As economy moves from largely informal set-up to a formal one, staffing and industrial services major Quess Corp sees newer opportunities.

“Three-four levers are available to us to maintain our pace of growth in the medium to long term, one being additionality, for example customer lifecycle management is something that we don’t do. It’s something that we can offer in areas like physical deliveries of goods and services,” said Jaipuria, president and CEO, global services, Quess Corp, told DNA Money.

Elaborating the opportunity in customer lifecycle management, he said, “When you buy an air-conditioner or a dish television antenna, someone is needed to get it installed and then service it. These things are almost handled exclusively by the informal sector. Maybe we can do these things. There is a large opportunity here.”

With the JAM trinity, or coming together of Jan Dhan accounts, universal acceptability of Aaadhar and mobile-based transactions, along with demonetisation, there’s a big shift happening from the informal to the formal.

“When formalisation of economy takes place, opportunities open up for large companies like ours. It’s something we are banking on to a large extent,” Jaipuria said.

While many start-ups like UrbanClap or Housejoy operate in this space, Quess Corp isn’t quite excited about investing in them for partnering.

“We are also open to work with start-ups (in these areas). But we will never burn money. For a start-up to gain scale is going to get very tough. What it takes (to succeed) is a nation-wide presence, and select, train and deploy and then monitor so many people. Except us, very few people have such capacities.”

Quess Corp, which had a stellar IPO, has been growing mainly through relentless acquisitions, about 14 in the last five years, the recent ones being Simpliance that added technology muscle to compliance management, Comtel, largest IT staffing player in Singapore, and stakes in Heptagon and Vedang Cellular, while it formed a joint venture with Trimax.

But its major deal was acquiring majority stake in Tata Business Support Services that offers customer experience management to some 130 marquee clients, including some top telecom, private banks and life insurance players with a headcount 27,000.

For a company that has been growing rapidly through acquisitions in sectors that find technology as their backbone, cutting-edge technologies like artificial intelligence haven’t been focus areas in its recent buyouts. Quess is looking at acquisitions that might bridge the gap.

“These (recent acquisitions) haven’t brought those in (techs like AI) but we are looking at few which might. AI can be greatly helpful in the way how you manage to automate certain processes such that the process of selection much faster and much more accurate. That’s what we are trying to move towards.”

ADDING VALUE

- With coming together of Jan Dhan accounts, universal acceptability of Aaadhar and mobile-based transactions, there’s a big shift happening from the informal to the formal.

- While many start-ups like UrbanClap or Housejoy operate in this space, Quess Corp isn’t quite excited about investing in them for partnering.

![submenu-img]() Three Indian nationals accused of killing Hardeep Singh Nijjar appear in Canadian court amid diplomatic crisis

Three Indian nationals accused of killing Hardeep Singh Nijjar appear in Canadian court amid diplomatic crisis![submenu-img]() Apple iPad Pro with M4 chip and AI capabilities launched in India, price starts at Rs 99900

Apple iPad Pro with M4 chip and AI capabilities launched in India, price starts at Rs 99900![submenu-img]() DNA Exclusive: Inside scoop of Congress' plan to defeat Smriti Irani, retain Amethi

DNA Exclusive: Inside scoop of Congress' plan to defeat Smriti Irani, retain Amethi![submenu-img]() This superstar was in love with Muslim actress, was about to marry her, relationship ruined after death threats from..

