Ankit Shah, an Ahmedabad-based investor, was not overly excited when the Sensex crossed the 13,000 mark on Monday.

Sanat Vallikappen & Himansh Dhomse

MUMBAI?AHMEDABAD: Ankit Shah, an Ahmedabad-based investor, was not overly excited when the Sensex crossed the 13,000 mark on Monday.

Like thousands of retail investors, he has bet on mid- and small-caps stocks, where there is not much to show by way of gains.

On Monday, the Sensex closed above the 13,000 milestone for the first time, ending 0.91 per cent up at 13,024.26 points, a gain of 117.45 points.

Meanwhile, the BSE Mid-cap Index ended with marginal gains of 0.49 per cent and the BSE Small-cap Index declined by 0.56 per cent.

This, in a way, mirrors what has been happening with these stocks over the past few months.

While the Sensex has been touching new highs every other day, it has been a rally based on a few stocks. The larger number of small- and mid-cap shares has been languishing.

In fact, in the period when the Sensex ran up from 12,000 to 13,000 points, gaining 8.18 per cent in the process, the BSE Mid-cap and Small-cap indices have delivered negative returns of -3.41 per cent and -7.35 per cent.

No wonder Shah is disenchanted. “I am concerned with small- and mid-cap stocks, where I’ve parked my money,” he said. “If they don’t go up, it doesn’t bother me even if the Sensex crosses 15,000.”

But will the Sensex continue scaling new highs?

“Global markets have been falling since Friday, and if their downside momentum gathers steam, then the Indian markets could also crack,” said Deepak Mohoni, managing director, trendwatchindia.com. “In any case, the gains of Friday and Monday have been confined to a few stocks.”

Mohoni said, however, that if global markets start rising again, there could be another broad-based short-term rally.

Mohoni advises investors not to be unduly thrilled by the number 13,000. “If one is taking a medium- or long-term view, it is best to wait for a dip to park your money in equities,” he said.

A correction cannot be too far away, as the rally has been going on since the end of July. But as has been the case in the past, the markets tend to defy logic, often leaving even the experts stunned.

![submenu-img]() Big update on Pakistan's first-ever Moon mission and it has this China connection...

Big update on Pakistan's first-ever Moon mission and it has this China connection...![submenu-img]() 2024 Maruti Suzuki Swift officially teased ahead of launch, bookings open at price of Rs…

2024 Maruti Suzuki Swift officially teased ahead of launch, bookings open at price of Rs…![submenu-img]() 'Kyun bhai kyun?': Sheezan Khan slams actors in Sanjay Leela Bhansali's Heeramandi, says 'nobody could...'

'Kyun bhai kyun?': Sheezan Khan slams actors in Sanjay Leela Bhansali's Heeramandi, says 'nobody could...'![submenu-img]() Meet Jai Anmol, his father had net worth of over Rs 183000 crore, he is Mukesh Ambani’s…

Meet Jai Anmol, his father had net worth of over Rs 183000 crore, he is Mukesh Ambani’s…![submenu-img]() Shooting victim in California not gangster Goldy Brar, accused of Sidhu Moosewala’s murder, confirm US police

Shooting victim in California not gangster Goldy Brar, accused of Sidhu Moosewala’s murder, confirm US police![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'

Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'![submenu-img]() In pics: Arti Singh stuns in red lehenga as she ties the knot with beau Dipak Chauhan in dreamy wedding

In pics: Arti Singh stuns in red lehenga as she ties the knot with beau Dipak Chauhan in dreamy wedding![submenu-img]() Actors who died due to cosmetic surgeries

Actors who died due to cosmetic surgeries![submenu-img]() See inside pics: Malayalam star Aparna Das' dreamy wedding with Manjummel Boys actor Deepak Parambol

See inside pics: Malayalam star Aparna Das' dreamy wedding with Manjummel Boys actor Deepak Parambol ![submenu-img]() In pics: Salman Khan, Alia Bhatt, Rekha, Neetu Kapoor attend grand premiere of Sanjay Leela Bhansali's Heeramandi

In pics: Salman Khan, Alia Bhatt, Rekha, Neetu Kapoor attend grand premiere of Sanjay Leela Bhansali's Heeramandi![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence

DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence![submenu-img]() 'Kyun bhai kyun?': Sheezan Khan slams actors in Sanjay Leela Bhansali's Heeramandi, says 'nobody could...'

