Things are falling in place fast for Sunil Mittal, and he’s nearly sealed the gigantic $20 billion buyout of majority stake in MTN investment banking sources said.

SingTel could buy shares of African operator to part-finance acquisition l Mittal rushes back from London for last-minute parleys

NEW DELHI: Things are falling in place fast for Sunil Mittal, and he’s nearly sealed the gigantic $20 billion buyout of majority stake in MTN, the African mobile phone operator, investment banking sources said.

The Bharti Airtel chairman cut short his “working holiday” and returned from London on Friday, after “advanced negotiations” with Phuthuma Nhleko, the CEO of MTN.

On the other side, the family of Najeeb Makati, which owns 9.8% in MTN through his London-based family firm M1, welcomed Mittal with open arms.

And the third player in the acquisition process, Singapore-based SingTel, which directly and indirectly holds 30.5% in Bharti Airtel, is likely to help Mittal raise money by buying shares of MTN, which will be through a dilution process following the acquisition, sources said.

Azim Makati, Najeeb’s son, was effusive on Friday: “I don’t see the Bharti transaction as a sale. It is really combining two great assets in what could become a really unique player in the emerging market of the mobile industry,” he told Dow Jones Newswires on Friday.

He said the discussion is being led by MTN’s management, and M1 has full confidence in the management.

“We are supportive of any decision the MTN management makes. We have seen what Bharti has done in India and it’s exceptional,” Azim said.

Bharti is going for debt financing of about $12 billion, while the remaining cost of acquisition —- pegged between $7 billion and $8 billion —- could be funded through the issue of MTN equity to SingTel.

Standard Chartered is advising Bharti and Goldman Sachs is advising SingTel.

So, where exactly does the proposed deal stand at this point?

An investment banking source said final terms are being negotiated and financing being arranged, indicating the deal is quite nigh.While Bharti is believed to have offered to pay 165 rands per share of MTN, the asking price could go up to 180 rands per share, it is believed.

At the current market price, MTN is valued at over 150 rands per share.

MTN operates across 21 markets and has over 68 million subscribers. Its market capitalisation is $37 billion, against Bharti’s $42 billion. Bharti has a subscriber base of 62 million.

According to Bharti top executives, the company wants to replicate its model of low Arpu (average revenue per user) and high Mou (minutes of usage) in emerging markets such as South Africa, through controlling stakes in local firms.

m_nivedita@dnaindia.net

![submenu-img]() Aamir Khan was unsure if censor board would clear Sarfarosh over mentions of Pakistan, ISI: 'If Advani ji can say...'

Aamir Khan was unsure if censor board would clear Sarfarosh over mentions of Pakistan, ISI: 'If Advani ji can say...'![submenu-img]() Gurucharan Singh missing case: Delhi Police questions TMKOC cast and crew, finds out actor's payments were...

Gurucharan Singh missing case: Delhi Police questions TMKOC cast and crew, finds out actor's payments were...![submenu-img]() 'You all are scaring me': Preity Zinta gets uncomfortable after paps follow her, video goes viral

'You all are scaring me': Preity Zinta gets uncomfortable after paps follow her, video goes viral![submenu-img]() Viral video: Influencer dances with gun in broad daylight on highway, UP Police reacts

Viral video: Influencer dances with gun in broad daylight on highway, UP Police reacts![submenu-img]() Family applauds and cheers as woman sends breakup text, viral video will make you laugh

Family applauds and cheers as woman sends breakup text, viral video will make you laugh![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Mother's Day 2024: Bollywood supermoms who balance motherhood, acting, and run multi-crore businesses

Mother's Day 2024: Bollywood supermoms who balance motherhood, acting, and run multi-crore businesses![submenu-img]() Rocky Aur Rani's Golu aka Anjali Anand shocks fans with drastic weight loss without gym, says fitness secret is...

