MSCI's broadest index of Asia-Pacific shares outside Japan gained 0.4 percent to their highest since July 2015 with Hong Kong, Taiwan and China among the region's best performing markets.

Asian shares climbed to their highest in more than 18 months on Thursday, as investors grew more confident about China while the dollar slightly firmed in the wake of growing concerns over political instability in Europe.

MSCI's broadest index of Asia-Pacific shares outside Japan gained 0.4 percent to their highest since July 2015 with Hong Kong, Taiwan and China among the region's best performing markets.

European stocks are set to follow Asia's cues, with key markets seen opening slightly higher.

"In China we have an overweight view on equities as we see improved corporate earnings outlook with the Chinese PPI (producer price index) turning around from deflation trend," said Fan Cheuk Wan, head of investment strategy for Asia at HSBC Private Bank.

It also has overweight recommendation on India and Indonesia.

An ongoing rally in commodity prices led by copper and iron ore, along with gentle policy tightening by Beijing via money market rates, has led to a more optimistic view of Chinese corporate earnings, analysts said.

Earnings growth for MSCI China is expected at nearly 15 percent over the next 12 months, slightly ahead of 13 percent projected for companies in MSCI Asia outside Japan, according to Thomson Reuters data.

Pictet Asset Management has cut its exposure to U.S. markets due to expensive valuations, and has turned bullish on emerging markets in Asia, citing strong correlations with commodity prices.

In other markets, New Zealand stocks rose after the central bank signalled that a further cut in interest rates was no longer likely while Japanese shares were in focus before a meeting between U.S. President Donald Trump and Japan's Prime Minister Shinzo Abe on Friday.

Abe will propose a new cabinet level framework for U.S.-Japan talks on trade, security and macroeconomic issues, including currencies, a Japanese government official involved in planning the summit in Washington said.

"Trade and defense will be in focus," said Norihiro Fujito, a senior investment strategist at Mitsubishi UFJ Morgan Stanley Securities. "We need to see if anything is said that has an effect on currencies, or on specific companies."

COMMODITY RALLY

In commodities, copper held onto gains after the world's top two mines said strikes and permit delays would force them to cut output. Helping sentiment was a recent pick-up in China's producer price index to its highest levels since September 2011. Copper prices are up 27 percent since late October.

Oil prices stabilised on Thursday, boosted by an unexpected draw in U.S. gasoline inventories. Brent crude futures was trading at $55.43 per barrel, up 0.5 percent.

However, bubbling political concerns, including a strong showing by far-right candidate Marine Le Pen in France's presidential race, have pushed up premiums demanded by investors to buy French debt over comparable bonds and pushed the yen and U.S. Treasuries higher.

Uncertainty translated into another day of gains for bonds, with 10-year U.S. benchmark bond yields declining for a third consecutive day to 2.34 percent, the lowest level in three weeks and retracing one-third of its rise since Trump's victory in early November.

The dollar bounced after the previous day's drop, but falling yields are set to limit the greenback's gains.

Against a broad trade-weighted basket of its rivals, the dollar was trading at 100.31 compared to a level of 99.30 last week. The Japanese yen also held its ground thanks to a broad rush to safety.

(This article has not been edited by DNA's editorial team and is auto-generated from an agency feed.)

![submenu-img]() MBOSE 12th Result 2024: HSSLC Meghalaya Board 12th result declared, direct link here

MBOSE 12th Result 2024: HSSLC Meghalaya Board 12th result declared, direct link here![submenu-img]() Apple iPhone 14 at ‘lowest price ever’ in Flipkart sale, available at just Rs 10499 after Rs 48500 discount

Apple iPhone 14 at ‘lowest price ever’ in Flipkart sale, available at just Rs 10499 after Rs 48500 discount![submenu-img]() Meet man who left high-paying job, built Rs 2000 crore business, moved to village due to…

Meet man who left high-paying job, built Rs 2000 crore business, moved to village due to…![submenu-img]() Meet star, who grew up poor, identity was kept hidden from public, thought about suicide; later became richest...

Meet star, who grew up poor, identity was kept hidden from public, thought about suicide; later became richest...![submenu-img]() Watch: Ranbir Kapoor recalls 'disturbing' memory from his childhood in throwback viral video, says 'I was four years...'

