Analysts are doubtful if such a line-up can support the ultra-premium Jaguar and Land Rover brands.

MUMBAI: As Tata Motors finalises its purchase of Jaguar and Land Rover, analysts are questioning its ability to integrate the luxury auto brands with its staid but profitable line-up of cars, trucks and buses.

Tata Motors is expected to announce an agreement to buy the two brands from Ford Motor Co as early as Wednesday, a deal analysts say will create opportunities but also challenges for India’s No 3 carmaker.

“About 10-12 years ago, Tata was clearly only a bus and truck maker, while today it is also about small cars, plus Jaguar and Land Rover,” said Mohit Arora, managing director for India at JD Power Asia-Pacific.

“It’s a bit like an elephant: whichever part you touch, you get a different impression. And there are fears that with so much bulk it can’t run,” he said.

Tata’s presence is mainly in the low- to mid-end segments in India and some developing markets, and some analysts have questioned the rationale behind it snapping up brands that will push it into the luxury category and into markets where it has limited experience.

Tata Motors dominates India’s commercial vehicle segment with a market share of 60%, producing a wide range of vehicles from sub-1-tonne mini trucks to buses with a reputation for sturdiness and good value for money. It moved into cars a decade ago with the functional Indica hatchback and in January unveiled Nano, priced at just above $2,500, or about half the price of the cheapest car on the market now.

Analysts are doubtful if such a line-up can support the ultra-premium Jaguar and Land Rover brands.

“There is very little fit with Tata’s current line-up, there are no product synergies, and it will also be very difficult to leverage Land Rover and Jaguar dealers to sell Tata vehicles,” said Ashvin Chotai, an independent consultant based in London.

Long term, Land Rover will provide Tata with technology that can gradually be leveraged on to Tata’s SUVs, he said, but for now the deal should be viewed more as “an opportunistic move.”

“Primarily, there are funding and management challenges, as it is a large-scale acquisition,” S&P credit analyst Anshukant Taneja said. “In the short- to medium-term, there could be a negative impact depending on how they fund it. Taking any more debt on their books is a concern,” he said.

Ratings agency Moody’s Investors Service said the deal could eventually elevate Tata into a global auto maker as well as enlarge its scale, improve its technology and broaden its range. However, execution and integration challenges were substantial, it said. — Reuters

Integration and cost-savings in the near term would be tough, said Ian Fletcher, auto analyst at Global Insight in London, as the deal was likely to be subject to several clauses on issues such as intellectual property rights, sourcing and jobs.

Jaguar and Land Rover could also face increased challenges from, for example, stricter environmental regulations in Europe that are weighted heavily against luxury cars and SUVs, he said.

These concerns have weighed on Tata’s shares, which have fallen about 10% since mid-July 2007, when media reports first indicated its interest in the brands. In the same period, the benchmark Indian index has gained 9%.

“I’m of the opinion that an automaker doesn’t need to have a luxury brand to be successful, and Jaguar-Land Rover could potentially be a weighty commitment for Tata,” Fletcher said.

However, the brands looked good value, with Jaguar restructuring and its new model line-up well received, he said, adding that Land Rover also had “the strongest product portfolio in a long time.”

The deal comes at a time when the credit-market crisis has raised borrowing costs and deterred deal-making across the globe.

Tata Motors is also facing growing competition at home and, like other vehicle makers, is battling high raw material costs.

It plans to spend about $3 billion in capex over three years. Besides the Nano, there is a new-generation Indica and Indigo, a crossover vehicle and a new-generation truck in the pipeline.

There is also a manufacturing venture with Fiat. In fact, extending its alliance with Fiat will probably help Tata enter international markets and tap new technologies faster than the purchase of Jaguar and Land Rover will, analysts said.

“Considering that financial and human resources will be stretched, providing sufficient management and other resources for the deal and turnaround will be a challenge,” Chotai said.

While Land Rover appeared to be in good shape, reviving Jaguar would be a major challenge and could strain resources.

“Ford has struggled for years to turn this operation around,” Chotai said. “Tata does seem to be over-extending itself.”

