The country's forex reserves were down for third month in a row.

China's foreign reserves fell for a third straight month in January, as the central bank dumped dollars to defend the yuan and prevent an increase in capital outflows.

China's foreign reserves fell $99.5 billion (nearly Rs 6.73 crore) to $3.23 trillion (nearly Rs 216.5 lakh crore) in January, the lowest level since May 2012, central bank data showed, but higher than the median forecast of $3.20 trillion from economists surveyed in a Reuters poll.

The size of the drop was second only to the $107.9 billion (nearly Rs 7.3 lakh crore) fall in December, the largest monthly decline on record. The central bank has intensified efforts to prop up the yuan after it staged a surprise devaluation in early August.

China's reserves remain the world's largest despite losing around $420 billion (nearly Rs 28.4 lakh crore) in the last six months. In 2015, they fell by $513 billion (nearly Rs 34.7 lakh crore), the largest annual drop in history.

The country's foreign exchange regulators said on February 4 that trade and investment had caused $342.3 billion (nearly Rs 23.2 lakh crore) of the drop in reserves in 2015 while currency and asset price changes caused another $170.3 billion fall.

Officials said the fall had been further exacerbated by a rush by local firms to repay foreign debt and increased dollar buying by local residents as the yuan fell.

Capital outflows have gained momentum since the yuan's August devaluation, fanned by concerns about China's economic slowdown and expectations of US interest rate rises.

"Monetary easing is highly needed amid the economic slowdown, but the capital outflow will naturally tighten the monetary policy," Hao Zhou, senior emerging markets economist at Commerzbank in Singapore, said in a note after the data.

"In the meantime, to prevent the currency from a fast depreciation, the PBOC (People's Bank of China) will have to sell its FX reserves, which will tighten the liquidity."

The PBOC has taken recent steps to curb currency speculation, including setting a limit on yuan-based funds to invest overseas and implementing a reserve requirement ratio on offshore banks' domestic yuan deposits.

China also eased capital rules for foreign institutional investors to buy onshore stocks and bonds.

Economists expect Beijing to tighten capital controls and close regulatory loopholes to curb the flight of money.

China's gold reserves rose to $63.57 billion at the end of January, from $60.19 billion (nearly Rs 40.7 lakh crore) at end-2015, the PBOC said.

They stood at 57.18 million fine troy ounces at the end of January, up from 56.66 million fine troy ounces in December.

China's International Monetary Fund reserve position was at $3.76 billion (nearly Rs 25.4 lakh crore) at end-January, down from $4.55 billion (nearly Rs 30,785 lakh crore) in December. The central bank held $10.27 billion (nearly Rs 69,486 lakh crore) of IMF Special Drawing Rights, compared with $10.28 billion (nearly Rs 69,554 crore) at end-December.

![submenu-img]() Anil Kapoor, Aditya Roy Kapur's The Night Manager becomes only entry from India to secure nomination at Emmy Awards 2024

Anil Kapoor, Aditya Roy Kapur's The Night Manager becomes only entry from India to secure nomination at Emmy Awards 2024![submenu-img]() Land-for-jobs case: President Murmu authorises prosecution of Lalu Prasad Yadav, CBI submits...

Land-for-jobs case: President Murmu authorises prosecution of Lalu Prasad Yadav, CBI submits...![submenu-img]() This billionaire, once world’s richest man, witnesses drop in wealth due to...; not Mukesh Ambani, Adani

This billionaire, once world’s richest man, witnesses drop in wealth due to...; not Mukesh Ambani, Adani![submenu-img]() Ranbir Kapoor's sister, Riddhima's 'maybe it's a house help' remark leaves netizens furious: 'Uneducated rich brats'

Ranbir Kapoor's sister, Riddhima's 'maybe it's a house help' remark leaves netizens furious: 'Uneducated rich brats'![submenu-img]() Mumbai man orders iPhone 16 online after standing in queue for hours, then..

