Falling passenger traffic is hitting the cash flows of airlines, making it difficult for them to meet their working capital requirements.

Falling domestic air passenger traffic is hitting the cash flows of airlines, making

it difficult for them to meet their working capital requirements.

Not so long ago, domestic carriers were able to mobilise close to 30-40% of the total working capital from advance sale of tickets. Today, with travellers being resistant to flying, airlines are able to raise only 15-20% cash from advance sales.

Such a low upfront revenue accrual is making airlines jittery. This is one of the reasons they are coming out with attractive schemes for passengers to get them onboard early. “Till the last quarter of 2007-08, the cash flow from advance sale was substantial. This made us comfortable but that has come down significantly today. Falling demand for air travel has affected our ability to raise enough passenger revenues to meet a large part of our working capital need,” said a senior executive of a budget airline.

The executive said that despite drop in the aviation turbine fuel (ATF) prices and other operational costs over the last few months, operating an A320 or a Boeing 737-800 for 180-200 flights can cost anywhere between Rs 10 crore and Rs 12 crore per month.

This means that airline with a fleet of 20 aircraft need to raise around Rs 200-250 crore from their operations to meet their working capital needs.

“In today’s scenario, it is becoming increasingly difficult to do so (ensure the cash flow for meeting their operational cost),” said the executive.

An aviation analyst said airlines were trying to strike a balance between yield and revenues by introducing and withdrawing promotional offers.

“By changing base fare and fuel surcharge, airlines are able to prop up booking volumes that ensures some cash flows but this hampers yields (average fare per passenger). So, the trade off is between getting higher volume with low ticket prices and getting lower volume with higher fares,” said the analyst, who did not want to be named.

With passenger revenues taking a dip, airlines were trying to generate some cash flow through sale and leaseback deals. And even though such a capacity induction could prove suicidal in a market that is slowing down, domestic carriers are taking delivery of planes to earn income from sale & leaseback.

“We sell and leaseback about 3-4 aircraft every year and that generates working capital for the airline, depending on the type and age of the aircraft,” said a senior executive with full service carrier Jet Airways.

Budget SpiceJet Ltd inducted four aircraft to its fleet since October while GoAir is going to add two by June.

Ankur Bhatia, managing director of Amadeus, believes the two no-frill airlines are trying to infuse cash into their operation by earning profits on S&L.

Though, softening prices of aircraft in recent times have pulled down the profits from such deal. Cash generated from an S&L deal on a B737-800 has slipped to $1.5 million from $3-3.5 million a year back.

Severe working capital crunch has driven full service carriers (FSC) Jet Airways and Kingfisher Airlines to lease aircraft to foreign airlines. Jet has already leased of its aircraft and Kingfisher two. This summer, Naresh Goyal-owned FSC is going to lease four planes.

Analysts feel this is a good strategy to ensure a steady flow of income, with no or lower operating cost.

A senior Jet Airways executive said his airline has flown into non-turbulent working capital zone after lining up funding of Rs 2,000 crore from Indian banks in the last few months.

Many Industry experts argue that the airlines cannot be dependent on the banks for meeting their working capital needs forever. As passenger revenues fall, they are borrowings from the banks are also shooting up.

Mark Martin, aviation head at research firm KPMG, says going forward private equity funding would become a popular mode of capital infusion for the airlines.

Kapil Kaul, CEO – India and Middle East —- of Centre for Asia Pacific Aviation (CAPA), says that survival of the airlines industry would depend on their ability to ensure uninterrupted cash flow.

“They (airlines) have to address the issue of cash flow for their survival. If they don’t then they’ll have no balance sheet by 2010,” said Kaul.

The CAPA chief for India and Middle East says the current enterprise value of the airline industry is not more than $ 1 billion. This means that with an industry loss of $2 billion, its current networth is negative.

![submenu-img]() Viral video: Woman tries to cook omelette on road, internet is not happy

Viral video: Woman tries to cook omelette on road, internet is not happy![submenu-img]() RCB cancels practice, press meet after threat to Virat Kohli's security ahead of IPL 2024 eliminator: Report

RCB cancels practice, press meet after threat to Virat Kohli's security ahead of IPL 2024 eliminator: Report ![submenu-img]() Meet Indian-origin man, IIT alumnus who is world's second-highest paid CEO, his salary per day is...

Meet Indian-origin man, IIT alumnus who is world's second-highest paid CEO, his salary per day is...![submenu-img]() RBI approves Rs 2.11 lakh crore dividend payout to Indian govt for 2023-24

RBI approves Rs 2.11 lakh crore dividend payout to Indian govt for 2023-24![submenu-img]() Mozz Guard Mosquito Zapper Reviews (Zap Guardian): Side effects, ingredients benefits, price

Mozz Guard Mosquito Zapper Reviews (Zap Guardian): Side effects, ingredients benefits, price![submenu-img]() IIT graduate builds Rs 1057990000000 company, leaves to get a job, now working as a….

