GTPL's legal battle has emerged as a crucial juncture, with the company challenging the Directorate General of Goods and Services Tax Intelligence's demands.

The online skill gaming industry in India has been propelled into the spotlight once again as the legal battle surrounding Goods and Services Tax (GST) applicability takes center stage. In a significant development, both Justice MR Shah and Justice R Subhash Reddy of the Supreme Court have delivered opinions in support of Gameskraft Technologies Private Limited (GTPL), shedding light on the complex GST landscape and its implications for the burgeoning sector.

The online skill gaming industry in India has been facing regulatory turbulence in recent years, with GST implications being a focal point of contention. The imposition of a 28% GST rate on online gaming platforms has been met with resistance, threatening to impede the industry's growth trajectory. Amidst this backdrop, GTPL's legal battle has emerged as a crucial juncture, with the company challenging the Directorate General of Goods and Services Tax Intelligence's demands.

In Justice MR Shah's opinion, he emphasizes the distinction between "games of skill" and "games of chance," highlighting the unique nature of skill-based games like "Rummy." He states, "A game of chance when played with monetary stakes is gambling but a game of skill whether played with stakes or without is not gambling." This assertion underscores the fundamental difference between chance-based and skill-based activities, providing clarity on the GST implications for online gaming platforms.

Furthermore, Justice Shah dismisses the applicability of the Skill Lotto case to GTPL's matter, emphasizing the distinct legal issues at play. He states, "The observations made by the Hon'ble Supreme Court in the case of Skill Lotto will have no relevance or applicability in context of online skill gaming sector in general and to GTPL's matter currently pending in the Supreme Court in particular." This stance reaffirms GTPL's position and sets the stage for an independent examination of the merits of their case.

Similarly, Justice R Subhash Reddy's opinion echoes Justice Shah's sentiments, emphasizing the unique nature of GTPL's case. He states, "In view of the above, I am of the considered opinion, that the Skill Lotto's case decided by the Supreme Court will not cover the issues, which are raised by GTPL and same are to be considered independently." Justice Reddy highlights the distinction between lotteries and skill-based games, reaffirming GTPL's contention that their activities do not fall under the purview of "betting and gambling."

Both Justice Shah and Justice Reddy's opinions underscore the need for a nuanced approach to GST taxation in the online skill gaming sector, taking into account the skill-based nature of certain games. Their support for GTPL's case provides a glimmer of hope for the industry, signaling a potential shift towards a more conducive regulatory environment.

As the Supreme Court prepares to adjudicate on the GTPL matter, the industry awaits with bated breath, hopeful for a favorable resolution that will pave the way for continued growth and innovation in the dynamic world of online gaming. With judicial backing from Justices Shah and Reddy, GTPL's case stands as a beacon of hope for online skill gaming enthusiasts and stakeholders alike, heralding a new era of legality and legitimacy in the ever-evolving landscape of online gaming.

