The Sesa Goa stock has been buzzing and is up 30.77% to Rs 1,551.55 in the last nine trading sessions.

Insight

The Sesa Goa stock has been buzzing and is up 30.77% to Rs 1,551.55 in the last nine trading sessions. Among notable developments is a hike in global prices of benchmark iron ore (fines), effective from April 1, 2007.

Brazil’s Companhia Vale do Rio Doce (CVRD) and Rio Tinto, two of the three biggest iron ore producers, have settled for a 9.5% hike in the price of benchmark iron ore with Chinese (Baosteel group, China’s largest steelmaker) and Korean steel producers.

This hike follows a 19% hike that took place last year (for 2006-07) besides a 71.5% hike in benchmark prices in 2005-06.

The firm demand and increased output of steel in China and other Asian countries are seen as the key reason for the hike in ore prices.

Incidentally, this time the Chinese companies have taken the lead to strike a deal with mining companies as regards the price for iron ore.

Earlier, it was the Japanese and European companies that took the initiative. And usually, once the first big deal is through, the other players tend to follow.

The significance of China in the global steel industry has increased since the country now accounts for a third of global steel output and is among the biggest importer of iron ore (320 million tons estimated for 2006). And China’s steel output is estimated to rise at a healthy rate over the next 4-5 years.

For Sesa Goa (83.3% of revenues accrue from sale of iron ore), which largely supplies fines and lumps (60% of its total iron ore sales accrue from exports to China and Taiwan), the hike is expected to be lower as the overall quality of its iron ore is relatively lower; analysts say that Sesa may have to settle for a hike of 7-8%.

Another key factor for the rise in Sesa Goa’s stock price is the news about a possible change of guard.

Its Japanese promoter, Mitsui & Co (51% stake), is reportedly planning to exit the business.

Analysts have pegged the company’s value at around Rs 8,000 crore. This works out a little over Rs 2,000 per share.

And what does the buyer get? Sesa Goa’s estimated iron ore reserves of 150 million tons (15-16 years of production at current 9-10 million tons annual output), a debt free company, cash surplus of nearly Rs 500 crore (as on March 2006), operating margins of 47% (last two years), current year’s estimated consolidated net profit of Rs 550-600 crore and two new mines in Jharkhand (to come up over next two years); the net value thus works out to less than Rs 7,000 crore for the buyer.

But what if there is no deal? At Rs 1,551.35, the stock trades at a PE of about 9.5 times its estimated EPS of Rs 162 for 2007-08 (estimated EPS for 2006-07 is Rs 140). While there are no strict comparisons, the valuations appear to be fair.

Logistics logic

The stock of Allcargo Global Logistics touched an all-time high of Rs 1,285.20 after the company announced its decision to acquire Hindustan Cargo, a wholly owned subsidiary of Thomas Cook and engaged in the business of air freight and logistics, for Rs 8.91 crore.

Allcargo is a Multimodal Transport Operator (MTO) offering end-to-end logistics services for export and import cargo. It also has presence in both LCL (less than container load) as well as FCL (full container load).

It is a formidable player in the ocean freight business and with this acquisition; Allcargo is equipped to offer an assortment of services in the freight division, as it adds air freight services.

Allcargo operates a state-of-the-art container freight station (CFS) at JNPT with a capacity to handle 120,000 containers (20-feet equivalent). The contribution from this segment is expected to increase on account of capacity expansions and setting up of green-field CFS at Chennai and Mundra and rail linked inland container depot at Delhi.

Add to it the higher margins at JNPT as compared to CFS operations at other places in India; Allcargo is well poised to benefit from this segment and narrowing the gap in this segment, with its competitor Gateway Distriparks.

Earlier, in June 2006, Allcargo acquired ECU Line, one of the leading global non-vessel owning company carrier (NVOCC) players.

ECU has 120 offices in 56 countries and franchisees and agents at 203 locations in 126 countries and catering to over 4,000 destinations; this is expected to add significantly to the company’s revenues.

ECU has strong presence in the high margin markets of Europe, Latin America, and Africa and on the cards are plans of expanding operations, in the high volume markets of USA and China.

It is interesting to note that Allcargo’s business is dependent on shipping lines. It is in a good bargaining position with the shipping lines as its combined total space requirements on ships will be bought as a common platform from Hong Kong resulting in greater discounts.

Also, MTO business buys containers from shipping lines whereas CFS depends on shipping lines to boost the handling of container volumes, resulting in a unique business model.

