Insurance industry should concentrate on consumer protection than micro-regulation.

The insurance industry has enjoyed strong growth since 2000. Economic development, spurred by reforms, has been the driver of growth for India, at large, and the insurance industry, in particular.

Domestic players still dominate but foreign capital and expertise is increasingly playing a supportive role.

The penetration rate is low and the per capita spend gives scope for substantial growth when compared with $3,747 in a developed market like Japan.

Entry barriers to most emerging markets have been reduced over the last decade. The market share of foreign-owned insurers in the life sector in the Asian region ranges from 2-87%, the range of share of the non-life sector is 1-74%.

India’s insurance market is still at a stage of relative immaturity despite rapid economic growth in recent years. India is a large and populous country and there are huge regional disparities as the relative wealth of the major cities contrasts with rural areas.

Awareness of the concept of insurance remains low among much of the population, particularly in the rural areas. However, this is set to change. India can be regarded as a collection of regional markets, the size and character of which vary with population and economic development. Regional disparities between the urban and rural areas are significant.

Indian life insurance market is still underdeveloped, notwithstanding that growth has been rapid. Some of the reasons behind the underdevelopment were cited in a recent survey, that only a few per cent of the population had a modest knowledge of the benefits of life insurance.

Aggressive and sometimes misleading sales practices have created wrong direction among consumers.

The Insurance Regulatory and Development Authority (IRDA) has issued a large number of regulations dealing with issues such as minimum capital, investment regulations and reserving standards, but not the establishment of a policyholders’ protection fund.

A further relaxation of investment rules should enable life insurers to match the maturities of their assets and liabilities more efficiently and enhance returns. In the non-life market, the introduction of motor third party liability pool is a retrograde step.

In order to achieve its broad objective of a large, financially secure and customer-focused insurance industry, IRDA should change its own focus from micro regulation to consumer protection. New legislation and revisions to existing rules should promote efficiency.

Product and pricing controls have to be abolished fully, not partly, and new solvency criteria have to be introduced as per global convergence norms.

A further relaxation of investment rules may benefit domestic and foreign JV insurance companies.

Skill shortages exist in most areas of the insurance industry including product development, financial management, general management, the actuarial field and technology.

Non-life insurers are required to establish unearned premium reserves, catastrophe reserves and loss reserves on actuarial basis. Reserves may be established net of ceded reinsurance.

Outstanding loss reserves must represent the full settlement cost of both reported and incurred but not reported claims. Claims reserves must be established on a gross basis and may not be discounted for the time value of money.

There is again flutter about gross amendment of insurance act. The matter is quietly referred to a group of ministers. Though the final contours are still anybody’s guess, it is almost sure that some of the public policy issues are not likely to be addressed even under the new amendments.

Only noise audible even to the deaf is the increase of FDI in insurance to 49% from 26%. Let there be arousal for larger and more substantive issues.

The writer is director,

National Insurance Academy, Pune

![submenu-img]() This film was made on taboo subject, yet earned five times its budget, marked lead actors' debut, won 3 National Awards

This film was made on taboo subject, yet earned five times its budget, marked lead actors' debut, won 3 National Awards![submenu-img]() SL vs SA T20 World Cup 2024: Predicted playing XIs, live streaming details, weather and pitch report

SL vs SA T20 World Cup 2024: Predicted playing XIs, live streaming details, weather and pitch report![submenu-img]() Amul Milk price hiked by Rs 2 per litre across India, check new rates here

Amul Milk price hiked by Rs 2 per litre across India, check new rates here![submenu-img]() Maldives bans entry of Israeli passport holders in 'solidarity with Palestine'

Maldives bans entry of Israeli passport holders in 'solidarity with Palestine'![submenu-img]() Not Suniel Shetty, but this actor was playing Dev in Dhadkan, he later replaced action star from Sunny Deol's...

Not Suniel Shetty, but this actor was playing Dev in Dhadkan, he later replaced action star from Sunny Deol's...![submenu-img]() Meet man who grew up in orphanage, began working at 10 as cleaner, delivery boy, then became IAS officer, is posted at..

Meet man who grew up in orphanage, began working at 10 as cleaner, delivery boy, then became IAS officer, is posted at..![submenu-img]() Meet UPSC topper who cleared JEE Advanced, went to IIT Kanpur, left high-paying job to become IPS officer, secured AIR..