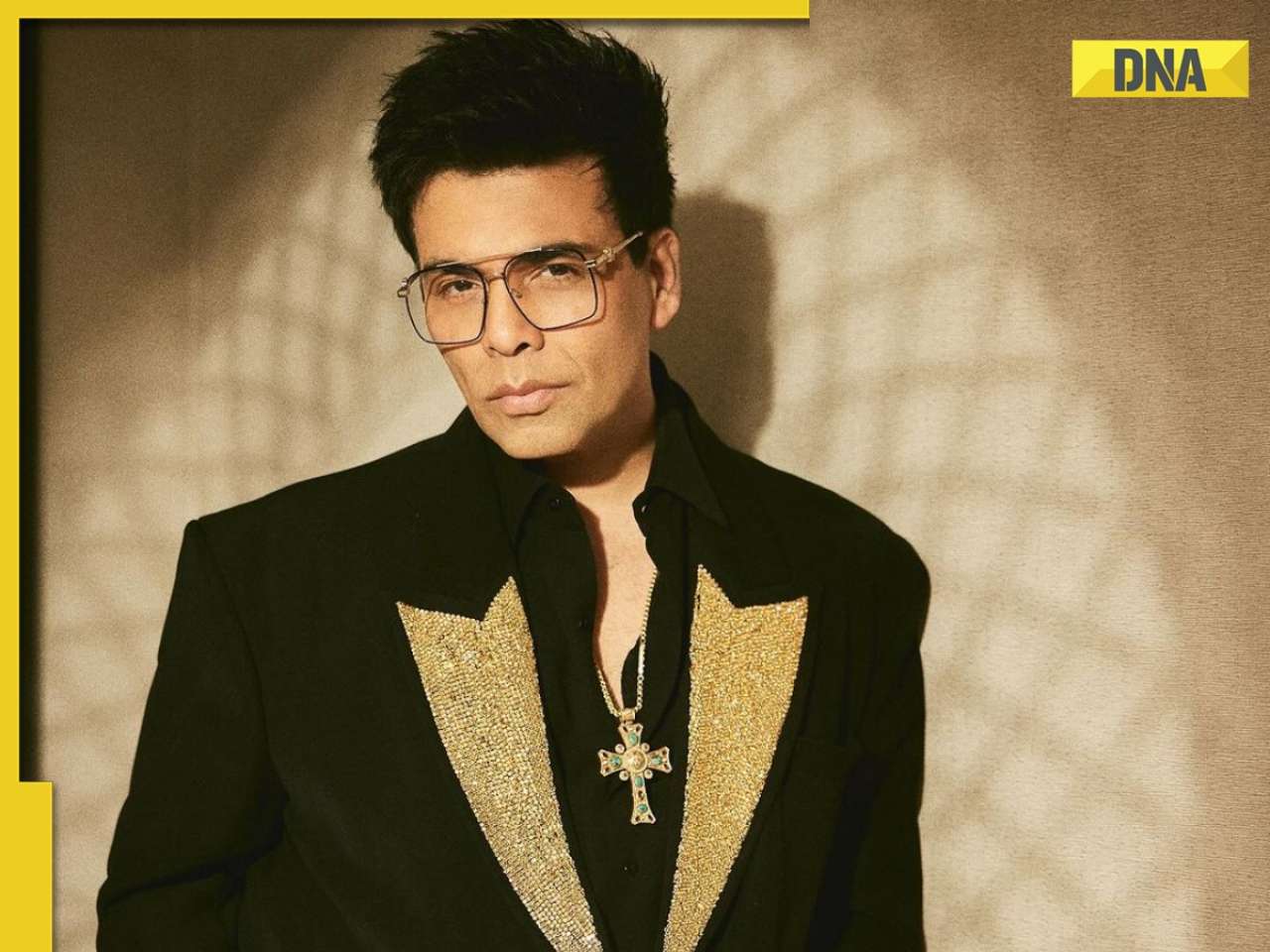

![submenu-img]() Meet India's highest paid director, charges 30 times more than his stars; not Hirani, Rohit Shetty, Atlee, Karan Johar

Meet India's highest paid director, charges 30 times more than his stars; not Hirani, Rohit Shetty, Atlee, Karan Johar![submenu-img]() Indian government issues warning for Google users, sensitive information can be leaked if…

Indian government issues warning for Google users, sensitive information can be leaked if…![submenu-img]() Prajwal Revanna Sex Scandal Case: Several women left home amid fear after clips surfaced, claims report

Prajwal Revanna Sex Scandal Case: Several women left home amid fear after clips surfaced, claims report![submenu-img]() Meet man who studied at IIT, IIM, started his own company, now serving 20-year jail term for…

Meet man who studied at IIT, IIM, started his own company, now serving 20-year jail term for…![submenu-img]() Gautam Adani’s project likely to get Rs 170000000000 push from SBI, making India’s largest…

Gautam Adani’s project likely to get Rs 170000000000 push from SBI, making India’s largest…![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Jr NTR-Lakshmi Pranathi's 13th wedding anniversary: Here's how strangers became soulmates

