BP chief executive Tony Hayward was set to face the wrath of US lawmakers as investors welcomed a plan to set up a $20 billion fund to cope with the Gulf of Mexico oil spill claims.

BP chief executive Tony Hayward was set to face the wrath of US lawmakers on Thursday as investors welcomed a plan to set up a $20 billion fund to cope with Gulf of Mexico oil spill claims.

Shares in BP, which nearly halved in value since the April 20 explosion on an offshore rig that led to the spill, rose 8%.

Analysts said some of the heat had been taken off the company by its move to set up the fund and suspend its dividend.

US president Barack Obama announced the agreement on Wednesday after White House officials held four hours of talks with BP executives.

The British company's bosses emerged from the discussions to offer an apology for the worst oil spill in US history.

"Investors were seriously worried that BP as we know it was under threat and that the company could be broken up or forced into liquidation," said Tom Nelson, co-manager at the Guinness Atkinson Global Energy Fund, which owns BP stock.

"What we see now for the first time is that Obama is not going to bring BP to its knees."

But a top-20 investor in BP was unimpressed. "They have ceded a lot of ground to politicans," said the investor. “In the fullness of time, someone’s got to have to pay the price."

BP chief executive officer Tony Hayward will appear at a congressional hearing later on Thursday to explain the events leading up to the spill and what BP has done to clean up the mess.

A number of other oil companies were seen to throw BP to the wolves in hearings this week, portraying themselves as a cut above the London-based firm in terms of safety practices and operational standards.

Hayward, in turn, will try to widen the circle of blame on Thursday and is expected to rebuff those claims.

"The entire industry needs to improve, and it is too early to understand the cause of the complex accident," Hayward said in prepared testimony, adding that "a number of companies are involved, including BP," in the disaster.

Hayward will also be under pressure to avoid another gaffe that could further damage BP's dented reputation.

He was forced to apologise publicly after telling Gulf of Mexico residents last month that he would "like my life back", a comment widely viewed as insensitive in the face of the region’s struggle to contain the impact of the slick and the deaths caused by the explosion.

BP chairman Carl-Henric Svanberg on Wednesday said the company was not greedy and cared "about the small people". He, too, apologised and issued a statement saying he "spoke clumsily."

BP announced a $10 billion asset sale programme as part of the deal, and bankers said most divestments would come from outside the United States. Oppenheimer & Co analyst Fadel Gheit pegged the value of the company’s assets at more than $250 billion.

The sales will take place in a red-hot market: oil and gas deal activity is at a record high this year, with more than $128.5 billion of transactions worldwide through June 4.

Any move by BP to cancel or suspend dividends is an emotive issue in the UK, where it accounts for 12-13% of payouts.

"We are taking the view that BP will plug the oil well later this year and will be back on the dividend paying list next year," George Luckraft, lead manager of the £200 million AXA Framlington Equity Income Fund, said.

"If you sell BP now, you will only have to buy it back next year and probably at a higher price. So we are holding onto the stock at the moment."

BP accounts for 4% of Luckraft's fund.

Politicians on both sides of the Atlantic have weighed in on the debate. UK finance minister George Osborne told a radio channel: "Let’s not forget this is a very important company, not just to the British economy but to the American economy as well. And we want it to succeed and flourish in the future for all our sakes."

The explosion on an offshore rig leased by BP killed 11 workers and ruptured a deep-sea well. The ensuing spill has fouled 120 miles (190km) of US coastline, imperilled multi-billion-dollar fishing and tourism industries, and killed birds, sea turtles and dolphin.

Public anger over the handling of the crisis is intense, especially on the US Gulf Coast.

Obama has sharpened his criticism of BP, and lawmakers have publicly grilled the company’s executives, particularly Hayward. It is expected to be no different today when the BP chief executive visits Capitol Hill.

Obama has watched support fade as his fellow Democrats gear up for tough congressional elections in November. With many voters riveted by the crisis, lawmakers are unlikely to go soft on Hayward.

The company said yesterday it started a second system to siphon oil from the leaking well, a day after a team of US scientists raised their high-end estimate of the amount of crude flowing from the well by 50%, to between 35,000 and 60,000 barrels a day.

The government’s probe of the spill, which is shared by the Coast Guard and the interior department’s minerals management service (MMS), will also come under scrutiny today when the interior department’s inspector general, Mary Kendall, testifies at a US House of Representatives hearing.

