BSE Sensex ended lower by 90 points at 27,746.66.

Equities fell for a second straight session on Monday as the BSE Sensex gave up all of its early gains to end lower by 90 points at 27,746.66 on widespread fag-end selling amid weaker opening in the European markets. Things changed dramatically in the last one hour as profit-booking emerged and Europe-based shares opened lower following the failed coup attempt in Turkey at the weekend.

The first half was upbeat, driven by better-than-expected earnings jump by Reliance Industries. Shares of the firm rose to a high of Rs 1,039 intra-day, but later on profit-booking it fell to end the session 0.82 % down at Rs 1,004.25. FMCG major Hindustan Unilever shares fell 2.04% to Rs 920.45 after company reported lower-than-expected 3.6% revenue growth for the first quarter. "Market has already factored in the passage of GST bill,

hence it is waiting before the start of the discussion. Additionally, the start of Q1FY17 result has been subdued which is creating extra volatility in the market," said Vinod Nair, Head of Research, Geojit BNP Paribas Financial Services.

Sensex started-off on a strong foot and regained the 28,000-mark to hit a high of 28,013.50. However, on selling in key bluechips it slipped to a low of 27,697.69, before settling 89.84 points or 0.32 % lower at 27,746.66. The NSE Nifty finished 32.70 points or 0.38% down at 8,508.70. It shuttled between 8,587.10 and 8,494.35. The broader markets too depicted a weak trend as retail investors locked-in gains. The BSE mid-cap index fell 0.62% and small-cap index shed 0.48%.

Shares of of telecom operator, Idea Cellular plunged by 6.52% to Rs 103.90 after company announced up to 67% reduction in 4G and 3G BIG internet packs rates. Elsewhere, Asian stocks mostly closed higher, showing little reaction to a failed coup in Turkey, although investors responded to a data out of China suggesting that the country's housing market was expanding at less frenetic pace.

Most of the European stocks were trading lower as investors digested a number of geopolitical events including the failed coup in Turkey. Asian indices like Hong Kong, Japan, South Korea, Singapore and Taiwan gained 0.12% to 0.68% while China fell 0.35%. European indices like France and Germany fell 0.40% and 0.19 %, respectively, while the UK rose 0.35%.

Back home, Foreign Portfolio Investors (FPIs) remained net buyers, purchasing shares worth Rs 1,461.26 crore on Friday, as per provisional data. In the domestic market, 20 scrips out of the 30-share Sensex pack ended lower while 10 ended higher. Major losers were, ONGC (4.97%), Bharti Airtel (3.98%), HUL (2.04%), Tata Steel (1.94%), Cipla (1.56%), SBI (1.25%), GAIL (1.20%), HDFC (1.11%), Adani Ports (1.11%), RIL (0.82%), Dr Reddy's (0.78%) and Larsen (0.70%).

However, Bajaj Auto rose 2.51 % followed by Axis Bank 0.94% and Infosys 0.88%. Among BSE sectoral indices, telecom dropped by 3.23%, followed by oil and gas 1.61%, realty 1.32%, energy 1.10%, metal 1.04%, consumer durables 0.96% and capital goods 0.63%.

The market breadth was weak as 1,640 stocks declined 1,092 rose and 181 ruled steady of the total 2,913 stocks. Total turnover fell to Rs 3,033.87 crore from Rs 3,913.55 crore on Friday.

![submenu-img]() MBOSE 12th Result 2024: HSSLC Meghalaya Board 12th result declared, direct link here

MBOSE 12th Result 2024: HSSLC Meghalaya Board 12th result declared, direct link here![submenu-img]() Apple iPhone 14 at ‘lowest price ever’ in Flipkart sale, available at just Rs 10499 after Rs 48500 discount

Apple iPhone 14 at ‘lowest price ever’ in Flipkart sale, available at just Rs 10499 after Rs 48500 discount![submenu-img]() Meet man who left high-paying job, built Rs 2000 crore business, moved to village due to…

Meet man who left high-paying job, built Rs 2000 crore business, moved to village due to…![submenu-img]() Meet star, who grew up poor, identity was kept hidden from public, thought about suicide; later became richest...

Meet star, who grew up poor, identity was kept hidden from public, thought about suicide; later became richest...![submenu-img]() Watch: Ranbir Kapoor recalls 'disturbing' memory from his childhood in throwback viral video, says 'I was four years...'

