Sitting in our living rooms, reading the papers that say the economy is galloping at 8.3% a year, seeing it shine, learning of Wal-Mart’s entry - one would think India is consuming voraciously.

NEW DELHI: Sitting in our living rooms, reading the papers that say the economy is galloping at 8.3% a year, seeing it shine, learning of Wal-Mart’s entry - one would think India is consuming voraciously. So it is, but perhaps not with the degree of hunger one would assume, especially when it comes to consumer durables.

Indeed, going by the IMRB Baseline Survey 2006, which covered 6,40,59,000 households across the country, the penetration of common durables is poor across the top 8 cities - Delhi, Mumbai, Pune, Kolkata, Ahemdabad, Chennai, Bangalore and Hyderabad. In absolute numbers, the story is worse in the small towns (of both 10-40 lakh and 5-10 lakh population).

Clearly, durables such as flat TVs, washing machines, air-conditioners, computers and microwaves have still to capture the imagination of the metro dwellers in a big way. Of the iPod, one had better not say.

The penetration of fully automatic washing machines (top loading) in the 8 metros is 3.5%, while that of semi-automatics is 10.1%. Air conditioners’ reach is 3.8% in the metros and 1.3% in semi-urban areas. Colour television is the only durable to have at least realised the potential of the markets in the metros as well as mini-metros. While all India urban reach is 62.3%, in the eight metros, it is 75.2% and in towns with 10-40 lakh towns 65.3%.

Figures for the other durables, however, are depressing.

Given this scenario, the task of the marketers seems not only hard but a challenging one, points out Puneet Avasthi VP-media & panel, IMRB International.

Sandeep Tiwari, head, marketing, LG Electronics India explains why India allures like a beautiful dream but can disappoint. There are close to 20 crore households that theoretically represent India’s true business potential. “Many multi-national companies get carried away with 20-crore household figure. But the reality is just over 5 crore households that can be tapped; the rest are either not electrified or not accessible on some count or the other. Which means 40% of the market is not addressable.” That takes away a fantastic opportunity from the hands of marketers.

Television has the highest penetration among consumer durables at 28% (IRS 2006), which itself is not very impressive.

One reason for the poor penetration is the mismatch between the durables’ functionality and the consumers’ need. A case in point is the washing machines category. One may have assumed that fully automatic would find better acceptability, but semi-automatics have a larger share.

“Indians have a philosophy and a science to washing clothes,” says Pradeep Tognatta, director, sales, Samsung India. Kitchen clothes cannot be washed along with the other clothes.

Therefore, the water is drained from the tank and refilled to wash bigger clothes. Colours run fast, so white clothes are washed separately. The best mechanical approximation to that approach is the semi-automatic, and hence people prefer semi-automatic. The problems are the same in the South. Technology is convenience and therefore cities such as Bangalore, go for the latest.

Like washing machines, air conditioners also come with their own problems, the major one being electricity consumption. “On an average, an air-conditioner runs for 8 hours, consumes electricity worth Rs 1,200-1,500,” says Tiwari of LG.

Refrigerators, too, are consumed differently and that largely determines why direct cool is more successful. When the electricity goes off, the thick ice plate that forms in the freezer compartment keeps the fridge cool. However, in a frost-free, there is no such formation. The freezer compartment is cut off from the main body, so when the electricity goes, cooling drops significantly. Secondly, since a large part of India’s population is vegetarian, it sees little use for a freezer, since it used for storing meat products.

Hence, the expansion requires a tightrope-balancing act with careful planning. And adaptation is the key.

Whirlpool had launched Genius, direct cool refrigerator, keeping in mind the space in rural homes. Genius is a single door refrigerator, 180 litre in capacity and comes with a utility drawer-cum-pedestal to help store vegetables that don’t need refrigeration. Whirlpool’s range of refrigerators maintains cooling retention of 1500 minutes during power cuts.

Samsung, on its part, has added features such as the cool pack and an inbuilt stabiliser to deal with the power fluctuation.

Besides trying to create a synergy between the product and the consumer’s needs through customisations, the marketers have an additional task of catering to the metros and the semi-urban areas as well.