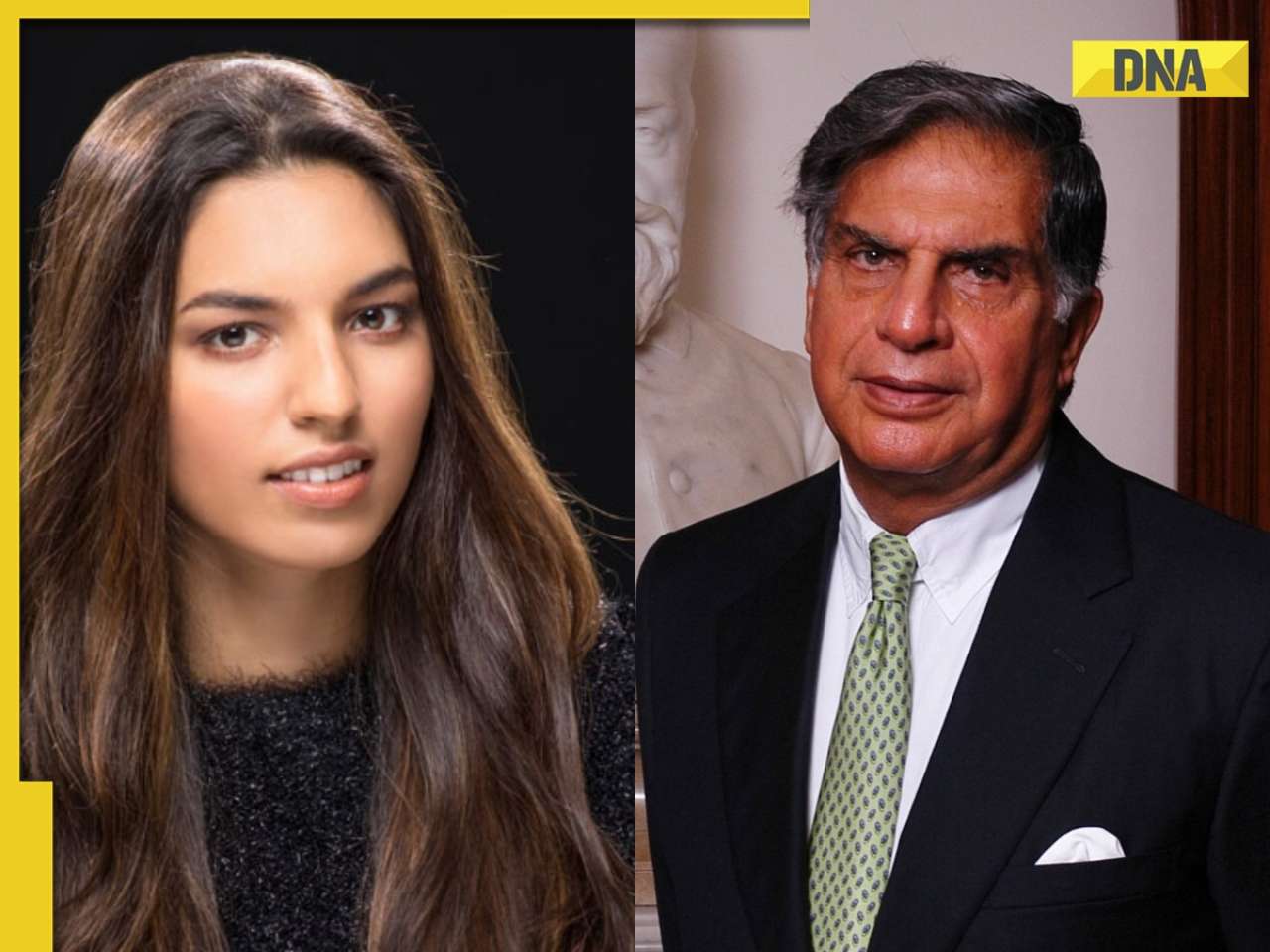

But the Tata Group, headed by Ratan Tata, has a good track-record of acquisitions of large overseas firms.

Among recent deals are Tata Motors’ purchase of Daewoo Commercial Vehicles in 2004, Tata Tea’s $432 million buy of Tetley and last year’s $13 billion buy of Corus by Tata Steel, India’s largest takeover.

“Tata seems to be very good at nurturing firms,” Fletcher said. “These are well known and prestigious brands, and as a way of promoting the Tata Group globally, they will be invaluable.”

![submenu-img]() Ramesh Awasthi: Kanpur's 'Karma Yogi' - Know inspirational journey of 'common man' devoted for society

Ramesh Awasthi: Kanpur's 'Karma Yogi' - Know inspirational journey of 'common man' devoted for society![submenu-img]() Tovino Thomas accused of stopping his film Vazhakku's release by director Sanal Kumar Sasidharan: 'The agenda of...'

