Public sector banks have decided to raise home loan tenors to 25 to 30 years or till the borrower touches 70 -- well past the working age.

After goading by the government and fearing risks to asset quality, a number of state-run banks, led by SBI, Central Bank, Syndicate and Canara, have decided to raise home loan tenors to 25 to 30 years or till the borrower touches 70 -- well past the working age.

State Bank of India took the lead and has reportedly decided to extend the tenor of home loans by 10 years or up to 30 years, while others are doing this on request.

"We have decided to increase the home loan tenure by up to 10 years to 30 years and up to the age of 70, depending on the customer profile. Our managing director (S Krishna Kumar), is likely to announce this tomorrow," a senior SBI official told PTI, requesting anonymity.

Kumar, who heads the national banking vertical at SBI, could not be reached for comments.

Fearing more bad loans in the system as interest kept on rising following tight monetary policy being under taken by RBI, the Finance Ministry had recently written to the public sector banks (PSBs) to increase the loan tenor instead of increasing the monthly repayment (EMI) amount.

However, all the banks that PTI contacted for reaction on the issue, said this guideline has been in existence for many years now and they had been implementing it on case to case basis.

Over the past 19 months, RBI has increased interest rate by 325 basis points (one basis point is one-hundredth of a percent) to 8.25 per cent to batten down stubbornly high inflation, which stood at 9.72 per cent in September.

Generally, home loans are scheduled for 20 years and in some cases up to 25 years, if the borrower will not be retiring by then at 65.

Typically on an average, a 25 bps spike in interest rate can push up EMI for a 20-year loan by Rs17 per lakh. With regular hikes by RBI, EMIs have been stretched too far.

The RBI has hiked policy rates by 325 basis points since March 2010, following which most banks have raised lending rates by up to 250-300 bps making loans dearer.

Central Bank of India chairman and managing director MV Tanksale, too, said his bank is open to requests from the borrowers over increasing loan tenors.

"The important question is the cash flow of the borrower, if it increases, he/she does not require an increase and vice versa. I think this has been a very proactive step on the part of the government to issue such a directive."

When contacted the Mangalore-based Syndicate Bank chairman and managing director B Seth said, "We have always been giving this option to our customers, even before the ministry's letter. The whole point is to keep our asset quality and we offer such options to customers on request."

"At Syndicate, we are not bothered about the age of the borrower, if the history of his or her banking behaviour is satisfactory and if the customer is capable of paying even if one is not working, we have no problem."

Similarly, Canara Bank chairman and managing director S Raman said the lender has been extending longer tenure to its customers for quite some time now on a loan-by-loan basis.

"We are not looking at age of the borrower, but his source of income, including pensions and retirement benefits."

When asked if there been an increase in any such request, the Bangalore-based bank's executive director AK Gupta, there has been only a negligible demand for increasing the tenor. Similarly, there has not been any visible spike in home loan non-performing assets.

Bank of Baroda executive director RK Bakshi said his bank also offers customers the option to increase payment schedule. "We are limiting this at up to 25 years. To extend it further we have to discus this at the board."

![submenu-img]() Yodha OTT release: Sidharth Malhotra, Disha Patani's hostage rescue drama releases online, here's where you can watch

Yodha OTT release: Sidharth Malhotra, Disha Patani's hostage rescue drama releases online, here's where you can watch![submenu-img]() Haldiram may get Rs 425790000000 offer soon, world’s biggest PE firm planning to…

Haldiram may get Rs 425790000000 offer soon, world’s biggest PE firm planning to…![submenu-img]() Meet Aastha Shah, influencer with skin disorder, was bullied, set to break boundaries by walking Cannes red carpet

Meet Aastha Shah, influencer with skin disorder, was bullied, set to break boundaries by walking Cannes red carpet![submenu-img]() Meet actress who confirmed divorce, removed all photos with husband from Instagram, not Deepika Padukone

Meet actress who confirmed divorce, removed all photos with husband from Instagram, not Deepika Padukone![submenu-img]() TN SSLC 10th Result 2024: Tamil Nadu Class 10 results DECLARED @ tnresults.nic.in, here's direct link

TN SSLC 10th Result 2024: Tamil Nadu Class 10 results DECLARED @ tnresults.nic.in, here's direct link![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

