First, the good news. The government finally cleared a slew of projects worth Rs 1.5 lakh crore what had been gathering dust, possibly because it adopted a suitcase by suitcase approach towards clearances. There was also a ray of hope in the World Bank’s recent (Global Economic Prospect) forecast that India’s GDP growth could be around 6.2% for 2014, climbing to 6.6% and 7.1% in 2015 and 2016, respectively. The Supreme Court too delivered a brilliant judgement, severely curtailing the power of governments to take over the management of temple-trusts and their properties, including money.

But the bad news was bigger. Many of the “cleared” projects may not be able to take off for at least 6-12 months because of two reasons. First, land acquisition problems are likely to multiply – thanks to the new laws enacted by the government. The concerns are laudable – to protect small farmers and marginalised people of India. But in its populism, the lawmakers failed to create the required caveats which would allow for industrial growth – at least on lands that are lying fallow or on 'forest' lands that have no tree-cover at all. Second, NREGA will end up destroying agricultural labour and the food security could possibly distress small farmers

Likewise, even though India faces the prospect of a bumper harvest, there will be little growth in storage. Expect more grain to rot. Not a pretty picture.

But it is the ugly side that is most worrisome. India has witnessed new practices that could derail the country.

Topping the list are banks that were asked to lend money to promoters without either proper scrutiny or adequate asset cover. They include public sector companies (like AirIndia's purchase of 40 aircraft without a business plan), or private sector enterprises (Kingfisher is a good example).

Not surprisingly, bad debts have soared. Banks have had to make bigger provisions for such debts. Thus while the number of debt restructuring cases went up by just 53% during the past two years, total debt involved went up 80% (see table). Clearly, bigger ticket loans have now become sticky. Not surprisingly, 86% of bad debts are with nationalised banks

And while over 70% of the cases referred for debt restructuring have new packages approved for them, there is a growing lurking fear that many more will fall by the wayside, making the pile of bad debts climb higher. Eventually, taxpayers will be compelled to pay the price.

This will also give rise to some creative accounting – like the sale and lease back of some of the aircraft that AirIndia recently purchased. On paper there is money on the books, but the cuts will now bleed more profusely than before.

Another ugly issue is that nobody will be held accountable. Not the aviation minister. Not the officials in the prime minister's office (PMO) under whose watch the aircraft purchase, the 2G telecom scam and the coal scam took place. In some states, legislators were allowed to run riot – consider how some of them beat up a policeman inside the assembly house and still retain their seats. Elsewhere, a governor protected another legislator from charges of corruption. And the brother of a votebank legislator got parole one more time. The list is endless. No wonder, Arvind Kejriwal, chief of the Aam Aadmi Party (AAP), has become a darling of the powerless masses, even though his methods are terrifyingly disruptive.

Will India be able to overcome the ugly future that confronts it? Yes, but only if there is more transparency and accountability on the one hand, and increased speed in the delivery of justice on the other.

For this India will need incorruptible, visionary and politically savvy administrators. Will 2014 throw up such a person?

![submenu-img]() BMW i5 M60 xDrive launched in India, all-electric sedan priced at Rs 11950000

BMW i5 M60 xDrive launched in India, all-electric sedan priced at Rs 11950000![submenu-img]() This superstar was arrested several times by age 17, thrown out of home, once had just Rs 250, now worth Rs 6600 crore

This superstar was arrested several times by age 17, thrown out of home, once had just Rs 250, now worth Rs 6600 crore![submenu-img]() Meet Reliance’s highest paid employee, gets over Rs 240000000 salary, he is Mukesh Ambani’s…

Meet Reliance’s highest paid employee, gets over Rs 240000000 salary, he is Mukesh Ambani’s… ![submenu-img]() Meet lesser-known relative of Mukesh Ambani, Anil Ambani, has worked with BCCI, he is married to...