Meet UPSC topper who cleared JEE Advanced, went to IIT Kanpur, left high-paying job to become IPS officer, secured AIR..![submenu-img]() Meet woman who cracked UPSC exam twice, left IPS to become an IAS officer, secured AIR...

Meet woman who cracked UPSC exam twice, left IPS to become an IAS officer, secured AIR...![submenu-img]() Meet woman, one of India’s youngest IAS officers who cracked UPSC in 1st attempt at 22 without coaching, her AIR was...

Meet woman, one of India’s youngest IAS officers who cracked UPSC in 1st attempt at 22 without coaching, her AIR was...![submenu-img]() Meet JEE Main topper with AIR 4, plans to pursue BTech from IIT Bombay, he is from...

Meet JEE Main topper with AIR 4, plans to pursue BTech from IIT Bombay, he is from...![submenu-img]() DNA Verified: Did Kangana Ranaut party with gangster Abu Salem? Actress reveals who's with her in viral photo

DNA Verified: Did Kangana Ranaut party with gangster Abu Salem? Actress reveals who's with her in viral photo![submenu-img]() DNA Verified: New Delhi Railway Station to be closed for 4 years? Know the truth here

DNA Verified: New Delhi Railway Station to be closed for 4 years? Know the truth here![submenu-img]() DNA Verified: Did RSS chief Mohan Bhagwat praise Congress during Lok Sabha Elections 2024? Know the truth here

DNA Verified: Did RSS chief Mohan Bhagwat praise Congress during Lok Sabha Elections 2024? Know the truth here![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

