorder, was bullied, set to break boundaries by walking Cannes red carpet

Meet Aastha Shah, influencer with skin disorder, was bullied, set to break boundaries by walking Cannes red carpet![submenu-img]() Meet actress who confirmed divorce, removed all photos with husband from Instagram, not Deepika Padukone

Meet actress who confirmed divorce, removed all photos with husband from Instagram, not Deepika Padukone![submenu-img]() TN SSLC 10th Result 2024: Tamil Nadu Class 10 results DECLARED @ tnresults.nic.in, here's direct link

TN SSLC 10th Result 2024: Tamil Nadu Class 10 results DECLARED @ tnresults.nic.in, here's direct link![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Alia Bhatt wears elegant saree made by 163 people over 1965 hours to Met Gala 2024, fans call her ‘princess Jasmine’

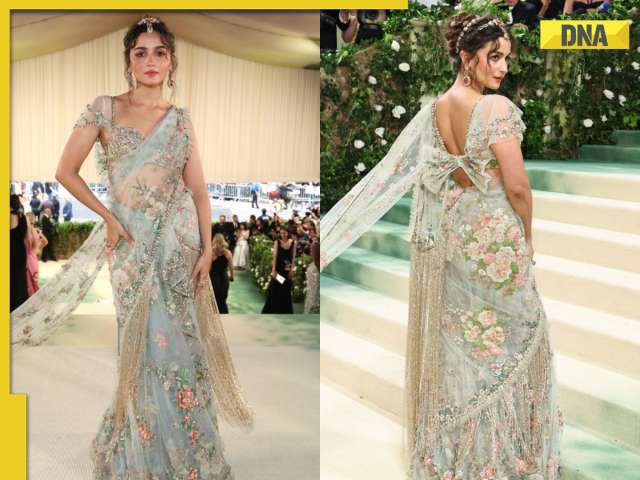

Alia Bhatt wears elegant saree made by 163 people over 1965 hours to Met Gala 2024, fans call her ‘princess Jasmine’![submenu-img]() Jr NTR-Lakshmi Pranathi's 13th wedding anniversary: Here's how strangers became soulmates

Jr NTR-Lakshmi Pranathi's 13th wedding anniversary: Here's how strangers became soulmates![submenu-img]() Streaming This Week: Heeramandi, Shaitaan, Manjummel Boys, latest OTT releases to binge-watch

Streaming This Week: Heeramandi, Shaitaan, Manjummel Boys, latest OTT releases to binge-watch![submenu-img]() Remember Ayesha Kapur? Michelle from Black, here's how actress, nutrition coach, entrepreneur looks after 19 years

Remember Ayesha Kapur? Michelle from Black, here's how actress, nutrition coach, entrepreneur looks after 19 years![submenu-img]() Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'

Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'![submenu-img]() Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?

Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() Yodha OTT release: Sidharth Malhotra, Disha Patani's hostage rescue drama releases online, here's where you can watch

Yodha OTT release: Sidharth Malhotra, Disha Patani's hostage rescue drama releases online, here's where you can watch![submenu-img]() Meet Aastha Shah, influencer with skin disorder, was bullied, set to break boundaries by walking Cannes red carpet

Meet Aastha Shah, influencer with skin disorder, was bullied, set to break boundaries by walking Cannes red carpet![submenu-img]() Meet actress who confirmed divorce, removed all photos with husband from Instagram, not Deepika Padukone

Meet actress who confirmed divorce, removed all photos with husband from Instagram, not Deepika Padukone![submenu-img]() Actress Laila Khan's step-father Parvez Tak found guilty of murdering her and five others

Actress Laila Khan's step-father Parvez Tak found guilty of murdering her and five others![submenu-img]() Justin Bieber announces wife Hailey's pregnancy, shows off her baby bump in heartwarming maternity shoot photos

Justin Bieber announces wife Hailey's pregnancy, shows off her baby bump in heartwarming maternity shoot photos![submenu-img]() IPL 2024: Punjab Kings knocked out of playoffs race after 60-run defeat to Royal Challengers Bengaluru

IPL 2024: Punjab Kings knocked out of playoffs race after 60-run defeat to Royal Challengers Bengaluru ![submenu-img]() PBKS vs RCB: Virat Kohli scripts history, becomes first batter to achieve this record in IPL

PBKS vs RCB: Virat Kohli scripts history, becomes first batter to achieve this record in IPL![submenu-img]() GT vs CSK IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

GT vs CSK IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() GT vs CSK IPL 2024 Dream11 prediction: Fantasy cricket tips for Gujarat Titans vs Chennai Super Kings

GT vs CSK IPL 2024 Dream11 prediction: Fantasy cricket tips for Gujarat Titans vs Chennai Super Kings![submenu-img]() ‘Ataichi leke baitha hua hai’: Virat Kohli, Mohammed Siraj troll RCB teammate during ad shoot, video goes viral

‘Ataichi leke baitha hua hai’: Virat Kohli, Mohammed Siraj troll RCB teammate during ad shoot, video goes viral![submenu-img]() Watch: Women's epic dance to Sapna Chaudhry's 'Teri Aakhya Ka Yo Kajal' on Amsterdam's street wins internet

Watch: Women's epic dance to Sapna Chaudhry's 'Teri Aakhya Ka Yo Kajal' on Amsterdam's street wins internet![submenu-img]() Ever seen bear climbing tree? If not, viral video will leave you stunned

Ever seen bear climbing tree? If not, viral video will leave you stunned![submenu-img]() This Indian King bought world's 10 most expensive cars and converted them into garbage trucks due to...

This Indian King bought world's 10 most expensive cars and converted them into garbage trucks due to...![submenu-img]() Pakistani college students recreate Anant Ambani, Radhika Merchant's pre-wedding festivities, video is viral

Pakistani college students recreate Anant Ambani, Radhika Merchant's pre-wedding festivities, video is viral![submenu-img]() Viral video: Brave mother hare battles hawk to protect her babies, watch

Viral video: Brave mother hare battles hawk to protect her babies, watch

)

)

)

)

)

)

)