The week gone by was an eventful one. The Sensex hit another 1,000 runs, taking only 16 sessions to climb the 12,000 mark.

The week gone by was an eventful one. The Sensex hit another 1,000 runs, taking only 16 sessions to climb the 12,000 mark.

The Reliance Petroleum IPO was oversubscribed some 50 times, garnering some Rs 1,30,000 crore in terms of application money, which must be some sort of a global record.

Reliance Industries reportedly struck oil in the KG basin, with reserves estimated at 1 billion barrels, enough to give it an additional revenue stream of $ 1.5 billion a year for the next 15 years! Gold prices hit a record high, as did real estate in Mumbai, with more liquidity (both foreign and domestic) chasing assets.

Bank deposit rates being so low, they act as a disincentive to savers after taking into account the fact that they are taxed (dividends are not) and after accounting for inflation. So, as and when deposits mature, investors are seeking other avenues such as stocks, bullion and real estate.

This has added a few furrows to the Reserve Bank governor's brow, and, in his credit policy announced last week, he hiked the risk weightage for higher value home loans, loans to builders and loan against shares. He left interest rates alone.

The week ended with the Sensex at 12,030 for a weekly gain of 793 points. Reliance contributed 160 points and Infosys 98. In the coming fortnight, it is likely to give one spurt before peaking out in the medium term. The next downswing ought to be longer in duration than extent; in other words it will test the patience of investors who get adrenalin rushes through daily action. The intervening rally ought to be taken as an opportunity to get much lighter and wait patiently for the correction which, one feels, will be an extended one.

Good corporate results also spurred investor sentiment, especially from the IT companies. Infosys, TCS, Satyam, HCL Technologies and Wipro declared good results, with the first three also giving a 1: 1 bonus issue. This indicates that they are all confident of future earnings growth. They are adding employee strength at a furious pace.

Good results were also declared by non-IT firms, including ONGC, Gujarat Ambuja, UTI Bank, Varun Shipping, JSW Steel and Marico. ONGC made the highest profit for any corporation in India, at Rs 14,175 crore, but that was after it suffered from underpricing (forced by government) of crude, which it estimates at another Rs 11,900 crore!

It is, in fact, this expertise of our politicians in ruining a perfectly good party that is the biggest risk factor and will probably contribute to the extended correction that is likely. In a bid to hide the mess to its trousers caused by fiscal diarrhea, the government seeks to pass this on to others, such as public sector oil companies. It later compensates them by issuing bonds, which is funny because if it is going to bear the burden anyway, why do so in a roundabout way? The balance-sheets of Indian Oil, HPCL and BPCL, which the government deemed as navratnas (nine jewels), are swimming in red, impairing their ability to undertake projects.

S&P has improved the outlook for India's rating, whilst keeping it below investment grade. The concerns are the same, viz. the poor performance of several public sector units, despite some having excellent managers, because of constant intervention by the majority holder, the government, and the lack of infrastructure. CalPERS, one of the largest pension funds in the world, rates emerging markets for investment opportunities and India has dropped from 9th to 18th place out of 27 markets which it says are worthy of investment. The low scores emanate from poor political stability, inflexibility in labour laws and capital market openness. One is surprised at the last named, for India is one of the most efficient and well-managed of markets.

In fact, few markets have achieved a T+3 settlement cycle as India has. The domestic market has enormous depth in terms of both number of listed stocks as well as number of investors and the market cap-GDP ratio has now hit 100%.

The market is likely to correct, albeit after a rally, in the coming fortnight. The rally should be taken as an opportunity to get lighter in preparation for the next downward correction which could be a long duration one.

![submenu-img]() MBOSE 12th Result 2024: HSSLC Meghalaya Board 12th result declared, direct link here

MBOSE 12th Result 2024: HSSLC Meghalaya Board 12th result declared, direct link here![submenu-img]() Apple iPhone 14 at ‘lowest price ever’ in Flipkart sale, available at just Rs 10499 after Rs 48500 discount

Apple iPhone 14 at ‘lowest price ever’ in Flipkart sale, available at just Rs 10499 after Rs 48500 discount![submenu-img]() Meet man who left high-paying job, built Rs 2000 crore business, moved to village due to…

Meet man who left high-paying job, built Rs 2000 crore business, moved to village due to…![submenu-img]() Meet star, who grew up poor, identity was kept hidden from public, thought about suicide; later became richest...