Rural markets are a challenge, agrees Shantanu Das Gupta, VP-marketing, Whirlpool, India. The major challenge is poor development of infrastructure. “Availability of electricity continues to be a major issue as far as refrigerators are concerned. With respect to washing machines, this is compounded with the lack of piped water supply.” Whirlpool’s distribution currently includes coverage of towns with +1 lakh population.

For Samsung, the task is to develop the markets in metros and semi-urban areas simultaneously. “One cannot be ignored for the other,” says Das Gupta. The growth and volumes are going to come from the rural markets. The company is clear on this.

Last year, Samsung had started the Dream Home Roadshow to target Tier1, 2 and 3 cities. But the emphasis remains on technology, be it the semi-urban areas or the metros. “Flat TV is expected to grow to 57% and the market share of the curved tube is declining. We have to create new markets and technology is the way forward. People have to be made aware of the technology,” says Tognatta. Therefore, Samsung includes the base models as well as the fully automatic washing machines and frost-free refrigerators for its semi-urban consumers.

Till recently, rural areas were not the focus for Samsung. It is in the past 10 months that the company has set up 20 branches and 89 sales units to cater to the small towns. “We expect 30-35% of our sales to come from semi-urban areas. The target is to reach more than 200 towns by the end of the year,” avers Tognatta.

He calls this district marketing. “Our sales office plans and executes roadshows. You will be surprised how the Tier 1 cities are consuming durables. In Lucknow, Samsung sold 500 LCD units in three days at the Coolex exhibition. And this insight has prompted Samsung to change its media mix. There is an equal emphasis on below-the-line activities. Samsung will adapt its campaigns for regional markets as well.”

LG, on the other hand, is trying to cut its advertising spend on vernaculars. “Literacy levels are still low. The best route to sell in the upcountry markets is through the dealer. The dealer is the brand ambassador,” says Tiwari. LG does not advertise on the terrestrial channel.

Avasthi of IMRB says advertisers generally do not include the terrestrial channel in their media plans and the cable penetration drops as one goes farther into cities with less population. As a result, exposure is hampered.

Though LG has 33 branch offices across India, and boasts of a wide distribution network, Tiwari says its priority is the metros. “By selling high-end products, we will expand our business and of course upgrade consumers. This will help us offset cost erosion.”

LG’s marketing budget for this year is Rs 200 crore, of which advertising would take Rs 100 crore. Traditional media will comprise 60% of the total spends. In future, however, LG would steadily decrease its dependence on mainline media and invest more on the shop floor and the point of purchase.

Like LG, Samsung is nurturing its markets in the metros, too. Samsung plans to have 150 brand shops by the end of this year. Improve the multi-brand dealers from 500 to another 300. Samsung expects to sell 8,000 units of side-by-side by refrigerators by the year-end. LG, on the other hand, is not too optimistic. “People are saying that side-by-side refrigerators will sell 10,000-15,000 units, but I suspect so. The segment is growing at a snail’s pace,” says Tognatta.

The way forward, says Tiwari of LG, is to cater to the Indian cultural experience.

![submenu-img]() Ramesh Awasthi: Kanpur's 'Karma Yogi' - Know inspirational journey of 'common man' devoted for society

Ramesh Awasthi: Kanpur's 'Karma Yogi' - Know inspirational journey of 'common man' devoted for society![submenu-img]() Tovino Thomas accused of stopping his film Vazhakku's release by director Sanal Kumar Sasidharan: 'The agenda of...'

