If more and more private equity (PE) firms are refraining from investing in tobacco, liquor and gambling companies, it shows the growing Arab interest in India.

Satish John and Sanat Vallikappen

Middle East investors largest contributors to some of the recent pvt equity funds

MUMBAI: If more and more private equity (PE) firms are refraining from investing in tobacco, liquor and gambling companies, it shows the growing Arab interest in India.

As the oil sheikhs find alternative investment avenues like rupee-backed assets an attractive proposition, PE firms are undergoing a 'purge'.

Alok Sama, founder and president of Baer Capital Partners, which recently raised a $250 million PE fund for India, says one-third of the money was from the Gulf region.

Sama said the $250 million fund will not invest in alcohol and gambling companies - sin businesses for Gulf investors.

"If you examine the books of funds like Carlyle and New Vernon, they raise a chunk of their capital from the Gulf region," said a PE investor who did not wish to be named.

The trend started after 9/11, when a lot of Middle East investors started withdrawing money from the West and looking for safer avenues.

Its traditional ties with the Gulf countries and success story among emerging markets made India an obvious destination.

Abraaj Capital, one of the largest PE players in the Middle East, North Africa and South Asia (MENASA) with over $4 billion of assets under management (AUM) currently, launched a $300 million India-focussed fund with Sabre Capital Worldwide Group last year.

The fund takes majority or significant minority stakes in listed and unlisted Indian companies, focusing on specific sector opportunities in their growth, buyout and early stages.

Early this year, the fund made its first acquisition of a strategic stake in Ramky Infrastructure Limited (Ramky), part of the Ramky Group, a rapidly growing infrastructure construction and development firm in Hyderabad.

Evolvence Capital, a Dubai-based firm, started an India-focussed fund of funds in mid-2005, targeting PE, real-estate development and infrastructure in India

The fund believes the "sweet spot" for the Indian PE space over the next couple of years lies with fund managers who target the mid-market transactions - in the range of $10-30 million.

A recent Wall Street Journal article said that the combined government investment arms of Saudi Arabia, Kuwait, Abu Dhabi, Dubai and Qatar hold an estimated $1.5 trillion of investible funds.

K G Krishnamurthy, managing director, HDFC Property Ventures, which recently raised an $800 million fund, also said a significant chunk came from the western Gulf.

"These (from the Middle East) investors understand Indian markets. A lot of Indian developers, including Shapoorji Pallonji and L&T, have worked with Gulf developers for various projects. The comfort level of having worked with them before has encouraged them to invest in projects in India," he says.

"Their decision-making is quite quick," says Krishnamurthy.

Gulf-based investors are also looking at markets where the economy is growing faster, which means that assets backed by the Korean won, Malaysian ringgit and the Indian rupee are the ideal parking bays for appreciation.

Another reason is that many of the investment houses have Indians, who are aware of the markets and regulations of their home country, manning crucial functions.

Narayan Ramachandran, chief executive officer and managing director of Morgan Stanley Investment Management India, says, "Rupee appreciation is only a manifestation of productivity enhancements and growth opportunities in India. So, the real reason is solid long-term growth potential," he said.

Citing the reasons for the growing interest in funds raised from the Middle East for India, Ramachandran says: "Oil price has created a lot of institutional wealth, relative economic growth rates are better in emerging markets than in developed markets, emerging markets are a high-growth region that require capital and offer decent returns on capital, proximity, and of all the emerging markets, China and India have a very deep domestic market. This means that growth can last for a long time."

The Abu Dhabi Investment Authority, the sovereign body responsible for investing all of the Abu Dhabi government's oil revenues and assets in countries and asset classes across the world, is believed to have between $500 million and $1 trillion in assets under management (AUM).

Similarly, the Kuwait Investment Authority is said to have $200 billion in AUM.