Watch: Ranbir Kapoor recalls 'disturbing' memory from his childhood in throwback viral video, says 'I was four years...'![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

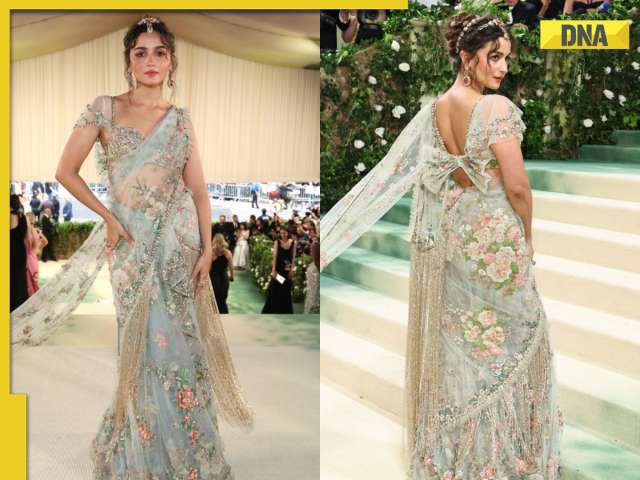

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Alia Bhatt wears elegant saree made by 163 people over 1965 hours to Met Gala 2024, fans call her ‘princess Jasmine’

Alia Bhatt wears elegant saree made by 163 people over 1965 hours to Met Gala 2024, fans call her ‘princess Jasmine’![submenu-img]() Jr NTR-Lakshmi Pranathi's 13th wedding anniversary: Here's how strangers became soulmates

Jr NTR-Lakshmi Pranathi's 13th wedding anniversary: Here's how strangers became soulmates![submenu-img]() Streaming This Week: Heeramandi, Shaitaan, Manjummel Boys, latest OTT releases to binge-watch

Streaming This Week: Heeramandi, Shaitaan, Manjummel Boys, latest OTT releases to binge-watch![submenu-img]() Remember Ayesha Kapur? Michelle from Black, here's how actress, nutrition coach, entrepreneur looks after 19 years

Remember Ayesha Kapur? Michelle from Black, here's how actress, nutrition coach, entrepreneur looks after 19 years![submenu-img]() Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'

Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'![submenu-img]() Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?

Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() Meet star, who grew up poor, identity was kept hidden from public, thought about suicide; later became richest...

Meet star, who grew up poor, identity was kept hidden from public, thought about suicide; later became richest...![submenu-img]() Watch: Ranbir Kapoor recalls 'disturbing' memory from his childhood in throwback viral video, says 'I was four years...'

Watch: Ranbir Kapoor recalls 'disturbing' memory from his childhood in throwback viral video, says 'I was four years...'![submenu-img]() This superstar was in love with Muslim actress, was about to marry her, relationship ruined after death threats from..

This superstar was in love with Muslim actress, was about to marry her, relationship ruined after death threats from..![submenu-img]() Meet Madhuri Dixit’s lookalike, who worked with Akshay Kumar, Govinda, quit films at peak of career, is married to…