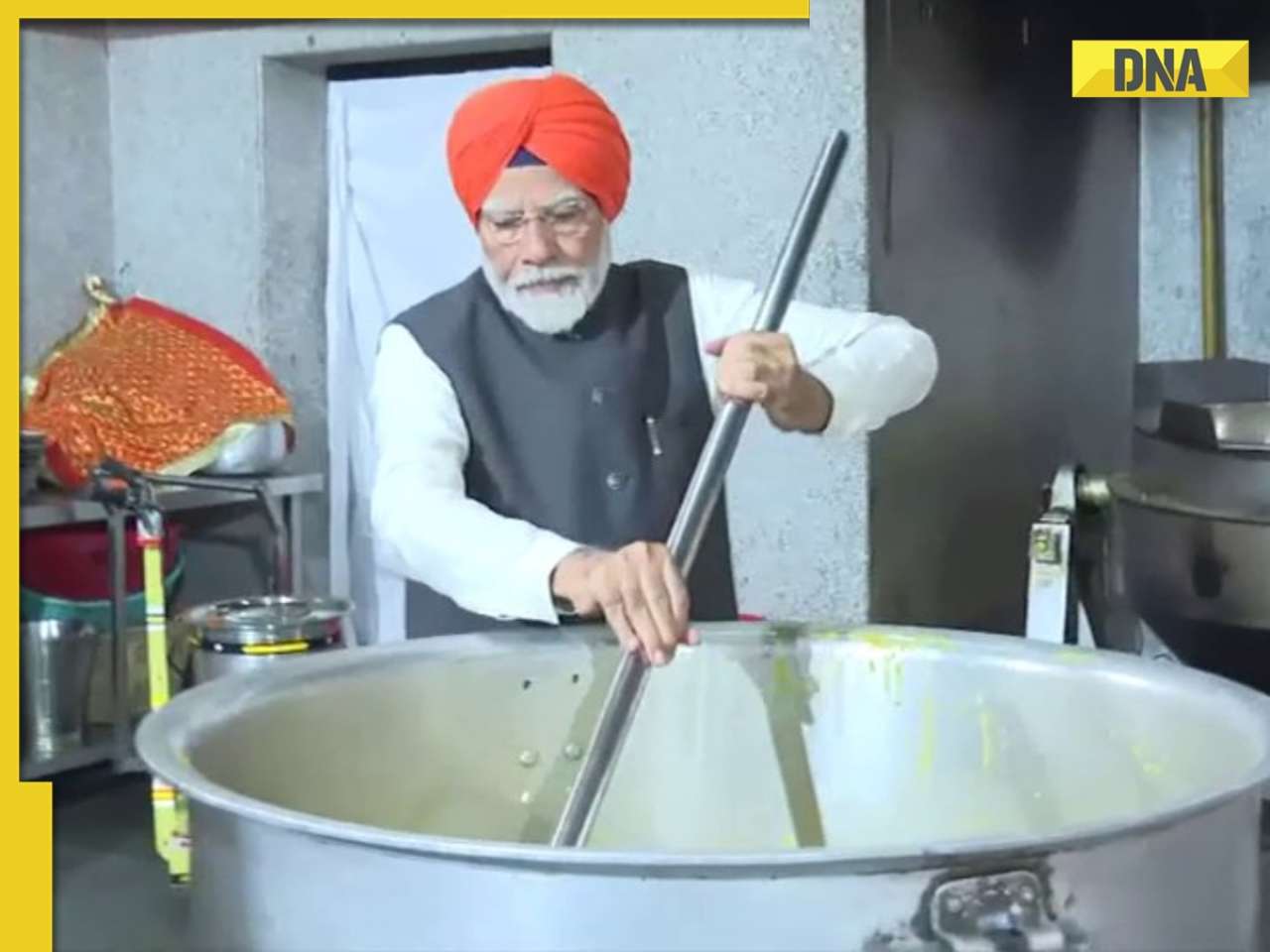

Tovino Thomas accused of stopping his film Vazhakku's release by director Sanal Kumar Sasidharan: 'The agenda of...'![submenu-img]() PM Modi wears turban, serves langar at Gurudwara Patna Sahib in Bihar, watch

PM Modi wears turban, serves langar at Gurudwara Patna Sahib in Bihar, watch![submenu-img]() Anil Ambani’s debt-ridden Reliance’s ‘buyer’ now waits for RBI nod, wants Rs 80000000000…

Anil Ambani’s debt-ridden Reliance’s ‘buyer’ now waits for RBI nod, wants Rs 80000000000…![submenu-img]() Man in bizarre jeans dances to Tinku Jiya in crowded metro, viral video makes internet furious

Man in bizarre jeans dances to Tinku Jiya in crowded metro, viral video makes internet furious![submenu-img]() Maharashtra Board HSC, SSC Results 2024: MSBSHSE class 10, 12 results soon at mahresult.nic.in, latest update here