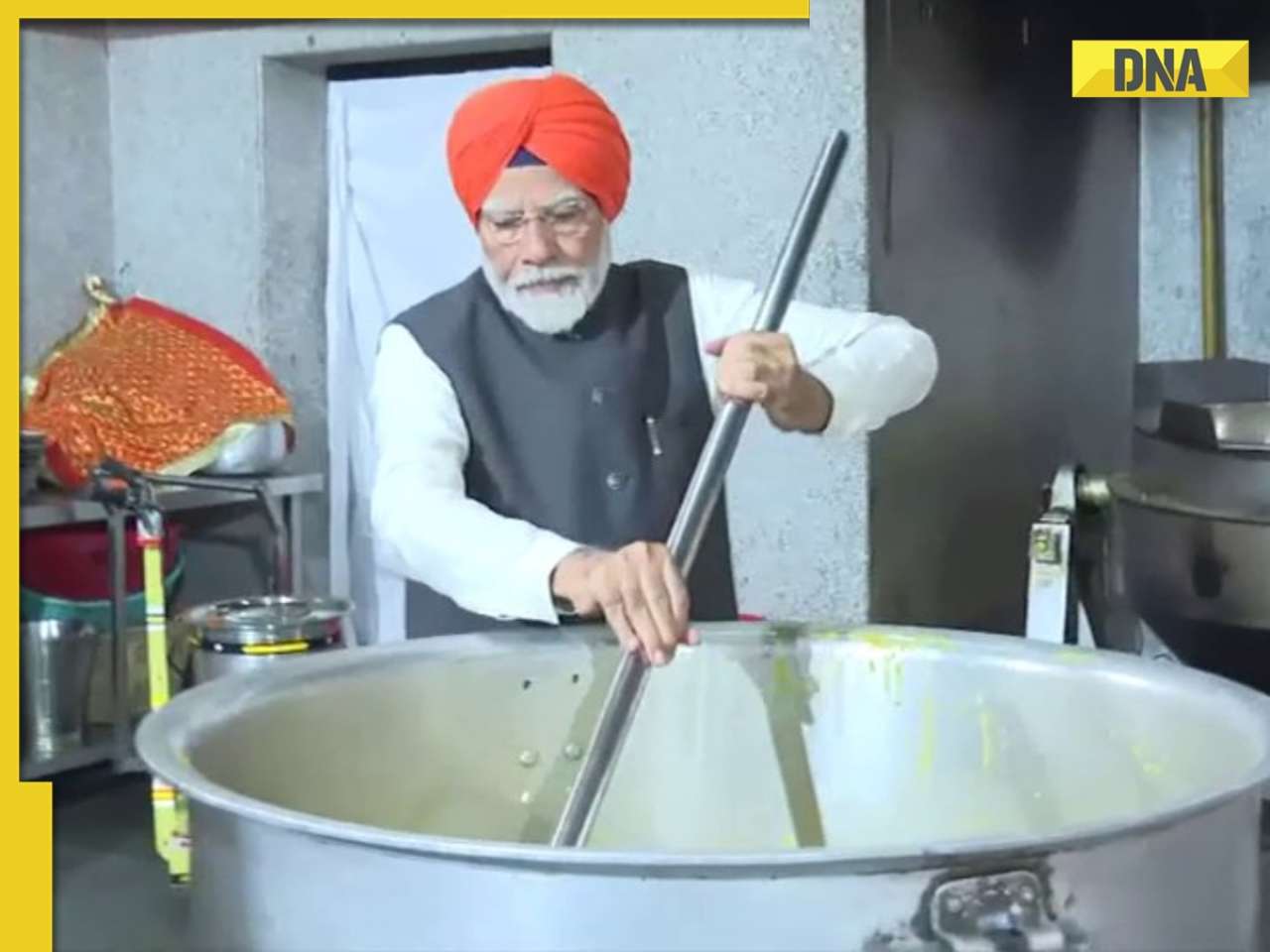

Tovino Thomas accused of stopping his film Vazhakku's release by director Sanal Kumar Sasidharan: 'The agenda of...'![submenu-img]() PM Modi wears turban, serves langar at Gurudwara Patna Sahib in Bihar, watch

