Andhra Pradesh High Court rules the double tax avoidance agreement between India and France exempts the French drugmaker from capital gains tax relating to 90% stake in Shantha Biotech.

In a landmark judgment, the Andhra Pradesh High Court (APHC) on Friday ruled that the French drugmaker Sanofi Aventis, which (by buying another French firm ShanH) had acquired a 90% stake in the Hyderabad-based vaccine-maker Shantha Biotech in 2009, need not pay tax in India.

The controversy dates back to 2006 when ShanH, a holding company, was incorporated in France as a joint venture (JV) between Merieux Alliance (MA) and Groupe Industriel Marcel Dassault (GIMD).

The income tax authorities claimed that ShanH was formed as a shell company only with the intention of avoiding tax. They sought to lift the corporate veil to understand the structure of ShanH.

Soon after its incorporation, ShanH acquired the Shantha stake in 2006. In 2009, it decided to sell that stake. So, MA and GIMD, founders of ShanH, sold their ShanH holding to Sanofi Pasteur Holding for an estimated Rs 3,700 crore.

This MA-GIMD-Sanofi deal for ShanH had come under the income tax radar. The income tax authorities had raised a claim for about Rs 700 crore to be payable on account of capital gains.

But MA (read Sanofi) rubbished the claim in its petition. ShanH, it said, was formed to make it “from the very first day the owner of the shares of Shantha”.

MA had contested the income tax department's claim and the issue has since been going through rounds of adjudication.

MA's contention is that the tax by the Indian authorities would tantamount to double taxation which is sought to be avoided by an India-France Double Taxation Avoidance Agreement (DTAA).

Even Sanofi referred the tax issue to the Authority for Advance Rulings (AAR). However, the AAR ruled against Sanofi.and favoured the tax authorities. In response, Sanofi approached the Andhra Pradesh High Court.

Citing the provisions of the India-France DTAA, Sanofi said in its petition that where shares of a resident company of France are transferred, representing the participation of anything more than 10%, the capital gains are taxable only in France.

Further, it contended, all other so-called rights, properties and assets held by a French resident, when transferred and even if located in India, are taxable in France.

Citing an earlier order of the Supreme Court in the case of Vodafone International Holdings, Sanofi said, “The situs of the shares would be where the company is incorporated and where its shares can be transferred. The situs cannot be determined on the basis of the location of the underlying assets.”

After prolonged hearing, the APHC bench of Justices Goda Raghuram and M S Ramachandra Rao quashed the rulings of the AAR and the notices of the tax authorities.

The bench has made seven key observations in the summary of its judgment running into 200-odd pages. According to the bench:

1) ShanH is an independent corporate entity, registered and resident in France. It has commercial substance and a purpose and is neither a mere nominee of MA and / or MA/GIMD nor is a contrivance / device for tax avoidance.

2) Since inception (in 2006), ShanH (not MA or MA/GIMD) had acquired, and continues to hold, the Shantha shares.

3) There is no warrant for lifting the corporate veil of ShanH and even on looking through the ShanH corporate persona, there is no material to conclude that there is a design or stratagem to avoid tax.

4) The capital gains arising as a consequence of the transaction in issue is chargeable to tax: and the resultant tax is allocated to France (and not to India) under the DTAA.

5) The retrospective amendments to the Income Tax Act, 1961 (vide the Finance Act, 2012) have no impact on interpretation of the DTAA; the transaction in issue falls within Article 14(5) of the DTAA and the tax resulting there from is allocated exclusively to France.

6) The ruling dated November 28, 2011 of the AAR is unsustainable.

7) The order of assessment dated May 25, 2010 (determining Sanofi to be an assessee in default, under Section 201 of the Act) is unsustainable. The consequent demand notice dated May 25, 2010 and the rectification order dated November 15, 2011, being orders/ proceedings consequent to the order dated May 25, 2010 are unsustainable.

The outcome of the case has been a matter of interest for various other firms, particularly those contemplating mergers and acquisitions in India but protected by the DTAA concerned.

"The (AP) High Court has clearly settled the law that the retrospective amendments have no impact on interpretation of the treaty provisions," said Rohit Jain, partner with law firm Economic Laws Practice that represented MA in the case.

Analysts, too, expect the APHC order to encourage foreign investments, particularly from countries having DTAA with India. For, the APHC has provided clarity on how to interpret the provisions of the DTAA.

"This order definitely gives boost to foreign investors in the country. It is a very positive development because there is clarity that such transactions are not liable for tax in cases of treaty agreements," said Vikram Doshi, partner with consultancy firm KPMG.

However, income tax authorities may exercise the option of appealing against the APHC order in the Supreme Court. “I cannot comment anything on this order. The decision on whether or not to appeal has to be taken by the income tax department,” said S R Ashok, the counsel for the department.

