Hindustan Dorr Oliver Ltd (HDOL) is a total engineering procurement and construction (EPC) solutions company.

Hindustan Dorr Oliver Ltd (HDOL) is a total engineering procurement and construction (EPC) solutions company.

Mumbai-based and a listed subsidiary of IVRCL, it has expertise in engineered solutions, technologies and EPC installation services in liquid-solid separation applications and pollution controls for various industries.

It has plants in Ahmedabad, Kolkata, New Delhi and Chennai. The R&D facilities have approvals from the department of science and technology, Government of India. It works in technological tie-ups with various international players as per the requirement. In addition to its business in India, HDOL has long-term business associations in Sri Lanka, Southeast Asia, Jordan, UAE, Iraq, Kenya, and Kuwait.

HDO Technologies is a fully-owned subsidiary and engineering arm.

HDOL’s diversified operations have ensured order inflows and profitability even in times of economic downturn.

Business: Established in 1949, HDOL has been upgrading, modifying, adapting and inventing products, processes and technologies to design, construct and install commission systems on EPC basis. It caters to industries such as mineral processing, fertilisers & chemicals, pulp & paper and environmental management. While mineral processing contributes about 50% to revenues, environmental management contributes 30%, with fertiliser and paper contributing the rest.

HDOL has capabilities to manufacture all types of industrial filters used in pulp & paper, sugar, chemical process and minerals industries.

In mineral processing business, its tie-up with GLV of Canada and Chalico Gami of China help in equipment for mineral processing & beneficiation and alumina smelter & refining, respectively. HDOL enjoys leadership in more than 70 different metallic and non-metallic mineral processing industries. Its solid-liquid separation technology supports processing of alumina, iron-ore, uranium, coal, copper, lead, zinc, chrome etc.

HODL has completed a major EPC contract for Vedanta and is a preferred vendor. Nalco, Hindalco, Balco and Malco are also customers. It has also been associated with Tata Steel, Jindal Steel and Power, Central Coal Fields, Coal India, etc for coal washery projects.

The company’s solid-liquid separation equipments and systems are used at iron-ore processing plants of NMDC, KIOCL, Tata Steel, Sesa Goa, Essar, etc.

HDOL has completed a majority of India’s phosphatic fertiliser plants on turnkey basis. Soda-ash industries such as Tata Chemicals, IPCL and Grasim use its systems and equipments.

Investment rationale: HDOL scores over peers as it has in-house engineering, manufacturing and construction capabilities. After its acquisition by IVRCL in September 2005, it has been strengthening capabilities. It has expanded its offices to Chennai, Bangalore and Ahmedabad which have a team of engineers for strengthening operations and generating business.

HDOL has also boosted capacities, and the Ahmedabad unit, which earlier contributed Rs 10 crore, is likely to do business of Rs 70 crore this year. These consolidated efforts have led HODL to grow at 50-60% y-o-y since 2006. HODL looks at opportunities in the minerals and environment management business. Unlike peers, its wastewater management services are not confined to sewage management. It does projects on recycling of water/waste water as well. Presently, it is doing four projects for major petroleum players such as HPCL and others. It had an excellent order book position of Rs 1,010 crore as on March 1, 2009. These projects are to be completed in 22-24 months. Additionally, it has Rs 400 crore worth of orders in the pipeline. These orders, mostly from the government sector, are ones in which HODL already has L1 status and are expected to come in the first half of the new fiscal.

Amongst its order book lies a Rs 441 crore order from Uranium Corp of India. This is for the greenfield ore-mining and processing facility of 3,000 mtdp coming up in Tumalapalle in Andhra Pradesh. Its technology partner is M/S Bateman of South Africa.

Another order worth Rs 24 crore has been recently awarded by HPCL. Work will involve detailed engineering, shop & site fabrication, transsportation and supply of process pressure vessels weighing 50-250 mt each.

HODL had capex allocation of Rs 30 crore this year, which has been utilised for manufacturing and engineering centres. This has helped fabrication capacity grow from 4,000 tonnes to 6,500-7,000 tonnes. A further Rs 60-70 crore has been allocated for manufacturing and engineering centres. The management has also indicated a possible acquisition of a technology-oriented company outside India focusing on the global markets, including India and Asia.

Concerns: Around 80% of the business for HODL is driven by PSUs and government projects. Any change in government policies or budget allocations can impact its revenues.

Valuations: Both top-line and profits for HDOL grew a robust 63.7% and 47.4% year-on-year at the end of the third quarter of FY09. The y-o-y growth of operating profits was at 78.18% and operating margins expansion of 96 bps was remarkable given the overall gloomy economic environment. Net profit margins suffered 66 bps due to high interest costs incurred on working capital requirements. Revenue for first nine months at Rs 329.21 crore has surpassed Rs 310.35 crore in FY08. HODL is all set to continue its growth patterns in this year and with excellent order book, prospects and competencies.

