Airlines are trying hard to keep their business afloat despite strong headwinds that threaten to crash-land them into a severe financial crisis.

BANGALORE: Airlines are trying hard to keep their business afloat despite strong headwinds that threaten to crash-land them into a severe financial crisis.

However, some strains of the cash-flow problem and the capital crunch owing to rising operational costs and falling demand growth, and thus revenue growth, are already emanating from the industry.

A New Delhi-based regional airline is so starved for cash that it has grounded one of its aircraft (BAE RJ70) to rip off spares from it whenever needed — a bleak reminder of what Air Sahara (now JetLite under Jet Airways) did just before it went under.

“It (the regional airline) does not have the financial muscle to maintain the inventory of spares. This way, they can operate the other two BAERJ 70s in their fleet without disturbing their on-time performance. It’s a desperate measure,” said an industry insider.

But it’s not just the smaller operators that are feeling the heat of spiralling fuel prices; bigger airlines are also pinching every penny to keep their aircraft in the air.

And the first to be affected by these desperate measures are the vendors (groundhandling service providers, pilot trainers, call centre operators, etc).

As the dark clouds of rising ATF prices gather over their heads, airlines have cut seat capacity. They are now operating fewer aircraft to lesser destinations.

This has reduced the revenues of the vendors considerably. Ground-handling service vendors are paid fees on the basis of aircraft flown by an airline.

However, the vendor’s woes do not end there.

As airlines’ flow of income turn into trickles due to plunging air traffic (down from 27% growth in November to less than 10% in April) and costs hitting the roof, airlines are postponing or making partial payments to their vendors for their services.

“We are a little bit concerned. Even though our payments can be rotated (pushed to a later date), dues from the airlines are only piling up. Most airlines have exceeded their credit period (normally one month),” says a vendor, who feels a shakeout in the aviation industry is imminent.

And it is not just a single airline, which was procrastinating paying to vendors; “They are all in dire straits. Of all, IndiGo seems to be in a somewhat better placed,” said a vendor.

An industry insider said dues of groundhandling service providers like Universal Aviation Services, Arun Aviation and Sunshine Aviation were running into crores and were mounting by the month.

“It’s a very tricky situation we are in. If we stopped services, our money will get stuck and if we continue, outstanding (dues) from the carriers are only shooting up,” whined a vendor.

And if the previous consolidation moves were supposed to improve the health of full service carriers Jet Airways and Kingfisher Airlines, a vendor had a different take on it.

“The merger of Kingfisher Airlines with Deccan and Jet Airways with JetLite (formerly Air Sahara) has sunk them into a deeper financial quagmire. We are getting indication that they are not happy with it. Capt G R Gopinath (previous owner of Deccan) and Subroto Roy (previous owner of Air Sahara) exited at the right time,” said a vendor.

And from how things stand today, the situation is only expected to get worse.

An industry insider said that whatever the airlines did—hiking, introducing passenger charges and trimming frills—their revenues were not catching up with their cost.

“Usually in June (peak season) revenues are higher than cost but this year costs will overshoot revenues for most airlines,” an executive of a regional airline said.

Information available from sources in the industry reveals that SpiceJet is expecting to earn revenues of around Rs 140 crore in June. Of this, its fuel bill alone would be close to Rs 110 crore (Thursday’s 4.3% cut in ATF prices is not factored in) while it would spend approximately Rs 22 crore as lease rentals.

“This does not include other costs like personnel, vendor fees and others. Department heads in the airline (SpiceJet) are worried about salaries of their staff,” said the source.

SpiceJet chief financial officer Partha Sarathi Basu brushed off such concerns. “Airline business is seasonal. Revenues waver as per season. There is no serious crisis.”

Vendors feel their problem will tide over only if airlines are sold or if they succeed in infusing more funds from investors. “We are hoping they (airlines) are able to raise funds from investors or sold to some cash rich company, which will settle our dues,” said an optimistic vendor.

p_sharma@dnaindia.net

![submenu-img]() Ramesh Awasthi: Kanpur's 'Karma Yogi' - Know inspirational journey of 'common man' devoted for society

Ramesh Awasthi: Kanpur's 'Karma Yogi' - Know inspirational journey of 'common man' devoted for society![submenu-img]() Tovino Thomas accused of stopping his film Vazhakku's release by director Sanal Kumar Sasidharan: 'The agenda of...'