Compare these to the US' largest pension fund, California Public Employees' Retirement System (CalPERS), which manages around $247.7 billion. Or, the biggest university endowment - Harvard University's $25.9 billion endowment - according to a 2005 Bloomberg survey of the 25 largest higher-education endowments.

It shows that the size and scale at which these Gulf institutions operate, and the petro-dollars, which only seem to be growing, has established a high standing for these institutions among global PE investors. The Qatar Investment Authority is another big institutional investor from the Gulf region.

Oman Investment Fund (OIF) is another example. It invests directly into businesses and real estate, globally, and not through funds. In India, it, along with global PE firm, 3i, and Cisco, invested $125 million in Mumbai-based TV content and broadcasting company Nimbus Communications.

"We have made one investment in India, but are actively looking at a number of other opportunities," said OIF's chief investment officer Vijai Gill in an email.

"Yes, Middle East investors are very attracted to the India growth story, and other growing regions such as Turkey, central and eastern Europe, China, Vietnam, etc," he added. He wasn't willing to divulge his fund's size though.

Other examples of direct investments include that of Shuaa Capital, a leading Dubai-based investment company that recently picked up a stake in Edelweiss Capital, an Indian financial services house in the city, which has just unfolded plans to list on the local stock exchanges.

Last year, Dubai Financial had acquired a majority stake in Thomas Cook.

Nakheel of Dubai joining hands with DLF, and Dubai's Emaar partnering with India's MGF are cases in point where investors and developers from the Middle East have promoted joint ventures in India.

P Krishnamurthy, CEO at Dubai-based Al Rostamani Group's financial services division, said: "India's growth story as an emerging market has attracted attention from across the globe and ME investors are no different, especially given their traditional proximity to the country. Going forward, investments will only increase as smaller private equity players take a cue from the likes of Emaar Properties and BankMuscat, which have done their due diligence on the country."

![submenu-img]() Ramesh Awasthi: Kanpur's 'Karma Yogi' - Know inspirational journey of 'common man' devoted for society

Ramesh Awasthi: Kanpur's 'Karma Yogi' - Know inspirational journey of 'common man' devoted for society![submenu-img]() Tovino Thomas accused of stopping his film Vazhakku's release by director Sanal Kumar Sasidharan: 'The agenda of...'