Jr NTR-Lakshmi Pranathi's 13th wedding anniversary: Here's how strangers became soulmates![submenu-img]() Streaming This Week: Heeramandi, Shaitaan, Manjummel Boys, latest OTT releases to binge-watch

Streaming This Week: Heeramandi, Shaitaan, Manjummel Boys, latest OTT releases to binge-watch![submenu-img]() Remember Ayesha Kapur? Michelle from Black, here's how actress, nutrition coach, entrepreneur looks after 19 years

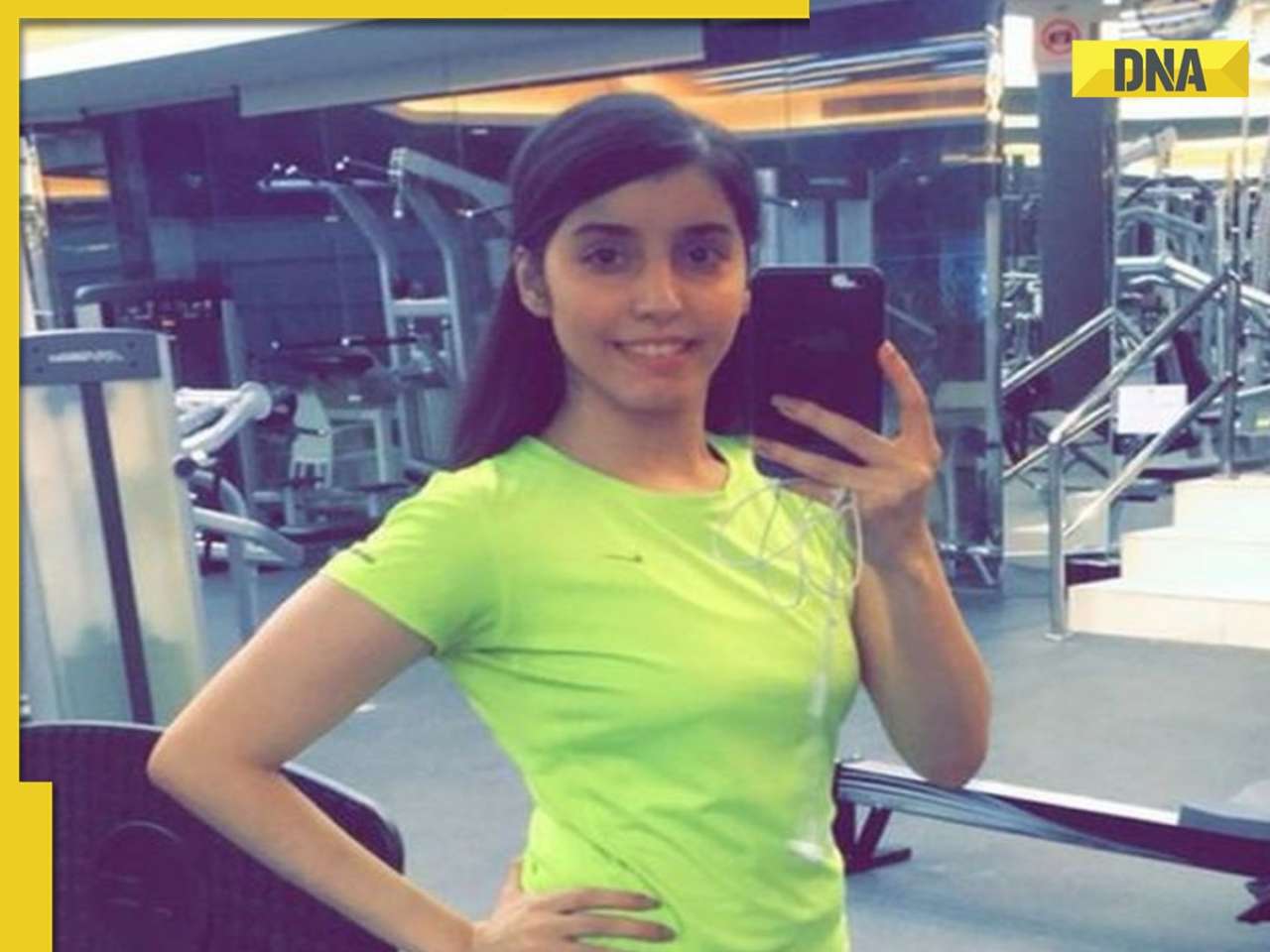

Remember Ayesha Kapur? Michelle from Black, here's how actress, nutrition coach, entrepreneur looks after 19 years![submenu-img]() Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'

Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'![submenu-img]() In pics: Arti Singh stuns in red lehenga as she ties the knot with beau Dipak Chauhan in dreamy wedding

In pics: Arti Singh stuns in red lehenga as she ties the knot with beau Dipak Chauhan in dreamy wedding![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence

DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence![submenu-img]() Meet India's highest paid director, charges 30 times more than his stars; not Hirani, Rohit Shetty, Atlee, Karan Johar

Meet India's highest paid director, charges 30 times more than his stars; not Hirani, Rohit Shetty, Atlee, Karan Johar![submenu-img]() This superstar worked as clerk, was banned from wearing black, received death threats; later became India's most...

This superstar worked as clerk, was banned from wearing black, received death threats; later became India's most...![submenu-img]() Karan Johar slams comic for mocking him, bashes reality show for 'disrespecting' him: 'When your own industry...'

Karan Johar slams comic for mocking him, bashes reality show for 'disrespecting' him: 'When your own industry...'![submenu-img]() Kapoor family's forgotten hero, highest paid actor, gave more hits than Raj Kapoor, Ranbir, never called star because...

