With an adverse change in the macro environment, viz. high interest rates, the situation is different for each auto segment and for each player.

Insight

With an adverse change in the macro environment, viz. high interest rates, the situation is different for each auto segment and for each player. Here, we look at how the car and UV players have performed.

Maruti continues to be the best performer in passenger cars. Its domestic sales jumped 24.8%, helped by new launches. And except for economy Maruti-800, all other segments did well. Higher contribution from the premium segment (SX4, Swift, Grand Vitara) should provide some cushion against rising costs.

For Maruti, exports were up nearly 60%, but that's because of lower base-in August 2006, export sales had dipped 25% to 3596 vehicles from 4792 a year ago. Thus, total sales jumped 27.22% to 65,968 vehicles in August.

However, Tata Motors reported a 5.25% decline in domestic passenger vehicles (car and UV) sales at 16,620 units, failing to sustain the 17,000-mark (May 2007) as seen in the past two months. In passenger vehicles, Indica sales fell 4%, Indigo by 1% and utility vehicles (Sumo and Safari) by 12%. Besides rising interest rates, the lack triggers in the form of new launches and stiff competition hurt the firm.

Total exports, too, fell 7.8% as export of cars fell 26.5% to 1,329 units-for the first five months, cumulative car exports were down nearly 29% thanks to the South African market where sales are dropping due to the strong currency there. Thus, overall sales were down 5.51% to 18,397 units in the passenger car & UV space.

For Mahindra & Mahindra (M&M), the leader in the UV space selling thrice as much UVs as Tata Motors, August sales were good, despite the 2% decline in sales of Scorpio for the first time in many months.

The boost came from higher sales of Bolero, its re-launched flagship brand around March 2007-UV sales excluding Scorpio have grown 30% during April to August 2007 as compared to just 13% for Scorpio. In passenger cars, sales of Logan stood at 2,252 vehicles - 22% lower than sales in July 2007 - largely due to supply problems.

All the three stocks have underperformed the Sensex in the last one year, thanks to the change in the macro environment. The company, which has been most hit so far may be Tata Motors, given that its heavy & medium commercial vehicle (H&MCV) sales are down 8.8% during the first five months.

Tata's ACE in the light commercial vehicle segment has helped grow LCV sales by 11%, which, though, is unlikely to help compensate for the drop in high-margin H&MCV sales. For M&M, the only drag has been the flat tractor sales during the first five months. And Maruti continues to be the least affected.

No wonder, Maruti remains a favourite of analysts, who have rated Mahindra as a 'buy' and TAMO as 'market performer'.

R&D boost for Nicholas

De-merging businesses into separate companies is not unusual and Nicholas Piramal (NPIL) is not the first pharma company to announce de-merger of its new chemical entity (NCE) research and development unit (to be listed separately later).

But, the markets are impressed by the move; the stock has risen 25.84% since August 27th, the day it announced the board meeting date for considering the de-merger. That's because the de-merger has various benefits - first, since research outfits need to spend lots of money before they can claim to have developed a successful product, it will mean reduction in R&D expenditure. As per analysts' estimates, this should boost Nicholas' EPS by about 20% annually.

The second advantage is that it will help unlock value for NPIL's shareholders, as typically, focused companies enjoy better valuations. The de-merger will also provide an exit opportunity to shareholders who do not wish to hold a stake in the high-risk and high-reward R&D business.

NPIL will transfer assets as well as cash (worth Rs 95 crore) to the new company. For this, existing shareholders will get 1 share of Rs 10 each in the new company for every 10 shares of Rs 2 each held in NPIL. The combined stake of existing NPIL shareholders will be 82%, as NPIL itself will also be holding an 18% stake in the R&D company. This means NPIL's stock will also have some rub-off from developments at the R&D company.

Since promoters currently hold 49.97% in NPIL, their holding will stand reduced to 40.97%, which together with Nicholas Piramal's 18% holding will provide an effective control of 58.97% in the R&D unit (equity capital of Rs 25.49 crore).

As the new R&D company will have 13 new compounds under various development stages (4 in clinical trials already and 4 more expected in 2007-08), it is expected to require huge funds to develop these-clinical trial costs account for about two-thirds of total R&D cost to develop a product.

While the Rs 95 crore should be sufficient in the medium term, the proposed equity holding pattern indicates that the ground is being laid for sale of equity through strategic investor or private placement route in future, without leading to dilution of promoter-holding to uncomfortable levels.

The de-merger will help Nicholas de-risk its business model with more stable revenues and profits, besides allowing it to concentrate on domestic formulations and contract manufacturing. In short, the move is positive. At Rs 299, the stock trades at a PE of 18 times its post de-merger estimated EPS for 2007-08, and merits attention.