Mumbai man orders iPhone 16 online after standing in queue for hours, then..![submenu-img]() J-K Assembly Elections 2024: राज्य नहीं अब है केंद्र शासित प्रदेश, क्या 370 की वापसी कर सकती है जम्मू-कश्मीर विधानसभा? जानें उसके अधिकार

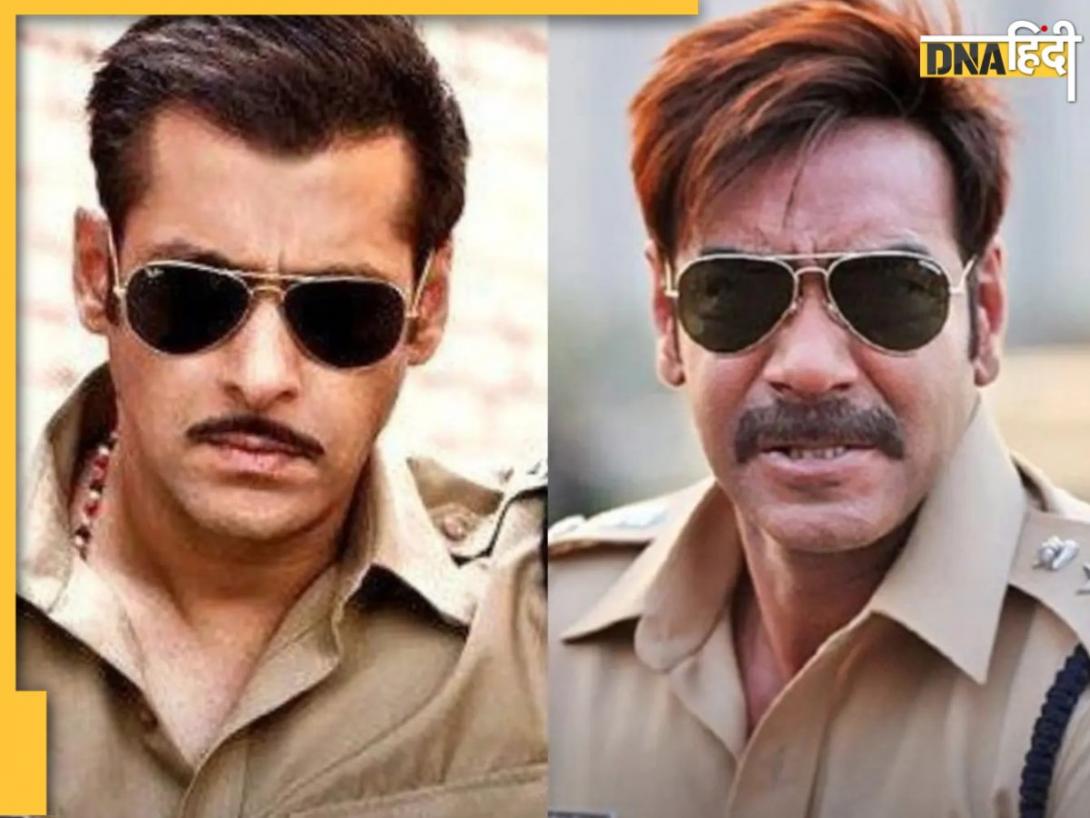

J-K Assembly Elections 2024: राज्य नहीं अब है केंद्र शासित प्रदेश, क्या 370 की वापसी कर सकती है जम्मू-कश्मीर विधानसभा? जानें उसके अधिकार![submenu-img]() DNA Verified: Singham Again में चुलबुल पांडे दिखेंगे या नहीं, जानिए क्या है Salman Khan की इस खबर का सच

DNA Verified: Singham Again में चुलबुल पांडे दिखेंगे या नहीं, जानिए क्या है Salman Khan की इस खबर का सच![submenu-img]() आप भी बाजार से खरीदकर खाते हैं देशी घी, जानिए कैसे जांचे उसमें Tirupati Laddu की तरह जानवर की चर्बी तो नहीं