Disclosure: The author does not hold any shares in the company

![submenu-img]() Aamir Khan was unsure if censor board would clear Sarfarosh over mentions of Pakistan, ISI: 'If Advani ji can say...'

Aamir Khan was unsure if censor board would clear Sarfarosh over mentions of Pakistan, ISI: 'If Advani ji can say...'![submenu-img]() Gurucharan Singh missing case: Delhi Police questions TMKOC cast and crew, finds out actor's payments were...

Gurucharan Singh missing case: Delhi Police questions TMKOC cast and crew, finds out actor's payments were...![submenu-img]() 'You all are scaring me': Preity Zinta gets uncomfortable after paps follow her, video goes viral

'You all are scaring me': Preity Zinta gets uncomfortable after paps follow her, video goes viral![submenu-img]() Viral video: Influencer dances with gun in broad daylight on highway, UP Police reacts

Viral video: Influencer dances with gun in broad daylight on highway, UP Police reacts![submenu-img]() Family applauds and cheers as woman sends breakup text, viral video will make you laugh

Family applauds and cheers as woman sends breakup text, viral video will make you laugh![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Mother's Day 2024: Bollywood supermoms who balance motherhood, acting, and run multi-crore businesses

Mother's Day 2024: Bollywood supermoms who balance motherhood, acting, and run multi-crore businesses![submenu-img]() Rocky Aur Rani's Golu aka Anjali Anand shocks fans with drastic weight loss without gym, says fitness secret is...

Rocky Aur Rani's Golu aka Anjali Anand shocks fans with drastic weight loss without gym, says fitness secret is...![submenu-img]() In pics: Ram Charan gets mobbed by fans during his visit to Pithapuram for ‘indirect campaign’ for uncle Pawan Kalyan

In pics: Ram Charan gets mobbed by fans during his visit to Pithapuram for ‘indirect campaign’ for uncle Pawan Kalyan![submenu-img]() Streaming This Week: Yodha, Aavesham, Murder In Mahim, Undekhi season 3, latest OTT releases to binge-watch

Streaming This Week: Yodha, Aavesham, Murder In Mahim, Undekhi season 3, latest OTT releases to binge-watch![submenu-img]() Aamir Khan, Naseeruddin Shah, Sonali Bendre celebrate 25 years of Sarfarosh, attend film's special screening

Aamir Khan, Naseeruddin Shah, Sonali Bendre celebrate 25 years of Sarfarosh, attend film's special screening![submenu-img]() Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?

Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() Aamir Khan was unsure if censor board would clear Sarfarosh over mentions of Pakistan, ISI: 'If Advani ji can say...'

Aamir Khan was unsure if censor board would clear Sarfarosh over mentions of Pakistan, ISI: 'If Advani ji can say...'![submenu-img]() Gurucharan Singh missing case: Delhi Police questions TMKOC cast and crew, finds out actor's payments were...

Gurucharan Singh missing case: Delhi Police questions TMKOC cast and crew, finds out actor's payments were...![submenu-img]() 'You all are scaring me': Preity Zinta gets uncomfortable after paps follow her, video goes viral

'You all are scaring me': Preity Zinta gets uncomfortable after paps follow her, video goes viral![submenu-img]() First Indian film to be insured was released 25 years ago, earned five times its budget, gave Bollywood three stars