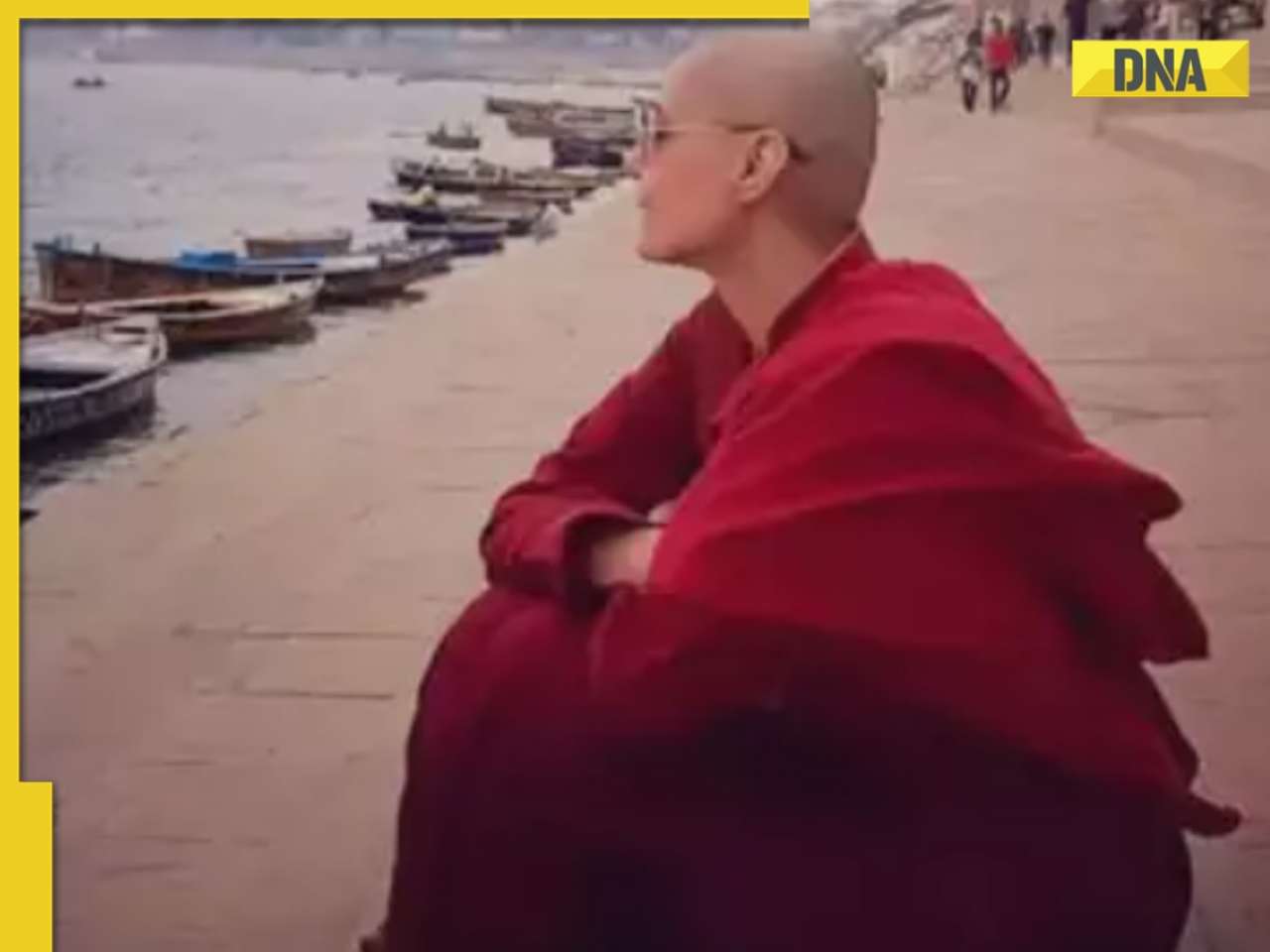

Meet Madhuri Dixit’s lookalike, who worked with Akshay Kumar, Govinda, quit films at peak of career, is married to… ![submenu-img]() Meet former beauty queen who competed with Aishwarya, made debut with a superstar, quit acting to become monk, is now..

Meet former beauty queen who competed with Aishwarya, made debut with a superstar, quit acting to become monk, is now..![submenu-img]() IPL 2024: Jake Fraser-McGurk, Abishek Porel power DC to 20-run win over RR

IPL 2024: Jake Fraser-McGurk, Abishek Porel power DC to 20-run win over RR![submenu-img]() SRH vs LSG, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

SRH vs LSG, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() IPL 2024: Here’s why CSK star MS Dhoni batted at No.9 against PBKS

IPL 2024: Here’s why CSK star MS Dhoni batted at No.9 against PBKS![submenu-img]() SRH vs LSG IPL 2024 Dream11 prediction: Fantasy cricket tips for Sunrisers Hyderabad vs Lucknow Super Giants

SRH vs LSG IPL 2024 Dream11 prediction: Fantasy cricket tips for Sunrisers Hyderabad vs Lucknow Super Giants![submenu-img]() Watch: Kuldeep Yadav, Yuzvendra Chahal team up for hilarious RR meme, video goes viral

Watch: Kuldeep Yadav, Yuzvendra Chahal team up for hilarious RR meme, video goes viral![submenu-img]() Not Alia Bhatt or Isha Ambani but this Indian CEO made heads turn at Met Gala 2024, she is from...