Meet star, who grew up poor, identity was kept hidden from public, thought about suicide; later became richest...![submenu-img]() Watch: Ranbir Kapoor recalls 'disturbing' memory from his childhood in throwback viral video, says 'I was four years...'

Watch: Ranbir Kapoor recalls 'disturbing' memory from his childhood in throwback viral video, says 'I was four years...'![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Alia Bhatt wears elegant saree made by 163 people over 1965 hours to Met Gala 2024, fans call her ‘princess Jasmine’

Alia Bhatt wears elegant saree made by 163 people over 1965 hours to Met Gala 2024, fans call her ‘princess Jasmine’![submenu-img]() Jr NTR-Lakshmi Pranathi's 13th wedding anniversary: Here's how strangers became soulmates

Jr NTR-Lakshmi Pranathi's 13th wedding anniversary: Here's how strangers became soulmates![submenu-img]() Streaming This Week: Heeramandi, Shaitaan, Manjummel Boys, latest OTT releases to binge-watch

Streaming This Week: Heeramandi, Shaitaan, Manjummel Boys, latest OTT releases to binge-watch![submenu-img]() Remember Ayesha Kapur? Michelle from Black, here's how actress, nutrition coach, entrepreneur looks after 19 years

Remember Ayesha Kapur? Michelle from Black, here's how actress, nutrition coach, entrepreneur looks after 19 years![submenu-img]() Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'

Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'![submenu-img]() Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?

Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() Meet star, who grew up poor, identity was kept hidden from public, thought about suicide; later became richest...

Meet star, who grew up poor, identity was kept hidden from public, thought about suicide; later became richest...![submenu-img]() Watch: Ranbir Kapoor recalls 'disturbing' memory from his childhood in throwback viral video, says 'I was four years...'

Watch: Ranbir Kapoor recalls 'disturbing' memory from his childhood in throwback viral video, says 'I was four years...'![submenu-img]() This superstar was in love with Muslim actress, was about to marry her, relationship ruined after death threats from..

This superstar was in love with Muslim actress, was about to marry her, relationship ruined after death threats from..![submenu-img]() Meet Madhuri Dixit’s lookalike, who worked with Akshay Kumar, Govinda, quit films at peak of career, is married to…

Meet Madhuri Dixit’s lookalike, who worked with Akshay Kumar, Govinda, quit films at peak of career, is married to… ![submenu-img]() Meet former beauty queen who competed with Aishwarya, made debut with a superstar, quit acting to become monk, is now..

Meet former beauty queen who competed with Aishwarya, made debut with a superstar, quit acting to become monk, is now..![submenu-img]() IPL 2024: Jake Fraser-McGurk, Abishek Porel power DC to 20-run win over RR

IPL 2024: Jake Fraser-McGurk, Abishek Porel power DC to 20-run win over RR![submenu-img]() SRH vs LSG, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

SRH vs LSG, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() IPL 2024: Here’s why CSK star MS Dhoni batted at No.9 against PBKS

IPL 2024: Here’s why CSK star MS Dhoni batted at No.9 against PBKS![submenu-img]() SRH vs LSG IPL 2024 Dream11 prediction: Fantasy cricket tips for Sunrisers Hyderabad vs Lucknow Super Giants

SRH vs LSG IPL 2024 Dream11 prediction: Fantasy cricket tips for Sunrisers Hyderabad vs Lucknow Super Giants![submenu-img]() Watch: Kuldeep Yadav, Yuzvendra Chahal team up for hilarious RR meme, video goes viral

Watch: Kuldeep Yadav, Yuzvendra Chahal team up for hilarious RR meme, video goes viral![submenu-img]() Not Alia Bhatt or Isha Ambani but this Indian CEO made heads turn at Met Gala 2024, she is from...

