Leading garment exporter Gokaldas Exports was a gaggle of 36 entities when Deven Mehta first met the Bangalore-based Hinduja family.

Investor Deven Mehta shares some trade secrets with DNA Money

MUMBAI: Leading garment exporter Gokaldas Exports was a gaggle of 36 entities when Deven Mehta first met the Bangalore-based Hinduja family (not to be confused with the Hinduja family of Ashok Leyland & IndusInd bank) way back in 1987.

It would be a good decade and a half before he would join them as one of their own and almost single-handedly shuffle the 36 entities into one behemoth.

Now 38 years old, this intrepid investor is admittedly the wiser for that experience.

“I am like Rakesh Jhunjhunwala, (the high-networth investor and BSE member), who prefers to invest and trade only for his proprietary account,” quips Mehta.

Unlike Jhunjhunwala, though, he prefers to invest in unlisted companies. And unlike other private equity investors, who are offered deals through investment bankers, Mehta is sounded on deals by word of mouth, and most often by the entrepreneurs themselves.

The risk is understandable. Still, his pipeline of at least 20 offers on any given day would easily be the envy of many investment bankers and private equity investors.

And so would be his experience.

Mehta started work for his father’s firm when he was barely 16 and studying in Sydenham College. Though born with a silver spoon, he is credited with ensuring that SJ group, started by his father Jitendra Mehta some 40 years ago, was steered smoothly from what was a sunset industry to sectors such as real estate and private equity.

“There might not be a single large corporate house or a multinational company who is not under our roster of clients for either buying or selling import licences,” he says. That includes the Tatas, the Birlas and the Ambanis, among others.

“This is a very personalised, service-oriented business, which entails tremendous amount of service at every level. It is one business that is handled in every corporate at a very senior level, even in MNCs. So, this got me a lot of relationships at every corporate house as anybody dealing in exports would need our service,” says Mehta.

Coming back to Gokaldas, Deven proudly says, “I was individually responsible in shuffling the 36 companies into a single entity.” Today, it is one of the country’s biggest employers with some 56,000 workers, and not one union representing them.

Back in 1987, Mehta’s firm, the SJ Group, was the largest intermediary in the import licence trade in the country. It began buying export incentives from Gokaldas, which were traded as export incentives to large corporations who were major importers.

“I would have probably made 400 trips to Bangalore,” he recalls giving some sense of the quantum of work required to get the Hinduja family enterprise to be corporatised.

“It was my plan. I hired the best of consultants such as RSM, the audit firm and Zia Mody, a leading corporate legal eagle, to devise the garment firm’s corporate restructuring.”

Of course, Mehta picked up an equity stake in the garment firm, which went for an IPO. And he exited the firm with bulge bracket profits from his initial investment. The Hindujas, too, got their investment’s worth as global private equity firm Blackstone bought out their stake.

“The due diligence by Blackstone was completed in an hour, and they got a business which was clean and had customers Nike, Gap and Banana Republic,” Mehta gleams.

For SJ group, which commands a market share of 55% in the Rs 6,500 crore export incentives market, the exposure was god sent, for the market was dwindling what with the government continually reducing import duties.

Today, though, Mehta is well-prepared. He is now focusing on real estate, and has picked up equity stake in a real estate company, Mumbai-based Dev Developers, besides two other companies that have shown a penchant for rapid growth in rail road and infrastructure ?? Innovate B2B Logistics and Bhubaneswar-based ARSS Infrastructure, which is due for an IPO in the next four months, respectively.

He has also wisely diversified into financial ventures, having secured in a broking license from the National Stock Exchange in the nineties.

While Deven is young, he also is ultra-conservative. When he invests in equity or real estate, it is with his own funds; debt, he says, is not for him and leverage is an anathema..

But, with PE firms awash with funds, can he spot the right companies to invest in? Mehta is confident: “We can excel in areas in which we can contribute enormously as we believe in tremendous amount of dialogue, interaction, time and energy in addition to the money we invest in the company.”

A look at his other investments tells the story. Among these is the Ambit House at Lower Parel, which he invested in and leased to the investment bank. Lease rentals flow in every month, even as capital appreciates, since he made the investment at the right time.

The same way, he has bought over 100 acres in Alibaug, on the outskirts of Mumbai, where he says real estate has appreciated 600-700% but still has scope for growth.

Where else near Mumbai can you still get land in acres? The property is located near a jetty, is close to the beach, and has a hilly terrain.

Today, he has only built a beach house for himself on this patch. Tomorrow, there would be beach villas and a boutique hotel on the hill as well.

