A top aviation expert and an industry leader said consolidation or restructuring was the way to go for Indian carriers to beat losses and stay afloat.

ISTANBUL: With jet fuel prices on an upward spiral globally, a top aviation expert and an industry leader on Tuesday said consolidation or restructuring was the way to go for Indian carriers to beat losses and stay afloat.

"There are a large number of new entrants and there exists a huge amount of capacity in India. Rising fuel costs will accelerate the restructuring of this capacity.

"The new entrants and even large leading carriers will find it difficult to maintain their bottom lines because high costs and high capacity have to be matched. So, it is either consolidate or exit the market," IATA's Chief Economist Brian Pearce told PTI in an interview.

He, however, conceded that there was a tremendous potential for air travel in India, which was also witnessing strong economic growth. "With proper infrastructure in place, there is a tremendous capacity for the Indian market to grow. Travel trade will continue to grow in Asia."

But under the given circumstances, the airline industry in India has to consolidate or go bust, he said replying to questions on the sidelines of the annual conference of the International Air Transport Association (IATA) here.

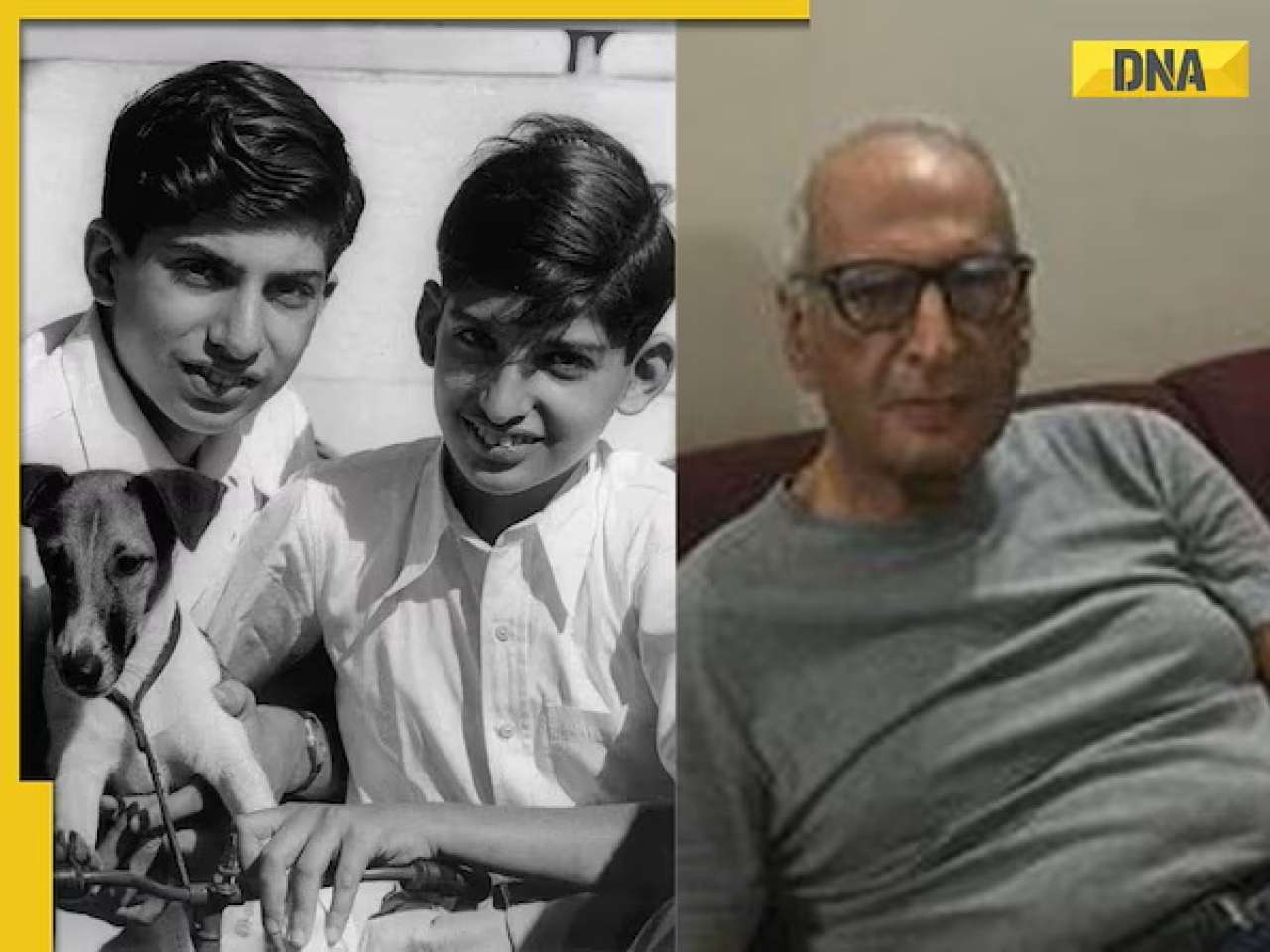

Agreeing with IATA's estimation, Jet Airways Chairman Naresh Goyal said the Indian airline industry was not only suffering from high jet fuel prices, but also a "crazy" pricing strategy.

"We all have been doing crazy and irrational pricing, selling tickets below costs," Goyal said.

Jet Airways pioneered consolidation in the Indian aviation space by acquiring full-service carrier Air Sahara, which has now been positioned as a no-frills airline. The merger of state-owned Air India and Indian and that of Kingfisher Airlines and Air Deccan followed.

The Jet Airways chief felt that the practice of trying to undercut each other "should stop forthwith if we have to be in business. Today, we are surviving on oxygen. We, the Indian aviation industry, cannot afford to absorb losses anymore."

He also spoke about the additional fuel bills that were being paid by Indian carriers for air traffic congestion and hovering over airports.

Projecting a "dramatic decline" in the US aviation business environment that would affect the growth scene worldwide, Pearce said there was a sharp slowdown in credit in the US and Europe, with banks and other financial institutions not ready to lend any more and imposing difficult conditions, including collateral, to dole out finances.

This, he said, was primarily because the lending institutions had suffered major losses in the sub-prime crisis in the US.