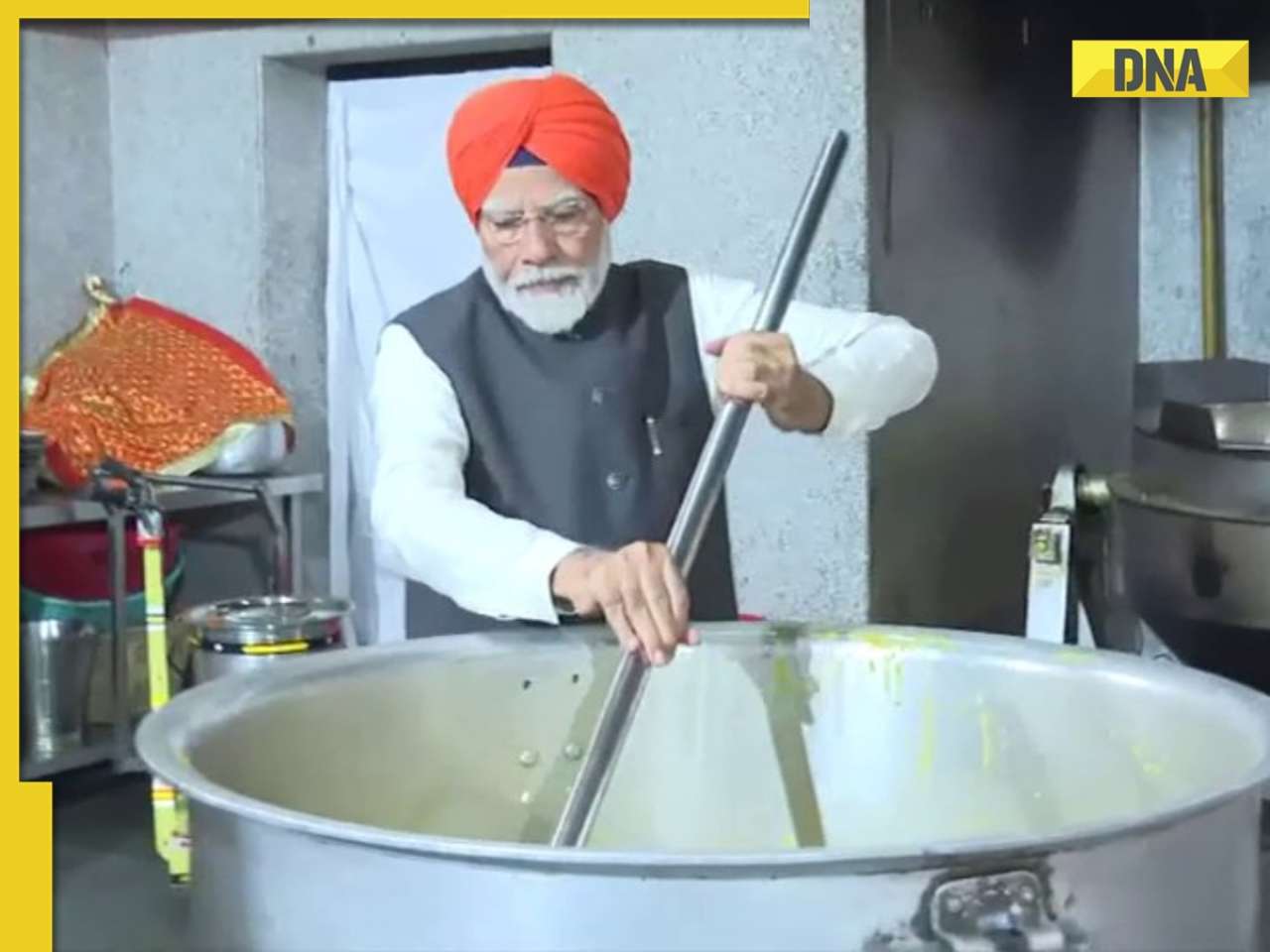

Tovino Thomas accused of stopping his film Vazhakku's release by director Sanal Kumar Sasidharan: 'The agenda of...'![submenu-img]() PM Modi wears turban, serves langar at Gurudwara Patna Sahib in Bihar, watch

PM Modi wears turban, serves langar at Gurudwara Patna Sahib in Bihar, watch![submenu-img]() Anil Ambani’s debt-ridden Reliance’s ‘buyer’ now waits for RBI nod, wants Rs 80000000000…

Anil Ambani’s debt-ridden Reliance’s ‘buyer’ now waits for RBI nod, wants Rs 80000000000…![submenu-img]() Man in bizarre jeans dances to Tinku Jiya in crowded metro, viral video makes internet furious

Man in bizarre jeans dances to Tinku Jiya in crowded metro, viral video makes internet furious![submenu-img]() Maharashtra Board HSC, SSC Results 2024: MSBSHSE class 10, 12 results soon at mahresult.nic.in, latest update here

Maharashtra Board HSC, SSC Results 2024: MSBSHSE class 10, 12 results soon at mahresult.nic.in, latest update here![submenu-img]() Meet IIT-JEE topper who passed JEE Advanced with AIR 1, decided to drop out of IIT due to…

Meet IIT-JEE topper who passed JEE Advanced with AIR 1, decided to drop out of IIT due to…![submenu-img]() Meet IPS Idashisha Nongrang, who became Meghalaya's first woman DGP

Meet IPS Idashisha Nongrang, who became Meghalaya's first woman DGP![submenu-img]() CBSE Results 2024: CBSE Class 10, 12 results date awaited, check latest update here

CBSE Results 2024: CBSE Class 10, 12 results date awaited, check latest update here![submenu-img]() Meet man, who was denied admission in IIT due to blindness, inspiration behind Rajkummar Rao’s film, now owns...

