Anu’s Laboratories Ltd (Anulabs), the Hyderabad-based pharmaceutical company, is a manufacturer and supplier of basic and advanced quality drug intermediates and active pharma ingredients (API).

Anu’s Laboratories Ltd (Anulabs), the Hyderabad-based pharmaceutical company, is a manufacturer and supplier of basic and advanced quality drug intermediates and active pharma ingredients (API).

Anulabs started of with supplying to Indian pharma companies and later expanded into exports to Israel. Thereon, its exports base expanded to the US, Japan and Europe.

Anulabs launched an initial public offering in June to raise funds for expansion. The proceeds from the public issue were used to start a new manufacturing plant for drug intermediates (APIs) and for setting up a pilot plant for contract research and manufacturing (CRAMS). API and CRAMS will give a major boost to the company’s revenues and also expand its exports.

Business

Anulabs offers a wide range of complex organic molecules and also extends its support to synthesis of new chemical entities. The firm has established itself as a leader in some of the basic intermediates such as 2,4 dichloro5-fluoro acetophenone and di-methyl acetate.

Optimised process has resulted in the two intermediates becoming the flagship products for Anulabs. These two intermediates contribute around 60% to the company’s revenues.

The company also offers other intermediates such as 2-chlorohexanone and 1,3-dibromo propane.

However, Anulabs is seeking to de-risk revenues generated by its two brand leaders.

So, it is now emphasising on other basic intermediates such as ortho hydroxy benzaldehyde, 2-chloroacetamide, potassium and sodium t-butoxide powder.

Anulabs also offers fine chemicals in the form of a wide range of complex organic molecules synthesised within custom synthesis, and contract research programme.

Investment rationale

Anulabs is a well-established manufacturer and supplier of basic and advanced intermediates and has an excellent client basket. Its client base extends from major pharma companies in the domestic market to controlled and matured markets such as Europe, the US, Japan and other emerging pharma markets. Its two basic intermediates — 2,4 dichloro 5- fluoro acetophenone and di-methyl acetate — are the market leaders. These two intermediates will, therefore, keep driving its revenues.

Anulabs’ developing product basket and also the products that are in its pipeline offer big revenue opportunities for the firm. Ciprofloxacin is said to be a major revenue-generating antibiotic. Pentoxyfyline is also a very popular product, which is used for increasing the microcirculation of blood.

Fexofenadine has emerged as a well-prescribed anti-allergic and diltiazem is a time tested medicine for treating cardiovascular disorders. Iopamodol and naproxen are also very successful molecules. Thus, intermediates for all these molecules have great revenue generating possibilities and can drive Anulabs’ growth. Chinese intermediates have had a big market in India and abroad. Lot of Indian and international companies have been using cost-effective Chinese intermediates. However, since China is hosting the Olympic Games, the authorities have suspended production of some of the intermediates. This has reduced the availability of Chinese intermediates in the market and has also pushed up prices.

Here’s where Anulabs and other companies stand to benefit. The company’s new intermediates plant will help it start production of API products that are in the pipeline. The pilot plant will also boost the company’s contract manufacturing activities. At present, Anulabs has a contract manufacturing agreement in place with Dr Reddy’s Laboratories for manufacturing ciprofloxacin. However, it is the CRAMS business that has immense revenue potentials. Both API and CRAMS will also provide impetus to its exports, which currently contribute 15% to total revenues.

Concerns

Anulabs gets almost 60% of its revenues from its two basic intermediates — 2,4 dichloro 5- fluoro acetophenone and di-methyl acetate. Therefore, it is crucial for the firm to develop other sources of revenues.

Anulabs gets most of its revenues from its top 10 customers. So, if it loses even one customer — for example Dr Reddy’s Lab, which contributed 48% to its revenues in FY07 — its revenues could be severely dented.

Growth of Anulabs also depends on the completion of its two plants. Both API and CRAMS business growth can be severely affected if there’s any delay in the execution of these projects.

Anulabs also doesn’t have any major supply agreement for raw materials in place. This has made the company extremely vulnerable to fluctuations in raw material costs. Also, any unfavourable ruling on its pending land disputes may affect its prospects.

Valuations

Anulabs saw its topline grow at 24.6% in FY08. However, in the first quarter of the fiscal, its topline declined by 15.3% sequentially. There was a 16% sequential de-growth in its net profit despite Anulabs maintaining its margins. Sequential fall of revenues and profits may be because Anulabs did not have any long-term contracts with customers. Anulabs operates on the basis of purchase orders. So, the decline may have been because of a delay in orders and it may gain on growth in the coming quarters.