The IATA Chief Economist said the global umbrella body of the airline industry had to revise its industry financial forecast for 2008 significantly downwards to project a loss of $ 2.3 billion. "For every dollar that the price of fuel increases, our costs go up by $ 1.6 billion," he said.

Giovanni Bisignani, IATA Director General and CEO, had yesterday said the industry's total fuel bill in 2008 was expected to be $ 176 billion, based on oil at $ 106.5 per barrel, accounting for 34 per cent of operating costs.

This was $ 40 billion more than the 2006 bill of $ 136 billion, which accounted for 29 per cent of operating costs. In 2002, the bill was $ 40 billion.

"We also need to take a reality check. Despite the consensus of experts on the oil price, today's oil prices make the $ 2.3 billion loss look optimistic. For every dollar that the oil price increases, we add $ 1.6 billion to costs. If we see $ 135 oil for the rest of the year, losses could be $ 6.1 billion," said Bisignani.

Pearce said the situation has changed dramatically in recent weeks. "Oil skyrocketing above $ 130 per barrel has brought us into uncharted territory. Add in the weakening global economy and this is yet another perfect storm."

IATA Chief Bisignani yesterday said "oil is changing everything. There are no easy answers. In the last six years, airlines improved fuel efficiency by 19 per cent and reduced non-fuel unit costs by 18 per cent. There is no fat left."

"To survive this crisis, even more massive changes will be needed quickly. Air transport is a catalyst for $ 3.5 trillion in business and 32 million jobs. This is an extraordinary crisis with the potential to re-shape the industry with impacts throughout the global economy.

"Governments, industry partners and labour must deliver change," said Bisignani.

State-run oil companies in India last week raised jet fuel prices by 18.5 per cent in view of high crude costs, triggering a spate of fare hikes by airlines.

![submenu-img]() Yodha OTT release: Sidharth Malhotra, Disha Patani's hostage rescue drama releases online, here's where you can watch

Yodha OTT release: Sidharth Malhotra, Disha Patani's hostage rescue drama releases online, here's where you can watch![submenu-img]() Haldiram may get Rs 425790000000 offer soon, world’s biggest PE firm planning to…

Haldiram may get Rs 425790000000 offer soon, world’s biggest PE firm planning to…![submenu-img]() Meet Aastha Shah, influencer with skin disorder, was bullied, set to break boundaries by walking Cannes red carpet

Meet Aastha Shah, influencer with skin disorder, was bullied, set to break boundaries by walking Cannes red carpet![submenu-img]() Meet actress who confirmed divorce, removed all photos with husband from Instagram, not Deepika Padukone

Meet actress who confirmed divorce, removed all photos with husband from Instagram, not Deepika Padukone![submenu-img]() TN SSLC 10th Result 2024: Tamil Nadu Class 10 results DECLARED @ tnresults.nic.in, here's direct link