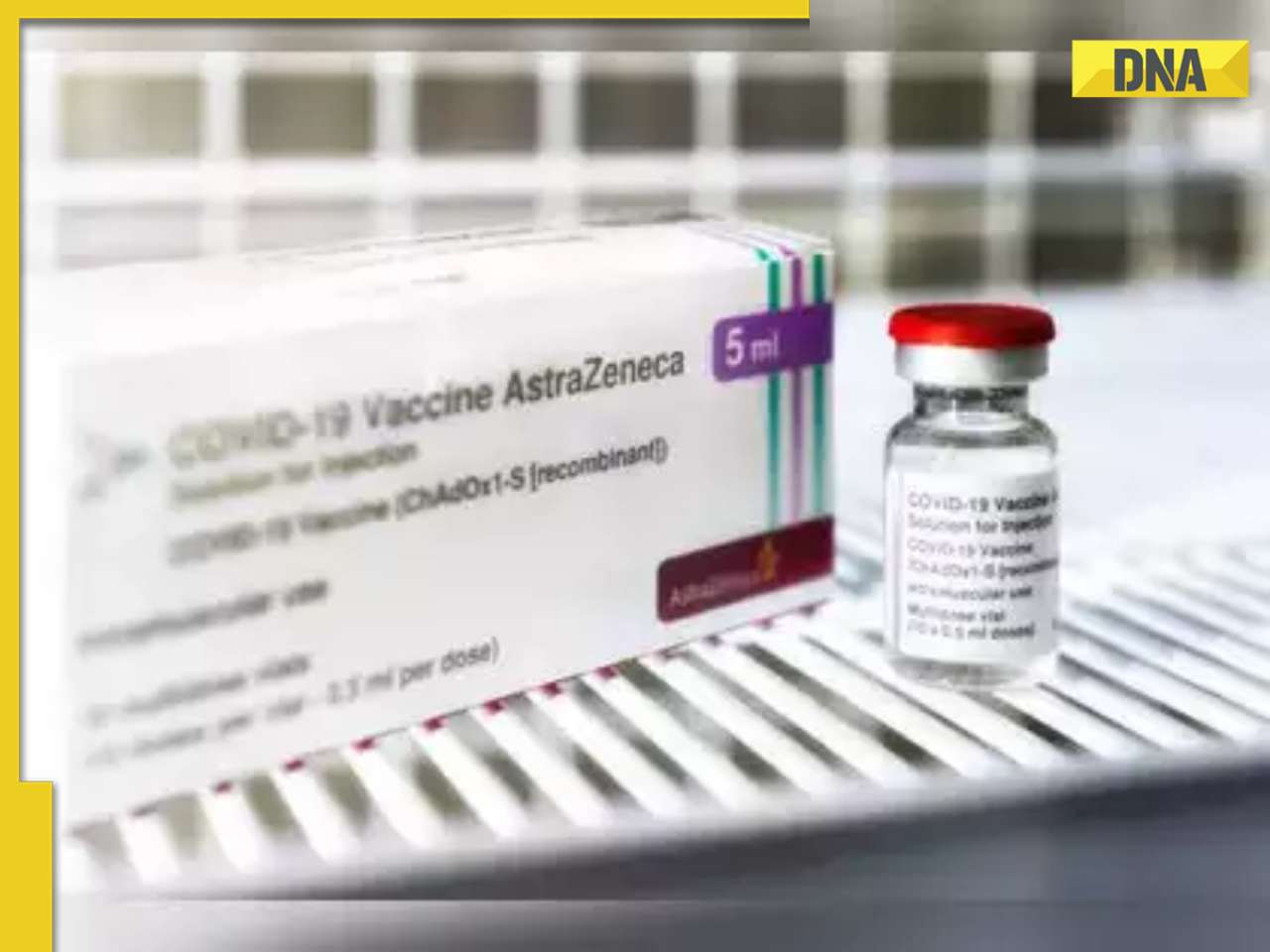

This superstar was in love with Muslim actress, was about to marry her, relationship ruined after death threats from..![submenu-img]() Covishield maker AstraZeneca to withdraw its COVID-19 vaccine globally due to...