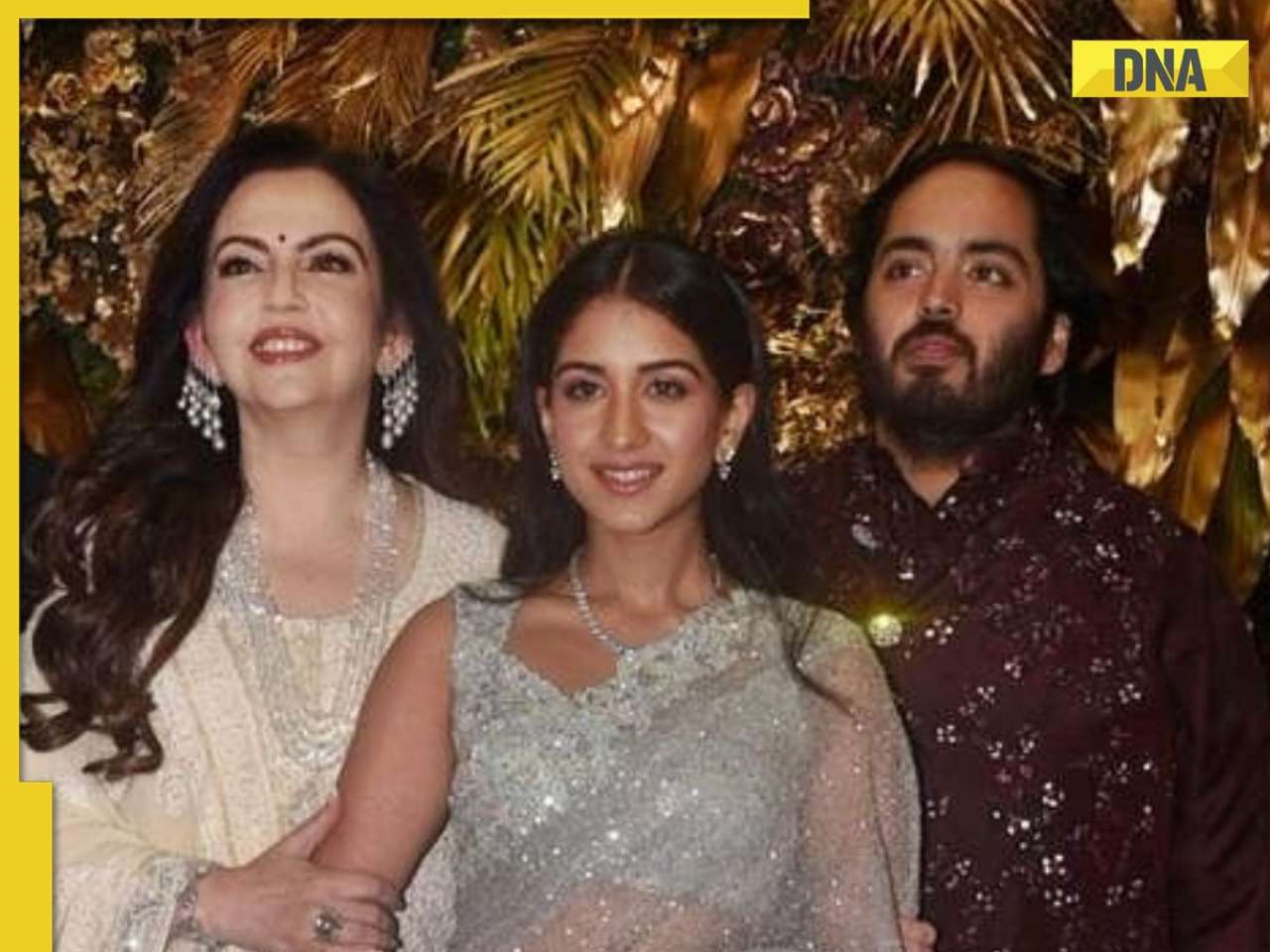

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() Inside pics from Anant Ambani-Radhika Merchant's bash: Shah Rukh with new hairstyle, Sid-Kiara's private moment, & more

Inside pics from Anant Ambani-Radhika Merchant's bash: Shah Rukh with new hairstyle, Sid-Kiara's private moment, & more![submenu-img]() Streaming This Week: Panchayat season 3, Swatantrya Veer Savarkar, Illegal season 3, latest OTT releases to binge-watch

Streaming This Week: Panchayat season 3, Swatantrya Veer Savarkar, Illegal season 3, latest OTT releases to binge-watch![submenu-img]() Avneet Kaur shines in navy blue gown with shimmery trail at Cannes 2024, fans say 'she is unstoppable now'

Avneet Kaur shines in navy blue gown with shimmery trail at Cannes 2024, fans say 'she is unstoppable now'![submenu-img]() Assamese actress Aimee Baruah wins hearts as she represents her culture in saree with 200-year-old motif at Cannes

Assamese actress Aimee Baruah wins hearts as she represents her culture in saree with 200-year-old motif at Cannes ![submenu-img]() Aditi Rao Hydari's monochrome gown at Cannes Film Festival divides social media: 'We love her but not the dress'

Aditi Rao Hydari's monochrome gown at Cannes Film Festival divides social media: 'We love her but not the dress'![submenu-img]() Lok Sabha Elections 2024: What are exit polls? When and how are they conducted?

Lok Sabha Elections 2024: What are exit polls? When and how are they conducted?![submenu-img]() DNA Explainer: Why was Iranian president Ebrahim Raisi, killed in helicopter crash, regarded as ‘Butcher of Tehran’?

DNA Explainer: Why was Iranian president Ebrahim Raisi, killed in helicopter crash, regarded as ‘Butcher of Tehran’?![submenu-img]() DNA Explainer: Why did deceased Iranian President Ebrahim Raisi wear black turban?

DNA Explainer: Why did deceased Iranian President Ebrahim Raisi wear black turban?![submenu-img]() Iran President Ebrahim Raisi's death: Will it impact gold, oil prices and stock markets?

Iran President Ebrahim Raisi's death: Will it impact gold, oil prices and stock markets?![submenu-img]() Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?

Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?![submenu-img]() This film was made on taboo subject, yet earned five times its budget, marked lead actors' debut, won 3 National Awards

This film was made on taboo subject, yet earned five times its budget, marked lead actors' debut, won 3 National Awards![submenu-img]() Not Suniel Shetty, but this actor was playing Dev in Dhadkan, he later replaced action star from Sunny Deol's...