PM Modi wears turban, serves langar at Gurudwara Patna Sahib in Bihar, watch![submenu-img]() Anil Ambani’s debt-ridden Reliance’s ‘buyer’ now waits for RBI nod, wants Rs 80000000000…

Anil Ambani’s debt-ridden Reliance’s ‘buyer’ now waits for RBI nod, wants Rs 80000000000…![submenu-img]() Man in bizarre jeans dances to Tinku Jiya in crowded metro, viral video makes internet furious

Man in bizarre jeans dances to Tinku Jiya in crowded metro, viral video makes internet furious![submenu-img]() Maharashtra Board HSC, SSC Results 2024: MSBSHSE class 10, 12 results soon at mahresult.nic.in, latest update here

Maharashtra Board HSC, SSC Results 2024: MSBSHSE class 10, 12 results soon at mahresult.nic.in, latest update here![submenu-img]() Meet IIT-JEE topper who passed JEE Advanced with AIR 1, decided to drop out of IIT due to…

Meet IIT-JEE topper who passed JEE Advanced with AIR 1, decided to drop out of IIT due to…![submenu-img]() Meet IPS Idashisha Nongrang, who became Meghalaya's first woman DGP

Meet IPS Idashisha Nongrang, who became Meghalaya's first woman DGP![submenu-img]() CBSE Results 2024: CBSE Class 10, 12 results date awaited, check latest update here

CBSE Results 2024: CBSE Class 10, 12 results date awaited, check latest update here![submenu-img]() Meet man, who was denied admission in IIT due to blindness, inspiration behind Rajkummar Rao’s film, now owns...

Meet man, who was denied admission in IIT due to blindness, inspiration behind Rajkummar Rao’s film, now owns...![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Remember Harsh Lunia? Just Mohabbat child star, here's how former actor looks now, his wife is Bollywood's popular...

Remember Harsh Lunia? Just Mohabbat child star, here's how former actor looks now, his wife is Bollywood's popular...![submenu-img]() Mother's Day 2024: Bollywood supermoms who balance motherhood, acting, and run multi-crore businesses

Mother's Day 2024: Bollywood supermoms who balance motherhood, acting, and run multi-crore businesses![submenu-img]() Rocky Aur Rani's Golu aka Anjali Anand shocks fans with drastic weight loss without gym, says fitness secret is...

Rocky Aur Rani's Golu aka Anjali Anand shocks fans with drastic weight loss without gym, says fitness secret is...![submenu-img]() In pics: Ram Charan gets mobbed by fans during his visit to Pithapuram for ‘indirect campaign’ for uncle Pawan Kalyan

In pics: Ram Charan gets mobbed by fans during his visit to Pithapuram for ‘indirect campaign’ for uncle Pawan Kalyan![submenu-img]() Streaming This Week: Yodha, Aavesham, Murder In Mahim, Undekhi season 3, latest OTT releases to binge-watch

Streaming This Week: Yodha, Aavesham, Murder In Mahim, Undekhi season 3, latest OTT releases to binge-watch![submenu-img]() Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?

Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() Tovino Thomas accused of stopping his film Vazhakku's release by director Sanal Kumar Sasidharan: 'The agenda of...'