Meet man, who was denied admission in IIT due to blindness, inspiration behind Rajkummar Rao’s film, now owns...![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Remember Harsh Lunia? Just Mohabbat child star, here's how former actor looks now, his wife is Bollywood's popular...

Remember Harsh Lunia? Just Mohabbat child star, here's how former actor looks now, his wife is Bollywood's popular...![submenu-img]() Mother's Day 2024: Bollywood supermoms who balance motherhood, acting, and run multi-crore businesses

Mother's Day 2024: Bollywood supermoms who balance motherhood, acting, and run multi-crore businesses![submenu-img]() Rocky Aur Rani's Golu aka Anjali Anand shocks fans with drastic weight loss without gym, says fitness secret is...

Rocky Aur Rani's Golu aka Anjali Anand shocks fans with drastic weight loss without gym, says fitness secret is...![submenu-img]() In pics: Ram Charan gets mobbed by fans during his visit to Pithapuram for ‘indirect campaign’ for uncle Pawan Kalyan

In pics: Ram Charan gets mobbed by fans during his visit to Pithapuram for ‘indirect campaign’ for uncle Pawan Kalyan![submenu-img]() Streaming This Week: Yodha, Aavesham, Murder In Mahim, Undekhi season 3, latest OTT releases to binge-watch

Streaming This Week: Yodha, Aavesham, Murder In Mahim, Undekhi season 3, latest OTT releases to binge-watch![submenu-img]() Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?

Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() Tovino Thomas accused of stopping his film Vazhakku's release by director Sanal Kumar Sasidharan: 'The agenda of...'