Watch: Ranbir Kapoor recalls 'disturbing' memory from his childhood in throwback viral video, says 'I was four years...'![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Alia Bhatt wears elegant saree made by 163 people over 1965 hours to Met Gala 2024, fans call her ‘princess Jasmine’

Alia Bhatt wears elegant saree made by 163 people over 1965 hours to Met Gala 2024, fans call her ‘princess Jasmine’![submenu-img]() Jr NTR-Lakshmi Pranathi's 13th wedding anniversary: Here's how strangers became soulmates

Jr NTR-Lakshmi Pranathi's 13th wedding anniversary: Here's how strangers became soulmates![submenu-img]() Streaming This Week: Heeramandi, Shaitaan, Manjummel Boys, latest OTT releases to binge-watch

Streaming This Week: Heeramandi, Shaitaan, Manjummel Boys, latest OTT releases to binge-watch![submenu-img]() Remember Ayesha Kapur? Michelle from Black, here's how actress, nutrition coach, entrepreneur looks after 19 years

Remember Ayesha Kapur? Michelle from Black, here's how actress, nutrition coach, entrepreneur looks after 19 years![submenu-img]() Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'

Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'![submenu-img]() Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?

Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() Meet star, who grew up poor, identity was kept hidden from public, thought about suicide; later became richest...

Meet star, who grew up poor, identity was kept hidden from public, thought about suicide; later became richest...![submenu-img]() Watch: Ranbir Kapoor recalls 'disturbing' memory from his childhood in throwback viral video, says 'I was four years...'

Watch: Ranbir Kapoor recalls 'disturbing' memory from his childhood in throwback viral video, says 'I was four years...'![submenu-img]() This superstar was in love with Muslim actress, was about to marry her, relationship ruined after death threats from..

This superstar was in love with Muslim actress, was about to marry her, relationship ruined after death threats from..![submenu-img]() Meet Madhuri Dixit’s lookalike, who worked with Akshay Kumar, Govinda, quit films at peak of career, is married to…

Meet Madhuri Dixit’s lookalike, who worked with Akshay Kumar, Govinda, quit films at peak of career, is married to… ![submenu-img]() Meet former beauty queen who competed with Aishwarya, made debut with a superstar, quit acting to become monk, is now..

Meet former beauty queen who competed with Aishwarya, made debut with a superstar, quit acting to become monk, is now..![submenu-img]() IPL 2024: Jake Fraser-McGurk, Abishek Porel power DC to 20-run win over RR

IPL 2024: Jake Fraser-McGurk, Abishek Porel power DC to 20-run win over RR![submenu-img]() SRH vs LSG, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

SRH vs LSG, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() IPL 2024: Here’s why CSK star MS Dhoni batted at No.9 against PBKS

IPL 2024: Here’s why CSK star MS Dhoni batted at No.9 against PBKS![submenu-img]() SRH vs LSG IPL 2024 Dream11 prediction: Fantasy cricket tips for Sunrisers Hyderabad vs Lucknow Super Giants

SRH vs LSG IPL 2024 Dream11 prediction: Fantasy cricket tips for Sunrisers Hyderabad vs Lucknow Super Giants![submenu-img]() Watch: Kuldeep Yadav, Yuzvendra Chahal team up for hilarious RR meme, video goes viral

Watch: Kuldeep Yadav, Yuzvendra Chahal team up for hilarious RR meme, video goes viral![submenu-img]() Not Alia Bhatt or Isha Ambani but this Indian CEO made heads turn at Met Gala 2024, she is from...