Covishield maker AstraZeneca to withdraw its COVID-19 vaccine globally due to...![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Alia Bhatt wears elegant saree made by 163 people over 1965 hours to Met Gala 2024, fans call her ‘princess Jasmine’

Alia Bhatt wears elegant saree made by 163 people over 1965 hours to Met Gala 2024, fans call her ‘princess Jasmine’![submenu-img]() Jr NTR-Lakshmi Pranathi's 13th wedding anniversary: Here's how strangers became soulmates

Jr NTR-Lakshmi Pranathi's 13th wedding anniversary: Here's how strangers became soulmates![submenu-img]() Streaming This Week: Heeramandi, Shaitaan, Manjummel Boys, latest OTT releases to binge-watch

Streaming This Week: Heeramandi, Shaitaan, Manjummel Boys, latest OTT releases to binge-watch![submenu-img]() Remember Ayesha Kapur? Michelle from Black, here's how actress, nutrition coach, entrepreneur looks after 19 years

Remember Ayesha Kapur? Michelle from Black, here's how actress, nutrition coach, entrepreneur looks after 19 years![submenu-img]() Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'

Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'![submenu-img]() Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?

Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() This superstar was in love with Muslim actress, was about to marry her, relationship ruined after death threats from..

This superstar was in love with Muslim actress, was about to marry her, relationship ruined after death threats from..![submenu-img]() Meet Madhuri Dixit’s lookalike, who worked with Akshay Kumar, Govinda, quit films at peak of career, is married to…

Meet Madhuri Dixit’s lookalike, who worked with Akshay Kumar, Govinda, quit films at peak of career, is married to… ![submenu-img]() Meet former beauty queen who competed with Aishwarya, made debut with a superstar, quit acting to become monk, is now..

Meet former beauty queen who competed with Aishwarya, made debut with a superstar, quit acting to become monk, is now..![submenu-img]() Imtiaz Ali reveals if Shahid Kapoor, Kareena Kapoor Khan's breakup affected Jab We Met: 'They were...'

Imtiaz Ali reveals if Shahid Kapoor, Kareena Kapoor Khan's breakup affected Jab We Met: 'They were...'![submenu-img]() Meet actor, who was once thrown out of set, beat up cops, then became popular villain; starred in Rs 1000-crore film

Meet actor, who was once thrown out of set, beat up cops, then became popular villain; starred in Rs 1000-crore film![submenu-img]() IPL 2024: Jake Fraser-McGurk, Abishek Porel power DC to 20-run win over RR

IPL 2024: Jake Fraser-McGurk, Abishek Porel power DC to 20-run win over RR![submenu-img]() SRH vs LSG, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

SRH vs LSG, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() IPL 2024: Here’s why CSK star MS Dhoni batted at No.9 against PBKS

IPL 2024: Here’s why CSK star MS Dhoni batted at No.9 against PBKS![submenu-img]() SRH vs LSG IPL 2024 Dream11 prediction: Fantasy cricket tips for Sunrisers Hyderabad vs Lucknow Super Giants

SRH vs LSG IPL 2024 Dream11 prediction: Fantasy cricket tips for Sunrisers Hyderabad vs Lucknow Super Giants![submenu-img]() Watch: Kuldeep Yadav, Yuzvendra Chahal team up for hilarious RR meme, video goes viral

Watch: Kuldeep Yadav, Yuzvendra Chahal team up for hilarious RR meme, video goes viral![submenu-img]() Not Alia Bhatt or Isha Ambani but this Indian CEO made heads turn at Met Gala 2024, she is from...