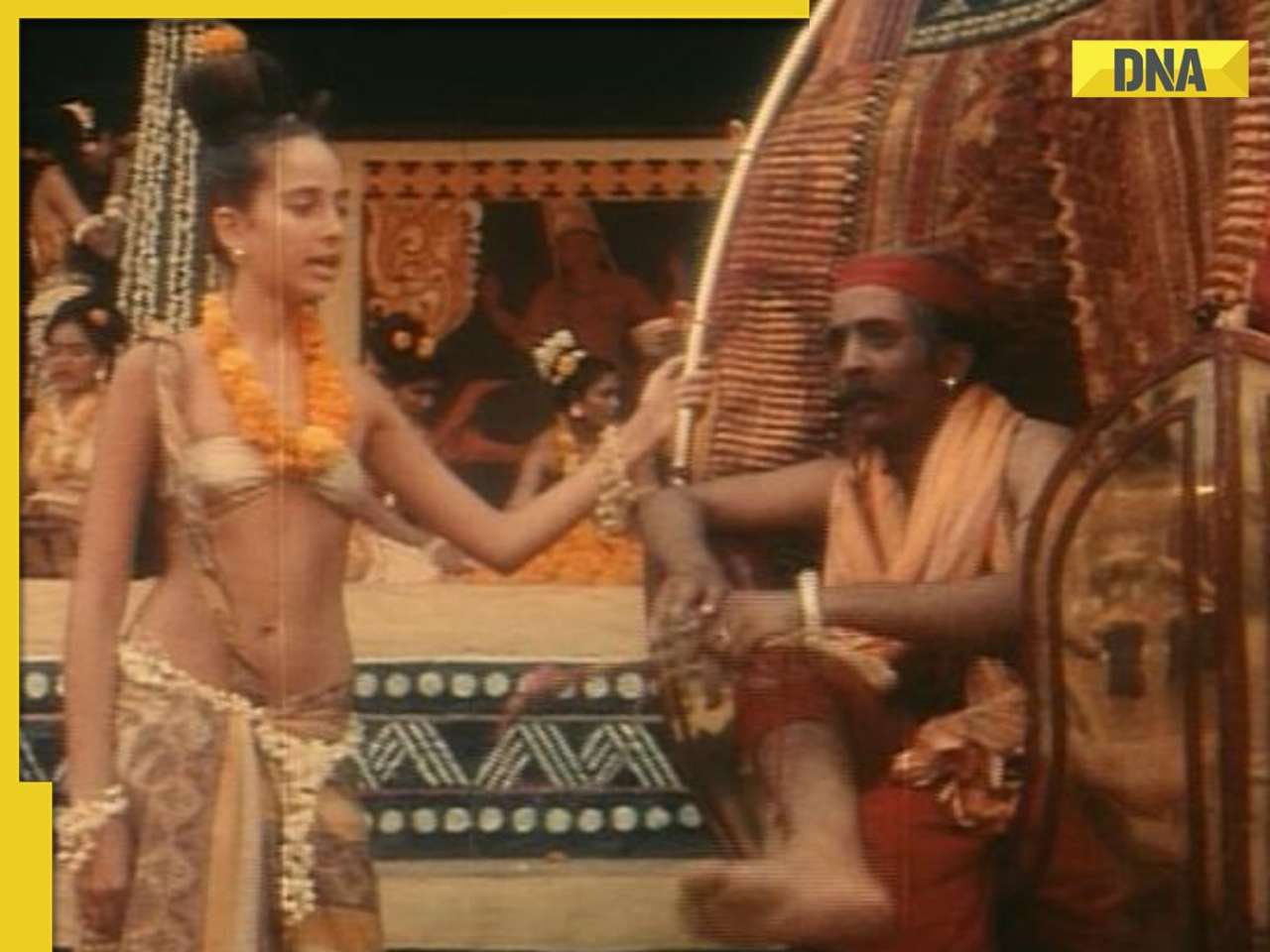

Kapoor family's forgotten hero, highest paid actor, gave more hits than Raj Kapoor, Ranbir, never called star because...![submenu-img]() Meet actress who lost stardom after getting pregnant at 15, husband cheated on her, she sold candles for living, now...

Meet actress who lost stardom after getting pregnant at 15, husband cheated on her, she sold candles for living, now...![submenu-img]() IPL 2024: Kolkata Knight Riders take top spot after 98 runs win over Lucknow Super Giants

IPL 2024: Kolkata Knight Riders take top spot after 98 runs win over Lucknow Super Giants![submenu-img]() ICC Women’s T20 World Cup 2024 schedule announced; India to face Pakistan on....

ICC Women’s T20 World Cup 2024 schedule announced; India to face Pakistan on....![submenu-img]() IPL 2024: Bowlers dominate as CSK beat PBKS by 28 runs

IPL 2024: Bowlers dominate as CSK beat PBKS by 28 runs![submenu-img]() IPL 2024: Big blow to CSK as star pacer returns home due to...

IPL 2024: Big blow to CSK as star pacer returns home due to...![submenu-img]() SRH vs MI IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

SRH vs MI IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() Job applicant offers to pay Rs 40000 to Bengaluru startup founder, here's what happened next

Job applicant offers to pay Rs 40000 to Bengaluru startup founder, here's what happened next![submenu-img]() Viral video: Family fearlessly conducts puja with live black cobra, internet reacts

Viral video: Family fearlessly conducts puja with live black cobra, internet reacts![submenu-img]() Woman demands Rs 50 lakh after receiving chicken instead of paneer

Woman demands Rs 50 lakh after receiving chicken instead of paneer![submenu-img]() Who is Manahel al-Otaibi, Saudi women's rights activist jailed for 11 years over clothing choices?

Who is Manahel al-Otaibi, Saudi women's rights activist jailed for 11 years over clothing choices?![submenu-img]() In candid rapid fire, Rahul Gandhi reveals why white T-shirts are his signature attire, watch

In candid rapid fire, Rahul Gandhi reveals why white T-shirts are his signature attire, watch

)

)

)

)

)

)

)