Not Alia Bhatt or Isha Ambani but this Indian CEO made heads turn at Met Gala 2024, she is from...![submenu-img]() Man makes Lord Hanuman co-litigant in plea, Delhi High Court asks him to pay Rs 100000…

Man makes Lord Hanuman co-litigant in plea, Delhi High Court asks him to pay Rs 100000…![submenu-img]() Four big dangerous asteroids coming toward Earth, but the good news is…

Four big dangerous asteroids coming toward Earth, but the good news is…![submenu-img]() Isha Ambani's Met Gala 2024 saree gown was created in over 10,000 hours, see pics

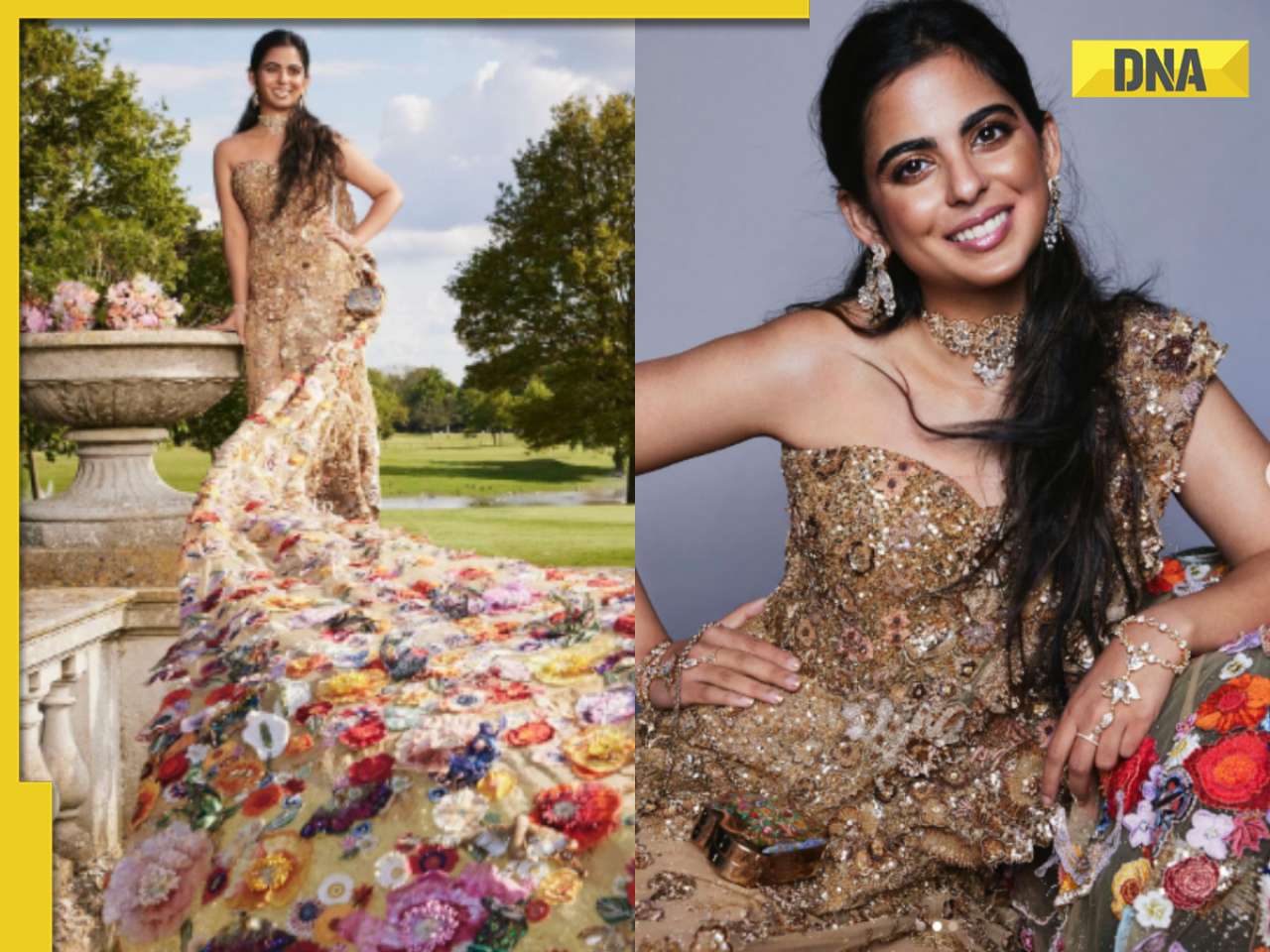

Isha Ambani's Met Gala 2024 saree gown was created in over 10,000 hours, see pics![submenu-img]() Indian-origin man says Apple CEO Tim Cook pushed him...

Indian-origin man says Apple CEO Tim Cook pushed him...

)

)

)

)

)

)