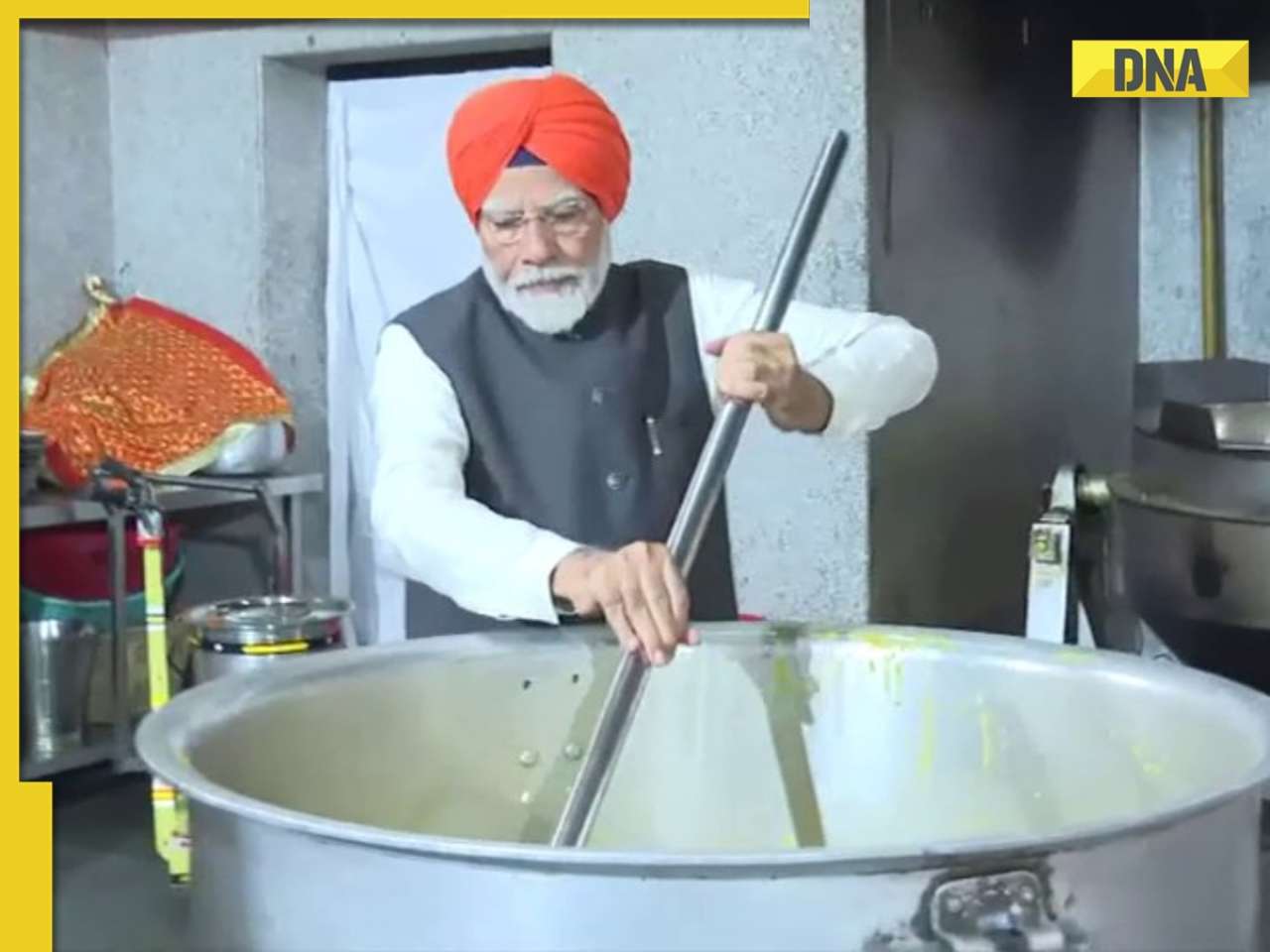

Tovino Thomas accused of stopping his film Vazhakku's release by director Sanal Kumar Sasidharan: 'The agenda of...'![submenu-img]() PM Modi wears turban, serves langar at Gurudwara Patna Sahib in Bihar, watch

PM Modi wears turban, serves langar at Gurudwara Patna Sahib in Bihar, watch![submenu-img]() Anil Ambani’s debt-ridden Reliance’s ‘buyer’ now waits for RBI nod, wants Rs 80000000000…