The stock has appreciated by 15.1% since the announcement on January 2nd 2007. At Rs 1,223, it trades at a PE of 15 times its estimated earnings for the year ending December 2008.

In the backdrop of strong macroeconomic parameters, the containerized trade may grow at a CAGR of 14-16% and being a major player, Allcargo merits attention at declines.

Contributed by Vishal Chhabria and Devangi Bhuta

![submenu-img]() Ramesh Awasthi: Kanpur's 'Karma Yogi' - Know inspirational journey of 'common man' devoted for society

Ramesh Awasthi: Kanpur's 'Karma Yogi' - Know inspirational journey of 'common man' devoted for society![submenu-img]() Tovino Thomas accused of stopping his film Vazhakku's release by director Sanal Kumar Sasidharan: 'The agenda of...'

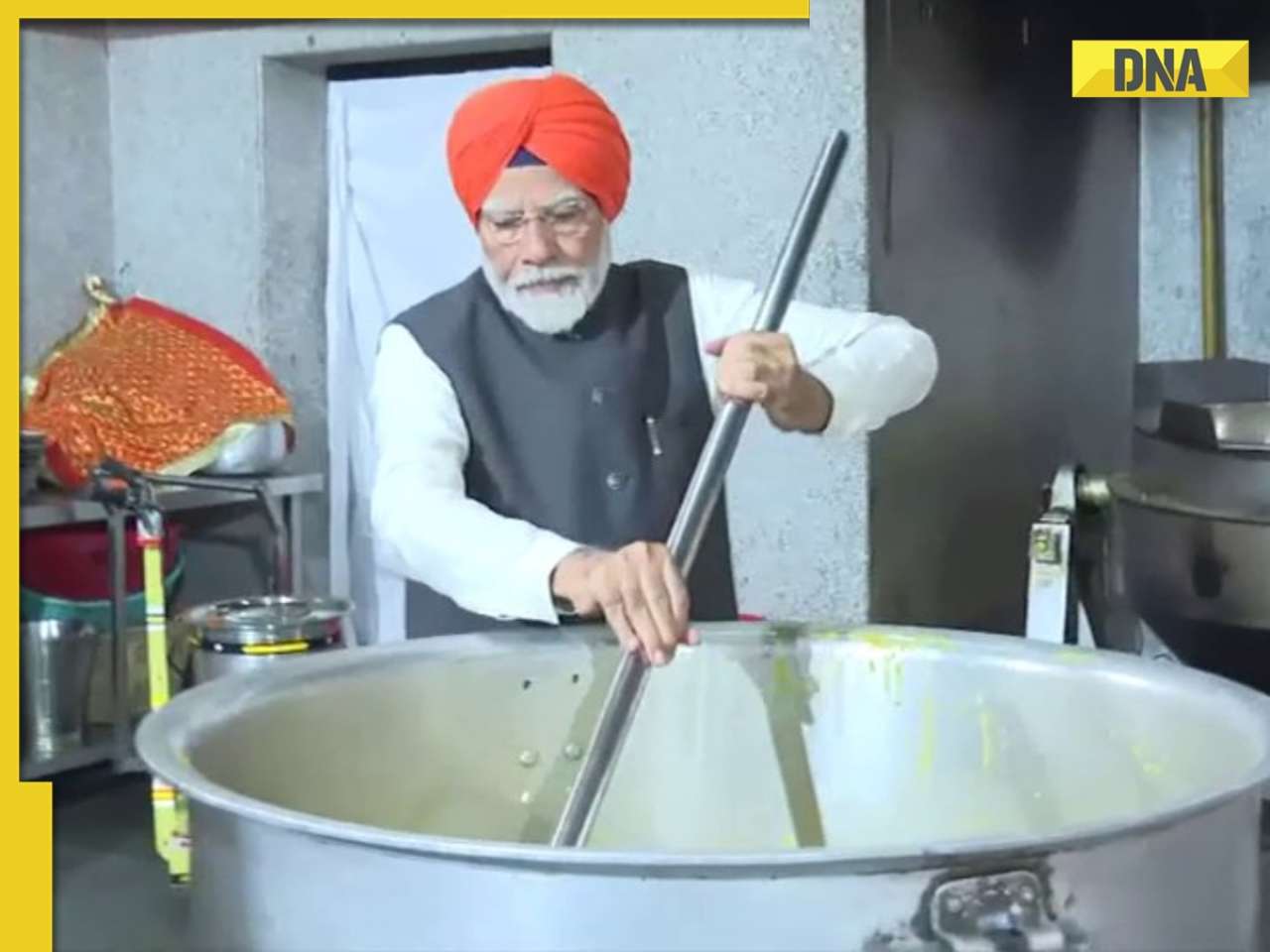

Tovino Thomas accused of stopping his film Vazhakku's release by director Sanal Kumar Sasidharan: 'The agenda of...'![submenu-img]() PM Modi wears turban, serves langar at Gurudwara Patna Sahib in Bihar, watch