He is also betting on the Rewas port to bring in a lot of commercial activity in Alibaug as he believes that shipping companies and logistic providers will move in quickly.

j_satish@dnaindia.net

![submenu-img]() Aamir Khan was unsure if censor board would clear Sarfarosh over mentions of Pakistan, ISI: 'If Advani ji can say...'

Aamir Khan was unsure if censor board would clear Sarfarosh over mentions of Pakistan, ISI: 'If Advani ji can say...'![submenu-img]() Gurucharan Singh missing case: Delhi Police questions TMKOC cast and crew, finds out actor's payments were...

Gurucharan Singh missing case: Delhi Police questions TMKOC cast and crew, finds out actor's payments were...![submenu-img]() 'You all are scaring me': Preity Zinta gets uncomfortable after paps follow her, video goes viral

'You all are scaring me': Preity Zinta gets uncomfortable after paps follow her, video goes viral![submenu-img]() Viral video: Influencer dances with gun in broad daylight on highway, UP Police reacts

Viral video: Influencer dances with gun in broad daylight on highway, UP Police reacts![submenu-img]() Family applauds and cheers as woman sends breakup text, viral video will make you laugh

Family applauds and cheers as woman sends breakup text, viral video will make you laugh![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Mother's Day 2024: Bollywood supermoms who balance motherhood, acting, and run multi-crore businesses

Mother's Day 2024: Bollywood supermoms who balance motherhood, acting, and run multi-crore businesses![submenu-img]() Rocky Aur Rani's Golu aka Anjali Anand shocks fans with drastic weight loss without gym, says fitness secret is...

Rocky Aur Rani's Golu aka Anjali Anand shocks fans with drastic weight loss without gym, says fitness secret is...![submenu-img]() In pics: Ram Charan gets mobbed by fans during his visit to Pithapuram for ‘indirect campaign’ for uncle Pawan Kalyan

In pics: Ram Charan gets mobbed by fans during his visit to Pithapuram for ‘indirect campaign’ for uncle Pawan Kalyan![submenu-img]() Streaming This Week: Yodha, Aavesham, Murder In Mahim, Undekhi season 3, latest OTT releases to binge-watch

Streaming This Week: Yodha, Aavesham, Murder In Mahim, Undekhi season 3, latest OTT releases to binge-watch![submenu-img]() Aamir Khan, Naseeruddin Shah, Sonali Bendre celebrate 25 years of Sarfarosh, attend film's special screening

Aamir Khan, Naseeruddin Shah, Sonali Bendre celebrate 25 years of Sarfarosh, attend film's special screening![submenu-img]() Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?

Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() Aamir Khan was unsure if censor board would clear Sarfarosh over mentions of Pakistan, ISI: 'If Advani ji can say...'

Aamir Khan was unsure if censor board would clear Sarfarosh over mentions of Pakistan, ISI: 'If Advani ji can say...'![submenu-img]() Gurucharan Singh missing case: Delhi Police questions TMKOC cast and crew, finds out actor's payments were...

Gurucharan Singh missing case: Delhi Police questions TMKOC cast and crew, finds out actor's payments were...![submenu-img]() 'You all are scaring me': Preity Zinta gets uncomfortable after paps follow her, video goes viral

'You all are scaring me': Preity Zinta gets uncomfortable after paps follow her, video goes viral![submenu-img]() First Indian film to be insured was released 25 years ago, earned five times its budget, gave Bollywood three stars

