The tie-up between the two companies will have easy access to availing motor insurance.

India's leading mobile app for transportation, Ola has partnered with Bajaj Allianz General Insurance to provide motor insurance solutions to its driver partners.

The tie-up between the two companies will have easy access to availing motor insurance with a host of value-added services and add-on covers like depreciation shield and engine protector provided by Bajaj Allianz.

The partnership will increase savings on insurance premiums for Ola driver-partners and provide convenient claim settlement services through a network of over 4,000 Bajaj Allianz preferred workshops.

The two companies are also working together to create a digital infrastructure that will bring insurance transactions like purchase or claims, fully online.

"Driver Entrepreneurs are key stakeholders to the growth of mobility in India and we are building a robust ecosystem for them through initiatives like these, enabling them to grow professionally and personally," said COO at Ola Pranay Jivrajka.

"Motor Insurance is essential for driver-partners and together with Bajaj Allianz, we are enabling easy access to driver-partners, giving them better savings, benefits and technology for the insurance they are buying. By investing in such partnerships, we are making a significant impact on the careers of driver-partners, who are integral to our mission of mobility for a billion Indians," added Pranay.

"We are pleased to tie up with Ola, an Industry disruptor that has set benchmarks in its services to customers and has transformed the lives of Indian commuters. This tie-up is aimed at providing Ola'?s driver partners a one-stop solution for all their motor insurance requirements, including value-added services," said Chief Technical Officer- Motor Insurance, Bajaj Allianz General Insurance Vijay Kumar.

The motor insurance will not only provide a cover for accidents, but will also insure theft of vehicles as well as damage due to natural and man-made calamities.

It will also provide a personal accident cover of Rs 2 lakh to the driver partner. The two companies' partnership in creating high customer value will also reflect through additional services beyond insurance like 24 x 7 roadside assistance (1800 103 5858), which will include towing facilities, medical assistance etc. for the drivers.

In the past two years, Ola has announced several social and financial benefits for its drivers. The company recently announced its partnership with Indifi to offer personal loans to its drivers.

Earlier in 2014, Ola had set aside a fund of Rs. 100 crore towards investment in the driver ecosystem to help nurture them as entrepreneurs.

Prior to that, Ola had launched 'Ola Pragati' in partnership with leading financial institutions like SBI to offer a tailor-made financing program to help drivers to take loans at lower rates and repay on a daily basis as against EMIs.

![submenu-img]() Yodha OTT release: Sidharth Malhotra, Disha Patani's hostage rescue drama releases online, here's where you can watch

Yodha OTT release: Sidharth Malhotra, Disha Patani's hostage rescue drama releases online, here's where you can watch![submenu-img]() Haldiram may get Rs 425790000000 offer soon, world’s biggest PE firm planning to…

Haldiram may get Rs 425790000000 offer soon, world’s biggest PE firm planning to…![submenu-img]() Meet Aastha Shah, influencer with skin disorder, was bullied, set to break boundaries by walking Cannes red carpet

Meet Aastha Shah, influencer with skin disorder, was bullied, set to break boundaries by walking Cannes red carpet![submenu-img]() Meet actress who confirmed divorce, removed all photos with husband from Instagram, not Deepika Padukone

Meet actress who confirmed divorce, removed all photos with husband from Instagram, not Deepika Padukone![submenu-img]() TN SSLC 10th Result 2024: Tamil Nadu Class 10 results DECLARED @ tnresults.nic.in, here's direct link

TN SSLC 10th Result 2024: Tamil Nadu Class 10 results DECLARED @ tnresults.nic.in, here's direct link![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

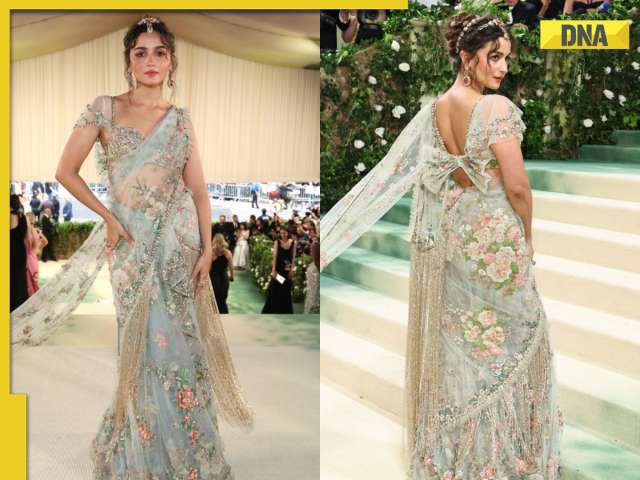

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Alia Bhatt wears elegant saree made by 163 people over 1965 hours to Met Gala 2024, fans call her ‘princess Jasmine’