IIT graduate builds Rs 1057990000000 company, leaves to get a job, now working as a….![submenu-img]() Indian Air Force Agniveervayu Recruitment 2024: Registration starts today, know eligibility, steps to apply

Indian Air Force Agniveervayu Recruitment 2024: Registration starts today, know eligibility, steps to apply![submenu-img]() Meet woman who was married at 16, faced domestic abuse, did odd jobs as single mom, became IAS officer, is posted at...

Meet woman who was married at 16, faced domestic abuse, did odd jobs as single mom, became IAS officer, is posted at...![submenu-img]() Maharashtra HSC 12th 2024: Result declared, know how to check

Maharashtra HSC 12th 2024: Result declared, know how to check![submenu-img]() Meet man who topped IIT-JEE, studied at IIT Bombay, then went to MIT, now is...

Meet man who topped IIT-JEE, studied at IIT Bombay, then went to MIT, now is...![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() AI models show bikini style for perfect beach holiday this summer

AI models show bikini style for perfect beach holiday this summer![submenu-img]() Laapataa Ladies actress Chhaya Kadam ditches designer clothes, wears late mother's saree, nose ring on Cannes red carpet

Laapataa Ladies actress Chhaya Kadam ditches designer clothes, wears late mother's saree, nose ring on Cannes red carpet![submenu-img]() Urvashi Rautela mesmerises in blue celestial gown, her dancing fish necklace steals the limelight at Cannes 2024

Urvashi Rautela mesmerises in blue celestial gown, her dancing fish necklace steals the limelight at Cannes 2024![submenu-img]() Kiara Advani attends Women In Cinema Gala in dramatic ensemble, netizens say 'who designs these hideous dresses'

Kiara Advani attends Women In Cinema Gala in dramatic ensemble, netizens say 'who designs these hideous dresses'![submenu-img]() Influencer Diipa Büller-Khosla looks 'drop dead gorgeous' in metallic structured dress at Cannes 2024

Influencer Diipa Büller-Khosla looks 'drop dead gorgeous' in metallic structured dress at Cannes 2024![submenu-img]() DNA Explainer: Why was Iranian president Ebrahim Raisi, killed in helicopter crash, regarded as ‘Butcher of Tehran’?

DNA Explainer: Why was Iranian president Ebrahim Raisi, killed in helicopter crash, regarded as ‘Butcher of Tehran’?![submenu-img]() DNA Explainer: Why did deceased Iranian President Ebrahim Raisi wear black turban?

DNA Explainer: Why did deceased Iranian President Ebrahim Raisi wear black turban?![submenu-img]() Iran President Ebrahim Raisi's death: Will it impact gold, oil prices and stock markets?

Iran President Ebrahim Raisi's death: Will it impact gold, oil prices and stock markets?![submenu-img]() Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?

Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() Watch: Kapil Sharma's daughter complains as paps click her photos in viral video, says 'papa aapne kaha tha ki...'

Watch: Kapil Sharma's daughter complains as paps click her photos in viral video, says 'papa aapne kaha tha ki...'![submenu-img]() Watch: Anil Kapoor hijacks The Great Indian Kapil Show, Farah Khan reveals which actor is 'most kanjoos' in Bollywood

Watch: Anil Kapoor hijacks The Great Indian Kapil Show, Farah Khan reveals which actor is 'most kanjoos' in Bollywood![submenu-img]() Manoj Bajpayee reveals why Anurag Kashyap didn’t work with him for 14 years: ‘My career was going down, he didn’t...'

