While announcing his proposed tax reforms in Congress, Barack Obama chose to cite Bangalore’s example to support his plan to end tax breaks for firms outsourcing jobs.

While announcing his proposed tax reforms in Congress, US president Barack Obama, ominously, chose to cite Bangalore’s example to support his plan to end tax breaks for firms outsourcing jobs.

Obama said he was seeking to change the “tax code that says you should pay lower taxes if you create a job in Bangalore, India, than if you create one in Buffalo, New York”.

If the reform were to become law, it would hurt many US companies like Intel, IBM, Accenture, Google, Cisco, and AMD, which have set up shop in India. Currently, companies like Accenture have a higher headcount at their development centres in India than in North America.

But would Obama’s bid to withdraw tax incentives put American companies investing in India on the back foot? Partha Iyengar, vice-president and regional research director at Gartner, doesn’t think so. “This tax break, which came about under president George Bush’s regime, helped MNCs to defer tax payment on profits till the time it was repatriated to the US,” he said. “It now puts the onus on them to repatriate profits to the US.”

TV Mohandas Pai, Infosys HR head, said the reform would have “least impact” on Bangalore and offshoring. “It has to do with American companies in banking, financial services, retail, and other sectors — including services — operating in the overseas markets,” Pai said. “Of these, services is a very small part, and within services, IT outsourcing is even smaller.”

Raman Roy, chairman and MD, Quattro BPO Solutions, said: “Indian companies were getting no tax incentives. Removal of tax incentives internationally will only impact India favourably.”

IT representative Nasscom said the impact of Obama’s proposal on India would be marginal. “Global companies that earn profits here are subject to a tax rate of 33.9% (including surcharge and cess) and the impact of the proposed reforms on them would be marginal,” it said in a statement.

But industry bodies Assocham and Ficci remain nervous. Sajjan Jindal, Assocham president, called on the US to reconsider the decision, saying it would be the biggest loser. “Protectionism will kill the spirit of competition and dilute the spirit of the World Trade Organisation,” he said.

Harsh Pati Singhania, Ficci president, said: “In this era of globalisation, a more meaningful measure would have been to evolve a consensus on harmonising national taxation systems.”

![submenu-img]() IND vs BAN T20 World Cup warm-up: Dominant India beat Bangladesh by 60 runs in New York

IND vs BAN T20 World Cup warm-up: Dominant India beat Bangladesh by 60 runs in New York![submenu-img]() Ankita Lokhande dedicates her career to Sushant Singh Rajput, pens emotional note on Pavitra Rishta completing 15 years

Ankita Lokhande dedicates her career to Sushant Singh Rajput, pens emotional note on Pavitra Rishta completing 15 years![submenu-img]() Amethi Lok Sabha Election 2024 Exit Poll LIVE: Smriti Irani vs KL Sharma, who will win?

Amethi Lok Sabha Election 2024 Exit Poll LIVE: Smriti Irani vs KL Sharma, who will win?![submenu-img]() Mumbai South Lok Sabha Election 2024 Exit Poll: Uddhav Thackeray vs Eknath Shinde, which Sena faction will win the seat?

Mumbai South Lok Sabha Election 2024 Exit Poll: Uddhav Thackeray vs Eknath Shinde, which Sena faction will win the seat?![submenu-img]() Basirhat Lok Sabha Election Exit Poll: Haji Nurul Islam likely to win the seat, according to India Today-Axis My India

Basirhat Lok Sabha Election Exit Poll: Haji Nurul Islam likely to win the seat, according to India Today-Axis My India![submenu-img]() Meet JEE Main topper with AIR 4, plans to pursue BTech from IIT Bombay, he is from...

Meet JEE Main topper with AIR 4, plans to pursue BTech from IIT Bombay, he is from...![submenu-img]() Meet Indian genius who won National Spelling Bee contest in US at age 12, he is from…

Meet Indian genius who won National Spelling Bee contest in US at age 12, he is from…![submenu-img]() Meet man who became IIT Bombay professor at just 22, got sacked from IIT after some years because..

Meet man who became IIT Bombay professor at just 22, got sacked from IIT after some years because..![submenu-img]() Meet Indian genius, son of constable, worked with IIT, NASA, then went missing, was found after years in...