PM Modi wears turban, serves langar at Gurudwara Patna Sahib in Bihar, watch![submenu-img]() Anil Ambani’s debt-ridden Reliance’s ‘buyer’ now waits for RBI nod, wants Rs 80000000000…

Anil Ambani’s debt-ridden Reliance’s ‘buyer’ now waits for RBI nod, wants Rs 80000000000…![submenu-img]() Man in bizarre jeans dances to Tinku Jiya in crowded metro, viral video makes internet furious

Man in bizarre jeans dances to Tinku Jiya in crowded metro, viral video makes internet furious![submenu-img]() Maharashtra Board HSC, SSC Results 2024: MSBSHSE class 10, 12 results soon at mahresult.nic.in, latest update here

Maharashtra Board HSC, SSC Results 2024: MSBSHSE class 10, 12 results soon at mahresult.nic.in, latest update here![submenu-img]() Meet IIT-JEE topper who passed JEE Advanced with AIR 1, decided to drop out of IIT due to…

Meet IIT-JEE topper who passed JEE Advanced with AIR 1, decided to drop out of IIT due to…![submenu-img]() Meet IPS Idashisha Nongrang, who became Meghalaya's first woman DGP

Meet IPS Idashisha Nongrang, who became Meghalaya's first woman DGP![submenu-img]() CBSE Results 2024: CBSE Class 10, 12 results date awaited, check latest update here

CBSE Results 2024: CBSE Class 10, 12 results date awaited, check latest update here![submenu-img]() Meet man, who was denied admission in IIT due to blindness, inspiration behind Rajkummar Rao’s film, now owns...

Meet man, who was denied admission in IIT due to blindness, inspiration behind Rajkummar Rao’s film, now owns...![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Remember Harsh Lunia? Just Mohabbat child star, here's how former actor looks now, his wife is Bollywood's popular...

Remember Harsh Lunia? Just Mohabbat child star, here's how former actor looks now, his wife is Bollywood's popular...![submenu-img]() Mother's Day 2024: Bollywood supermoms who balance motherhood, acting, and run multi-crore businesses

Mother's Day 2024: Bollywood supermoms who balance motherhood, acting, and run multi-crore businesses![submenu-img]() Rocky Aur Rani's Golu aka Anjali Anand shocks fans with drastic weight loss without gym, says fitness secret is...

Rocky Aur Rani's Golu aka Anjali Anand shocks fans with drastic weight loss without gym, says fitness secret is...![submenu-img]() In pics: Ram Charan gets mobbed by fans during his visit to Pithapuram for ‘indirect campaign’ for uncle Pawan Kalyan

In pics: Ram Charan gets mobbed by fans during his visit to Pithapuram for ‘indirect campaign’ for uncle Pawan Kalyan![submenu-img]() Streaming This Week: Yodha, Aavesham, Murder In Mahim, Undekhi season 3, latest OTT releases to binge-watch

Streaming This Week: Yodha, Aavesham, Murder In Mahim, Undekhi season 3, latest OTT releases to binge-watch![submenu-img]() Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?

Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() Tovino Thomas accused of stopping his film Vazhakku's release by director Sanal Kumar Sasidharan: 'The agenda of...'