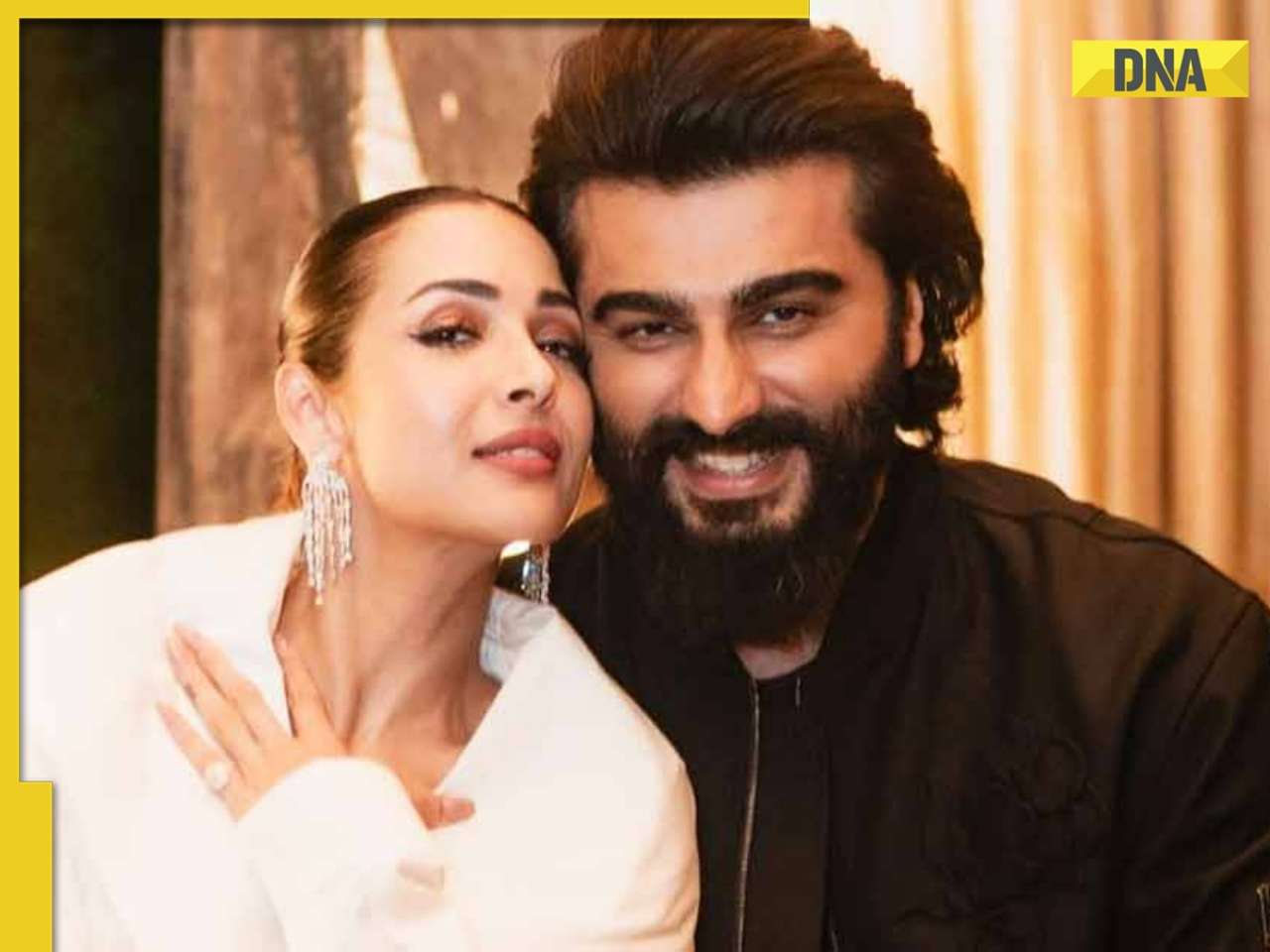

Not Suniel Shetty, but this actor was playing Dev in Dhadkan, he later replaced action star from Sunny Deol's...![submenu-img]() Malaika Arora shares cryptic post amid breakup rumours with Arjun Kapoor: 'When they say you can't...'

Malaika Arora shares cryptic post amid breakup rumours with Arjun Kapoor: 'When they say you can't...'![submenu-img]() Sanjeeda Shaikh recalls shocking incident when a woman groped her: 'She just touched my breast, ladkiyaan bhi koi...'