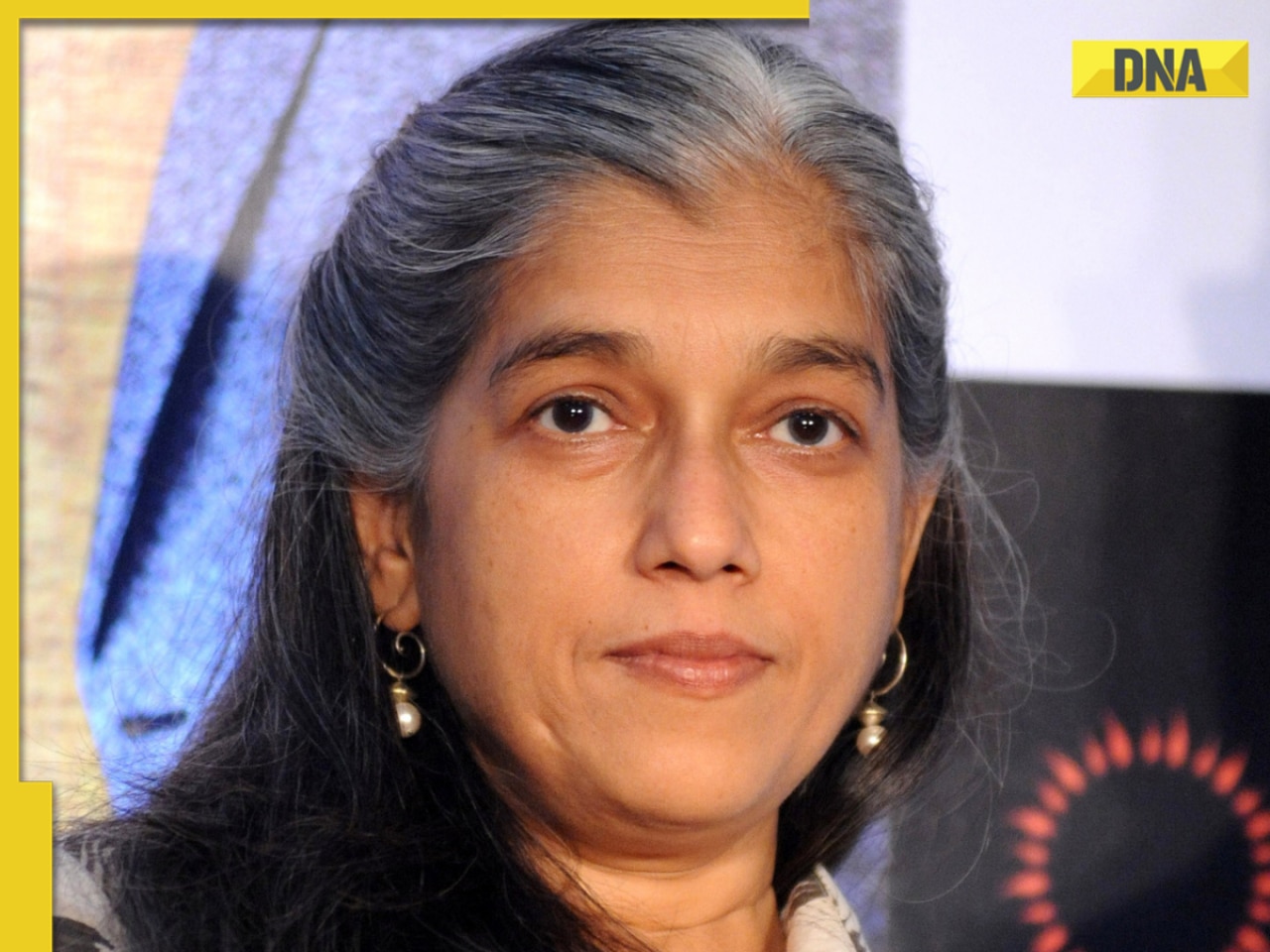

Tovino Thomas accused of stopping his film Vazhakku's release by director Sanal Kumar Sasidharan: 'The agenda of...'![submenu-img]() Ratna Pathak Shah calls Guru Dutt and Bimal Roy's films 'offensive', says, 'women are constantly...'

Ratna Pathak Shah calls Guru Dutt and Bimal Roy's films 'offensive', says, 'women are constantly...'![submenu-img]() Shreyas Talpade recalls how he felt bad when his film Kaun Pravin Tambe did not release in theatres: 'It deserved...'

Shreyas Talpade recalls how he felt bad when his film Kaun Pravin Tambe did not release in theatres: 'It deserved...'![submenu-img]() Anup Soni slams his deepfake video from Crime Patrol, being used to promote IPL betting