![submenu-img]() MBOSE 12th Result 2024: HSSLC Meghalaya Board 12th result declared, direct link here

MBOSE 12th Result 2024: HSSLC Meghalaya Board 12th result declared, direct link here![submenu-img]() Apple iPhone 14 at ‘lowest price ever’ in Flipkart sale, available at just Rs 10499 after Rs 48500 discount

Apple iPhone 14 at ‘lowest price ever’ in Flipkart sale, available at just Rs 10499 after Rs 48500 discount![submenu-img]() Meet man who left high-paying job, built Rs 2000 crore business, moved to village due to…

Meet man who left high-paying job, built Rs 2000 crore business, moved to village due to…![submenu-img]() Meet star, who grew up poor, identity was kept hidden from public, thought about suicide; later became richest...

Meet star, who grew up poor, identity was kept hidden from public, thought about suicide; later became richest...![submenu-img]() Watch: Ranbir Kapoor recalls 'disturbing' memory from his childhood in throwback viral video, says 'I was four years...'

Watch: Ranbir Kapoor recalls 'disturbing' memory from his childhood in throwback viral video, says 'I was four years...'![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Alia Bhatt wears elegant saree made by 163 people over 1965 hours to Met Gala 2024, fans call her ‘princess Jasmine’

Alia Bhatt wears elegant saree made by 163 people over 1965 hours to Met Gala 2024, fans call her ‘princess Jasmine’![submenu-img]() Jr NTR-Lakshmi Pranathi's 13th wedding anniversary: Here's how strangers became soulmates

Jr NTR-Lakshmi Pranathi's 13th wedding anniversary: Here's how strangers became soulmates![submenu-img]() Streaming This Week: Heeramandi, Shaitaan, Manjummel Boys, latest OTT releases to binge-watch

Streaming This Week: Heeramandi, Shaitaan, Manjummel Boys, latest OTT releases to binge-watch![submenu-img]() Remember Ayesha Kapur? Michelle from Black, here's how actress, nutrition coach, entrepreneur looks after 19 years

Remember Ayesha Kapur? Michelle from Black, here's how actress, nutrition coach, entrepreneur looks after 19 years![submenu-img]() Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'

Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'![submenu-img]() Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?

Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() Meet star, who grew up poor, identity was kept hidden from public, thought about suicide; later became richest...

Meet star, who grew up poor, identity was kept hidden from public, thought about suicide; later became richest...![submenu-img]() Watch: Ranbir Kapoor recalls 'disturbing' memory from his childhood in throwback viral video, says 'I was four years...'

Watch: Ranbir Kapoor recalls 'disturbing' memory from his childhood in throwback viral video, says 'I was four years...'![submenu-img]() This superstar was in love with Muslim actress, was about to marry her, relationship ruined after death threats from..

This superstar was in love with Muslim actress, was about to marry her, relationship ruined after death threats from..![submenu-img]() Meet Madhuri Dixit’s lookalike, who worked with Akshay Kumar, Govinda, quit films at peak of career, is married to…

Meet Madhuri Dixit’s lookalike, who worked with Akshay Kumar, Govinda, quit films at peak of career, is married to… ![submenu-img]() Meet former beauty queen who competed with Aishwarya, made debut with a superstar, quit acting to become monk, is now..

Meet former beauty queen who competed with Aishwarya, made debut with a superstar, quit acting to become monk, is now..![submenu-img]() IPL 2024: Jake Fraser-McGurk, Abishek Porel power DC to 20-run win over RR

IPL 2024: Jake Fraser-McGurk, Abishek Porel power DC to 20-run win over RR![submenu-img]() SRH vs LSG, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

SRH vs LSG, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() IPL 2024: Here’s why CSK star MS Dhoni batted at No.9 against PBKS

IPL 2024: Here’s why CSK star MS Dhoni batted at No.9 against PBKS![submenu-img]() SRH vs LSG IPL 2024 Dream11 prediction: Fantasy cricket tips for Sunrisers Hyderabad vs Lucknow Super Giants

SRH vs LSG IPL 2024 Dream11 prediction: Fantasy cricket tips for Sunrisers Hyderabad vs Lucknow Super Giants![submenu-img]() Watch: Kuldeep Yadav, Yuzvendra Chahal team up for hilarious RR meme, video goes viral

Watch: Kuldeep Yadav, Yuzvendra Chahal team up for hilarious RR meme, video goes viral![submenu-img]() Not Alia Bhatt or Isha Ambani but this Indian CEO made heads turn at Met Gala 2024, she is from...