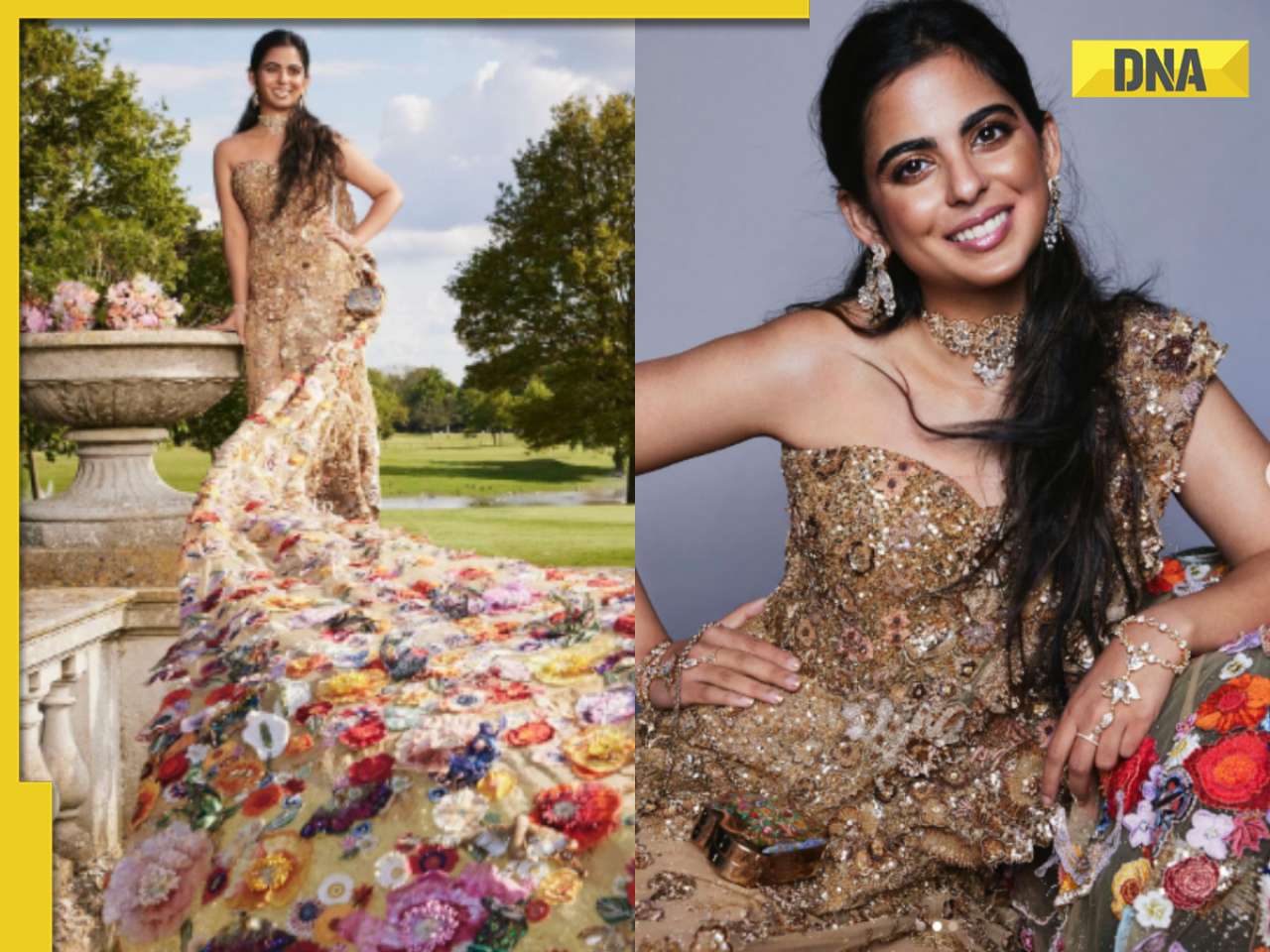

Not Alia Bhatt or Isha Ambani but this Indian CEO made heads turn at Met Gala 2024, she is from...![submenu-img]() Man makes Lord Hanuman co-litigant in plea, Delhi High Court asks him to pay Rs 100000…

Man makes Lord Hanuman co-litigant in plea, Delhi High Court asks him to pay Rs 100000…![submenu-img]() Four big dangerous asteroids coming toward Earth, but the good news is…

Four big dangerous asteroids coming toward Earth, but the good news is…![submenu-img]() Isha Ambani's Met Gala 2024 saree gown was created in over 10,000 hours, see pics

Isha Ambani's Met Gala 2024 saree gown was created in over 10,000 hours, see pics![submenu-img]() Indian-origin man says Apple CEO Tim Cook pushed him...

Indian-origin man says Apple CEO Tim Cook pushed him...

)

)

)

)

)

)

)