Rocky Aur Rani's Golu aka Anjali Anand shocks fans with drastic weight loss without gym, says fitness secret is...![submenu-img]() In pics: Ram Charan gets mobbed by fans during his visit to Pithapuram for ‘indirect campaign’ for uncle Pawan Kalyan

In pics: Ram Charan gets mobbed by fans during his visit to Pithapuram for ‘indirect campaign’ for uncle Pawan Kalyan![submenu-img]() Streaming This Week: Yodha, Aavesham, Murder In Mahim, Undekhi season 3, latest OTT releases to binge-watch

Streaming This Week: Yodha, Aavesham, Murder In Mahim, Undekhi season 3, latest OTT releases to binge-watch![submenu-img]() Aamir Khan, Naseeruddin Shah, Sonali Bendre celebrate 25 years of Sarfarosh, attend film's special screening

Aamir Khan, Naseeruddin Shah, Sonali Bendre celebrate 25 years of Sarfarosh, attend film's special screening![submenu-img]() Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?

Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() Aamir Khan was unsure if censor board would clear Sarfarosh over mentions of Pakistan, ISI: 'If Advani ji can say...'

Aamir Khan was unsure if censor board would clear Sarfarosh over mentions of Pakistan, ISI: 'If Advani ji can say...'![submenu-img]() Gurucharan Singh missing case: Delhi Police questions TMKOC cast and crew, finds out actor's payments were...

Gurucharan Singh missing case: Delhi Police questions TMKOC cast and crew, finds out actor's payments were...![submenu-img]() 'You all are scaring me': Preity Zinta gets uncomfortable after paps follow her, video goes viral

'You all are scaring me': Preity Zinta gets uncomfortable after paps follow her, video goes viral![submenu-img]() First Indian film to be insured was released 25 years ago, earned five times its budget, gave Bollywood three stars

