Last week, RBI governor Raghuram Rajan made a strong plea that assets of wilful defaulters should be sold right away. In the case of “malfeasance” defaulters should not be allowed to recast bank loans, he said.

On November 16, in a presentation to bankers, the deputy governor of the Reserve Bank of India (RBI), K C Chakrabarty, said, “In the last 13 years, banks have written off Rs 1 lakh crore and 95% of these are large loans. Everyone talks of the farm loan write-off, but it is the medium and large enterprises segment that has a 50% share in NPAs.”

RBI numbers showed that the banks added Rs 494,836 crore to their bad loans between 2007 and 2013. During the same period, they reduced NPAs to the extent of Rs 350,332 crore. This was possible because loans worth Rs 141,295 crore were written off; another Rs 90,887 crore were upgraded to repaying loans; and a small part — Rs 118,149 crore — was recovered from defaulters.

As Chakrabarty explained, after a technical write-off there is no incentive to pursue recovery.

True, some advances made by banks become bad debts because junior (and senior) bank officers do not diligently monitor the end use of loans taken. But much of it is on account of collusion and corruption. About 86% of such bad debts are with public sector banks.

Take one instance: A large industrial house had indirectly promoted – all through the ‘eighties and the ‘nineties – hundreds of ‘satellite’ companies. The directors of such companies were employees and friends. These satellites, in turn, raised loans of Rs 5-10 crore each. Since they were under Rs 50 crore, they often escaped RBI’s radar. Each year, after a life-span of around 5-7 years of existence, a clutch of such companies would plead helplessness in repaying the loans. New companies would then be formed to take their place. Most defaults were “technically settled” at a fraction (sometimes one-fourth) of the principal sum lent out. The rest was written off under oral instructions “from above”.

Even though the RBI was in the dark about the quantum of such happenings, the finance ministry was quite aware of this. Its own department, – the Central Economic Intelligence Bureau (CEIB) – kept track of such borrowings, and it was from the CEIB that this correspondent got several details. However, no action was taken against the bank managers, the companies or their officials.

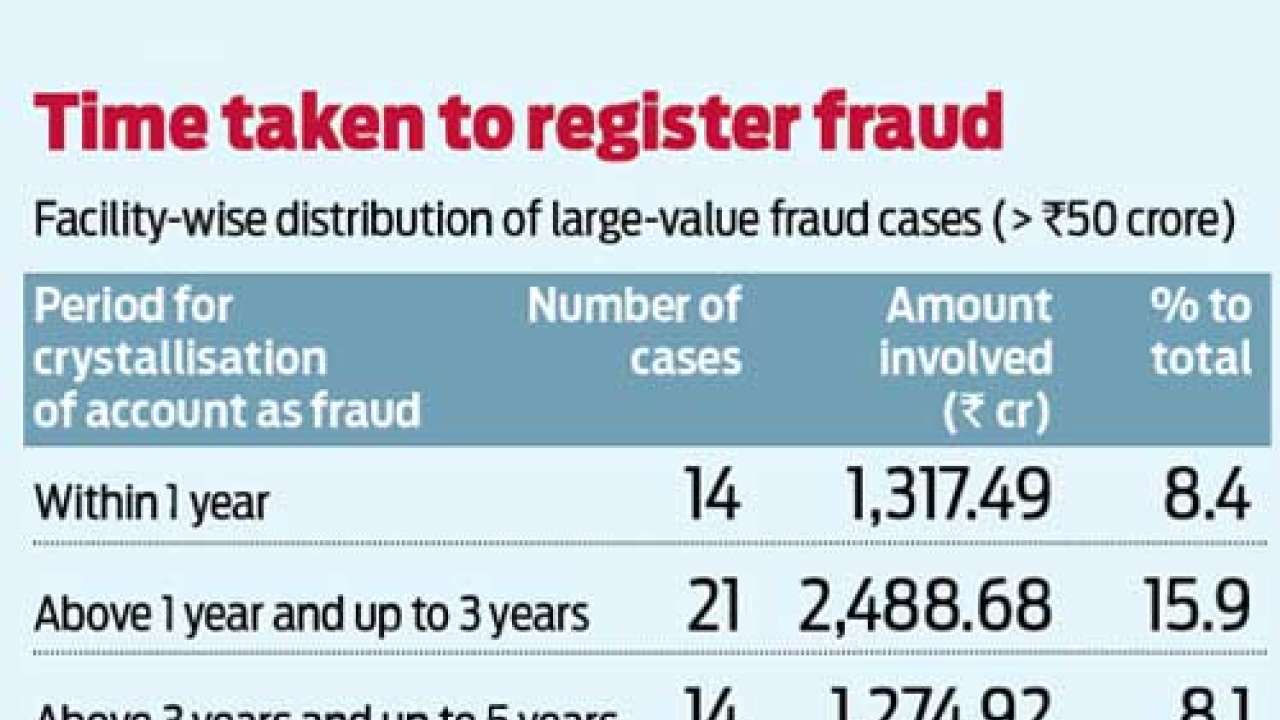

Multiply such stratagems several-fold, and you can then appreciate the numbers presented by Chakrabarty in his talk on November 11 this year (see table). It can be seen that just 181 companies accounted for almost 78% (Rs 10,596 crore) of big frauds (of over Rs 50 crore) and involved a period of at least five years for “crystallisation” of the loans as bad debts. Of these, the bulk related to just 88 companies (involving around Rs 7,000 crore) and took over ten years for being “crystallised” as frauds.

What this means is that bankers invariably resorted to ways to conceal the non-performing nature of the amounts borrowed. In many cases, they were “ever-greened” (http://www.dnaindia.com/money/column-policy-watch-the-janus-headed-nature-of-bad-debts-and-it-s-just-getting-scarier-1931967) till a technical write-off was possible.

That is why it took the banks and the RBI over ten years to crystallise many such loans as frauds.

Sadly, very few of the companies and directors are ever labelled as wilful defaulters. The assets of the borrowers, and the colluding bankers are seldom attached. The only notable exception in recent memory is that of NSEL (National Spot Exchange Ltd) whose officers were slapped with “wilful default”. One only wishes that the same law had been applied to others as well many bigger defaulters than NSEL.

Moreover, NSEL’s defaults related to private funds. The defaults with public sector banks involved public funds (hence taxpayers’ money). Surely, the latter deserve more serious care and attention.

Consequently, banks and the taxpayer are made to suffer. The agricultural loans market has been ‘poisoned’ by teaching honest farmers to become dishonest. Politicians have taught them not to repay their loans. This alone has cost banks over Rs 60,000 crore during the last decade.

At the other end of the spectrum, politicians, bureaucrats and bankers colluded with fraudsters and allowed write-offs of over Rs 1 lakh crore.

Is it then any surprise that many citizens of India are now disgusted with the system? Will Indian banks be allowed to survive? Or will everything be handed over to foreign banks?