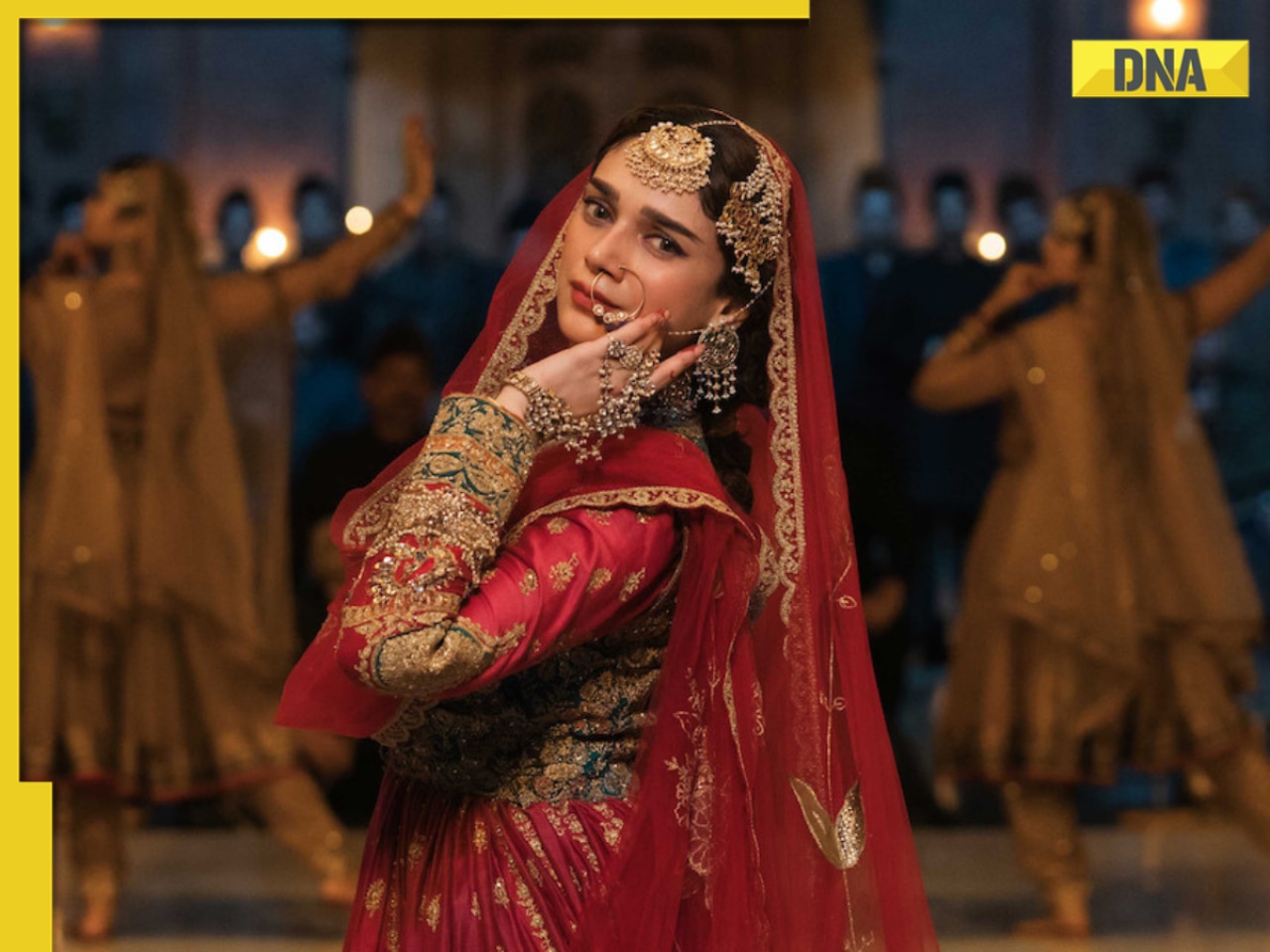

Anup Soni slams his deepfake video from Crime Patrol, being used to promote IPL betting![submenu-img]() Real story that inspired Heeramandi: The tawaif who helped Gandhi fight British Raj, was raped, abused, died in...

Real story that inspired Heeramandi: The tawaif who helped Gandhi fight British Raj, was raped, abused, died in...![submenu-img]() Man in bizarre jeans dances to Tinku Jiya in crowded metro, viral video makes internet furious

Man in bizarre jeans dances to Tinku Jiya in crowded metro, viral video makes internet furious![submenu-img]() Lift collides with roof in Noida society after brakes fail, 3 injured

Lift collides with roof in Noida society after brakes fail, 3 injured![submenu-img]() Zomato CEO Deepinder Goyal invites employees' moms to office for Mother's Day celebration, watch

Zomato CEO Deepinder Goyal invites employees' moms to office for Mother's Day celebration, watch![submenu-img]() This clip of kind woman feeding rotis to stray cows will bring tears of joy to your eyes, watch

This clip of kind woman feeding rotis to stray cows will bring tears of joy to your eyes, watch![submenu-img]() Viral video: Seagull swallows squirrel whole in single go, internet is stunned

Viral video: Seagull swallows squirrel whole in single go, internet is stunned

)

)

)

)

)

)