The euro fell to a 20-month low after the Italian PM Matteo Renzi said he would resign.

The euro was under the gun on Monday, skidding to a 20-month low after Italian Prime Minister Matteo Renzi said he would resign following a stinging defeat on constitutional reform that could destabilise the country's shaky banking system.

Renzi's defeat deals a body blow to the European Union already reeling under anti-establishment anger that led to the shock exit of UK from the club in June this year.

The single currency, which slumped as much as 1.4% to $1.0505 after opening at around $1.0685, recovered a bit to $1.056.

The drop to its session low was the sharpest fall since June and opened the way to a retest of the March 2015 trough around $1.0457.

"The 'no' vote was priced in to a certain extent in advance. So I do not expect a freefall in the euro in the near term," said Minori Uchida, chief currency analyst at the Bank of Tokyo-Mitsubishi.

"But in the long run, this will delay progress in Italy's efforts to get rid of banks' bad debt and is likely to widen the yield spread of German Bunts and the Italian bonds," he added.

The euro slid as much as 2.1% to 118.71 yen, but pared some of the losses to trade down 0.9% at 120.08 yen.

The dollar was supported by expectations of a U.S. rate increase this month and gained 0.2% to 113.78 yen.

The dollar index,, which tracks the greenback against a basket of six global peers, jumped 0.6% to 101.44.

The New Zealand dollar slipped 0.8% to $0.7074 after Prime Minister John Key unexpectedly announced his resignation on Monday, saying it was the "right time" to leave politics.

Key, a former foreign exchange dealer who worked at firms including Merrill Lynch, won office for the National Party in 2008, ending the nine-year rule of Labour's Helen Clark.

New Zealand stocks extended losses to trade 0.6% lower.

MSCI's broadest index of Asia-Pacific shares outside Japan eased 0.3%, while E-mini futures for the S&P 500 narrowed losses to 0.2%. Japan's Nikkei slid 0.5%.

While the the long-awaited opening of the Shenzhen-Hong Kong Stock Connect went live on Monday, global risk aversion weighed on China's and Hong Kong's main indices.

China's CSI 300 index tumbled 1.2%. Hong Kong's Hang Seng index reversed earlier losses to trade flat.

The link between China's booming Shenzhen stock market and neighbouring Hong Kong allows foreign investors first-time access to some of the fastest growing technology companies in the world's second-biggest economy.

Back in Europe, dealers said Italian bonds were set to come under pressure as top-rated U.S. Treasuries and German bunds gained. Futures for U.S. 10-year Treasury notes added 5 ticks.

Investors and Europe's politicians fear victory for the opposition 'No' camp could cause political instability and renewed turmoil for Italy's banking sector, which has been hit by fears over its huge exposure to bad loans built up during years of economic downturn.

Renzi's resignation represents a fresh blow to the European Union, the euro zone's heavily indebted third-largest economy which is struggling to overcome a raft of crises

"For markets, the risks posed by Italy's 'no' vote are about the potential for political instability and the possibility of an election in Italy rather than with any missed opportunity for long term constitutional reform," Ric Spooner, chief market analyst at CMC Markets in Sydney, wrote in a note.

"The real concern for markets is whether this situation may ultimately lead to election of the Five Star Movement whose policy is to hold a referendum on whether Italy should remain in the Eurozone."

Analysts at RBCCM argued that, based on what happened in 2012 at the height of the Greek crisis, such a risk could see the euro trade as low as $0.8000.

"It may sound extreme, but if a second euro zone crisis were to hit, with the U.S. dollar at a much stronger starting point, EUR/USD could arguably trade lower still," they wrote.

Markets had earlier taken some encouragement when Austria's far-right presidential candidate was soundly defeated by a pro-European contender, confounding forecasts of a tight election.

The European Central Bank also meets Thursday amid much speculation it will announce a six month extension of its asset buying program and widen the type of bonds it can purchase.

"There has been some speculation that the ECB would step and front load purchases of Italian bonds if markets became unsettled by a 'No' result, so perhaps it is the thoughts of a central bank liquidity sugar pill driving things again," said ANZ economist Jo Masters.

OIL PULLS BACK

Wall Street ended last week on a cautious note, with the Dow off 0.11%, while the S&P 500 rose 0.04% and the Nasdaq gained 0.09%.

While Friday's U.S. payroll report was firm enough to cement expectations of a rate hike by the Federal Reserve this month, a surprise pullback in wages helped bonds pare a little of their recent losses.

In commodity markets, oil ran into risk aversion and some profit-taking after boasting its best week in at least five years following OPEC's decision to cut crude output.

Markets are now focused on the implementation and impact of OPEC's first output cuts since 2008, to be joined by Russia and possibly other non-OPEC producers.

Brent crude was down 55 cents at $53.95 a barrel, while U.S. crude lost 47 cents to $51.21.