Alia Bhatt wears elegant saree made by 163 people over 1965 hours to Met Gala 2024, fans call her ‘princess Jasmine’![submenu-img]() Jr NTR-Lakshmi Pranathi's 13th wedding anniversary: Here's how strangers became soulmates

Jr NTR-Lakshmi Pranathi's 13th wedding anniversary: Here's how strangers became soulmates![submenu-img]() Streaming This Week: Heeramandi, Shaitaan, Manjummel Boys, latest OTT releases to binge-watch

Streaming This Week: Heeramandi, Shaitaan, Manjummel Boys, latest OTT releases to binge-watch![submenu-img]() Remember Ayesha Kapur? Michelle from Black, here's how actress, nutrition coach, entrepreneur looks after 19 years

Remember Ayesha Kapur? Michelle from Black, here's how actress, nutrition coach, entrepreneur looks after 19 years![submenu-img]() Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'

Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'![submenu-img]() Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?

Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() Yodha OTT release: Sidharth Malhotra, Disha Patani's hostage rescue drama releases online, here's where you can watch

Yodha OTT release: Sidharth Malhotra, Disha Patani's hostage rescue drama releases online, here's where you can watch![submenu-img]() Meet Aastha Shah, influencer with skin disorder, was bullied, set to break boundaries by walking Cannes red carpet

Meet Aastha Shah, influencer with skin disorder, was bullied, set to break boundaries by walking Cannes red carpet![submenu-img]() Meet actress who confirmed divorce, removed all photos with husband from Instagram, not Deepika Padukone

Meet actress who confirmed divorce, removed all photos with husband from Instagram, not Deepika Padukone![submenu-img]() Actress Laila Khan's step-father Parvez Tak found guilty of murdering her and five others

Actress Laila Khan's step-father Parvez Tak found guilty of murdering her and five others![submenu-img]() Justin Bieber announces wife Hailey's pregnancy, shows off her baby bump in heartwarming maternity shoot photos

Justin Bieber announces wife Hailey's pregnancy, shows off her baby bump in heartwarming maternity shoot photos![submenu-img]() IPL 2024: Punjab Kings knocked out of playoffs race after 60-run defeat to Royal Challengers Bengaluru

IPL 2024: Punjab Kings knocked out of playoffs race after 60-run defeat to Royal Challengers Bengaluru ![submenu-img]() PBKS vs RCB: Virat Kohli scripts history, becomes first batter to achieve this record in IPL

PBKS vs RCB: Virat Kohli scripts history, becomes first batter to achieve this record in IPL![submenu-img]() GT vs CSK IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

GT vs CSK IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() GT vs CSK IPL 2024 Dream11 prediction: Fantasy cricket tips for Gujarat Titans vs Chennai Super Kings

GT vs CSK IPL 2024 Dream11 prediction: Fantasy cricket tips for Gujarat Titans vs Chennai Super Kings![submenu-img]() ‘Ataichi leke baitha hua hai’: Virat Kohli, Mohammed Siraj troll RCB teammate during ad shoot, video goes viral

‘Ataichi leke baitha hua hai’: Virat Kohli, Mohammed Siraj troll RCB teammate during ad shoot, video goes viral![submenu-img]() Watch: Women's epic dance to Sapna Chaudhry's 'Teri Aakhya Ka Yo Kajal' on Amsterdam's street wins internet

Watch: Women's epic dance to Sapna Chaudhry's 'Teri Aakhya Ka Yo Kajal' on Amsterdam's street wins internet![submenu-img]() Ever seen bear climbing tree? If not, viral video will leave you stunned

Ever seen bear climbing tree? If not, viral video will leave you stunned![submenu-img]() This Indian King bought world's 10 most expensive cars and converted them into garbage trucks due to...

This Indian King bought world's 10 most expensive cars and converted them into garbage trucks due to...![submenu-img]() Pakistani college students recreate Anant Ambani, Radhika Merchant's pre-wedding festivities, video is viral

Pakistani college students recreate Anant Ambani, Radhika Merchant's pre-wedding festivities, video is viral![submenu-img]() Viral video: Brave mother hare battles hawk to protect her babies, watch

Viral video: Brave mother hare battles hawk to protect her babies, watch

)

)

)

)

)

)

)