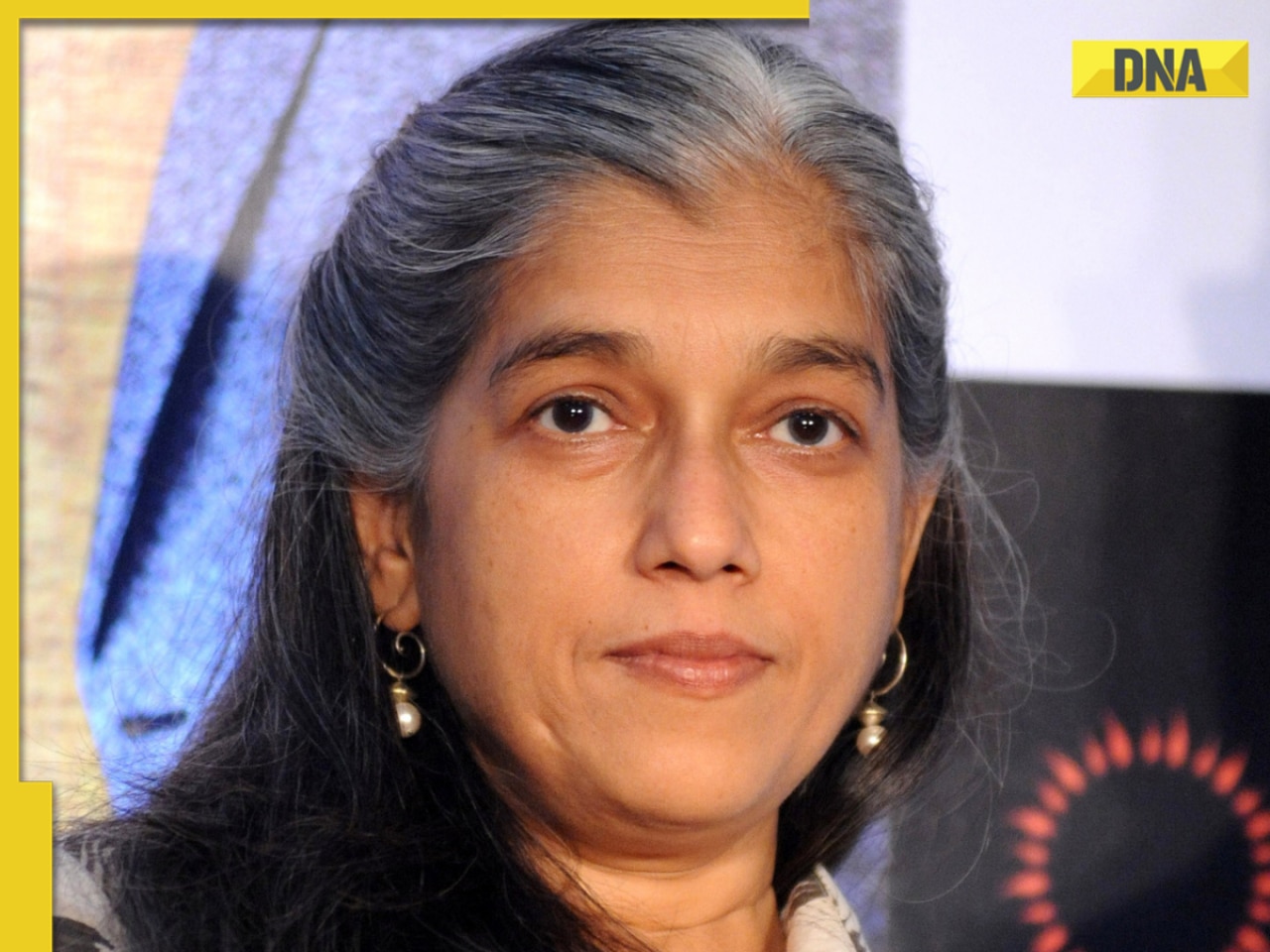

Tovino Thomas accused of stopping his film Vazhakku's release by director Sanal Kumar Sasidharan: 'The agenda of...'![submenu-img]() Ratna Pathak Shah calls Guru Dutt and Bimal Roy's films 'offensive', says, 'women are constantly...'

Ratna Pathak Shah calls Guru Dutt and Bimal Roy's films 'offensive', says, 'women are constantly...'![submenu-img]() Shreyas Talpade recalls how he felt bad when his film Kaun Pravin Tambe did not release in theatres: 'It deserved...'

Shreyas Talpade recalls how he felt bad when his film Kaun Pravin Tambe did not release in theatres: 'It deserved...'![submenu-img]() Anup Soni slams his deepfake video from Crime Patrol, being used to promote IPL betting

Anup Soni slams his deepfake video from Crime Patrol, being used to promote IPL betting![submenu-img]() Real story that inspired Heeramandi: The tawaif who helped Gandhi fight British Raj, was raped, abused, died in...