'Kyun bhai kyun?': Sheezan Khan slams actors in Sanjay Leela Bhansali's Heeramandi, says 'nobody could...'![submenu-img]() Meet actress who once competed with Aishwarya Rai on her mother's insistence, became single mother at 24, she is now..

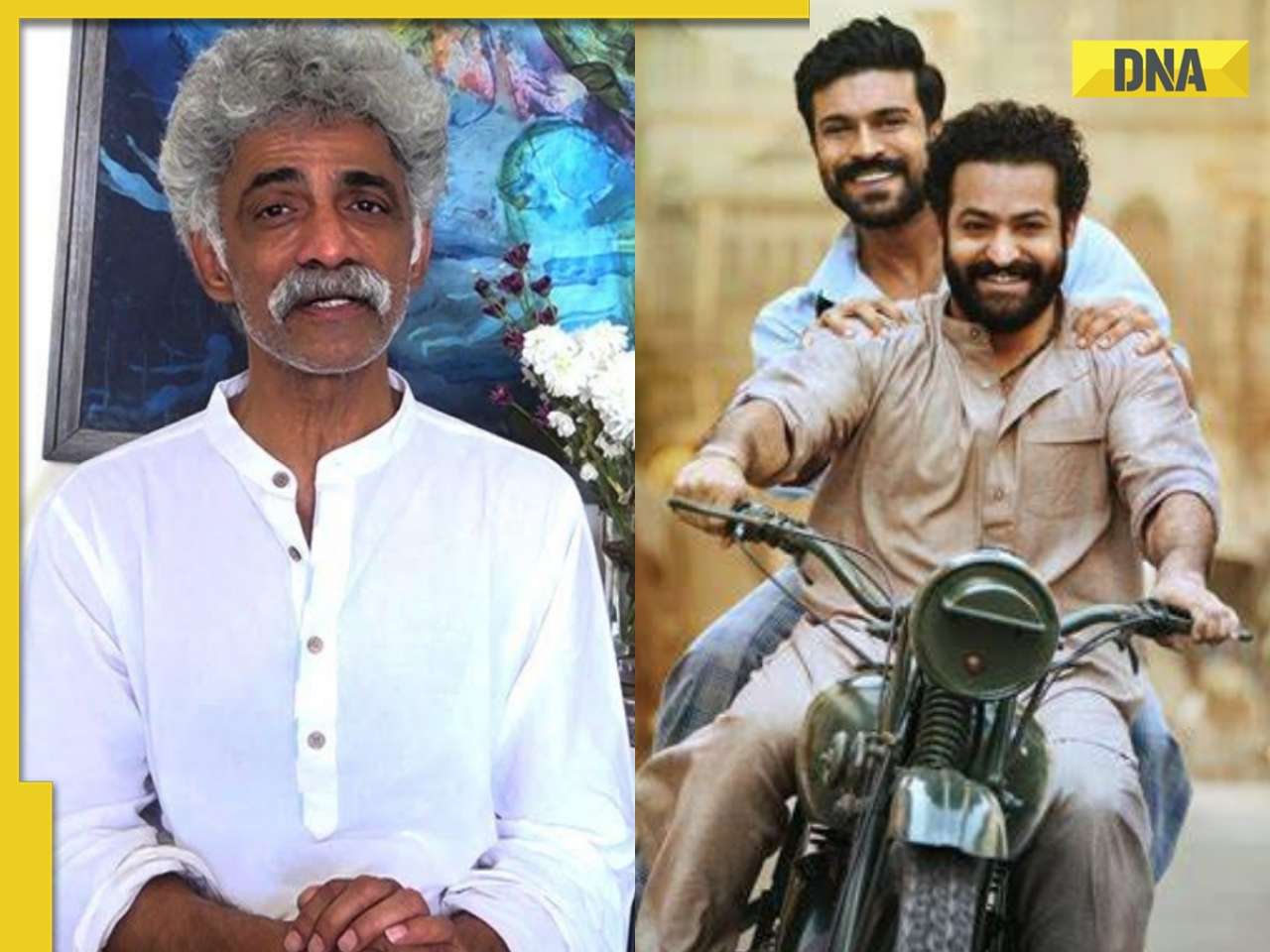

Meet actress who once competed with Aishwarya Rai on her mother's insistence, became single mother at 24, she is now..![submenu-img]() Makarand Deshpande says his scenes were cut in SS Rajamouli’s RRR: ‘It became difficult for…’

Makarand Deshpande says his scenes were cut in SS Rajamouli’s RRR: ‘It became difficult for…’![submenu-img]() Meet 70s' most daring actress, who created controversy with nude scenes, was rumoured to be dating Ratan Tata, is now...

Meet 70s' most daring actress, who created controversy with nude scenes, was rumoured to be dating Ratan Tata, is now...![submenu-img]() Meet superstar’s sister, who debuted at 57, worked with SRK, Akshay, Ajay Devgn; her films earned over Rs 1600 crore

Meet superstar’s sister, who debuted at 57, worked with SRK, Akshay, Ajay Devgn; her films earned over Rs 1600 crore![submenu-img]() IPL 2024: Spinners dominate as Punjab Kings beat Chennai Super Kings by 7 wickets

IPL 2024: Spinners dominate as Punjab Kings beat Chennai Super Kings by 7 wickets![submenu-img]() Australia T20 World Cup 2024 squad: Mitchell Marsh named captain, Steve Smith misses out, check full list here

Australia T20 World Cup 2024 squad: Mitchell Marsh named captain, Steve Smith misses out, check full list here![submenu-img]() SRH vs RR, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