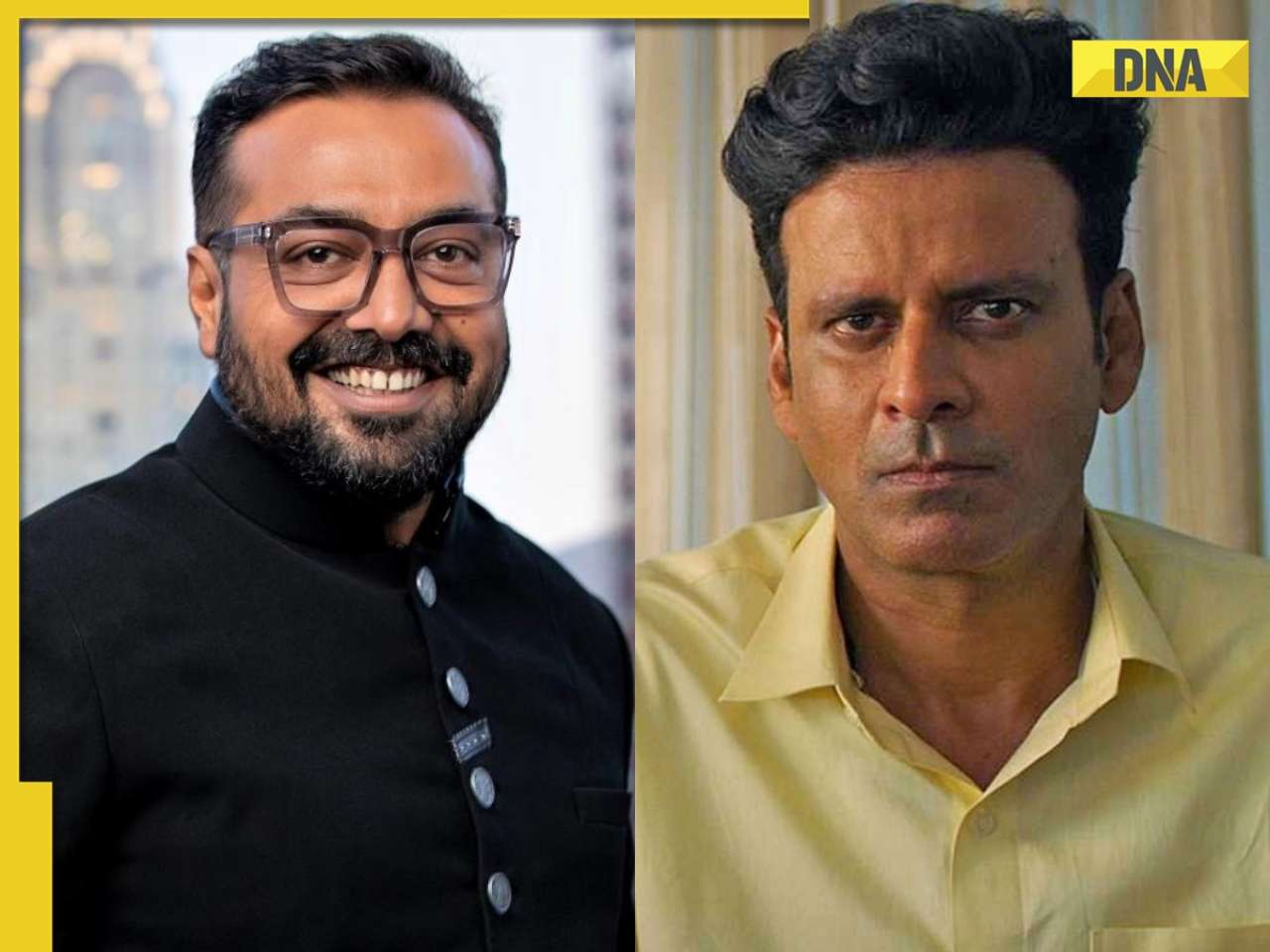

Manoj Bajpayee reveals why Anurag Kashyap didn’t work with him for 14 years: ‘My career was going down, he didn’t...'![submenu-img]() Sanjay Dutt quits Welcome 3 after fallout with Akshay Kumar? Report says he walked out after first day because...

Sanjay Dutt quits Welcome 3 after fallout with Akshay Kumar? Report says he walked out after first day because...![submenu-img]() Allu Arjun enjoys lunch with wife Sneha at dhaba; fans hail his ‘simplicity’ despite Pushpa success

Allu Arjun enjoys lunch with wife Sneha at dhaba; fans hail his ‘simplicity’ despite Pushpa success![submenu-img]() Viral video: Woman tries to cook omelette on road, internet is not happy

Viral video: Woman tries to cook omelette on road, internet is not happy![submenu-img]() Groom saves bride from unexpected milk bath during haldi ceremony, viral video melts internet

Groom saves bride from unexpected milk bath during haldi ceremony, viral video melts internet![submenu-img]() Viral video captures epic showdown between two king cobras, watch who wins

Viral video captures epic showdown between two king cobras, watch who wins![submenu-img]() Viral video: Woman's 'Senorita' dance steals hearts during RCB vs CSK match in Bengaluru, watch

Viral video: Woman's 'Senorita' dance steals hearts during RCB vs CSK match in Bengaluru, watch ![submenu-img]() Viral video: Lion's terrifying ambush on napping wildebeest stuns internet, watch

Viral video: Lion's terrifying ambush on napping wildebeest stuns internet, watch

)

)

)

)

)

)