However, looking at its expansion plans, Anulabs seems to have good long-term growth prospects. These prospects will, however, depend upon the timely execution of projects. This is also crucial for Anulabs’ growth in the fields of API and CRAMS. The success of its other products is also important as its revenues largely depend on its two flagship intermediates.

Thus, looking its expansion plans and the products in the pipeline, Anulabs holds promise for growth in both API and CRAMS segments. However, investors willing to buy the stock will have to keep a close watch on its new orders. Also, investors should watch out for the success rate of its new products and the timely execution of its manufacturing facilities.

Disclaimer: The author does not hold any shares in the company.

![submenu-img]() Anil Kapoor, Aditya Roy Kapur's The Night Manager becomes only entry from India to secure nomination at Emmy Awards 2024

Anil Kapoor, Aditya Roy Kapur's The Night Manager becomes only entry from India to secure nomination at Emmy Awards 2024![submenu-img]() Land-for-jobs case: President Murmu authorises prosecution of Lalu Prasad Yadav, CBI submits...

Land-for-jobs case: President Murmu authorises prosecution of Lalu Prasad Yadav, CBI submits...![submenu-img]() This billionaire, once world’s richest man, witnesses drop in wealth due to...; not Mukesh Ambani, Adani

This billionaire, once world’s richest man, witnesses drop in wealth due to...; not Mukesh Ambani, Adani![submenu-img]() Ranbir Kapoor's sister, Riddhima's 'maybe it's a house help' remark leaves netizens furious: 'Uneducated rich brats'

Ranbir Kapoor's sister, Riddhima's 'maybe it's a house help' remark leaves netizens furious: 'Uneducated rich brats'![submenu-img]() Mumbai man orders iPhone 16 online after standing in queue for hours, then..

Mumbai man orders iPhone 16 online after standing in queue for hours, then..![submenu-img]() J-K Assembly Elections 2024: राज्य नहीं अब है केंद्र शासित प्रदेश, क्या 370 की वापसी कर सकती है जम्मू-कश्मीर विधानसभा? जानें उसके अधिकार