![submenu-img]() MBOSE 12th Result 2024: HSSLC Meghalaya Board 12th result declared, direct link here

MBOSE 12th Result 2024: HSSLC Meghalaya Board 12th result declared, direct link here![submenu-img]() Apple iPhone 14 at ‘lowest price ever’ in Flipkart sale, available at just Rs 10499 after Rs 48500 discount

Apple iPhone 14 at ‘lowest price ever’ in Flipkart sale, available at just Rs 10499 after Rs 48500 discount![submenu-img]() Meet man who left high-paying job, built Rs 2000 crore business, moved to village due to…

Meet man who left high-paying job, built Rs 2000 crore business, moved to village due to…![submenu-img]() Meet star, who grew up poor, identity was kept hidden from public, thought about suicide; later became richest...

Meet star, who grew up poor, identity was kept hidden from public, thought about suicide; later became richest...![submenu-img]() Watch: Ranbir Kapoor recalls 'disturbing' memory from his childhood in throwback viral video, says 'I was four years...'

Watch: Ranbir Kapoor recalls 'disturbing' memory from his childhood in throwback viral video, says 'I was four years...'![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Alia Bhatt wears elegant saree made by 163 people over 1965 hours to Met Gala 2024, fans call her ‘princess Jasmine’

Alia Bhatt wears elegant saree made by 163 people over 1965 hours to Met Gala 2024, fans call her ‘princess Jasmine’![submenu-img]() Jr NTR-Lakshmi Pranathi's 13th wedding anniversary: Here's how strangers became soulmates

Jr NTR-Lakshmi Pranathi's 13th wedding anniversary: Here's how strangers became soulmates![submenu-img]() Streaming This Week: Heeramandi, Shaitaan, Manjummel Boys, latest OTT releases to binge-watch

Streaming This Week: Heeramandi, Shaitaan, Manjummel Boys, latest OTT releases to binge-watch![submenu-img]() Remember Ayesha Kapur? Michelle from Black, here's how actress, nutrition coach, entrepreneur looks after 19 years

Remember Ayesha Kapur? Michelle from Black, here's how actress, nutrition coach, entrepreneur looks after 19 years![submenu-img]() Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'

Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'![submenu-img]() Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?

Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() Meet star, who grew up poor, identity was kept hidden from public, thought about suicide; later became richest...

Meet star, who grew up poor, identity was kept hidden from public, thought about suicide; later became richest...![submenu-img]() Watch: Ranbir Kapoor recalls 'disturbing' memory from his childhood in throwback viral video, says 'I was four years...'

Watch: Ranbir Kapoor recalls 'disturbing' memory from his childhood in throwback viral video, says 'I was four years...'![submenu-img]() This superstar was in love with Muslim actress, was about to marry her, relationship ruined after death threats from..

This superstar was in love with Muslim actress, was about to marry her, relationship ruined after death threats from..![submenu-img]() Meet Madhuri Dixit’s lookalike, who worked with Akshay Kumar, Govinda, quit films at peak of career, is married to…

Meet Madhuri Dixit’s lookalike, who worked with Akshay Kumar, Govinda, quit films at peak of career, is married to… ![submenu-img]() Meet former beauty queen who competed with Aishwarya, made debut with a superstar, quit acting to become monk, is now..

Meet former beauty queen who competed with Aishwarya, made debut with a superstar, quit acting to become monk, is now..![submenu-img]() IPL 2024: Jake Fraser-McGurk, Abishek Porel power DC to 20-run win over RR

IPL 2024: Jake Fraser-McGurk, Abishek Porel power DC to 20-run win over RR![submenu-img]() SRH vs LSG, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

SRH vs LSG, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() IPL 2024: Here’s why CSK star MS Dhoni batted at No.9 against PBKS

IPL 2024: Here’s why CSK star MS Dhoni batted at No.9 against PBKS![submenu-img]() SRH vs LSG IPL 2024 Dream11 prediction: Fantasy cricket tips for Sunrisers Hyderabad vs Lucknow Super Giants

SRH vs LSG IPL 2024 Dream11 prediction: Fantasy cricket tips for Sunrisers Hyderabad vs Lucknow Super Giants![submenu-img]() Watch: Kuldeep Yadav, Yuzvendra Chahal team up for hilarious RR meme, video goes viral

Watch: Kuldeep Yadav, Yuzvendra Chahal team up for hilarious RR meme, video goes viral![submenu-img]() Not Alia Bhatt or Isha Ambani but this Indian CEO made heads turn at Met Gala 2024, she is from...