Meet lesser-known relative of Mukesh Ambani, Anil Ambani, has worked with BCCI, he is married to...![submenu-img]() Made in just Rs 95,000, this film was a superhit, but destroyed lead actress' career, saw controversy over bold scenes

Made in just Rs 95,000, this film was a superhit, but destroyed lead actress' career, saw controversy over bold scenes![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() In pics: Arti Singh stuns in red lehenga as she ties the knot with beau Dipak Chauhan in dreamy wedding

In pics: Arti Singh stuns in red lehenga as she ties the knot with beau Dipak Chauhan in dreamy wedding![submenu-img]() Actors who died due to cosmetic surgeries

Actors who died due to cosmetic surgeries![submenu-img]() See inside pics: Malayalam star Aparna Das' dreamy wedding with Manjummel Boys actor Deepak Parambol

See inside pics: Malayalam star Aparna Das' dreamy wedding with Manjummel Boys actor Deepak Parambol ![submenu-img]() In pics: Salman Khan, Alia Bhatt, Rekha, Neetu Kapoor attend grand premiere of Sanjay Leela Bhansali's Heeramandi

In pics: Salman Khan, Alia Bhatt, Rekha, Neetu Kapoor attend grand premiere of Sanjay Leela Bhansali's Heeramandi![submenu-img]() Streaming This Week: Crakk, Tillu Square, Ranneeti, Dil Dosti Dilemma, latest OTT releases to binge-watch

Streaming This Week: Crakk, Tillu Square, Ranneeti, Dil Dosti Dilemma, latest OTT releases to binge-watch![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence

DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence![submenu-img]() DNA Explainer: What is India's stand amid Iran-Israel conflict?

DNA Explainer: What is India's stand amid Iran-Israel conflict?![submenu-img]() This superstar was arrested several times by age 17, thrown out of home, once had just Rs 250, now worth Rs 6600 crore

This superstar was arrested several times by age 17, thrown out of home, once had just Rs 250, now worth Rs 6600 crore![submenu-img]() Made in just Rs 95,000, this film was a superhit, but destroyed lead actress' career, saw controversy over bold scenes

Made in just Rs 95,000, this film was a superhit, but destroyed lead actress' career, saw controversy over bold scenes![submenu-img]() Meet 72-year-old who earns Rs 280 cr per film, Asia's highest-paid actor, bigger than Shah Rukh, Salman, Akshay, Prabhas

Meet 72-year-old who earns Rs 280 cr per film, Asia's highest-paid actor, bigger than Shah Rukh, Salman, Akshay, Prabhas![submenu-img]() This star, who once lived in chawl, worked as tailor, later gave four Rs 200-crore films; he's now worth...

This star, who once lived in chawl, worked as tailor, later gave four Rs 200-crore films; he's now worth...![submenu-img]() Tamil star Prasanna reveals why he chose series Ranneeti for Hindi debut: 'Getting into Bollywood is not...'

Tamil star Prasanna reveals why he chose series Ranneeti for Hindi debut: 'Getting into Bollywood is not...'![submenu-img]() IPL 2024: Virat Kohli, Rajat Patidar fifties and disciplined bowling help RCB beat Sunrisers Hyderabad by 35 runs

IPL 2024: Virat Kohli, Rajat Patidar fifties and disciplined bowling help RCB beat Sunrisers Hyderabad by 35 runs![submenu-img]() 'This is the problem in India...': Wasim Akram's blunt take on fans booing Mumbai Indians skipper Hardik Pandya