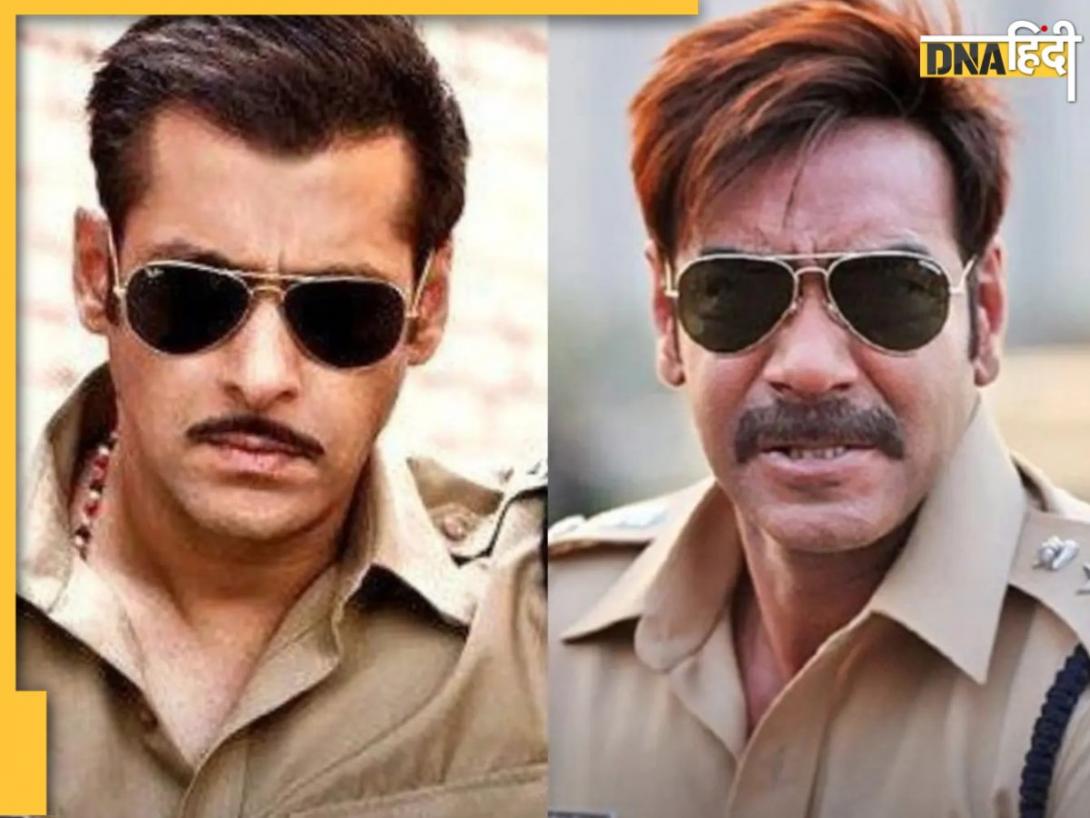

J-K Assembly Elections 2024: राज्य नहीं अब है केंद्र शासित प्रदेश, क्या 370 की वापसी कर सकती है जम्मू-कश्मीर विधानसभा? जानें उसके अधिकार![submenu-img]() DNA Verified: Singham Again में चुलबुल पांडे दिखेंगे या नहीं, जानिए क्या है Salman Khan की इस खबर का सच

DNA Verified: Singham Again में चुलबुल पांडे दिखेंगे या नहीं, जानिए क्या है Salman Khan की इस खबर का सच![submenu-img]() आप भी बाजार से खरीदकर खाते हैं देशी घी, जानिए कैसे जांचे उसमें Tirupati Laddu की तरह जानवर की चर्बी तो नहीं

आप भी बाजार से खरीदकर खाते हैं देशी घी, जानिए कैसे जांचे उसमें Tirupati Laddu की तरह जानवर की चर्बी तो नहीं![submenu-img]() सड़क पर खड़ा हुआ था नगर निगम का टैंकर और अचानक कुछ ऐसा हुआ, डरा देगा पुणे का Viral Video

सड़क पर खड़ा हुआ था नगर निगम का टैंकर और अचानक कुछ ऐसा हुआ, डरा देगा पुणे का Viral Video![submenu-img]() 'असंवैधानिक है सरकारी फैक्ट चेक यूनिट' कॉमेडियन Kunal Kamra केस में Bombay High Court का मोदी सरकार को झटका

'असंवैधानिक है सरकारी फैक्ट चेक यूनिट' कॉमेडियन Kunal Kamra केस में Bombay High Court का मोदी सरकार को झटका![submenu-img]() Ford to return to India after 2 years with reopening of....

Ford to return to India after 2 years with reopening of....![submenu-img]() Maruti Suzuki launches new Swift CNG, check price, mileage, other features

Maruti Suzuki launches new Swift CNG, check price, mileage, other features![submenu-img]() ‘30 LPA, 3BHK, no in-laws’: Woman earning Rs 1.32 lakh salary lists demands for future husband, netizens say...

‘30 LPA, 3BHK, no in-laws’: Woman earning Rs 1.32 lakh salary lists demands for future husband, netizens say...![submenu-img]() In a big EV push, Centre launches Rs 10900 crore PM E-Drive scheme to replace…

In a big EV push, Centre launches Rs 10900 crore PM E-Drive scheme to replace…![submenu-img]() World’s longest car has helipad, swimming pool, mini-golf course, can seat over…; it cost…

World’s longest car has helipad, swimming pool, mini-golf course, can seat over…; it cost…![submenu-img]() Meet man who passed JEE Advanced with AIR 1, completed B.Tech from IIT Bombay, is now pursuing…

Meet man who passed JEE Advanced with AIR 1, completed B.Tech from IIT Bombay, is now pursuing…![submenu-img]() Meet man, whose father's death encouraged him to quit IAS job, create multi-crore company, he is...

Meet man, whose father's death encouraged him to quit IAS job, create multi-crore company, he is...![submenu-img]() Meet woman, who scored 97% in class 12, secured 705 out of 720 marks in NEET exam, her AIR is...

Meet woman, who scored 97% in class 12, secured 705 out of 720 marks in NEET exam, her AIR is...![submenu-img]() NEET UG Counselling 2024: Round 2 seat allotment result declared at mcc.nic.in, check direct link here

NEET UG Counselling 2024: Round 2 seat allotment result declared at mcc.nic.in, check direct link here![submenu-img]() Meet IPS officer who has resigned after serving for 18 yrs due to...