आप भी बाजार से खरीदकर खाते हैं देशी घी, जानिए कैसे जांचे उसमें Tirupati Laddu की तरह जानवर की चर्बी तो नहीं![submenu-img]() सड़क पर खड़ा हुआ था नगर निगम का टैंकर और अचानक कुछ ऐसा हुआ, डरा देगा पुणे का Viral Video

सड़क पर खड़ा हुआ था नगर निगम का टैंकर और अचानक कुछ ऐसा हुआ, डरा देगा पुणे का Viral Video![submenu-img]() 'असंवैधानिक है सरकारी फैक्ट चेक यूनिट' कॉमेडियन Kunal Kamra केस में Bombay High Court का मोदी सरकार को झटका

'असंवैधानिक है सरकारी फैक्ट चेक यूनिट' कॉमेडियन Kunal Kamra केस में Bombay High Court का मोदी सरकार को झटका![submenu-img]() Ford to return to India after 2 years with reopening of....

Ford to return to India after 2 years with reopening of....![submenu-img]() Maruti Suzuki launches new Swift CNG, check price, mileage, other features

Maruti Suzuki launches new Swift CNG, check price, mileage, other features![submenu-img]() ‘30 LPA, 3BHK, no in-laws’: Woman earning Rs 1.32 lakh salary lists demands for future husband, netizens say...

‘30 LPA, 3BHK, no in-laws’: Woman earning Rs 1.32 lakh salary lists demands for future husband, netizens say...![submenu-img]() In a big EV push, Centre launches Rs 10900 crore PM E-Drive scheme to replace…

In a big EV push, Centre launches Rs 10900 crore PM E-Drive scheme to replace…![submenu-img]() World’s longest car has helipad, swimming pool, mini-golf course, can seat over…; it cost…

World’s longest car has helipad, swimming pool, mini-golf course, can seat over…; it cost…![submenu-img]() Meet man who passed JEE Advanced with AIR 1, completed B.Tech from IIT Bombay, is now pursuing…

Meet man who passed JEE Advanced with AIR 1, completed B.Tech from IIT Bombay, is now pursuing…![submenu-img]() Meet man, whose father's death encouraged him to quit IAS job, create multi-crore company, he is...

Meet man, whose father's death encouraged him to quit IAS job, create multi-crore company, he is...![submenu-img]() Meet woman, who scored 97% in class 12, secured 705 out of 720 marks in NEET exam, her AIR is...

Meet woman, who scored 97% in class 12, secured 705 out of 720 marks in NEET exam, her AIR is...![submenu-img]() NEET UG Counselling 2024: Round 2 seat allotment result declared at mcc.nic.in, check direct link here

NEET UG Counselling 2024: Round 2 seat allotment result declared at mcc.nic.in, check direct link here![submenu-img]() Meet IPS officer who has resigned after serving for 18 yrs due to...

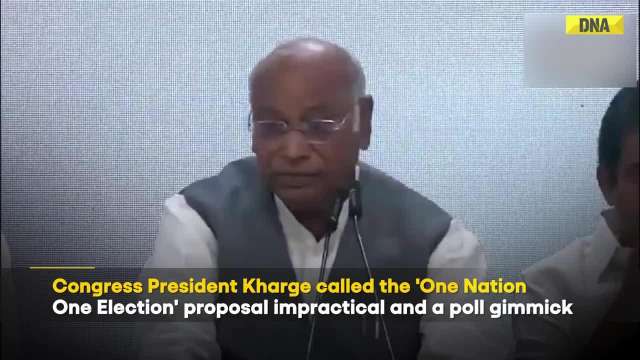

Meet IPS officer who has resigned after serving for 18 yrs due to...![submenu-img]() Congress President Kharge Slams & Opposes 'One Nation, One Election' Proposal, Calls It Impractical

Congress President Kharge Slams & Opposes 'One Nation, One Election' Proposal, Calls It Impractical![submenu-img]() Why 'One Nation One Election' Is important? Ashwini Vaishnaw Explains After It Gets Cabinet Approval

Why 'One Nation One Election' Is important? Ashwini Vaishnaw Explains After It Gets Cabinet Approval![submenu-img]() Jammu Kashmir Assembly Election 2024 Phase 1 Highlights: What Happened In First phase In J&K Polls?