Maharashtra Board HSC, SSC Results 2024: MSBSHSE class 10, 12 results soon at mahresult.nic.in, latest update here![submenu-img]() Meet IIT-JEE topper who passed JEE Advanced with AIR 1, decided to drop out of IIT due to…

Meet IIT-JEE topper who passed JEE Advanced with AIR 1, decided to drop out of IIT due to…![submenu-img]() Meet IPS Idashisha Nongrang, who became Meghalaya's first woman DGP

Meet IPS Idashisha Nongrang, who became Meghalaya's first woman DGP![submenu-img]() CBSE Results 2024: CBSE Class 10, 12 results date awaited, check latest update here

CBSE Results 2024: CBSE Class 10, 12 results date awaited, check latest update here![submenu-img]() Meet man, who was denied admission in IIT due to blindness, inspiration behind Rajkummar Rao’s film, now owns...

Meet man, who was denied admission in IIT due to blindness, inspiration behind Rajkummar Rao’s film, now owns...![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Remember Harsh Lunia? Just Mohabbat child star, here's how former actor looks now, his wife is Bollywood's popular...

Remember Harsh Lunia? Just Mohabbat child star, here's how former actor looks now, his wife is Bollywood's popular...![submenu-img]() Mother's Day 2024: Bollywood supermoms who balance motherhood, acting, and run multi-crore businesses

Mother's Day 2024: Bollywood supermoms who balance motherhood, acting, and run multi-crore businesses![submenu-img]() Rocky Aur Rani's Golu aka Anjali Anand shocks fans with drastic weight loss without gym, says fitness secret is...

Rocky Aur Rani's Golu aka Anjali Anand shocks fans with drastic weight loss without gym, says fitness secret is...![submenu-img]() In pics: Ram Charan gets mobbed by fans during his visit to Pithapuram for ‘indirect campaign’ for uncle Pawan Kalyan

In pics: Ram Charan gets mobbed by fans during his visit to Pithapuram for ‘indirect campaign’ for uncle Pawan Kalyan![submenu-img]() Streaming This Week: Yodha, Aavesham, Murder In Mahim, Undekhi season 3, latest OTT releases to binge-watch

Streaming This Week: Yodha, Aavesham, Murder In Mahim, Undekhi season 3, latest OTT releases to binge-watch![submenu-img]() Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?

Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() Tovino Thomas accused of stopping his film Vazhakku's release by director Sanal Kumar Sasidharan: 'The agenda of...'