Not Alia Bhatt or Isha Ambani but this Indian CEO made heads turn at Met Gala 2024, she is from...![submenu-img]() Man makes Lord Hanuman co-litigant in plea, Delhi High Court asks him to pay Rs 100000…

Man makes Lord Hanuman co-litigant in plea, Delhi High Court asks him to pay Rs 100000…![submenu-img]() Four big dangerous asteroids coming toward Earth, but the good news is…

Four big dangerous asteroids coming toward Earth, but the good news is…![submenu-img]() Isha Ambani's Met Gala 2024 saree gown was created in over 10,000 hours, see pics

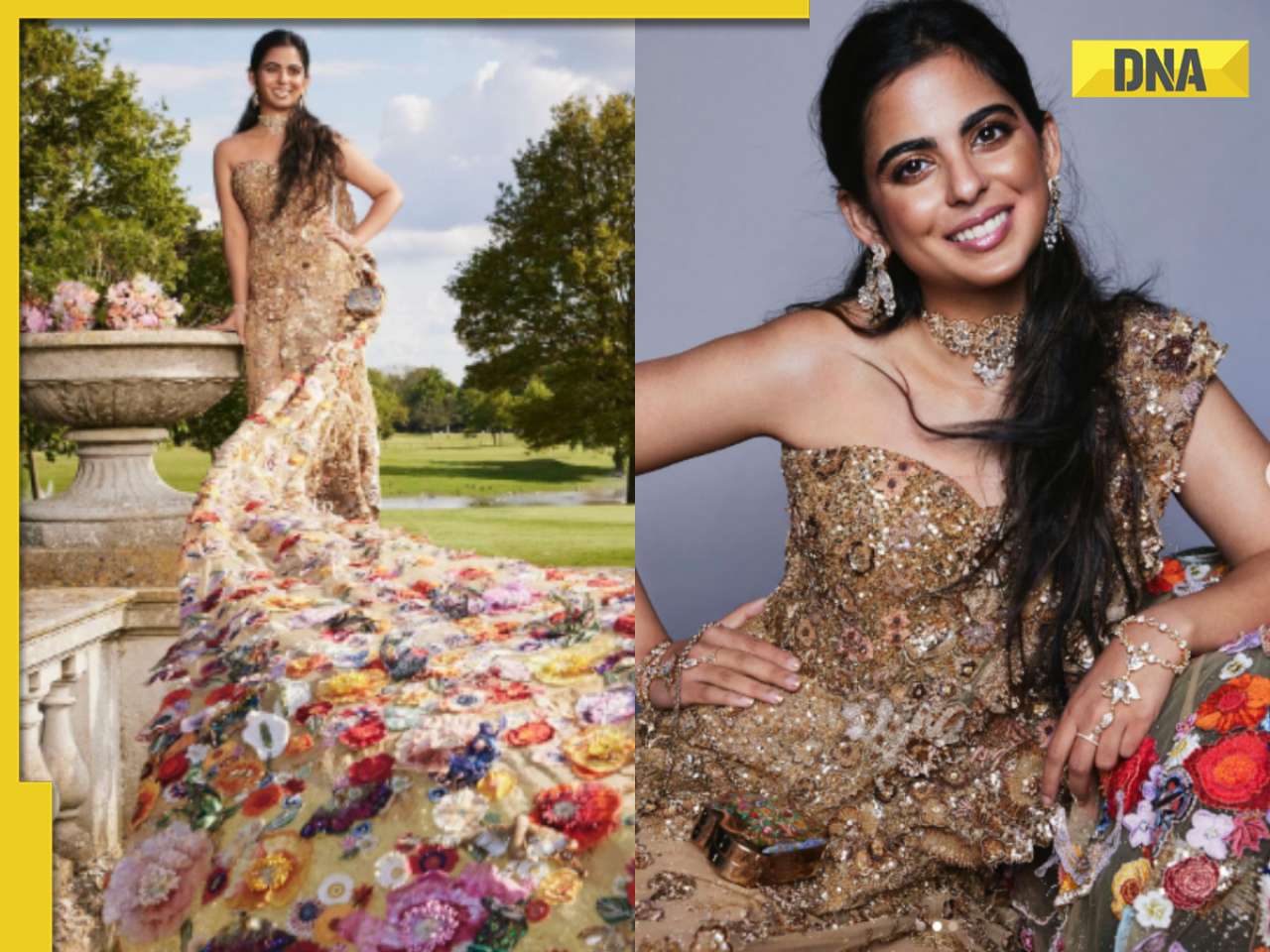

Isha Ambani's Met Gala 2024 saree gown was created in over 10,000 hours, see pics![submenu-img]() Indian-origin man says Apple CEO Tim Cook pushed him...

Indian-origin man says Apple CEO Tim Cook pushed him...

)

)

)

)

)

)