SRH vs RR, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() SRH vs RR IPL 2024 Dream11 prediction: Fantasy cricket tips for Sunrisers Hyderabad vs Rajasthan Royals

SRH vs RR IPL 2024 Dream11 prediction: Fantasy cricket tips for Sunrisers Hyderabad vs Rajasthan Royals ![submenu-img]() IPL 2024: Marcus Stoinis, Mohsin Khan power Lucknow Super Giants to 4-wicket win over Mumbai Indians

IPL 2024: Marcus Stoinis, Mohsin Khan power Lucknow Super Giants to 4-wicket win over Mumbai Indians![submenu-img]() Viral video: Man's 'peek-a-boo' moment with tiger sends shockwaves online, watch

Viral video: Man's 'peek-a-boo' moment with tiger sends shockwaves online, watch![submenu-img]() Viral video: Desi woman's sizzling dance to Jacqueline Fernandez’s ‘Yimmy Yimmy’ burns internet, watch

Viral video: Desi woman's sizzling dance to Jacqueline Fernandez’s ‘Yimmy Yimmy’ burns internet, watch![submenu-img]() Viral video: Men turn car into mobile swimming pool, internet reacts

Viral video: Men turn car into mobile swimming pool, internet reacts![submenu-img]() Meet Youtuber Dhruv Rathee's wife Julie, know viral claims about her and how did the two meet

Meet Youtuber Dhruv Rathee's wife Julie, know viral claims about her and how did the two meet![submenu-img]() Viral video of baby gorilla throwing tantrum in front of mother will cure your midweek blues, watch

Viral video of baby gorilla throwing tantrum in front of mother will cure your midweek blues, watch

)

)

)

)

)

)