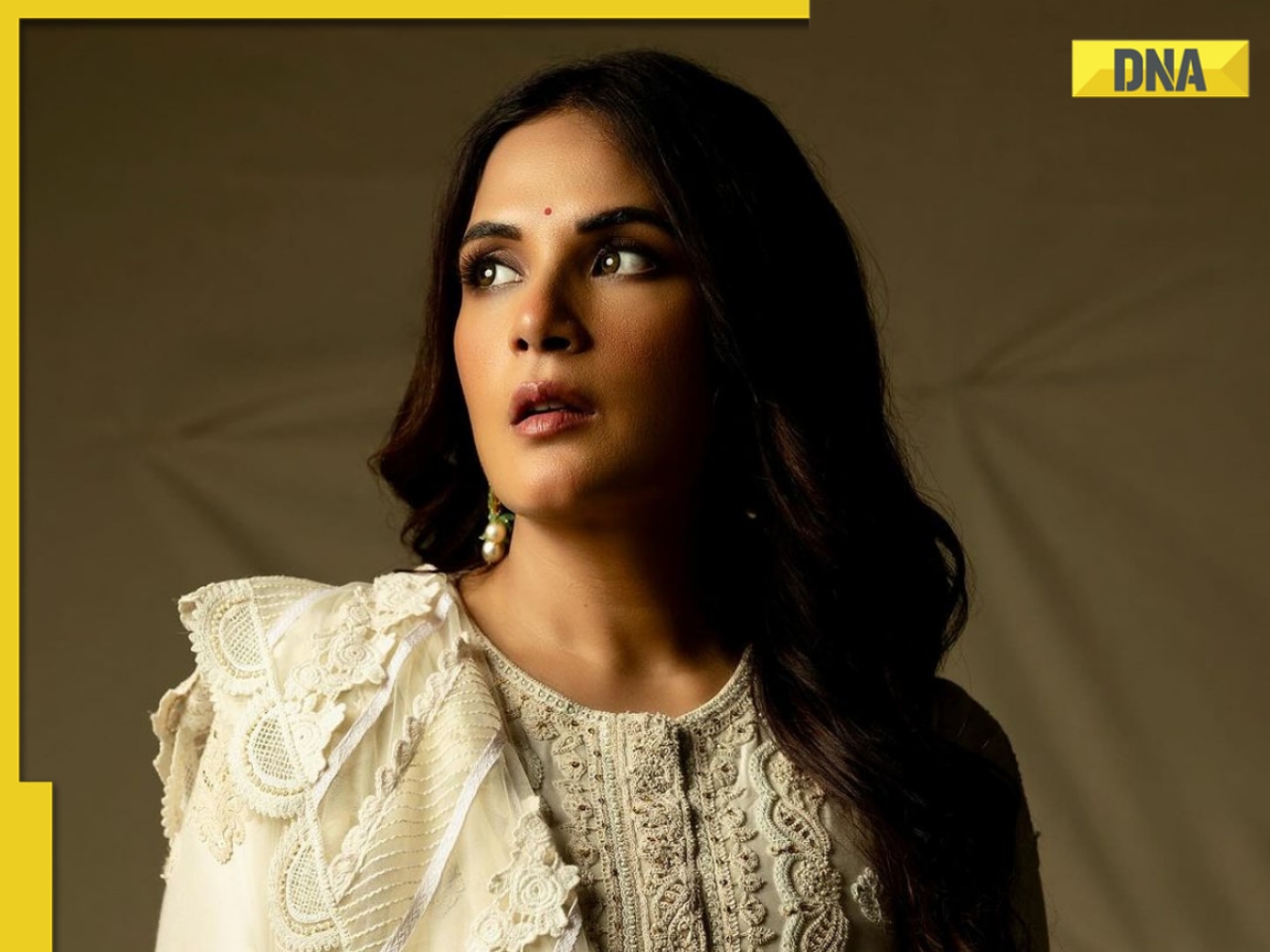

First Indian film to be insured was released 25 years ago, earned five times its budget, gave Bollywood three stars![submenu-img]() Mother’s Day Special: Mom-to-be Richa Chadha talks on motherhood, fixing inequalities for moms in India | Exclusive

Mother’s Day Special: Mom-to-be Richa Chadha talks on motherhood, fixing inequalities for moms in India | Exclusive![submenu-img]() Kolkata Knight Riders become first team to qualify for IPL 2024 playoffs after thumping win over Mumbai Indians

Kolkata Knight Riders become first team to qualify for IPL 2024 playoffs after thumping win over Mumbai Indians![submenu-img]() IPL 2024: This player to lead Delhi Capitals in Rishabh Pant's absence against Royal Challengers Bengaluru

IPL 2024: This player to lead Delhi Capitals in Rishabh Pant's absence against Royal Challengers Bengaluru![submenu-img]() RCB vs DC IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

RCB vs DC IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() CSK vs RR IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

CSK vs RR IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() RCB vs DC IPL 2024 Dream11 prediction: Fantasy cricket tips for Royal Challengers Bengaluru vs Delhi Capitals

RCB vs DC IPL 2024 Dream11 prediction: Fantasy cricket tips for Royal Challengers Bengaluru vs Delhi Capitals![submenu-img]() Viral video: Influencer dances with gun in broad daylight on highway, UP Police reacts

Viral video: Influencer dances with gun in broad daylight on highway, UP Police reacts![submenu-img]() Family applauds and cheers as woman sends breakup text, viral video will make you laugh

Family applauds and cheers as woman sends breakup text, viral video will make you laugh![submenu-img]() Man grabs snake mid-lunge before it strikes his face, terrifying video goes viral

Man grabs snake mid-lunge before it strikes his face, terrifying video goes viral![submenu-img]() Viral video: Man wrestles giant python, internet is scared

Viral video: Man wrestles giant python, internet is scared![submenu-img]() Viral video: Delhi University girls' sizzling dance to Haryanvi song sets the internet ablaze

Viral video: Delhi University girls' sizzling dance to Haryanvi song sets the internet ablaze

)

)

)

)

)

)