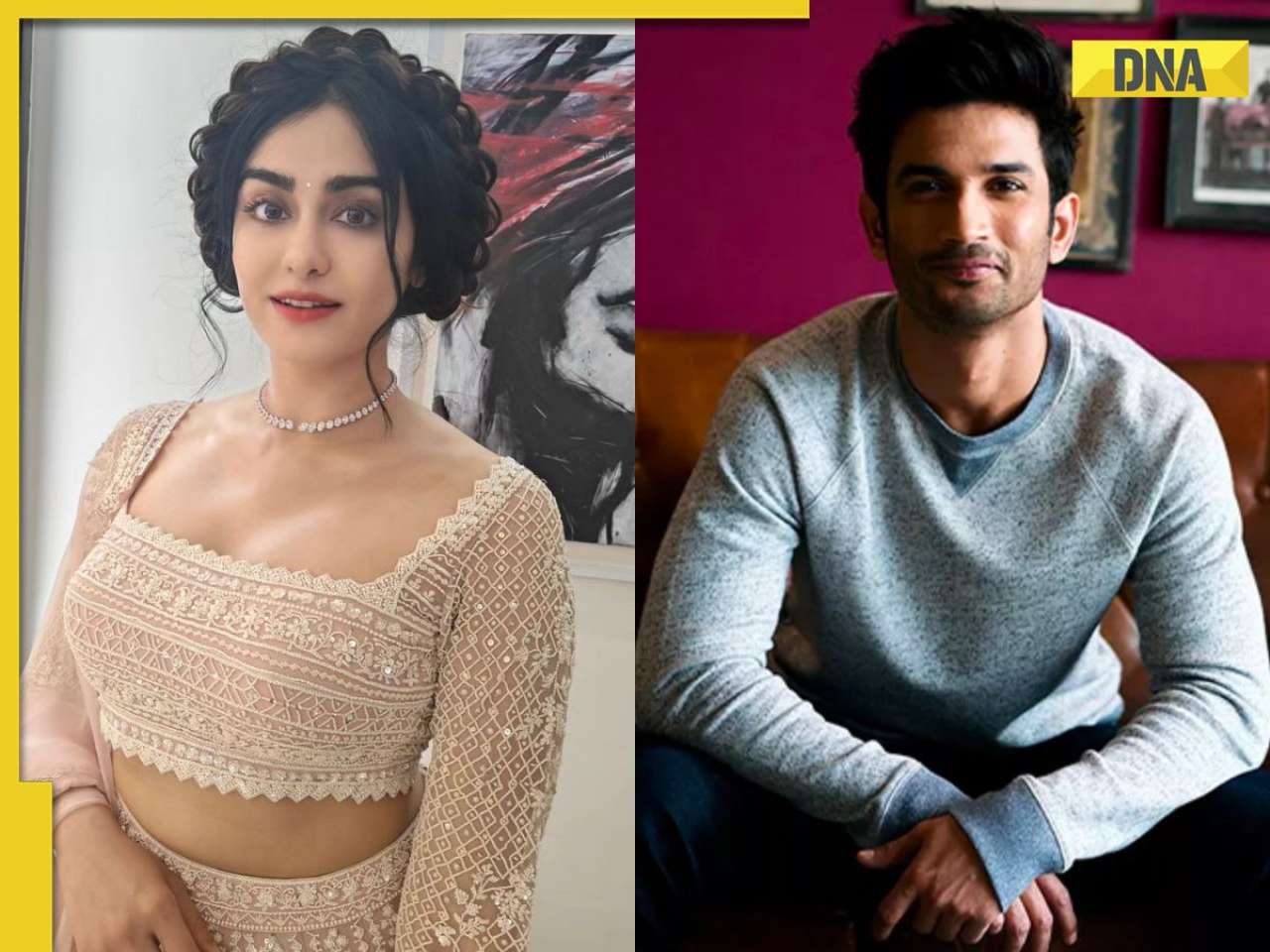

Sanjeeda Shaikh recalls shocking incident when a woman groped her: 'She just touched my breast, ladkiyaan bhi koi...'![submenu-img]() Adah Sharma opens up on living in Sushant Singh Rajput's house: 'The place gives me...'

Adah Sharma opens up on living in Sushant Singh Rajput's house: 'The place gives me...'![submenu-img]() Radhika Merchant, Anant Ambani's first look from their 2nd pre-wedding in Italy goes viral

Radhika Merchant, Anant Ambani's first look from their 2nd pre-wedding in Italy goes viral![submenu-img]() MrBeast beats T-Series to become most subscribed YouTuber, followers reached...

MrBeast beats T-Series to become most subscribed YouTuber, followers reached...![submenu-img]() Terrifying encounter: Mama elephant battles crocodile to protect her calf, video goes viral

Terrifying encounter: Mama elephant battles crocodile to protect her calf, video goes viral![submenu-img]() Pawsitively adorable: Viral video shows real-life Tom & Jerry cuddling after cute catfight

Pawsitively adorable: Viral video shows real-life Tom & Jerry cuddling after cute catfight![submenu-img]() Meet Chillikompan, the mango-loving tusker from Kerala

Meet Chillikompan, the mango-loving tusker from Kerala

)

)

)

)

)

)