Jet Airways has drawn a new route map to fly into a high-profit zone -- by consolidating locally and expanding presence overseas.

BANGALORE: Jet Airways has drawn a new route map to fly into a high-profit zone -- by consolidating locally and expanding presence overseas.

So much so, the carrier is forecasting its domestic operations to grow at a lower rate than the sector average.

Jet has projected 16-17% compounded annual growth rate (CAGR) in domestic operations growth as against the industry average of 22-25% in the next 3 years.

Its toned-down estimate is also based on continuing supply pressure as budget airlines build capacity to scale up operations and widen their network in the domestic market.

Analysts consider the 16-17% CAGR of domestic income, on a high base, to be a good forecast. “It’s a healthy revenue projection. The competition (from new entrants) has already taken its toll on Jet’s revenue. Since the airline has already built up capacity in the domestic market, now onwards its volume will now, more or less, remain the same. It will now concentrate on building its franchisee network and brand image and command a premium for better service in the market,” said an analyst with an Indian broking house.

In the short term, Jet expects domestic yields to be steady at 13% despite the onset of the lean season. “We think this (steady yields) will be to some extent buffered by surcharges,” states the carrier in its presentation.

However, Jet’s long-term forecasts of 20% EBITDAR margins s seen as pessimistic. “My estimate is the margins would definitely be hovering at 25% in the long term, that is if the jet fuel prices stay where they are today or slip further,” said an analyst.

And more than anything else, the carrier is banking on its overseas operations to surge ahead of competition.

That’s a sound strategy, said the analyst.

Jet plans to start flights from three cities — New York, San Francisco and Toronto — in the next fiscal. These routes are expected to break even in 12-18 months.

Currently, all its overseas routes (including London) are profitable. However, it is expecting some of the South East (SE) Asian routes to turn unprofitable, again, once wide bodied aircraft are deployed in place of the current Boeing 737s on them.

![submenu-img]() MBOSE 12th Result 2024: HSSLC Meghalaya Board 12th result declared, direct link here

MBOSE 12th Result 2024: HSSLC Meghalaya Board 12th result declared, direct link here![submenu-img]() Apple iPhone 14 at ‘lowest price ever’ in Flipkart sale, available at just Rs 10499 after Rs 48500 discount

Apple iPhone 14 at ‘lowest price ever’ in Flipkart sale, available at just Rs 10499 after Rs 48500 discount![submenu-img]() Meet man who left high-paying job, built Rs 2000 crore business, moved to village due to…

Meet man who left high-paying job, built Rs 2000 crore business, moved to village due to…![submenu-img]() Meet star, who grew up poor, identity was kept hidden from public, thought about suicide; later became richest...

Meet star, who grew up poor, identity was kept hidden from public, thought about suicide; later became richest...![submenu-img]() Watch: Ranbir Kapoor recalls 'disturbing' memory from his childhood in throwback viral video, says 'I was four years...'

Watch: Ranbir Kapoor recalls 'disturbing' memory from his childhood in throwback viral video, says 'I was four years...'![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Alia Bhatt wears elegant saree made by 163 people over 1965 hours to Met Gala 2024, fans call her ‘princess Jasmine’

Alia Bhatt wears elegant saree made by 163 people over 1965 hours to Met Gala 2024, fans call her ‘princess Jasmine’![submenu-img]() Jr NTR-Lakshmi Pranathi's 13th wedding anniversary: Here's how strangers became soulmates

Jr NTR-Lakshmi Pranathi's 13th wedding anniversary: Here's how strangers became soulmates![submenu-img]() Streaming This Week: Heeramandi, Shaitaan, Manjummel Boys, latest OTT releases to binge-watch

Streaming This Week: Heeramandi, Shaitaan, Manjummel Boys, latest OTT releases to binge-watch![submenu-img]() Remember Ayesha Kapur? Michelle from Black, here's how actress, nutrition coach, entrepreneur looks after 19 years

Remember Ayesha Kapur? Michelle from Black, here's how actress, nutrition coach, entrepreneur looks after 19 years![submenu-img]() Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'

Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'![submenu-img]() Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?

Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() Meet star, who grew up poor, identity was kept hidden from public, thought about suicide; later became richest...

Meet star, who grew up poor, identity was kept hidden from public, thought about suicide; later became richest...![submenu-img]() Watch: Ranbir Kapoor recalls 'disturbing' memory from his childhood in throwback viral video, says 'I was four years...'

Watch: Ranbir Kapoor recalls 'disturbing' memory from his childhood in throwback viral video, says 'I was four years...'![submenu-img]() This superstar was in love with Muslim actress, was about to marry her, relationship ruined after death threats from..

This superstar was in love with Muslim actress, was about to marry her, relationship ruined after death threats from..![submenu-img]() Meet Madhuri Dixit’s lookalike, who worked with Akshay Kumar, Govinda, quit films at peak of career, is married to…

Meet Madhuri Dixit’s lookalike, who worked with Akshay Kumar, Govinda, quit films at peak of career, is married to… ![submenu-img]() Meet former beauty queen who competed with Aishwarya, made debut with a superstar, quit acting to become monk, is now..