Meet Indian genius, son of constable, worked with IIT, NASA, then went missing, was found after years in...![submenu-img]() Meet IAS officer who was victim of domestic violence, mother of two, cracked UPSC exam in first attempt, she's posted in

Meet IAS officer who was victim of domestic violence, mother of two, cracked UPSC exam in first attempt, she's posted in![submenu-img]() DNA Verified: Did Kangana Ranaut party with gangster Abu Salem? Actress reveals who's with her in viral photo

DNA Verified: Did Kangana Ranaut party with gangster Abu Salem? Actress reveals who's with her in viral photo![submenu-img]() DNA Verified: New Delhi Railway Station to be closed for 4 years? Know the truth here

DNA Verified: New Delhi Railway Station to be closed for 4 years? Know the truth here![submenu-img]() DNA Verified: Did RSS chief Mohan Bhagwat praise Congress during Lok Sabha Elections 2024? Know the truth here

DNA Verified: Did RSS chief Mohan Bhagwat praise Congress during Lok Sabha Elections 2024? Know the truth here![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() Streaming This Week: Panchayat season 3, Swatantrya Veer Savarkar, Illegal season 3, latest OTT releases to binge-watch

Streaming This Week: Panchayat season 3, Swatantrya Veer Savarkar, Illegal season 3, latest OTT releases to binge-watch![submenu-img]() Avneet Kaur shines in navy blue gown with shimmery trail at Cannes 2024, fans say 'she is unstoppable now'

Avneet Kaur shines in navy blue gown with shimmery trail at Cannes 2024, fans say 'she is unstoppable now'![submenu-img]() Assamese actress Aimee Baruah wins hearts as she represents her culture in saree with 200-year-old motif at Cannes

Assamese actress Aimee Baruah wins hearts as she represents her culture in saree with 200-year-old motif at Cannes ![submenu-img]() Aditi Rao Hydari's monochrome gown at Cannes Film Festival divides social media: 'We love her but not the dress'

Aditi Rao Hydari's monochrome gown at Cannes Film Festival divides social media: 'We love her but not the dress'![submenu-img]() AI models play volley ball on beach in bikini

AI models play volley ball on beach in bikini![submenu-img]() Lok Sabha Elections 2024: What are exit polls? When and how are they conducted?

Lok Sabha Elections 2024: What are exit polls? When and how are they conducted?![submenu-img]() DNA Explainer: Why was Iranian president Ebrahim Raisi, killed in helicopter crash, regarded as ‘Butcher of Tehran’?

DNA Explainer: Why was Iranian president Ebrahim Raisi, killed in helicopter crash, regarded as ‘Butcher of Tehran’?![submenu-img]() DNA Explainer: Why did deceased Iranian President Ebrahim Raisi wear black turban?

DNA Explainer: Why did deceased Iranian President Ebrahim Raisi wear black turban?![submenu-img]() Iran President Ebrahim Raisi's death: Will it impact gold, oil prices and stock markets?

Iran President Ebrahim Raisi's death: Will it impact gold, oil prices and stock markets?![submenu-img]() Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?

Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?![submenu-img]() Ankita Lokhande dedicates her career to Sushant Singh Rajput, pens emotional note on Pavitra Rishta completing 15 years

Ankita Lokhande dedicates her career to Sushant Singh Rajput, pens emotional note on Pavitra Rishta completing 15 years![submenu-img]() Kajal Agarwal says south heroines are 'stereotyped', explains why Bollywood has meatier roles for married actresses

Kajal Agarwal says south heroines are 'stereotyped', explains why Bollywood has meatier roles for married actresses![submenu-img]() Before Rani Mukerji, this actress was finalised for Kabhi Alvida Naa Kehna, she rejected to star opposite SRK because...

Before Rani Mukerji, this actress was finalised for Kabhi Alvida Naa Kehna, she rejected to star opposite SRK because...![submenu-img]() Amid breakup rumours with Malaika Arora, Arjun Kapoor says 'we have two choices in life', shares cryptic post on Insta

Amid breakup rumours with Malaika Arora, Arjun Kapoor says 'we have two choices in life', shares cryptic post on Insta![submenu-img]() Who is Alexander Ilic? Mystery man spotted with Hardik Pandya's wife Natasa Stankovic; earlier linked to Disha, Tripti

Who is Alexander Ilic? Mystery man spotted with Hardik Pandya's wife Natasa Stankovic; earlier linked to Disha, Tripti![submenu-img]() Viral video: Little girl dances her heart out to Neha Kakkar's Balenciaga, internet loves it

Viral video: Little girl dances her heart out to Neha Kakkar's Balenciaga, internet loves it![submenu-img]() Caught on CCTV: Leopard's jaw-dropping leap over wall to snatch hen stuns internet, watch

Caught on CCTV: Leopard's jaw-dropping leap over wall to snatch hen stuns internet, watch![submenu-img]() NASA warns of strong solar storm with blackouts, likely to hit Earth on…