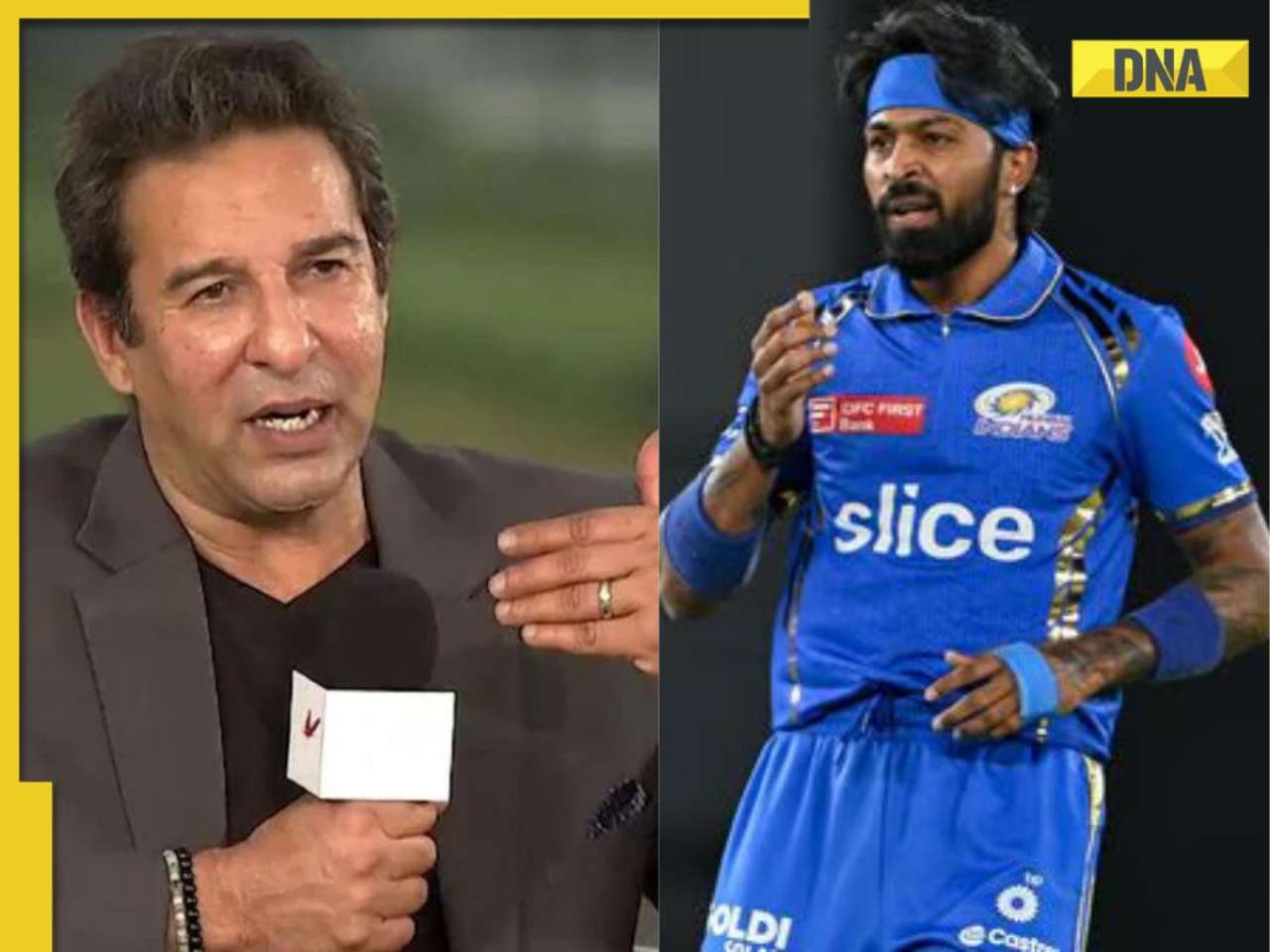

'This is the problem in India...': Wasim Akram's blunt take on fans booing Mumbai Indians skipper Hardik Pandya![submenu-img]() KKR vs PBKS, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

KKR vs PBKS, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() KKR vs PBKS IPL 2024 Dream11 prediction: Fantasy cricket tips for Kolkata Knight Riders vs Punjab Kings

KKR vs PBKS IPL 2024 Dream11 prediction: Fantasy cricket tips for Kolkata Knight Riders vs Punjab Kings![submenu-img]() IPL 2024: KKR star Rinku Singh finally gets another bat from Virat Kohli after breaking previous one - Watch

IPL 2024: KKR star Rinku Singh finally gets another bat from Virat Kohli after breaking previous one - Watch![submenu-img]() Viral video: Teacher's cute way to capture happy student faces melts internet, watch

Viral video: Teacher's cute way to capture happy student faces melts internet, watch![submenu-img]() Woman attends online meeting on scooter while stuck in traffic, video goes viral

Woman attends online meeting on scooter while stuck in traffic, video goes viral![submenu-img]() Viral video: Pilot proposes to flight attendant girlfriend before takeoff, internet hearts it

Viral video: Pilot proposes to flight attendant girlfriend before takeoff, internet hearts it![submenu-img]() Pakistani teen receives life-saving heart transplant from Indian donor, details here

Pakistani teen receives life-saving heart transplant from Indian donor, details here![submenu-img]() Viral video: Truck driver's innovative solution to beat the heat impresses internet, watch

Viral video: Truck driver's innovative solution to beat the heat impresses internet, watch

)

)

)

)

)

)

)