Contributed by Pallavi Pengonda & Vishal Chhabria

![submenu-img]() Aamir Khan was unsure if censor board would clear Sarfarosh over mentions of Pakistan, ISI: 'If Advani ji can say...'

Aamir Khan was unsure if censor board would clear Sarfarosh over mentions of Pakistan, ISI: 'If Advani ji can say...'![submenu-img]() Gurucharan Singh missing case: Delhi Police questions TMKOC cast and crew, finds out actor's payments were...

Gurucharan Singh missing case: Delhi Police questions TMKOC cast and crew, finds out actor's payments were...![submenu-img]() 'You all are scaring me': Preity Zinta gets uncomfortable after paps follow her, video goes viral

'You all are scaring me': Preity Zinta gets uncomfortable after paps follow her, video goes viral![submenu-img]() Viral video: Influencer dances with gun in broad daylight on highway, UP Police reacts

Viral video: Influencer dances with gun in broad daylight on highway, UP Police reacts![submenu-img]() Family applauds and cheers as woman sends breakup text, viral video will make you laugh

Family applauds and cheers as woman sends breakup text, viral video will make you laugh![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Mother's Day 2024: Bollywood supermoms who balance motherhood, acting, and run multi-crore businesses

Mother's Day 2024: Bollywood supermoms who balance motherhood, acting, and run multi-crore businesses![submenu-img]() Rocky Aur Rani's Golu aka Anjali Anand shocks fans with drastic weight loss without gym, says fitness secret is...

Rocky Aur Rani's Golu aka Anjali Anand shocks fans with drastic weight loss without gym, says fitness secret is...![submenu-img]() In pics: Ram Charan gets mobbed by fans during his visit to Pithapuram for ‘indirect campaign’ for uncle Pawan Kalyan

In pics: Ram Charan gets mobbed by fans during his visit to Pithapuram for ‘indirect campaign’ for uncle Pawan Kalyan![submenu-img]() Streaming This Week: Yodha, Aavesham, Murder In Mahim, Undekhi season 3, latest OTT releases to binge-watch

Streaming This Week: Yodha, Aavesham, Murder In Mahim, Undekhi season 3, latest OTT releases to binge-watch![submenu-img]() Aamir Khan, Naseeruddin Shah, Sonali Bendre celebrate 25 years of Sarfarosh, attend film's special screening

Aamir Khan, Naseeruddin Shah, Sonali Bendre celebrate 25 years of Sarfarosh, attend film's special screening![submenu-img]() Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?

Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() Aamir Khan was unsure if censor board would clear Sarfarosh over mentions of Pakistan, ISI: 'If Advani ji can say...'

Aamir Khan was unsure if censor board would clear Sarfarosh over mentions of Pakistan, ISI: 'If Advani ji can say...'![submenu-img]() Gurucharan Singh missing case: Delhi Police questions TMKOC cast and crew, finds out actor's payments were...

Gurucharan Singh missing case: Delhi Police questions TMKOC cast and crew, finds out actor's payments were...![submenu-img]() 'You all are scaring me': Preity Zinta gets uncomfortable after paps follow her, video goes viral

'You all are scaring me': Preity Zinta gets uncomfortable after paps follow her, video goes viral![submenu-img]() First Indian film to be insured was released 25 years ago, earned five times its budget, gave Bollywood three stars