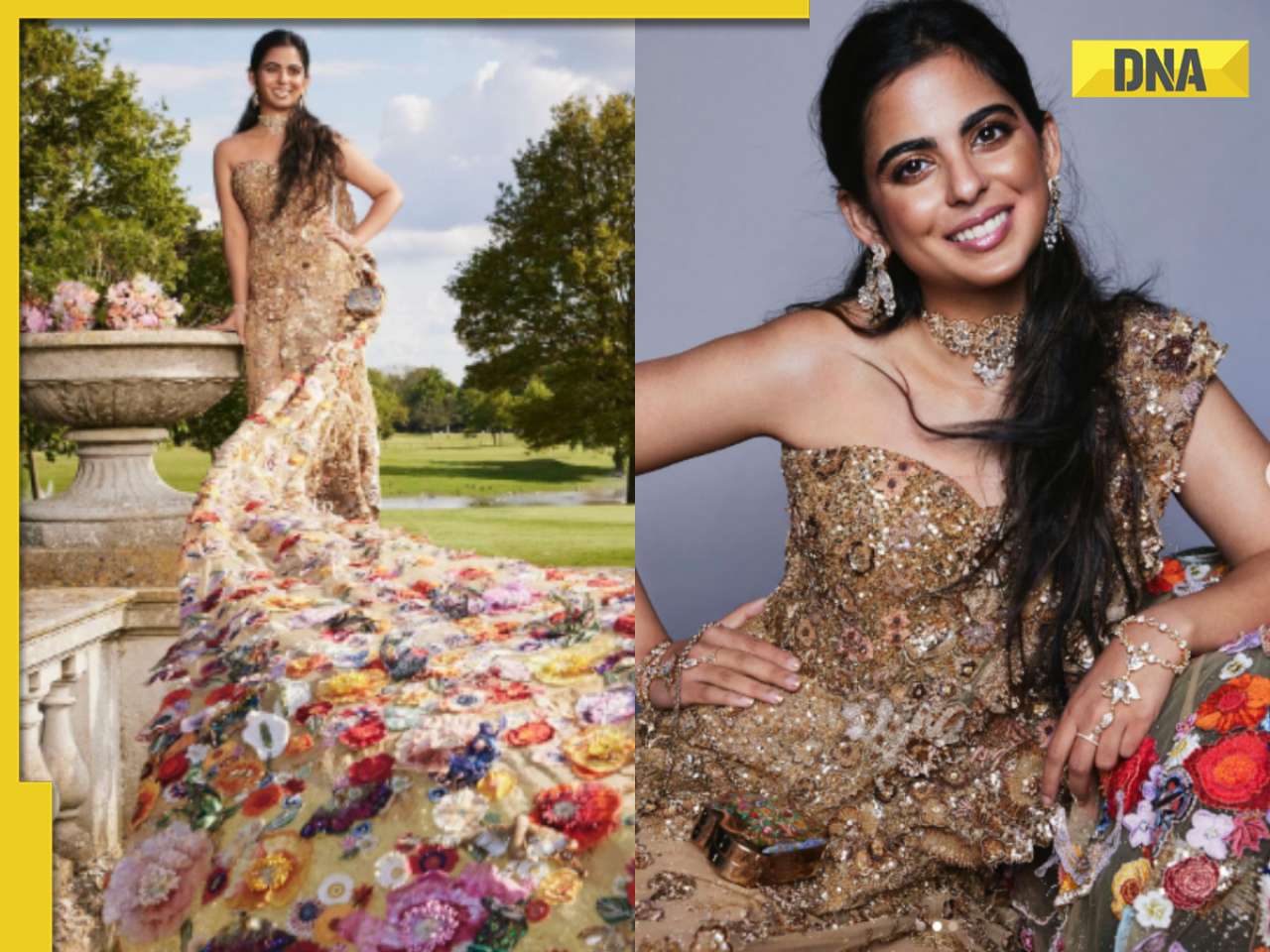

Not Alia Bhatt or Isha Ambani but this Indian CEO made heads turn at Met Gala 2024, she is from...![submenu-img]() Man makes Lord Hanuman co-litigant in plea, Delhi High Court asks him to pay Rs 100000…

Man makes Lord Hanuman co-litigant in plea, Delhi High Court asks him to pay Rs 100000…![submenu-img]() Four big dangerous asteroids coming toward Earth, but the good news is…

Four big dangerous asteroids coming toward Earth, but the good news is…![submenu-img]() Isha Ambani's Met Gala 2024 saree gown was created in over 10,000 hours, see pics

Isha Ambani's Met Gala 2024 saree gown was created in over 10,000 hours, see pics![submenu-img]() Indian-origin man says Apple CEO Tim Cook pushed him...

Indian-origin man says Apple CEO Tim Cook pushed him...

)

)

)

)

)

)