Meet former beauty queen who competed with Aishwarya, made debut with a superstar, quit acting to become monk, is now..![submenu-img]() IPL 2024: Jake Fraser-McGurk, Abishek Porel power DC to 20-run win over RR

IPL 2024: Jake Fraser-McGurk, Abishek Porel power DC to 20-run win over RR![submenu-img]() SRH vs LSG, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

SRH vs LSG, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() IPL 2024: Here’s why CSK star MS Dhoni batted at No.9 against PBKS

IPL 2024: Here’s why CSK star MS Dhoni batted at No.9 against PBKS![submenu-img]() SRH vs LSG IPL 2024 Dream11 prediction: Fantasy cricket tips for Sunrisers Hyderabad vs Lucknow Super Giants

SRH vs LSG IPL 2024 Dream11 prediction: Fantasy cricket tips for Sunrisers Hyderabad vs Lucknow Super Giants![submenu-img]() Watch: Kuldeep Yadav, Yuzvendra Chahal team up for hilarious RR meme, video goes viral

Watch: Kuldeep Yadav, Yuzvendra Chahal team up for hilarious RR meme, video goes viral![submenu-img]() Not Alia Bhatt or Isha Ambani but this Indian CEO made heads turn at Met Gala 2024, she is from...

Not Alia Bhatt or Isha Ambani but this Indian CEO made heads turn at Met Gala 2024, she is from...![submenu-img]() Man makes Lord Hanuman co-litigant in plea, Delhi High Court asks him to pay Rs 100000…

Man makes Lord Hanuman co-litigant in plea, Delhi High Court asks him to pay Rs 100000…![submenu-img]() Four big dangerous asteroids coming toward Earth, but the good news is…

Four big dangerous asteroids coming toward Earth, but the good news is…![submenu-img]() Isha Ambani's Met Gala 2024 saree gown was created in over 10,000 hours, see pics

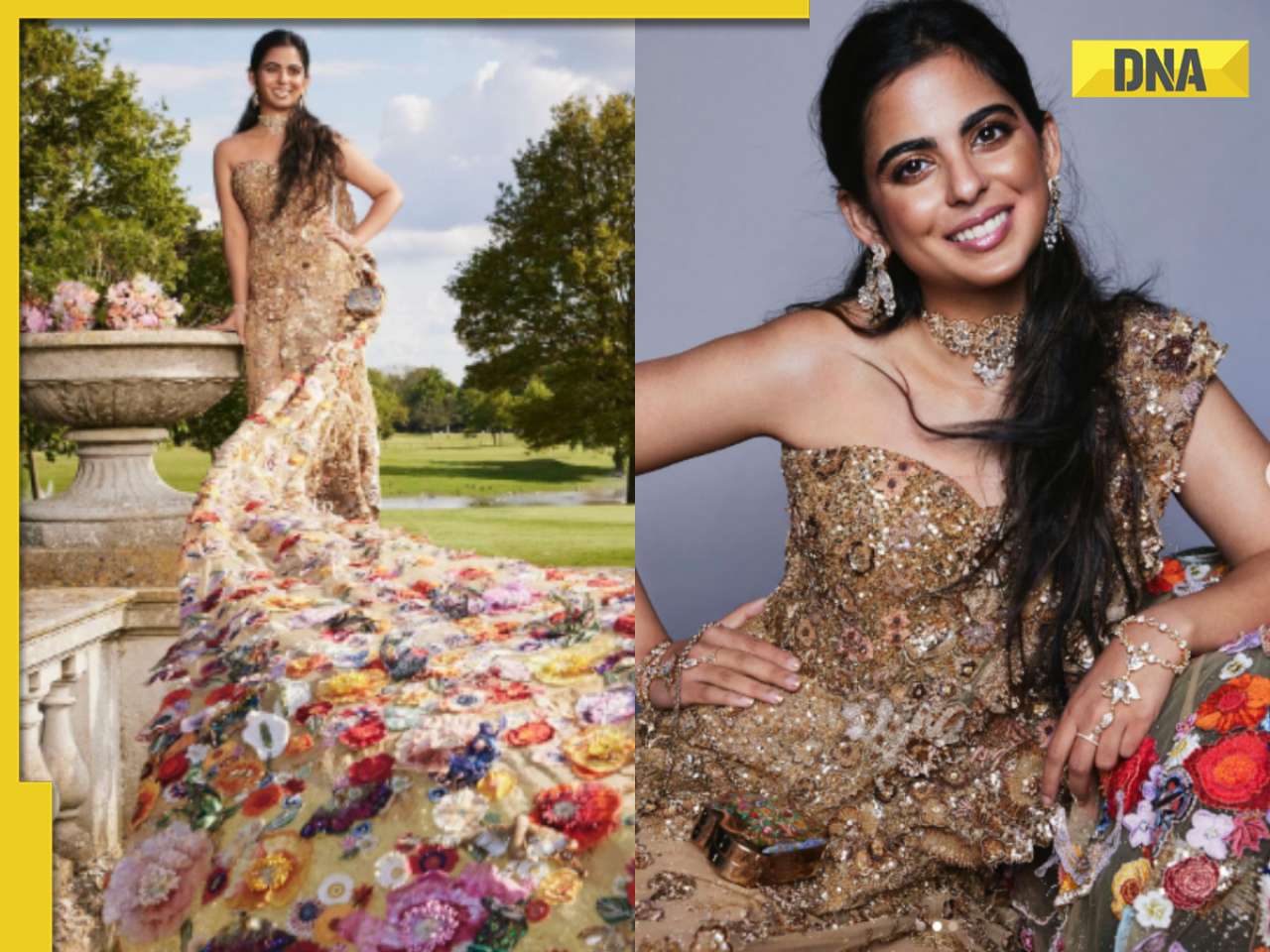

Isha Ambani's Met Gala 2024 saree gown was created in over 10,000 hours, see pics![submenu-img]() Indian-origin man says Apple CEO Tim Cook pushed him...

Indian-origin man says Apple CEO Tim Cook pushed him...

)

)

)

)

)

)