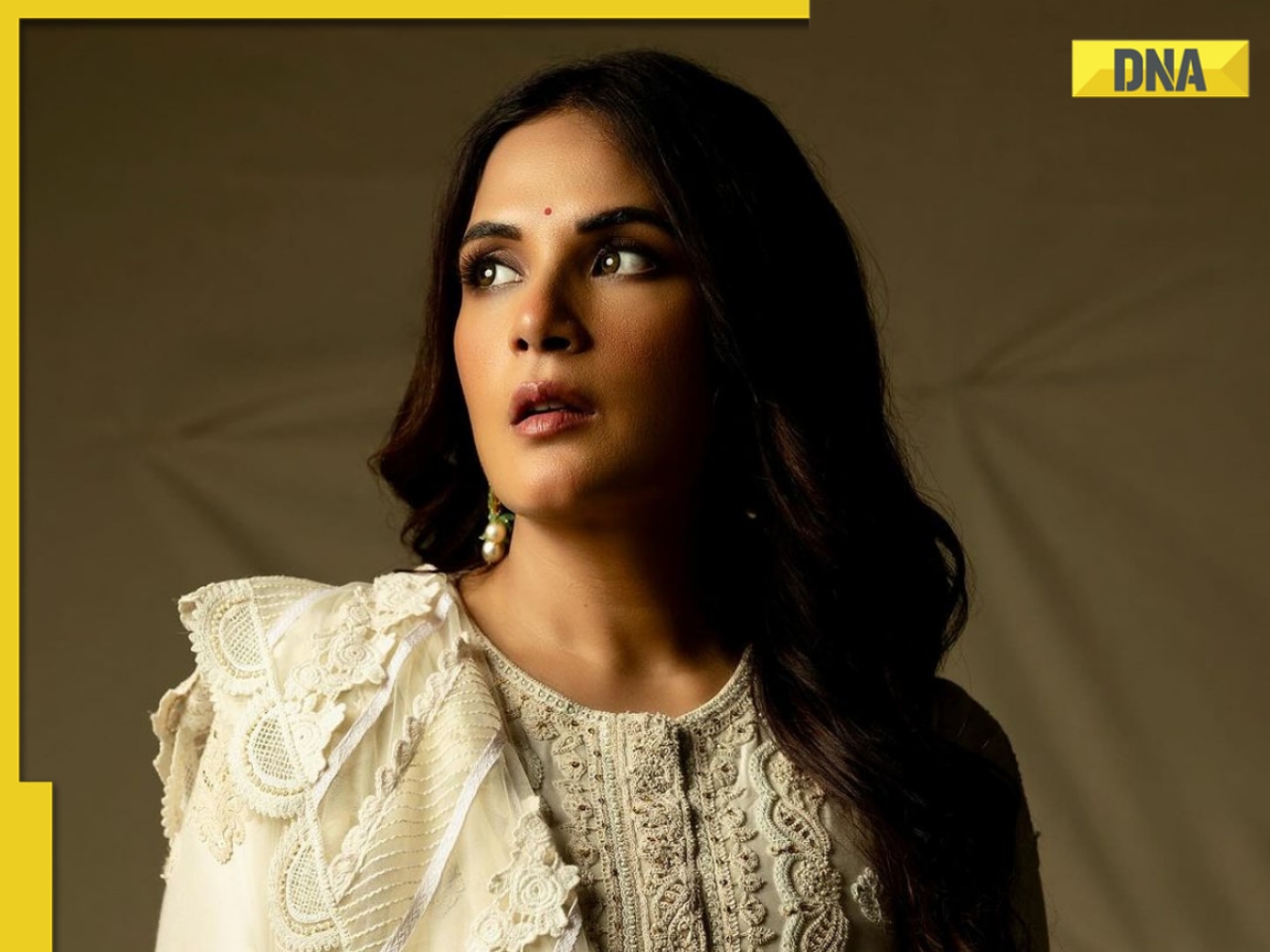

First Indian film to be insured was released 25 years ago, earned five times its budget, gave Bollywood three stars![submenu-img]() Mother’s Day Special: Mom-to-be Richa Chadha talks on motherhood, fixing inequalities for moms in India | Exclusive

Mother’s Day Special: Mom-to-be Richa Chadha talks on motherhood, fixing inequalities for moms in India | Exclusive![submenu-img]() Kolkata Knight Riders become first team to qualify for IPL 2024 playoffs after thumping win over Mumbai Indians

Kolkata Knight Riders become first team to qualify for IPL 2024 playoffs after thumping win over Mumbai Indians![submenu-img]() IPL 2024: This player to lead Delhi Capitals in Rishabh Pant's absence against Royal Challengers Bengaluru

IPL 2024: This player to lead Delhi Capitals in Rishabh Pant's absence against Royal Challengers Bengaluru![submenu-img]() RCB vs DC IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

RCB vs DC IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() CSK vs RR IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

CSK vs RR IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() RCB vs DC IPL 2024 Dream11 prediction: Fantasy cricket tips for Royal Challengers Bengaluru vs Delhi Capitals

RCB vs DC IPL 2024 Dream11 prediction: Fantasy cricket tips for Royal Challengers Bengaluru vs Delhi Capitals![submenu-img]() Viral video: Influencer dances with gun in broad daylight on highway, UP Police reacts

Viral video: Influencer dances with gun in broad daylight on highway, UP Police reacts![submenu-img]() Family applauds and cheers as woman sends breakup text, viral video will make you laugh

Family applauds and cheers as woman sends breakup text, viral video will make you laugh![submenu-img]() Man grabs snake mid-lunge before it strikes his face, terrifying video goes viral

Man grabs snake mid-lunge before it strikes his face, terrifying video goes viral![submenu-img]() Viral video: Man wrestles giant python, internet is scared

Viral video: Man wrestles giant python, internet is scared![submenu-img]() Viral video: Delhi University girls' sizzling dance to Haryanvi song sets the internet ablaze

Viral video: Delhi University girls' sizzling dance to Haryanvi song sets the internet ablaze

)

)

)

)

)

)