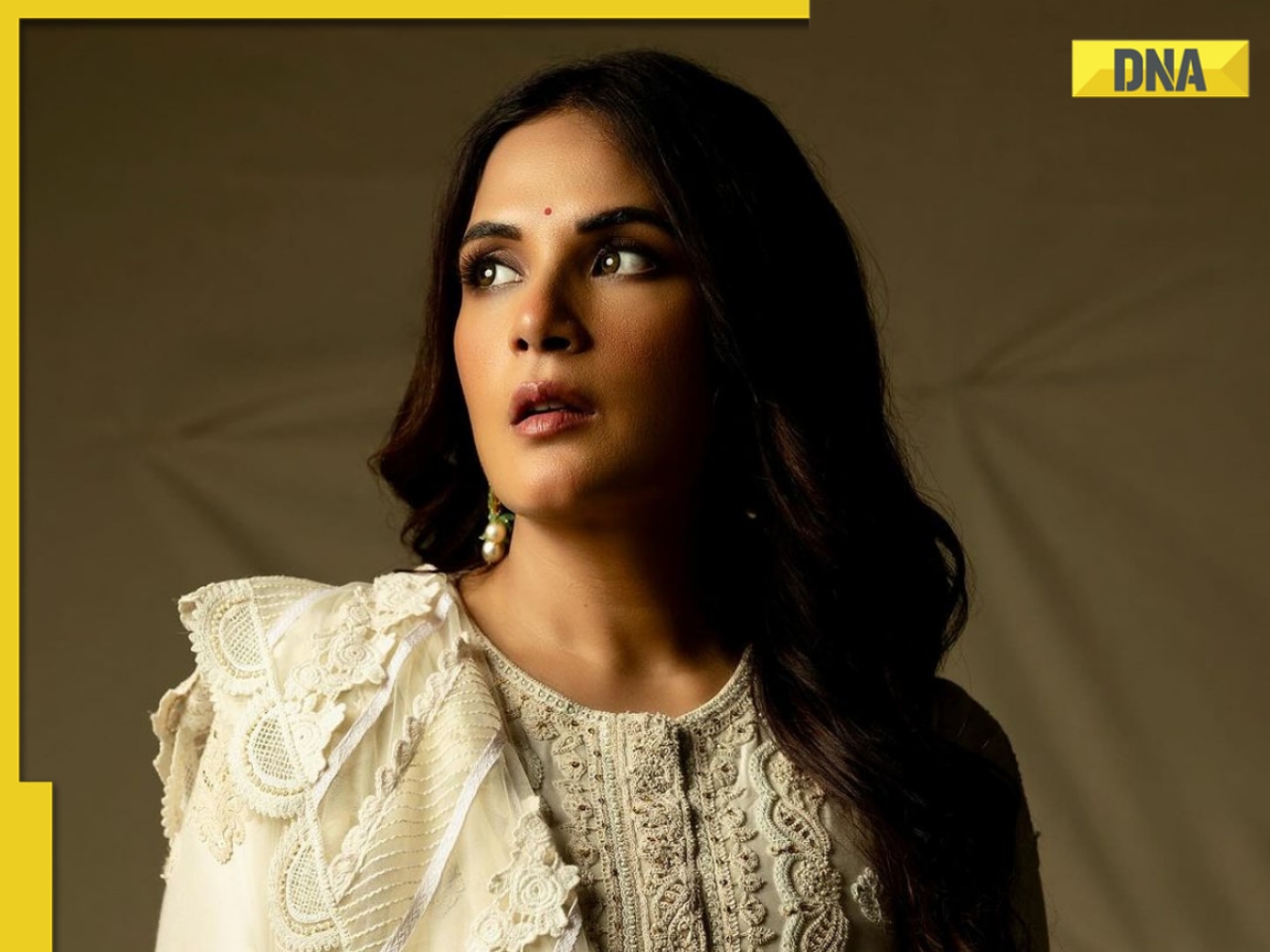

First Indian film to be insured was released 25 years ago, earned five times its budget, gave Bollywood three stars![submenu-img]() Mother’s Day Special: Mom-to-be Richa Chadha talks on motherhood, fixing inequalities for moms in India | Exclusive

Mother’s Day Special: Mom-to-be Richa Chadha talks on motherhood, fixing inequalities for moms in India | Exclusive![submenu-img]() Kolkata Knight Riders become first team to qualify for IPL 2024 playoffs after thumping win over Mumbai Indians

Kolkata Knight Riders become first team to qualify for IPL 2024 playoffs after thumping win over Mumbai Indians![submenu-img]() IPL 2024: This player to lead Delhi Capitals in Rishabh Pant's absence against Royal Challengers Bengaluru

IPL 2024: This player to lead Delhi Capitals in Rishabh Pant's absence against Royal Challengers Bengaluru![submenu-img]() RCB vs DC IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

RCB vs DC IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() CSK vs RR IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

CSK vs RR IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() RCB vs DC IPL 2024 Dream11 prediction: Fantasy cricket tips for Royal Challengers Bengaluru vs Delhi Capitals

RCB vs DC IPL 2024 Dream11 prediction: Fantasy cricket tips for Royal Challengers Bengaluru vs Delhi Capitals![submenu-img]() Viral video: Influencer dances with gun in broad daylight on highway, UP Police reacts

Viral video: Influencer dances with gun in broad daylight on highway, UP Police reacts![submenu-img]() Family applauds and cheers as woman sends breakup text, viral video will make you laugh

Family applauds and cheers as woman sends breakup text, viral video will make you laugh![submenu-img]() Man grabs snake mid-lunge before it strikes his face, terrifying video goes viral

Man grabs snake mid-lunge before it strikes his face, terrifying video goes viral![submenu-img]() Viral video: Man wrestles giant python, internet is scared

Viral video: Man wrestles giant python, internet is scared![submenu-img]() Viral video: Delhi University girls' sizzling dance to Haryanvi song sets the internet ablaze

Viral video: Delhi University girls' sizzling dance to Haryanvi song sets the internet ablaze

)

)

)

)

)

)