Anil Ambani’s debt-ridden Reliance’s ‘buyer’ now waits for RBI nod, wants Rs 80000000000…![submenu-img]() Man in bizarre jeans dances to Tinku Jiya in crowded metro, viral video makes internet furious

Man in bizarre jeans dances to Tinku Jiya in crowded metro, viral video makes internet furious![submenu-img]() Maharashtra Board HSC, SSC Results 2024: MSBSHSE class 10, 12 results soon at mahresult.nic.in, latest update here

Maharashtra Board HSC, SSC Results 2024: MSBSHSE class 10, 12 results soon at mahresult.nic.in, latest update here![submenu-img]() Meet IIT-JEE topper who passed JEE Advanced with AIR 1, decided to drop out of IIT due to…

Meet IIT-JEE topper who passed JEE Advanced with AIR 1, decided to drop out of IIT due to…![submenu-img]() Meet IPS Idashisha Nongrang, who became Meghalaya's first woman DGP

Meet IPS Idashisha Nongrang, who became Meghalaya's first woman DGP![submenu-img]() CBSE Results 2024: CBSE Class 10, 12 results date awaited, check latest update here

CBSE Results 2024: CBSE Class 10, 12 results date awaited, check latest update here![submenu-img]() Meet man, who was denied admission in IIT due to blindness, inspiration behind Rajkummar Rao’s film, now owns...

Meet man, who was denied admission in IIT due to blindness, inspiration behind Rajkummar Rao’s film, now owns...![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Remember Harsh Lunia? Just Mohabbat child star, here's how former actor looks now, his wife is Bollywood's popular...

Remember Harsh Lunia? Just Mohabbat child star, here's how former actor looks now, his wife is Bollywood's popular...![submenu-img]() Mother's Day 2024: Bollywood supermoms who balance motherhood, acting, and run multi-crore businesses

Mother's Day 2024: Bollywood supermoms who balance motherhood, acting, and run multi-crore businesses![submenu-img]() Rocky Aur Rani's Golu aka Anjali Anand shocks fans with drastic weight loss without gym, says fitness secret is...

Rocky Aur Rani's Golu aka Anjali Anand shocks fans with drastic weight loss without gym, says fitness secret is...![submenu-img]() In pics: Ram Charan gets mobbed by fans during his visit to Pithapuram for ‘indirect campaign’ for uncle Pawan Kalyan

In pics: Ram Charan gets mobbed by fans during his visit to Pithapuram for ‘indirect campaign’ for uncle Pawan Kalyan![submenu-img]() Streaming This Week: Yodha, Aavesham, Murder In Mahim, Undekhi season 3, latest OTT releases to binge-watch

Streaming This Week: Yodha, Aavesham, Murder In Mahim, Undekhi season 3, latest OTT releases to binge-watch![submenu-img]() Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?

Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() Tovino Thomas accused of stopping his film Vazhakku's release by director Sanal Kumar Sasidharan: 'The agenda of...'