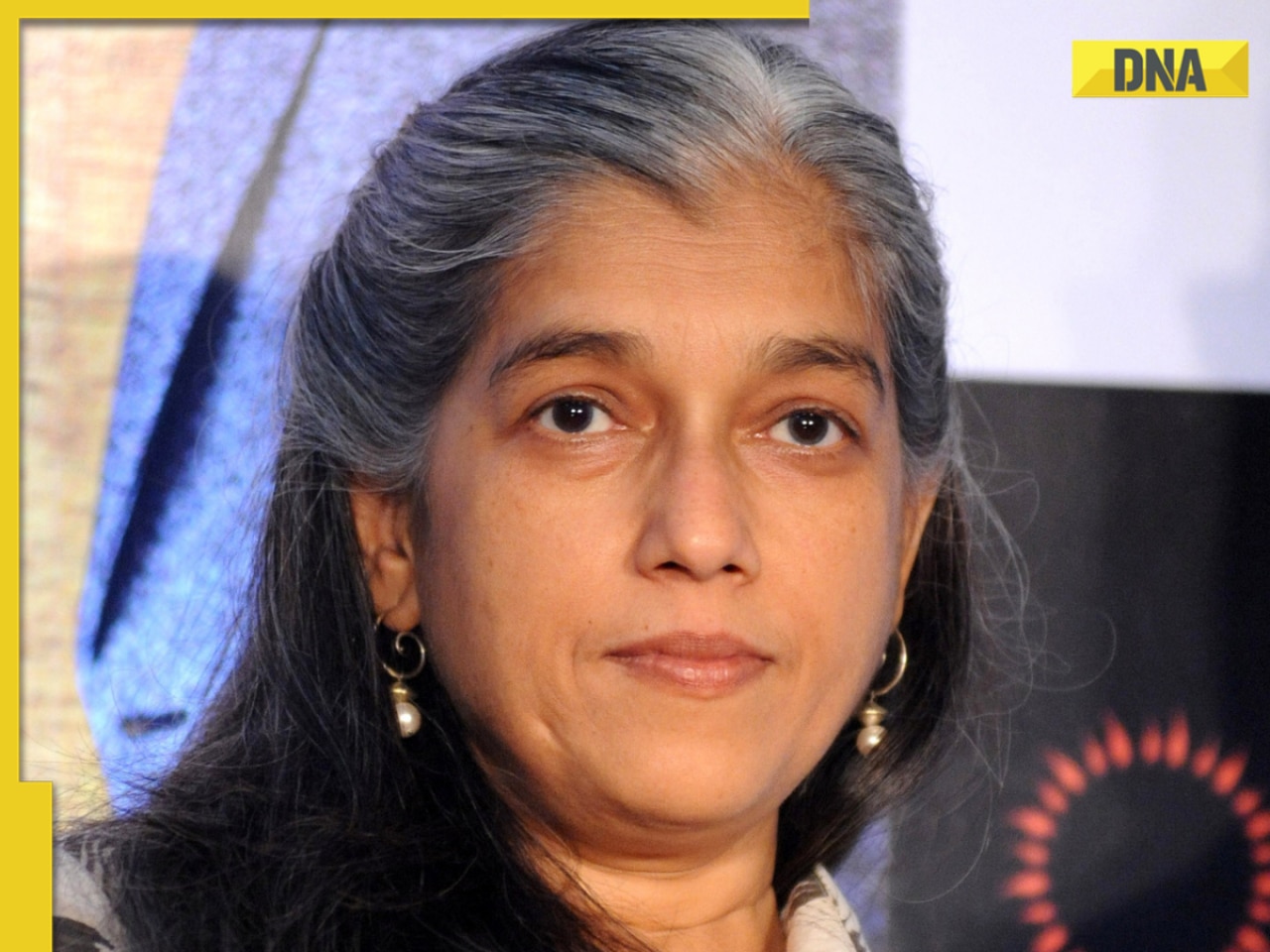

Tovino Thomas accused of stopping his film Vazhakku's release by director Sanal Kumar Sasidharan: 'The agenda of...'![submenu-img]() Ratna Pathak Shah calls Guru Dutt and Bimal Roy's films 'offensive', says, 'women are constantly...'

Ratna Pathak Shah calls Guru Dutt and Bimal Roy's films 'offensive', says, 'women are constantly...'![submenu-img]() Shreyas Talpade recalls how he felt bad when his film Kaun Pravin Tambe did not release in theatres: 'It deserved...'

Shreyas Talpade recalls how he felt bad when his film Kaun Pravin Tambe did not release in theatres: 'It deserved...'![submenu-img]() Anup Soni slams his deepfake video from Crime Patrol, being used to promote IPL betting

Anup Soni slams his deepfake video from Crime Patrol, being used to promote IPL betting![submenu-img]() Real story that inspired Heeramandi: The tawaif who helped Gandhi fight British Raj, was raped, abused, died in...