![submenu-img]() BMW i5 M60 xDrive launched in India, all-electric sedan priced at Rs 11950000

BMW i5 M60 xDrive launched in India, all-electric sedan priced at Rs 11950000![submenu-img]() This superstar was arrested several times by age 17, thrown out of home, once had just Rs 250, now worth Rs 6600 crore

This superstar was arrested several times by age 17, thrown out of home, once had just Rs 250, now worth Rs 6600 crore![submenu-img]() Meet Reliance’s highest paid employee, gets over Rs 240000000 salary, he is Mukesh Ambani’s…

Meet Reliance’s highest paid employee, gets over Rs 240000000 salary, he is Mukesh Ambani’s… ![submenu-img]() Meet lesser-known relative of Mukesh Ambani, Anil Ambani, has worked with BCCI, he is married to...

Meet lesser-known relative of Mukesh Ambani, Anil Ambani, has worked with BCCI, he is married to...![submenu-img]() Made in just Rs 95,000, this film was a superhit, but destroyed lead actress' career, saw controversy over bold scenes

Made in just Rs 95,000, this film was a superhit, but destroyed lead actress' career, saw controversy over bold scenes![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() In pics: Arti Singh stuns in red lehenga as she ties the knot with beau Dipak Chauhan in dreamy wedding

In pics: Arti Singh stuns in red lehenga as she ties the knot with beau Dipak Chauhan in dreamy wedding![submenu-img]() Actors who died due to cosmetic surgeries

Actors who died due to cosmetic surgeries![submenu-img]() See inside pics: Malayalam star Aparna Das' dreamy wedding with Manjummel Boys actor Deepak Parambol

See inside pics: Malayalam star Aparna Das' dreamy wedding with Manjummel Boys actor Deepak Parambol ![submenu-img]() In pics: Salman Khan, Alia Bhatt, Rekha, Neetu Kapoor attend grand premiere of Sanjay Leela Bhansali's Heeramandi

In pics: Salman Khan, Alia Bhatt, Rekha, Neetu Kapoor attend grand premiere of Sanjay Leela Bhansali's Heeramandi![submenu-img]() Streaming This Week: Crakk, Tillu Square, Ranneeti, Dil Dosti Dilemma, latest OTT releases to binge-watch

Streaming This Week: Crakk, Tillu Square, Ranneeti, Dil Dosti Dilemma, latest OTT releases to binge-watch![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence

DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence![submenu-img]() DNA Explainer: What is India's stand amid Iran-Israel conflict?

DNA Explainer: What is India's stand amid Iran-Israel conflict?![submenu-img]() This superstar was arrested several times by age 17, thrown out of home, once had just Rs 250, now worth Rs 6600 crore

This superstar was arrested several times by age 17, thrown out of home, once had just Rs 250, now worth Rs 6600 crore![submenu-img]() Made in just Rs 95,000, this film was a superhit, but destroyed lead actress' career, saw controversy over bold scenes

Made in just Rs 95,000, this film was a superhit, but destroyed lead actress' career, saw controversy over bold scenes![submenu-img]() Meet 72-year-old who earns Rs 280 cr per film, Asia's highest-paid actor, bigger than Shah Rukh, Salman, Akshay, Prabhas

Meet 72-year-old who earns Rs 280 cr per film, Asia's highest-paid actor, bigger than Shah Rukh, Salman, Akshay, Prabhas![submenu-img]() This star, who once lived in chawl, worked as tailor, later gave four Rs 200-crore films; he's now worth...

This star, who once lived in chawl, worked as tailor, later gave four Rs 200-crore films; he's now worth...![submenu-img]() Tamil star Prasanna reveals why he chose series Ranneeti for Hindi debut: 'Getting into Bollywood is not...'

Tamil star Prasanna reveals why he chose series Ranneeti for Hindi debut: 'Getting into Bollywood is not...'![submenu-img]() IPL 2024: Virat Kohli, Rajat Patidar fifties and disciplined bowling help RCB beat Sunrisers Hyderabad by 35 runs

IPL 2024: Virat Kohli, Rajat Patidar fifties and disciplined bowling help RCB beat Sunrisers Hyderabad by 35 runs![submenu-img]() 'This is the problem in India...': Wasim Akram's blunt take on fans booing Mumbai Indians skipper Hardik Pandya