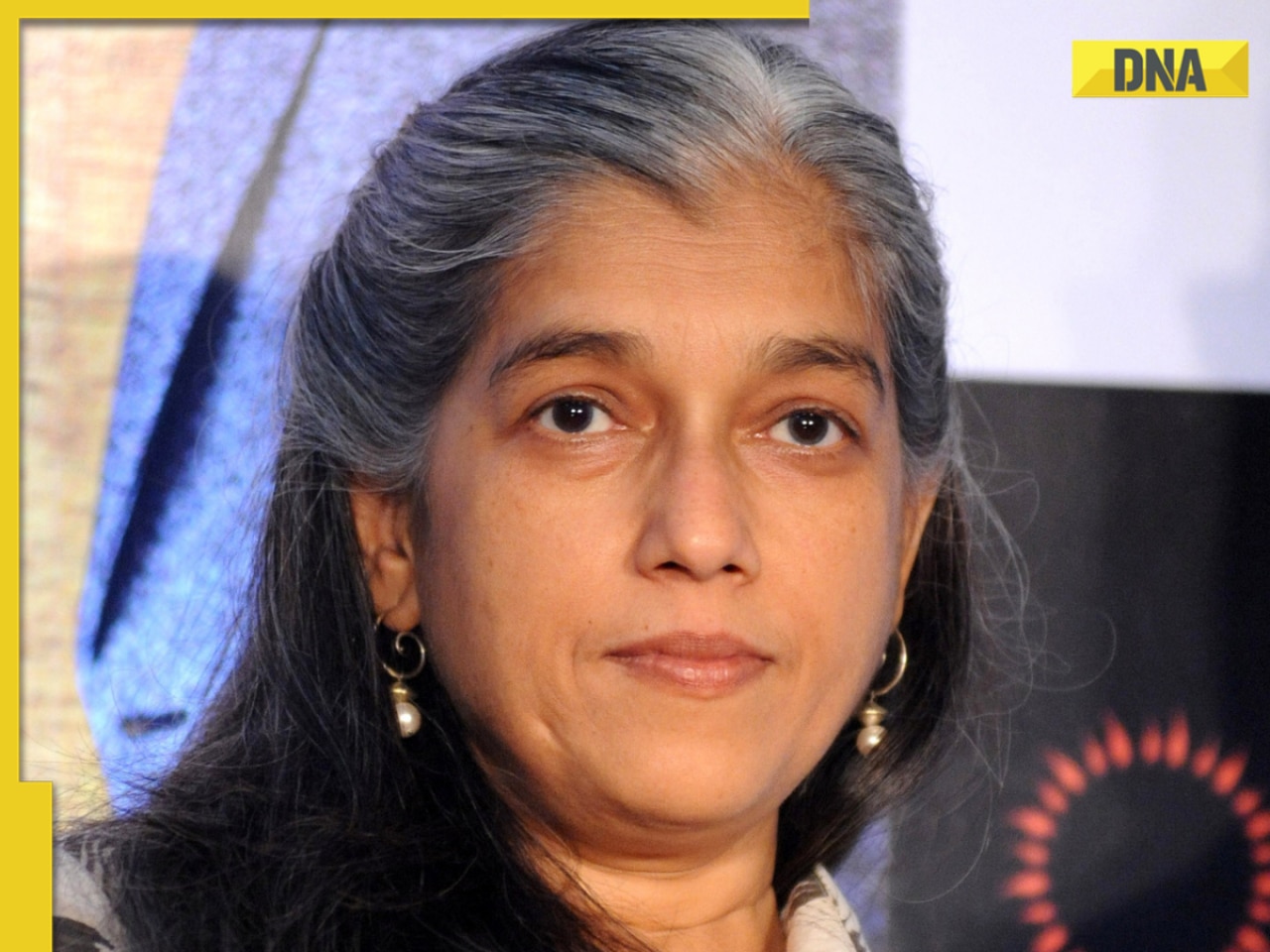

Tovino Thomas accused of stopping his film Vazhakku's release by director Sanal Kumar Sasidharan: 'The agenda of...'![submenu-img]() Ratna Pathak Shah calls Guru Dutt and Bimal Roy's films 'offensive', says, 'women are constantly...'

Ratna Pathak Shah calls Guru Dutt and Bimal Roy's films 'offensive', says, 'women are constantly...'![submenu-img]() Shreyas Talpade recalls how he felt bad when his film Kaun Pravin Tambe did not release in theatres: 'It deserved...'

Shreyas Talpade recalls how he felt bad when his film Kaun Pravin Tambe did not release in theatres: 'It deserved...'![submenu-img]() Anup Soni slams his deepfake video from Crime Patrol, being used to promote IPL betting

Anup Soni slams his deepfake video from Crime Patrol, being used to promote IPL betting![submenu-img]() Real story that inspired Heeramandi: The tawaif who helped Gandhi fight British Raj, was raped, abused, died in...