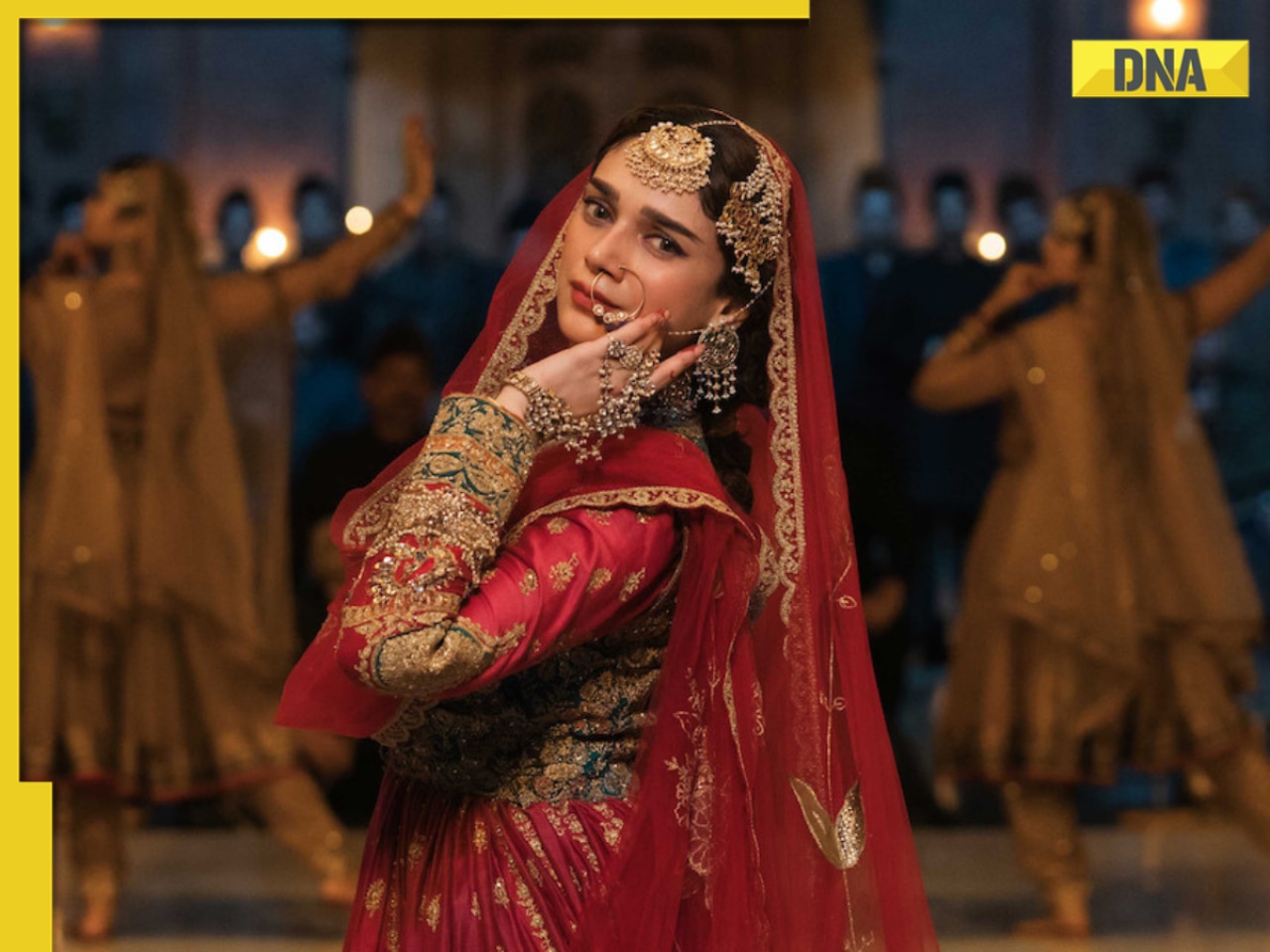

Real story that inspired Heeramandi: The tawaif who helped Gandhi fight British Raj, was raped, abused, died in...![submenu-img]() Man in bizarre jeans dances to Tinku Jiya in crowded metro, viral video makes internet furious

Man in bizarre jeans dances to Tinku Jiya in crowded metro, viral video makes internet furious![submenu-img]() Lift collides with roof in Noida society after brakes fail, 3 injured

Lift collides with roof in Noida society after brakes fail, 3 injured![submenu-img]() Zomato CEO Deepinder Goyal invites employees' moms to office for Mother's Day celebration, watch

Zomato CEO Deepinder Goyal invites employees' moms to office for Mother's Day celebration, watch![submenu-img]() This clip of kind woman feeding rotis to stray cows will bring tears of joy to your eyes, watch

This clip of kind woman feeding rotis to stray cows will bring tears of joy to your eyes, watch![submenu-img]() Viral video: Seagull swallows squirrel whole in single go, internet is stunned

Viral video: Seagull swallows squirrel whole in single go, internet is stunned

)

)

)

)

)

)