TN SSLC 10th Result 2024: Tamil Nadu Class 10 results DECLARED @ tnresults.nic.in, here's direct link![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Alia Bhatt wears elegant saree made by 163 people over 1965 hours to Met Gala 2024, fans call her ‘princess Jasmine’

Alia Bhatt wears elegant saree made by 163 people over 1965 hours to Met Gala 2024, fans call her ‘princess Jasmine’![submenu-img]() Jr NTR-Lakshmi Pranathi's 13th wedding anniversary: Here's how strangers became soulmates

Jr NTR-Lakshmi Pranathi's 13th wedding anniversary: Here's how strangers became soulmates![submenu-img]() Streaming This Week: Heeramandi, Shaitaan, Manjummel Boys, latest OTT releases to binge-watch

Streaming This Week: Heeramandi, Shaitaan, Manjummel Boys, latest OTT releases to binge-watch![submenu-img]() Remember Ayesha Kapur? Michelle from Black, here's how actress, nutrition coach, entrepreneur looks after 19 years

Remember Ayesha Kapur? Michelle from Black, here's how actress, nutrition coach, entrepreneur looks after 19 years![submenu-img]() Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'

Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'![submenu-img]() Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?

Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() Yodha OTT release: Sidharth Malhotra, Disha Patani's hostage rescue drama releases online, here's where you can watch

Yodha OTT release: Sidharth Malhotra, Disha Patani's hostage rescue drama releases online, here's where you can watch![submenu-img]() Meet Aastha Shah, influencer with skin disorder, was bullied, set to break boundaries by walking Cannes red carpet

Meet Aastha Shah, influencer with skin disorder, was bullied, set to break boundaries by walking Cannes red carpet![submenu-img]() Meet actress who confirmed divorce, removed all photos with husband from Instagram, not Deepika Padukone

Meet actress who confirmed divorce, removed all photos with husband from Instagram, not Deepika Padukone![submenu-img]() Actress Laila Khan's step-father Parvez Tak found guilty of murdering her and five others

Actress Laila Khan's step-father Parvez Tak found guilty of murdering her and five others![submenu-img]() Justin Bieber announces wife Hailey's pregnancy, shows off her baby bump in heartwarming maternity shoot photos

Justin Bieber announces wife Hailey's pregnancy, shows off her baby bump in heartwarming maternity shoot photos![submenu-img]() IPL 2024: Punjab Kings knocked out of playoffs race after 60-run defeat to Royal Challengers Bengaluru

IPL 2024: Punjab Kings knocked out of playoffs race after 60-run defeat to Royal Challengers Bengaluru ![submenu-img]() PBKS vs RCB: Virat Kohli scripts history, becomes first batter to achieve this record in IPL

PBKS vs RCB: Virat Kohli scripts history, becomes first batter to achieve this record in IPL![submenu-img]() GT vs CSK IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

GT vs CSK IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() GT vs CSK IPL 2024 Dream11 prediction: Fantasy cricket tips for Gujarat Titans vs Chennai Super Kings

GT vs CSK IPL 2024 Dream11 prediction: Fantasy cricket tips for Gujarat Titans vs Chennai Super Kings![submenu-img]() ‘Ataichi leke baitha hua hai’: Virat Kohli, Mohammed Siraj troll RCB teammate during ad shoot, video goes viral

‘Ataichi leke baitha hua hai’: Virat Kohli, Mohammed Siraj troll RCB teammate during ad shoot, video goes viral![submenu-img]() Watch: Women's epic dance to Sapna Chaudhry's 'Teri Aakhya Ka Yo Kajal' on Amsterdam's street wins internet

Watch: Women's epic dance to Sapna Chaudhry's 'Teri Aakhya Ka Yo Kajal' on Amsterdam's street wins internet![submenu-img]() Ever seen bear climbing tree? If not, viral video will leave you stunned

Ever seen bear climbing tree? If not, viral video will leave you stunned![submenu-img]() This Indian King bought world's 10 most expensive cars and converted them into garbage trucks due to...

This Indian King bought world's 10 most expensive cars and converted them into garbage trucks due to...![submenu-img]() Pakistani college students recreate Anant Ambani, Radhika Merchant's pre-wedding festivities, video is viral

Pakistani college students recreate Anant Ambani, Radhika Merchant's pre-wedding festivities, video is viral![submenu-img]() Viral video: Brave mother hare battles hawk to protect her babies, watch

Viral video: Brave mother hare battles hawk to protect her babies, watch

)

)

)

)

)

)