Not Alia Bhatt or Isha Ambani but this Indian CEO made heads turn at Met Gala 2024, she is from...![submenu-img]() Man makes Lord Hanuman co-litigant in plea, Delhi High Court asks him to pay Rs 100000…

Man makes Lord Hanuman co-litigant in plea, Delhi High Court asks him to pay Rs 100000…![submenu-img]() Four big dangerous asteroids coming toward Earth, but the good news is…

Four big dangerous asteroids coming toward Earth, but the good news is…![submenu-img]() Isha Ambani's Met Gala 2024 saree gown was created in over 10,000 hours, see pics

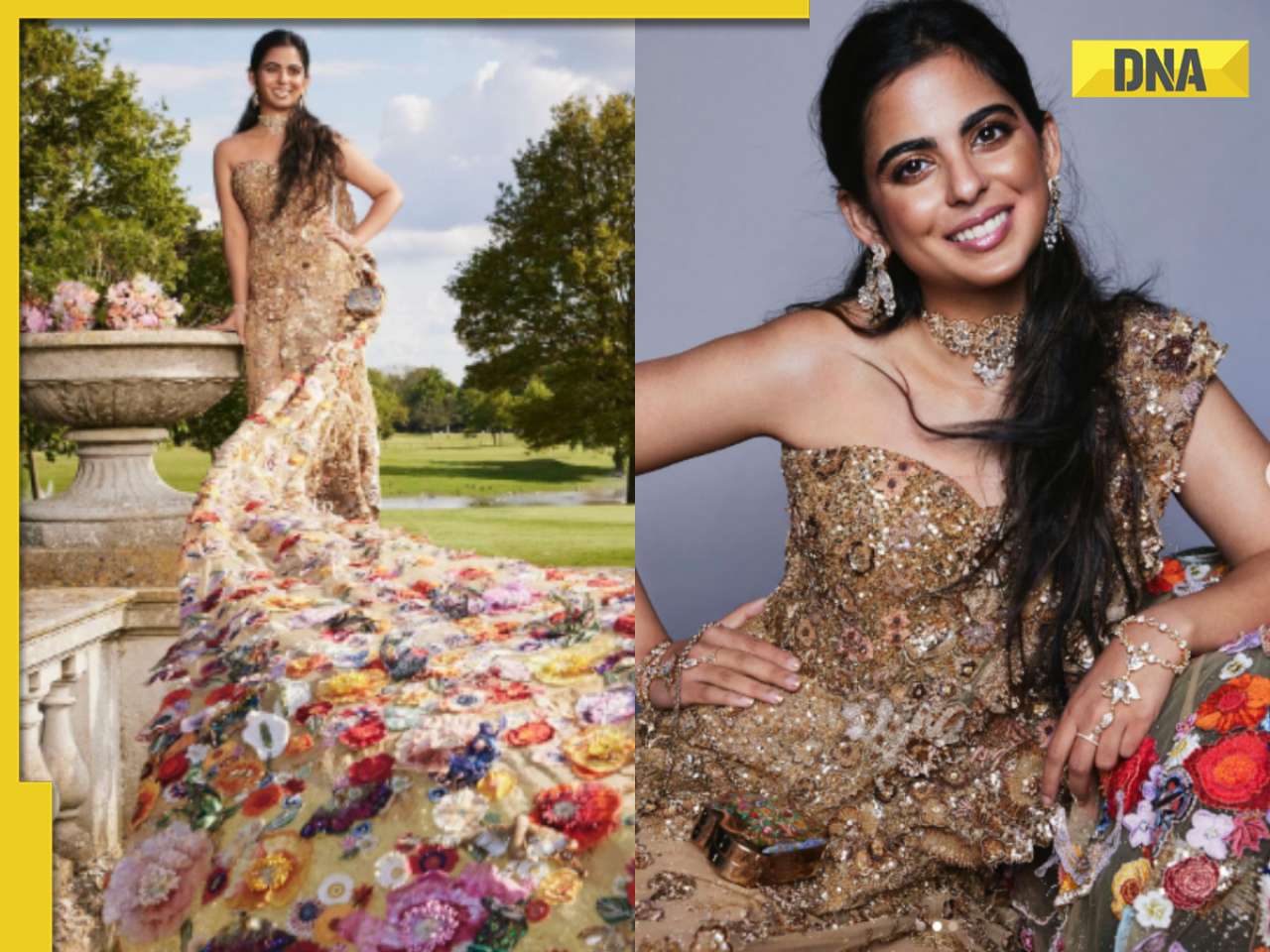

Isha Ambani's Met Gala 2024 saree gown was created in over 10,000 hours, see pics![submenu-img]() Indian-origin man says Apple CEO Tim Cook pushed him...

Indian-origin man says Apple CEO Tim Cook pushed him...

)

)

)

)

)

)