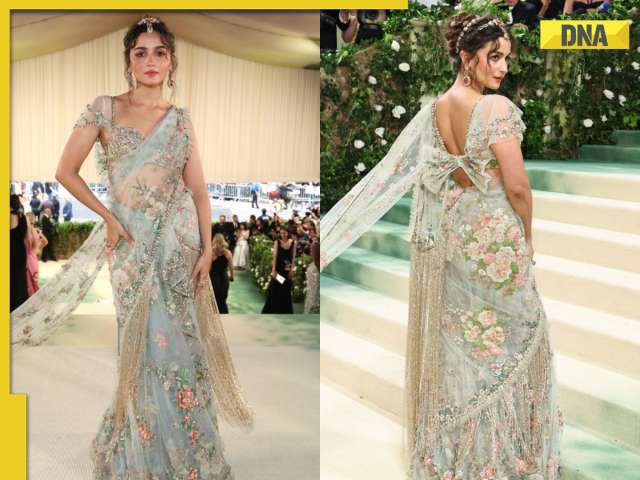

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Alia Bhatt wears elegant saree made by 163 people over 1965 hours to Met Gala 2024, fans call her ‘princess Jasmine’

Alia Bhatt wears elegant saree made by 163 people over 1965 hours to Met Gala 2024, fans call her ‘princess Jasmine’![submenu-img]() Jr NTR-Lakshmi Pranathi's 13th wedding anniversary: Here's how strangers became soulmates

Jr NTR-Lakshmi Pranathi's 13th wedding anniversary: Here's how strangers became soulmates![submenu-img]() Streaming This Week: Heeramandi, Shaitaan, Manjummel Boys, latest OTT releases to binge-watch

Streaming This Week: Heeramandi, Shaitaan, Manjummel Boys, latest OTT releases to binge-watch![submenu-img]() Remember Ayesha Kapur? Michelle from Black, here's how actress, nutrition coach, entrepreneur looks after 19 years

Remember Ayesha Kapur? Michelle from Black, here's how actress, nutrition coach, entrepreneur looks after 19 years![submenu-img]() Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'

Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'![submenu-img]() Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?

Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() Yodha OTT release: Sidharth Malhotra, Disha Patani's hostage rescue drama releases online, here's where you can watch

Yodha OTT release: Sidharth Malhotra, Disha Patani's hostage rescue drama releases online, here's where you can watch![submenu-img]() Meet Aastha Shah, influencer with skin disorder, was bullied, set to break boundaries by walking Cannes red carpet

Meet Aastha Shah, influencer with skin disorder, was bullied, set to break boundaries by walking Cannes red carpet![submenu-img]() Meet actress who confirmed divorce, removed all photos with husband from Instagram, not Deepika Padukone

Meet actress who confirmed divorce, removed all photos with husband from Instagram, not Deepika Padukone![submenu-img]() Actress Laila Khan's step-father Parvez Tak found guilty of murdering her and five others

Actress Laila Khan's step-father Parvez Tak found guilty of murdering her and five others![submenu-img]() Justin Bieber announces wife Hailey's pregnancy, shows off her baby bump in heartwarming maternity shoot photos

Justin Bieber announces wife Hailey's pregnancy, shows off her baby bump in heartwarming maternity shoot photos![submenu-img]() IPL 2024: Punjab Kings knocked out of playoffs race after 60-run defeat to Royal Challengers Bengaluru

IPL 2024: Punjab Kings knocked out of playoffs race after 60-run defeat to Royal Challengers Bengaluru ![submenu-img]() PBKS vs RCB: Virat Kohli scripts history, becomes first batter to achieve this record in IPL

PBKS vs RCB: Virat Kohli scripts history, becomes first batter to achieve this record in IPL![submenu-img]() GT vs CSK IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

GT vs CSK IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() GT vs CSK IPL 2024 Dream11 prediction: Fantasy cricket tips for Gujarat Titans vs Chennai Super Kings

GT vs CSK IPL 2024 Dream11 prediction: Fantasy cricket tips for Gujarat Titans vs Chennai Super Kings![submenu-img]() ‘Ataichi leke baitha hua hai’: Virat Kohli, Mohammed Siraj troll RCB teammate during ad shoot, video goes viral

‘Ataichi leke baitha hua hai’: Virat Kohli, Mohammed Siraj troll RCB teammate during ad shoot, video goes viral![submenu-img]() Watch: Women's epic dance to Sapna Chaudhry's 'Teri Aakhya Ka Yo Kajal' on Amsterdam's street wins internet

Watch: Women's epic dance to Sapna Chaudhry's 'Teri Aakhya Ka Yo Kajal' on Amsterdam's street wins internet![submenu-img]() Ever seen bear climbing tree? If not, viral video will leave you stunned

Ever seen bear climbing tree? If not, viral video will leave you stunned![submenu-img]() This Indian King bought world's 10 most expensive cars and converted them into garbage trucks due to...

This Indian King bought world's 10 most expensive cars and converted them into garbage trucks due to...![submenu-img]() Pakistani college students recreate Anant Ambani, Radhika Merchant's pre-wedding festivities, video is viral

Pakistani college students recreate Anant Ambani, Radhika Merchant's pre-wedding festivities, video is viral![submenu-img]() Viral video: Brave mother hare battles hawk to protect her babies, watch

Viral video: Brave mother hare battles hawk to protect her babies, watch

)

)

)

)

)

)