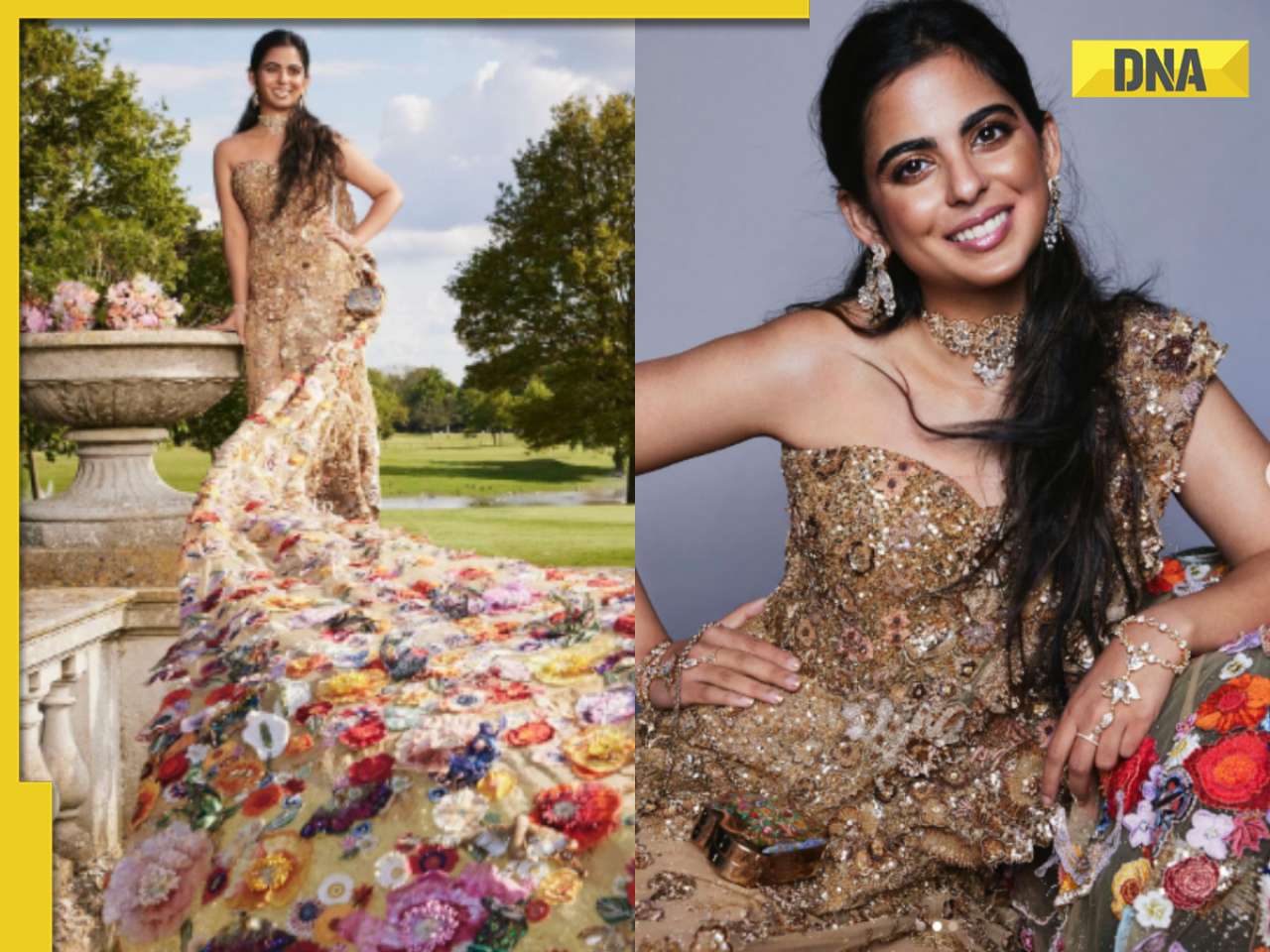

Not Alia Bhatt or Isha Ambani but this Indian CEO made heads turn at Met Gala 2024, she is from...![submenu-img]() Man makes Lord Hanuman co-litigant in plea, Delhi High Court asks him to pay Rs 100000…

Man makes Lord Hanuman co-litigant in plea, Delhi High Court asks him to pay Rs 100000…![submenu-img]() Four big dangerous asteroids coming toward Earth, but the good news is…

Four big dangerous asteroids coming toward Earth, but the good news is…![submenu-img]() Isha Ambani's Met Gala 2024 saree gown was created in over 10,000 hours, see pics

Isha Ambani's Met Gala 2024 saree gown was created in over 10,000 hours, see pics![submenu-img]() Indian-origin man says Apple CEO Tim Cook pushed him...

Indian-origin man says Apple CEO Tim Cook pushed him...

)

)

)

)

)

)

)

)