Meet IPS officer who has resigned after serving for 18 yrs due to...![submenu-img]() Congress President Kharge Slams & Opposes 'One Nation, One Election' Proposal, Calls It Impractical

Congress President Kharge Slams & Opposes 'One Nation, One Election' Proposal, Calls It Impractical![submenu-img]() Why 'One Nation One Election' Is important? Ashwini Vaishnaw Explains After It Gets Cabinet Approval

Why 'One Nation One Election' Is important? Ashwini Vaishnaw Explains After It Gets Cabinet Approval![submenu-img]() Jammu Kashmir Assembly Election 2024 Phase 1 Highlights: What Happened In First phase In J&K Polls?

Jammu Kashmir Assembly Election 2024 Phase 1 Highlights: What Happened In First phase In J&K Polls?![submenu-img]() One Nation One Election: Centre Clears Proposal, Bill To Be Introduced In Winter Session | Modi 3.0

One Nation One Election: Centre Clears Proposal, Bill To Be Introduced In Winter Session | Modi 3.0![submenu-img]() Haryana Elections 2024: Is BJP Set To Lose In Haryana? Anti-Incumbency And Other Factors Analysed

Haryana Elections 2024: Is BJP Set To Lose In Haryana? Anti-Incumbency And Other Factors Analysed![submenu-img]() This billionaire, once world’s richest man, witnesses drop in wealth due to...; not Mukesh Ambani, Adani

This billionaire, once world’s richest man, witnesses drop in wealth due to...; not Mukesh Ambani, Adani![submenu-img]() Meet man who started as intern at Nike, is now its CEO after 32 years, his salary is Rs...

Meet man who started as intern at Nike, is now its CEO after 32 years, his salary is Rs...![submenu-img]() Meet man who received gift worth Rs 15000000000 from Mukesh Ambani, is referred to as his 'right hand', he is...

Meet man who received gift worth Rs 15000000000 from Mukesh Ambani, is referred to as his 'right hand', he is...![submenu-img]() Elon Musk, Oracle CEO once begged this company to take their money, know what had happened

Elon Musk, Oracle CEO once begged this company to take their money, know what had happened![submenu-img]() 'Office was filled with…': Ashneer Grover on why he left EY in one day despite having package of Rs…

'Office was filled with…': Ashneer Grover on why he left EY in one day despite having package of Rs…![submenu-img]() Luxurious homes to swanky cars: Most expensive things owned by Virat Kohli

Luxurious homes to swanky cars: Most expensive things owned by Virat Kohli![submenu-img]() Akshay Kumar's biggest flop film was remake of a Malayalam blockbuster, still broke Guinness World Record set by...

Akshay Kumar's biggest flop film was remake of a Malayalam blockbuster, still broke Guinness World Record set by...![submenu-img]() Exploring Uttarakhand: 6 breathtaking destinations in scenic state

Exploring Uttarakhand: 6 breathtaking destinations in scenic state![submenu-img]() From Puga Valley to Hanle: Must-visit places in Ladakh

From Puga Valley to Hanle: Must-visit places in Ladakh![submenu-img]() Meet Himachal officer who has been transferred without posting, as popular as IAS Tina Dabi on social media, she is...

Meet Himachal officer who has been transferred without posting, as popular as IAS Tina Dabi on social media, she is...![submenu-img]() Land-for-jobs case: President Murmu authorises prosecution of Lalu Prasad Yadav, CBI submits...

Land-for-jobs case: President Murmu authorises prosecution of Lalu Prasad Yadav, CBI submits...![submenu-img]() Tirupati Laddoo Row: Jagan Reddy says he will write to PM Modi, CJI to take action against...

Tirupati Laddoo Row: Jagan Reddy says he will write to PM Modi, CJI to take action against...![submenu-img]() AAP demands government accommodation for outgoing Delhi CM Arvind Kejriwal, says he is...

AAP demands government accommodation for outgoing Delhi CM Arvind Kejriwal, says he is...![submenu-img]() 'Samples highly adulterated, we will...': Tirupati Temple Trust issues first statement on laddoo row

'Samples highly adulterated, we will...': Tirupati Temple Trust issues first statement on laddoo row![submenu-img]() NEET UG 2024: CBI files second-chargesheet against six accused in paper leak case

NEET UG 2024: CBI files second-chargesheet against six accused in paper leak case

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)