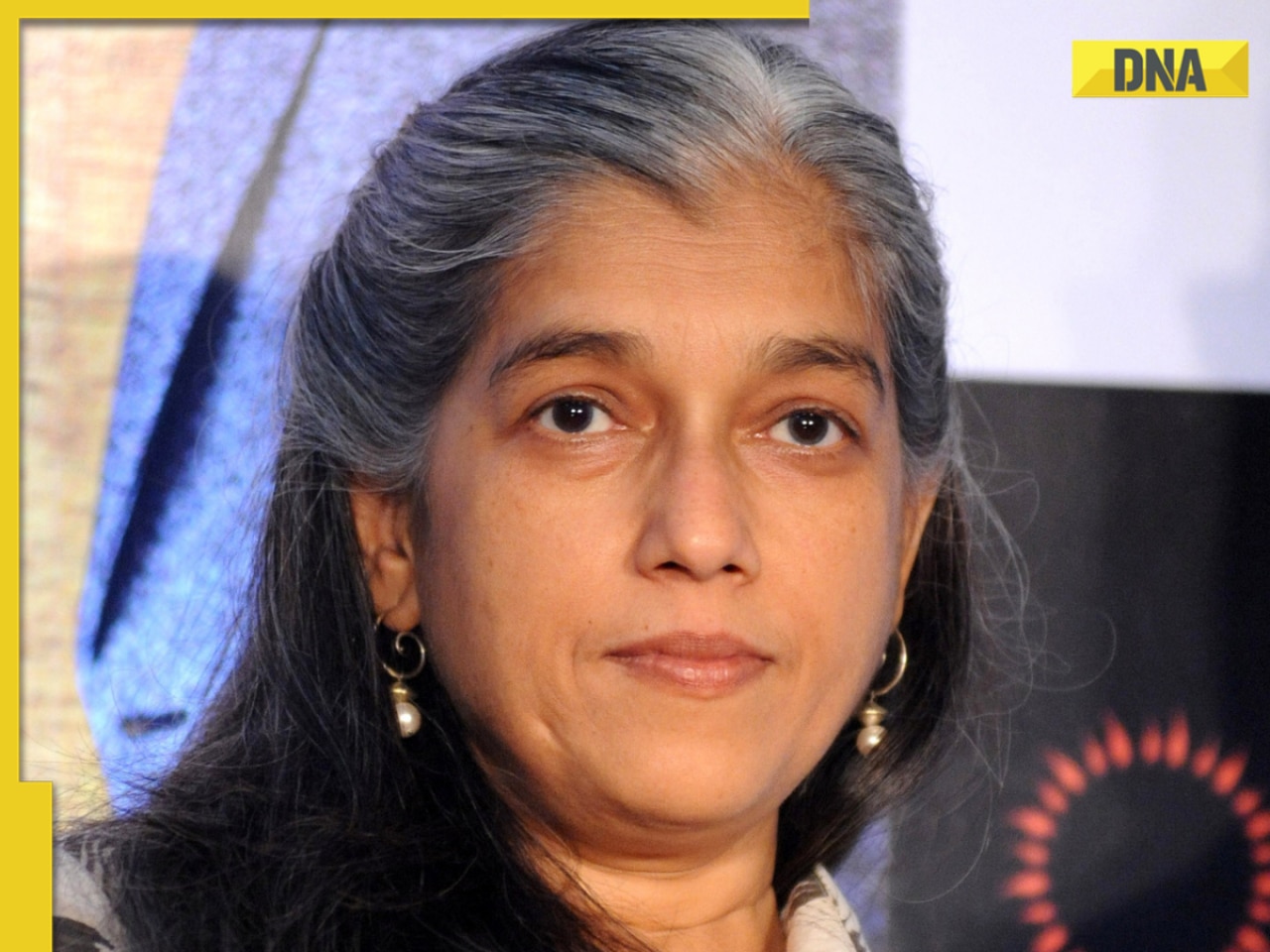

Tovino Thomas accused of stopping his film Vazhakku's release by director Sanal Kumar Sasidharan: 'The agenda of...'![submenu-img]() Ratna Pathak Shah calls Guru Dutt and Bimal Roy's films 'offensive', says, 'women are constantly...'

Ratna Pathak Shah calls Guru Dutt and Bimal Roy's films 'offensive', says, 'women are constantly...'![submenu-img]() Shreyas Talpade recalls how he felt bad when his film Kaun Pravin Tambe did not release in theatres: 'It deserved...'

Shreyas Talpade recalls how he felt bad when his film Kaun Pravin Tambe did not release in theatres: 'It deserved...'![submenu-img]() Anup Soni slams his deepfake video from Crime Patrol, being used to promote IPL betting

Anup Soni slams his deepfake video from Crime Patrol, being used to promote IPL betting![submenu-img]() Real story that inspired Heeramandi: The tawaif who helped Gandhi fight British Raj, was raped, abused, died in...