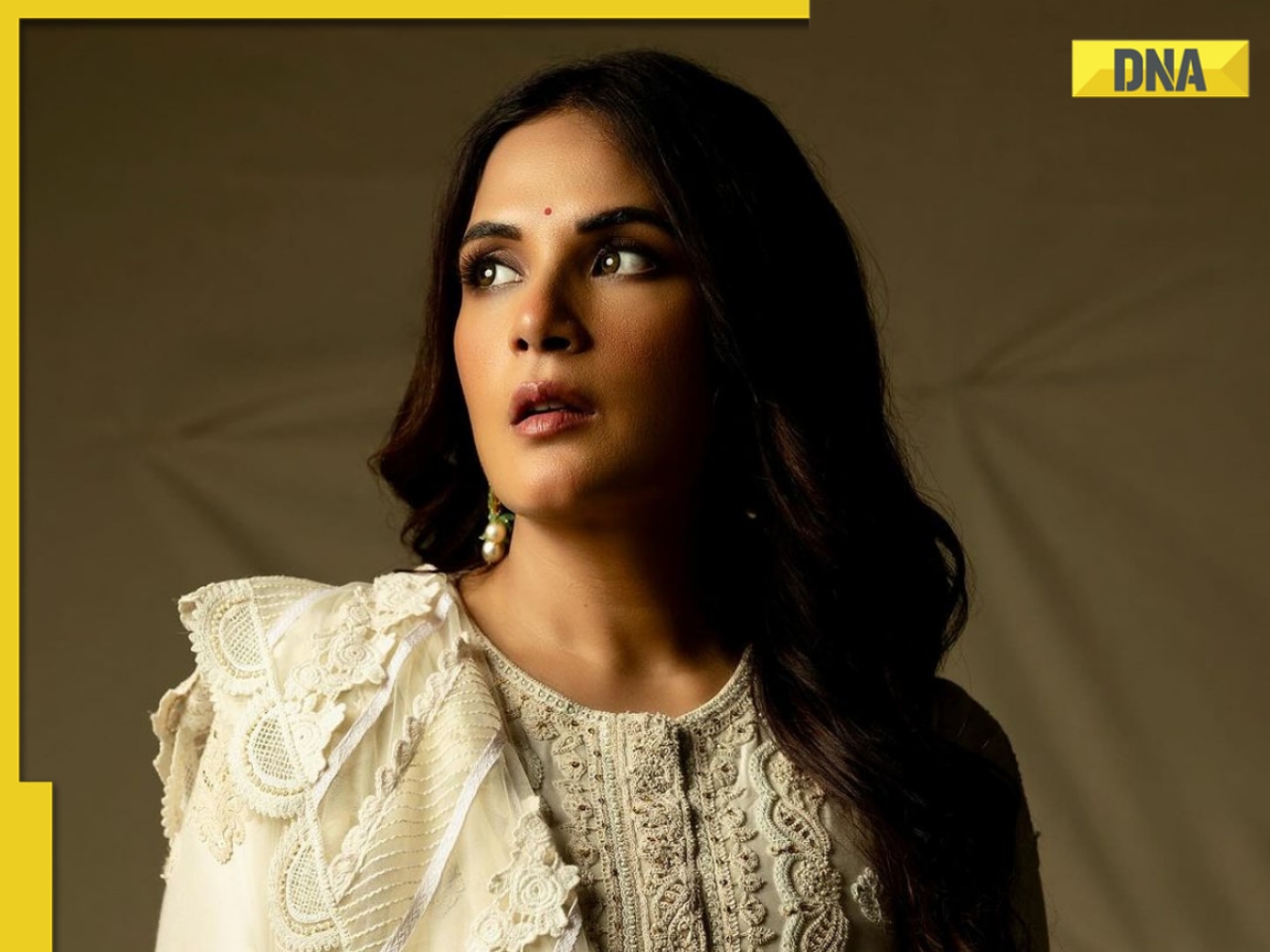

First Indian film to be insured was released 25 years ago, earned five times its budget, gave Bollywood three stars![submenu-img]() Mother’s Day Special: Mom-to-be Richa Chadha talks on motherhood, fixing inequalities for moms in India | Exclusive

Mother’s Day Special: Mom-to-be Richa Chadha talks on motherhood, fixing inequalities for moms in India | Exclusive![submenu-img]() Kolkata Knight Riders become first team to qualify for IPL 2024 playoffs after thumping win over Mumbai Indians

Kolkata Knight Riders become first team to qualify for IPL 2024 playoffs after thumping win over Mumbai Indians![submenu-img]() IPL 2024: This player to lead Delhi Capitals in Rishabh Pant's absence against Royal Challengers Bengaluru

IPL 2024: This player to lead Delhi Capitals in Rishabh Pant's absence against Royal Challengers Bengaluru![submenu-img]() RCB vs DC IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

RCB vs DC IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() CSK vs RR IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

CSK vs RR IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() RCB vs DC IPL 2024 Dream11 prediction: Fantasy cricket tips for Royal Challengers Bengaluru vs Delhi Capitals

RCB vs DC IPL 2024 Dream11 prediction: Fantasy cricket tips for Royal Challengers Bengaluru vs Delhi Capitals![submenu-img]() Viral video: Influencer dances with gun in broad daylight on highway, UP Police reacts

Viral video: Influencer dances with gun in broad daylight on highway, UP Police reacts![submenu-img]() Family applauds and cheers as woman sends breakup text, viral video will make you laugh

Family applauds and cheers as woman sends breakup text, viral video will make you laugh![submenu-img]() Man grabs snake mid-lunge before it strikes his face, terrifying video goes viral

Man grabs snake mid-lunge before it strikes his face, terrifying video goes viral![submenu-img]() Viral video: Man wrestles giant python, internet is scared

Viral video: Man wrestles giant python, internet is scared![submenu-img]() Viral video: Delhi University girls' sizzling dance to Haryanvi song sets the internet ablaze

Viral video: Delhi University girls' sizzling dance to Haryanvi song sets the internet ablaze

)

)

)

)

)

)