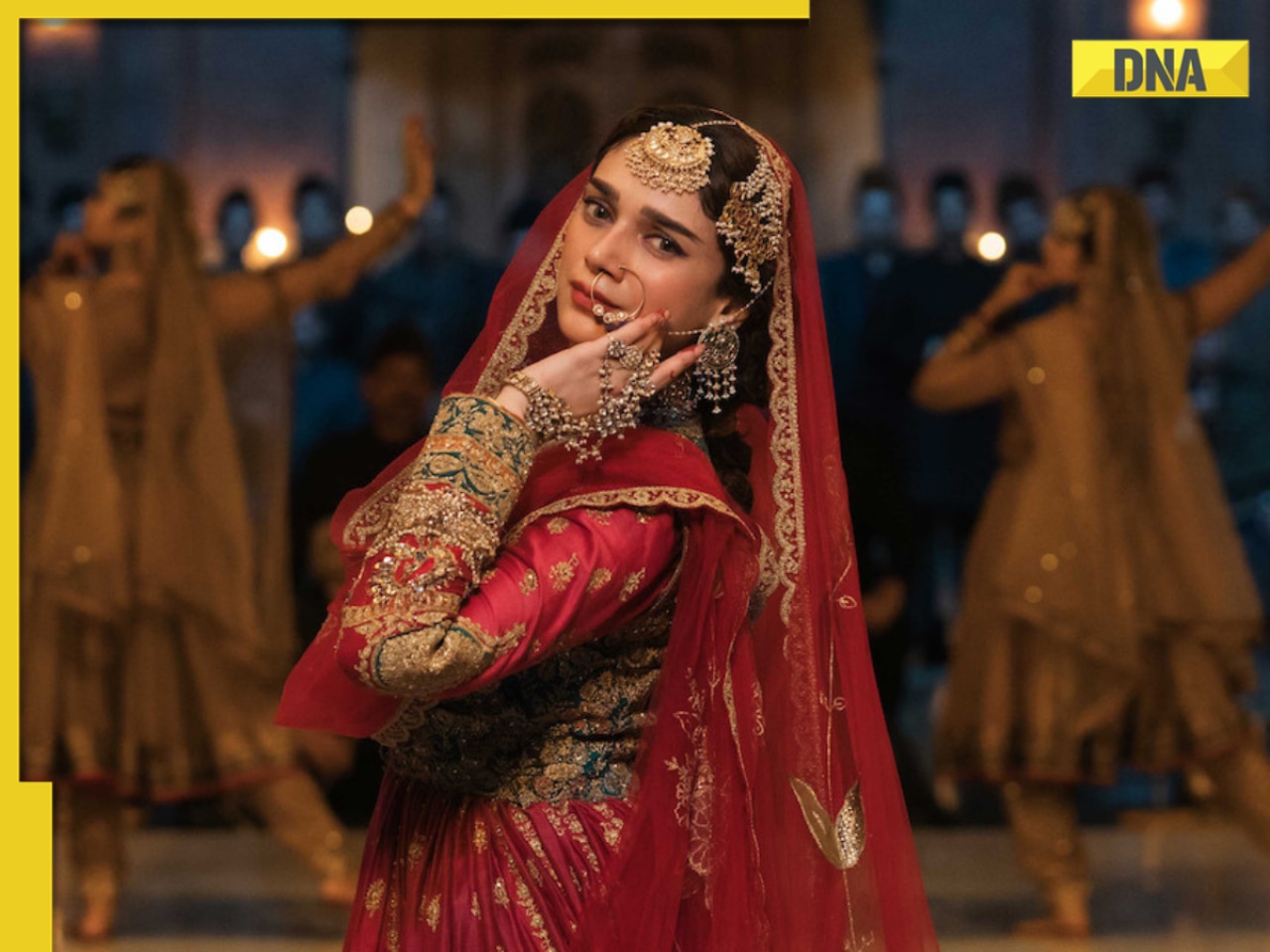

Real story that inspired Heeramandi: The tawaif who helped Gandhi fight British Raj, was raped, abused, died in...![submenu-img]() Man in bizarre jeans dances to Tinku Jiya in crowded metro, viral video makes internet furious

Man in bizarre jeans dances to Tinku Jiya in crowded metro, viral video makes internet furious![submenu-img]() Lift collides with roof in Noida society after brakes fail, 3 injured

Lift collides with roof in Noida society after brakes fail, 3 injured![submenu-img]() Zomato CEO Deepinder Goyal invites employees' moms to office for Mother's Day celebration, watch

Zomato CEO Deepinder Goyal invites employees' moms to office for Mother's Day celebration, watch![submenu-img]() This clip of kind woman feeding rotis to stray cows will bring tears of joy to your eyes, watch

This clip of kind woman feeding rotis to stray cows will bring tears of joy to your eyes, watch![submenu-img]() Viral video: Seagull swallows squirrel whole in single go, internet is stunned

Viral video: Seagull swallows squirrel whole in single go, internet is stunned

)

)

)

)

)

)