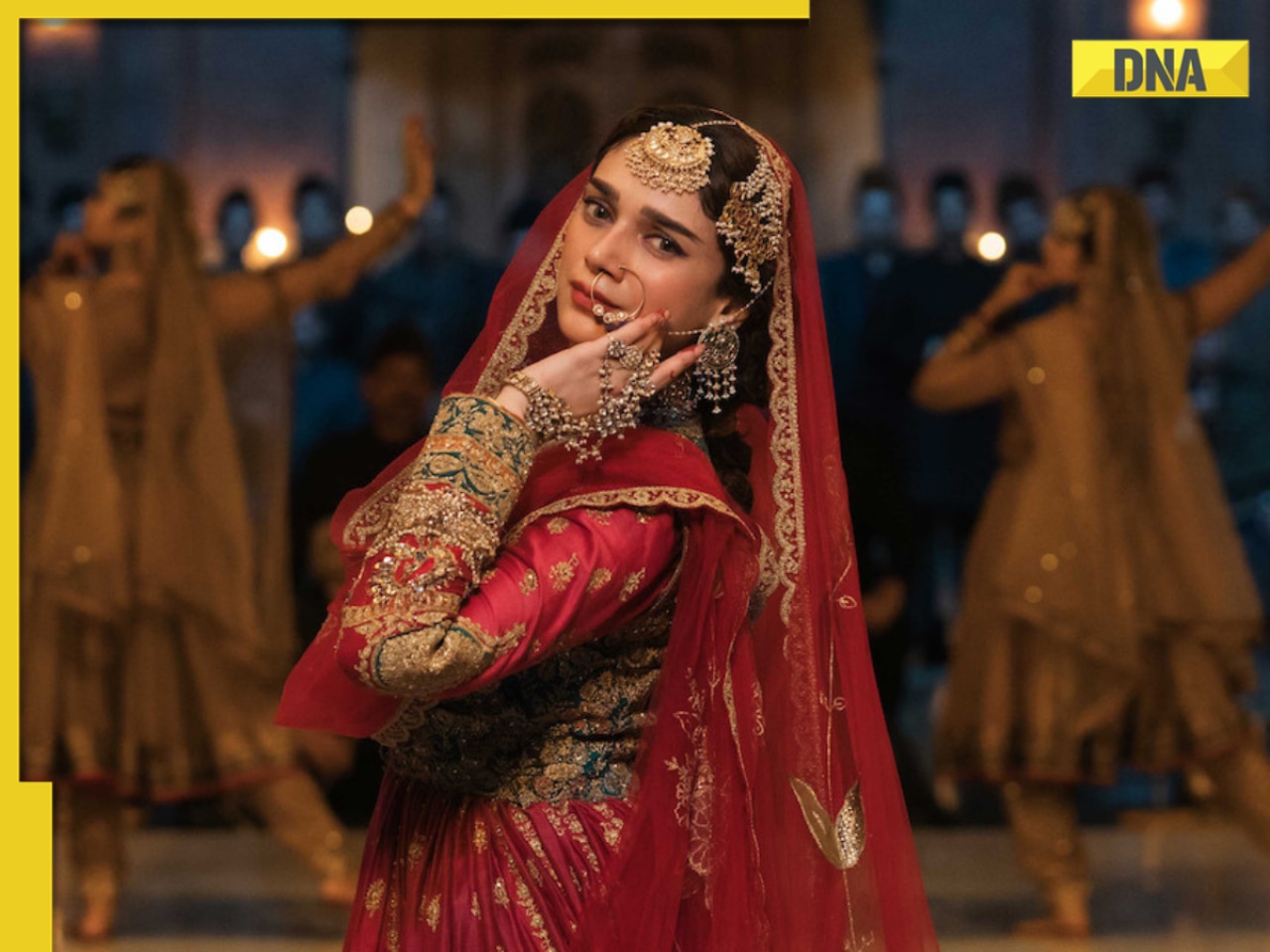

Real story that inspired Heeramandi: The tawaif who helped Gandhi fight British Raj, was raped, abused, died in...![submenu-img]() Man in bizarre jeans dances to Tinku Jiya in crowded metro, viral video makes internet furious

Man in bizarre jeans dances to Tinku Jiya in crowded metro, viral video makes internet furious![submenu-img]() Lift collides with roof in Noida society after brakes fail, 3 injured

Lift collides with roof in Noida society after brakes fail, 3 injured![submenu-img]() Zomato CEO Deepinder Goyal invites employees' moms to office for Mother's Day celebration, watch

Zomato CEO Deepinder Goyal invites employees' moms to office for Mother's Day celebration, watch![submenu-img]() This clip of kind woman feeding rotis to stray cows will bring tears of joy to your eyes, watch

This clip of kind woman feeding rotis to stray cows will bring tears of joy to your eyes, watch![submenu-img]() Viral video: Seagull swallows squirrel whole in single go, internet is stunned

Viral video: Seagull swallows squirrel whole in single go, internet is stunned

)

)

)

)

)

)