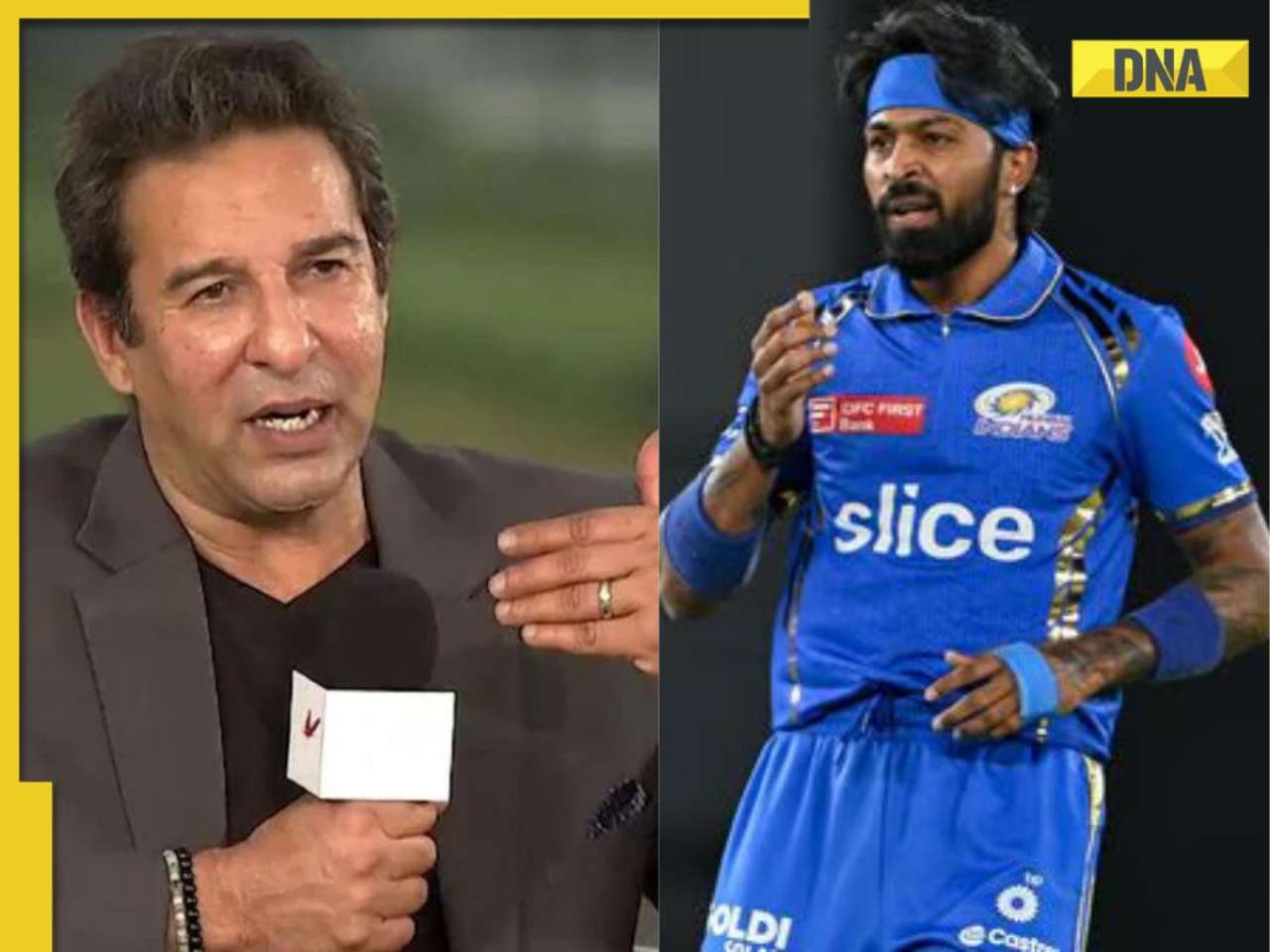

'This is the problem in India...': Wasim Akram's blunt take on fans booing Mumbai Indians skipper Hardik Pandya![submenu-img]() KKR vs PBKS, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

KKR vs PBKS, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() KKR vs PBKS IPL 2024 Dream11 prediction: Fantasy cricket tips for Kolkata Knight Riders vs Punjab Kings

KKR vs PBKS IPL 2024 Dream11 prediction: Fantasy cricket tips for Kolkata Knight Riders vs Punjab Kings![submenu-img]() IPL 2024: KKR star Rinku Singh finally gets another bat from Virat Kohli after breaking previous one - Watch

IPL 2024: KKR star Rinku Singh finally gets another bat from Virat Kohli after breaking previous one - Watch![submenu-img]() Viral video: Teacher's cute way to capture happy student faces melts internet, watch

Viral video: Teacher's cute way to capture happy student faces melts internet, watch![submenu-img]() Woman attends online meeting on scooter while stuck in traffic, video goes viral

Woman attends online meeting on scooter while stuck in traffic, video goes viral![submenu-img]() Viral video: Pilot proposes to flight attendant girlfriend before takeoff, internet hearts it

Viral video: Pilot proposes to flight attendant girlfriend before takeoff, internet hearts it![submenu-img]() Pakistani teen receives life-saving heart transplant from Indian donor, details here

Pakistani teen receives life-saving heart transplant from Indian donor, details here![submenu-img]() Viral video: Truck driver's innovative solution to beat the heat impresses internet, watch

Viral video: Truck driver's innovative solution to beat the heat impresses internet, watch

)

)

)

)

)

)

)