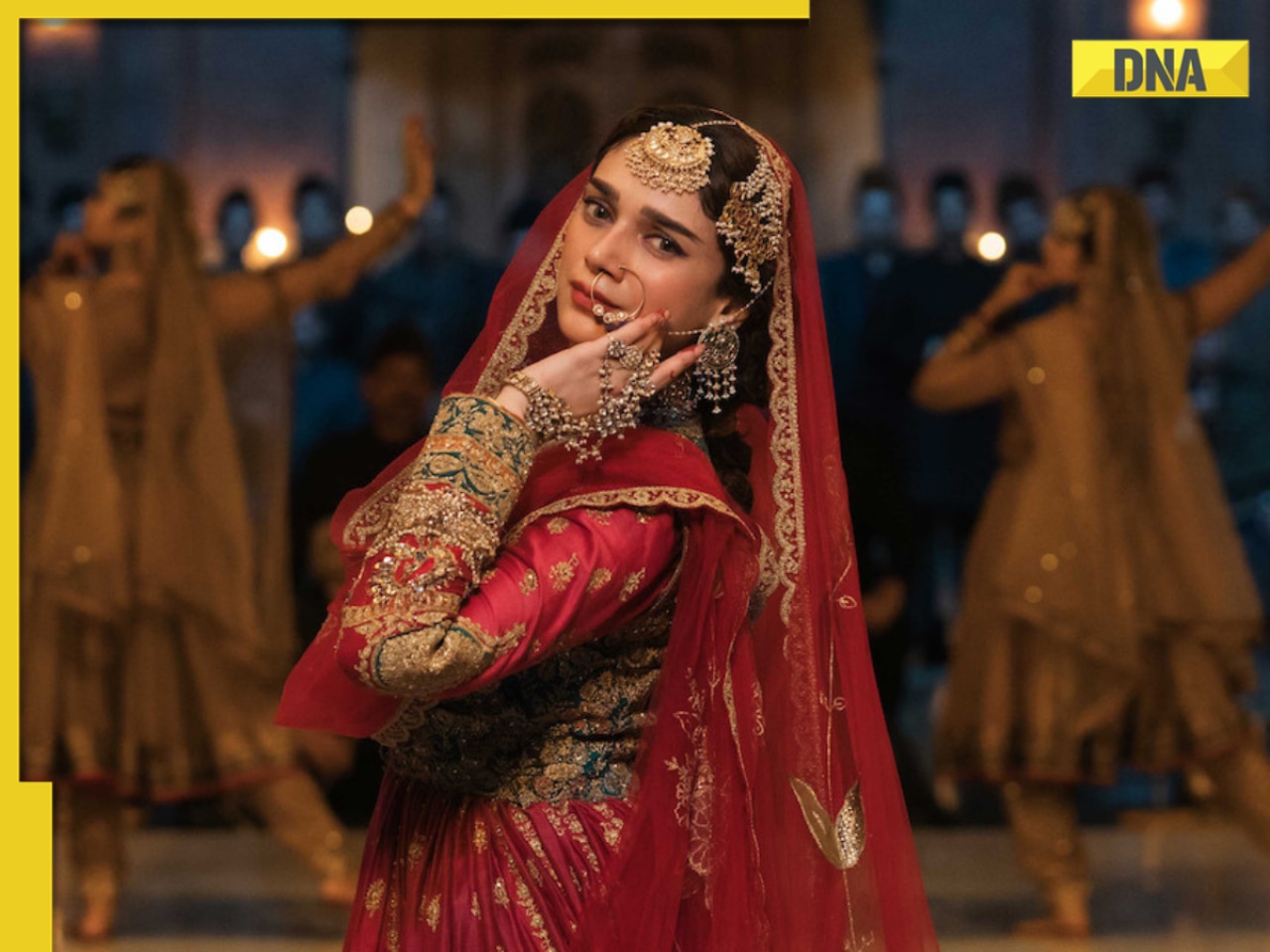

Real story that inspired Heeramandi: The tawaif who helped Gandhi fight British Raj, was raped, abused, died in...![submenu-img]() Man in bizarre jeans dances to Tinku Jiya in crowded metro, viral video makes internet furious

Man in bizarre jeans dances to Tinku Jiya in crowded metro, viral video makes internet furious![submenu-img]() Lift collides with roof in Noida society after brakes fail, 3 injured

Lift collides with roof in Noida society after brakes fail, 3 injured![submenu-img]() Zomato CEO Deepinder Goyal invites employees' moms to office for Mother's Day celebration, watch

Zomato CEO Deepinder Goyal invites employees' moms to office for Mother's Day celebration, watch![submenu-img]() This clip of kind woman feeding rotis to stray cows will bring tears of joy to your eyes, watch

This clip of kind woman feeding rotis to stray cows will bring tears of joy to your eyes, watch![submenu-img]() Viral video: Seagull swallows squirrel whole in single go, internet is stunned

Viral video: Seagull swallows squirrel whole in single go, internet is stunned

)

)

)

)

)

)