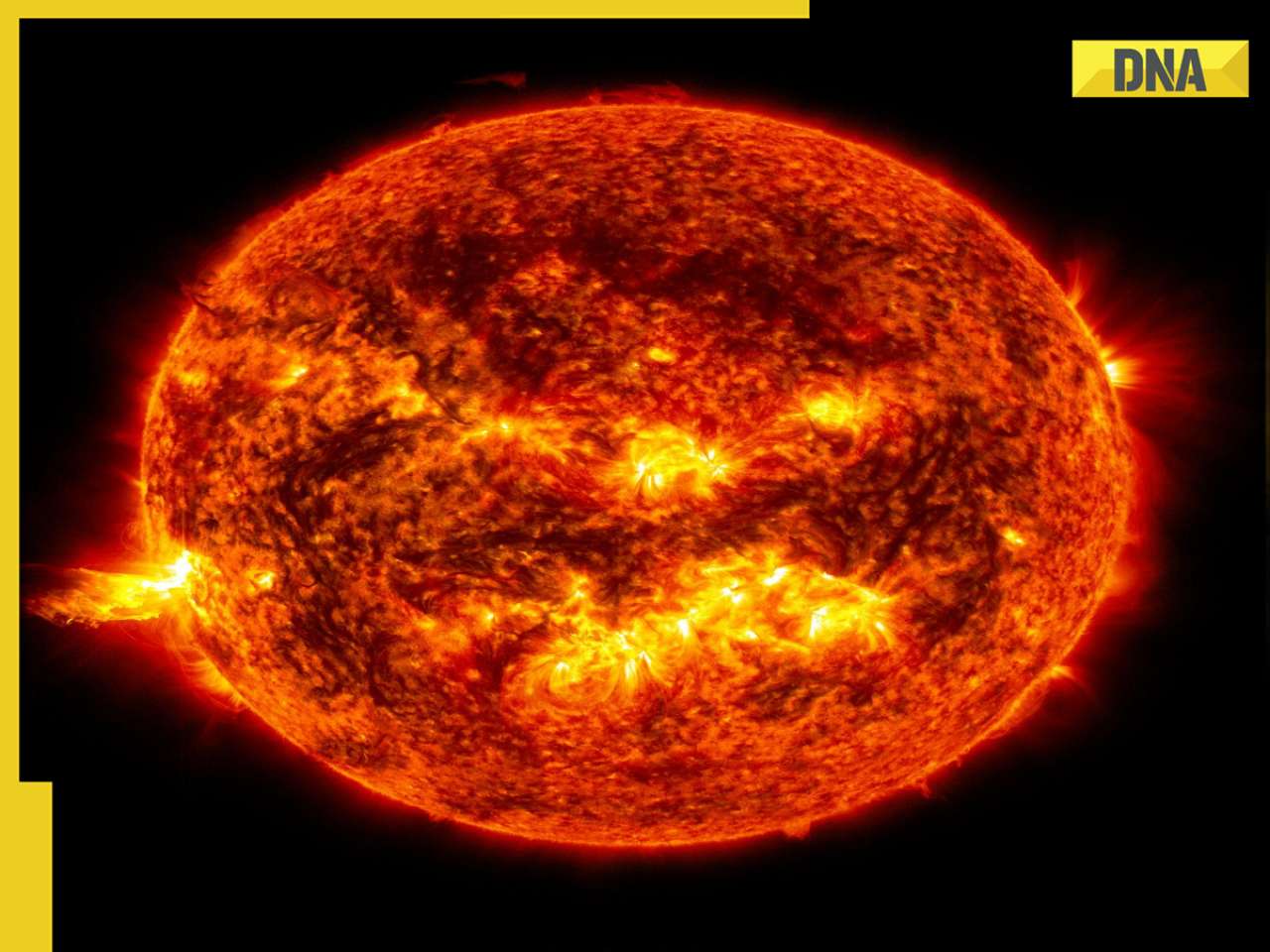

NASA warns of strong solar storm with blackouts, likely to hit Earth on…![submenu-img]() Nita Ambani nearly missed Anant Ambani, Radhika Merchant's 2nd pre-wedding bash due to....

Nita Ambani nearly missed Anant Ambani, Radhika Merchant's 2nd pre-wedding bash due to....![submenu-img]() Viral video: Little girl’s adorable dance to 'Ruki Sukhi Roti' will melt your heart, watch

Viral video: Little girl’s adorable dance to 'Ruki Sukhi Roti' will melt your heart, watch

)

)

)

)

)

)