Jammu Kashmir Assembly Election 2024 Phase 1 Highlights: What Happened In First phase In J&K Polls?![submenu-img]() One Nation One Election: Centre Clears Proposal, Bill To Be Introduced In Winter Session | Modi 3.0

One Nation One Election: Centre Clears Proposal, Bill To Be Introduced In Winter Session | Modi 3.0![submenu-img]() Haryana Elections 2024: Is BJP Set To Lose In Haryana? Anti-Incumbency And Other Factors Analysed

Haryana Elections 2024: Is BJP Set To Lose In Haryana? Anti-Incumbency And Other Factors Analysed![submenu-img]() This billionaire, once world’s richest man, witnesses drop in wealth due to...; not Mukesh Ambani, Adani

This billionaire, once world’s richest man, witnesses drop in wealth due to...; not Mukesh Ambani, Adani![submenu-img]() Meet man who started as intern at Nike, is now its CEO after 32 years, his salary is Rs...

Meet man who started as intern at Nike, is now its CEO after 32 years, his salary is Rs...![submenu-img]() Meet man who received gift worth Rs 15000000000 from Mukesh Ambani, is referred to as his 'right hand', he is...

Meet man who received gift worth Rs 15000000000 from Mukesh Ambani, is referred to as his 'right hand', he is...![submenu-img]() Elon Musk, Oracle CEO once begged this company to take their money, know what had happened

Elon Musk, Oracle CEO once begged this company to take their money, know what had happened![submenu-img]() 'Office was filled with…': Ashneer Grover on why he left EY in one day despite having package of Rs…

'Office was filled with…': Ashneer Grover on why he left EY in one day despite having package of Rs…![submenu-img]() Luxurious homes to swanky cars: Most expensive things owned by Virat Kohli

Luxurious homes to swanky cars: Most expensive things owned by Virat Kohli![submenu-img]() Akshay Kumar's biggest flop film was remake of a Malayalam blockbuster, still broke Guinness World Record set by...

Akshay Kumar's biggest flop film was remake of a Malayalam blockbuster, still broke Guinness World Record set by...![submenu-img]() Exploring Uttarakhand: 6 breathtaking destinations in scenic state

Exploring Uttarakhand: 6 breathtaking destinations in scenic state![submenu-img]() From Puga Valley to Hanle: Must-visit places in Ladakh

From Puga Valley to Hanle: Must-visit places in Ladakh![submenu-img]() Meet Himachal officer who has been transferred without posting, as popular as IAS Tina Dabi on social media, she is...

Meet Himachal officer who has been transferred without posting, as popular as IAS Tina Dabi on social media, she is...![submenu-img]() Land-for-jobs case: President Murmu authorises prosecution of Lalu Prasad Yadav, CBI submits...

Land-for-jobs case: President Murmu authorises prosecution of Lalu Prasad Yadav, CBI submits...![submenu-img]() Tirupati Laddoo Row: Jagan Reddy says he will write to PM Modi, CJI to take action against...

Tirupati Laddoo Row: Jagan Reddy says he will write to PM Modi, CJI to take action against...![submenu-img]() AAP demands government accommodation for outgoing Delhi CM Arvind Kejriwal, says he is...

AAP demands government accommodation for outgoing Delhi CM Arvind Kejriwal, says he is...![submenu-img]() 'Samples highly adulterated, we will...': Tirupati Temple Trust issues first statement on laddoo row

'Samples highly adulterated, we will...': Tirupati Temple Trust issues first statement on laddoo row![submenu-img]() NEET UG 2024: CBI files second-chargesheet against six accused in paper leak case

NEET UG 2024: CBI files second-chargesheet against six accused in paper leak case

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)