Scan through real estate listings online and in newspapers for the property prices

Buying a home is a one of the most important decisions that involves detailed planning and implementation. After you have decided to buy a home, here are a few steps to simplify your journey towards owning your dream home.

In-depth research: Check for the current housing trends and various regulations and factors affecting the housing industry. Scan through real estate listings online and in newspapers for the property prices of the various locations in the city of your choice. Make a note of particular houses you are interested in and check their value, demand in the market and change in price. Connect and consult with relevant sources to collate the right information to make an informed decision.

Budget identification: It is important to understand the affordability level and home loan approval status to identify your budget to buy your dream home. Lenders generally recommend that people look for homes that cost no more than three to five times their annual household income if the home buyers plan to make a 20% down payment and have a moderate amount of other debt. You can use your funds from fixed deposits, investments and other asset sale to make this down-payment.

Listing out investment goals: Before applying any loan, list out your investment goals and check how much money you can keep aside for your home loan EMI. Your investment goals can be retirement savings, child’s education, life Insurance plans, medical Insurance premiums, etc. Servicing your investment goals is important but ensure that you don’t miss out your EMIs due to an emergency.

Lending institution: After identifying your budget, collect information on the rate of interest offered by different housing finance companies (HFCs). There are multiple factors that you need to consider before choosing a home loan provider - interest rates, fixed or floating, processing fee, part-payment charges, waivers on foreclosure fees, conversion fees, top-up loan facility, etc., another important element is the service standards. Always compare across lenders and conduct thorough research before choosing the right home loan.

Credit bureau score: Financial institutions consider credit bureau scores to assess the credit-worthiness of the candidate applying for home loan. The score determines the financial discipline and loan servicing capability of the applicant. Timely payment of credit cards and of other EMIs, and a stable source of income contributes majorly to a healthy score. Financial institutions prefer customers with a good credit score as it reflects stronger credit worthiness. This gives a clear picture about the applicant’s credit history, past payment behaviour and makes way for attractive interest rates for the borrower. Improving one’s loan eligibility will also have positive impacts on one’s personal financial planning and help move towards better financial security in life.

Pre-approved home loan: One must avail a pre-qualified credit status through a loan sanction letter stating that the borrower will be able to avail a loan up to a certain amount subject to meeting certain terms and conditions. This status helps the borrower get clarity in terms of eligibility and finances and holds a validity from one to six months. The status not only provides a prospective seller an impression that the buyer is a serious customer but also enables quick loan disbursal.

Government reforms/schemes: Based on your income group, you can avail the Pradhan Mantri Awas Yojana (PMAY), a ‘Housing for all’ initiative by the government to ensure a credit-linked subsidy scheme on home loans for properties in the market space.

Tenure of loan repayment: People are often confused about what is better - increase in EMI or increase in tenure? Owing to inflation and interest rates, longer tenure are helpful for home borrowers as it eases the burden of EMIs. Most HFCs also advice increasing the tenure rather than increasing the EMI. Home borrowers also prefer to increase the tenure than the EMI as their budget is fixed and any instability in expenses will have wider consequence on their lifestyle. The loan tenure should not exceed your retirement age as you will need more money for health and old age-related expenses.

Use advanced technology: Nowadays, most HFCs are equipped with advanced technologies to serve all types of customers according to their needs. Due to government’s digital push, HFCs have geared up towards processing credit decisions in a fast, transparent and cost-effective manner. They have extended its reach beyond the physical branch setup and embedded speed in its loan processing systems. It is definitely a win-win situation for both the lender and the end customer.

The writer is joint managing director and CEO, DHFL

![submenu-img]() BMW i5 M60 xDrive launched in India, all-electric sedan priced at Rs 11950000

BMW i5 M60 xDrive launched in India, all-electric sedan priced at Rs 11950000![submenu-img]() This superstar was arrested several times by age 17, thrown out of home, once had just Rs 250, now worth Rs 6600 crore

This superstar was arrested several times by age 17, thrown out of home, once had just Rs 250, now worth Rs 6600 crore![submenu-img]() Meet Reliance’s highest paid employee, gets over Rs 240000000 salary, he is Mukesh Ambani’s…

Meet Reliance’s highest paid employee, gets over Rs 240000000 salary, he is Mukesh Ambani’s… ![submenu-img]() Meet lesser-known relative of Mukesh Ambani, Anil Ambani, has worked with BCCI, he is married to...

Meet lesser-known relative of Mukesh Ambani, Anil Ambani, has worked with BCCI, he is married to...![submenu-img]() Made in just Rs 95,000, this film was a superhit, but destroyed lead actress' career, saw controversy over bold scenes

Made in just Rs 95,000, this film was a superhit, but destroyed lead actress' career, saw controversy over bold scenes![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() In pics: Arti Singh stuns in red lehenga as she ties the knot with beau Dipak Chauhan in dreamy wedding

In pics: Arti Singh stuns in red lehenga as she ties the knot with beau Dipak Chauhan in dreamy wedding![submenu-img]() Actors who died due to cosmetic surgeries

Actors who died due to cosmetic surgeries![submenu-img]() See inside pics: Malayalam star Aparna Das' dreamy wedding with Manjummel Boys actor Deepak Parambol

See inside pics: Malayalam star Aparna Das' dreamy wedding with Manjummel Boys actor Deepak Parambol ![submenu-img]() In pics: Salman Khan, Alia Bhatt, Rekha, Neetu Kapoor attend grand premiere of Sanjay Leela Bhansali's Heeramandi

In pics: Salman Khan, Alia Bhatt, Rekha, Neetu Kapoor attend grand premiere of Sanjay Leela Bhansali's Heeramandi![submenu-img]() Streaming This Week: Crakk, Tillu Square, Ranneeti, Dil Dosti Dilemma, latest OTT releases to binge-watch

Streaming This Week: Crakk, Tillu Square, Ranneeti, Dil Dosti Dilemma, latest OTT releases to binge-watch![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence

DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence![submenu-img]() DNA Explainer: What is India's stand amid Iran-Israel conflict?

DNA Explainer: What is India's stand amid Iran-Israel conflict?![submenu-img]() This superstar was arrested several times by age 17, thrown out of home, once had just Rs 250, now worth Rs 6600 crore

This superstar was arrested several times by age 17, thrown out of home, once had just Rs 250, now worth Rs 6600 crore![submenu-img]() Made in just Rs 95,000, this film was a superhit, but destroyed lead actress' career, saw controversy over bold scenes

Made in just Rs 95,000, this film was a superhit, but destroyed lead actress' career, saw controversy over bold scenes![submenu-img]() Meet 72-year-old who earns Rs 280 cr per film, Asia's highest-paid actor, bigger than Shah Rukh, Salman, Akshay, Prabhas

Meet 72-year-old who earns Rs 280 cr per film, Asia's highest-paid actor, bigger than Shah Rukh, Salman, Akshay, Prabhas![submenu-img]() This star, who once lived in chawl, worked as tailor, later gave four Rs 200-crore films; he's now worth...

This star, who once lived in chawl, worked as tailor, later gave four Rs 200-crore films; he's now worth...![submenu-img]() Tamil star Prasanna reveals why he chose series Ranneeti for Hindi debut: 'Getting into Bollywood is not...'

Tamil star Prasanna reveals why he chose series Ranneeti for Hindi debut: 'Getting into Bollywood is not...'![submenu-img]() IPL 2024: Virat Kohli, Rajat Patidar fifties and disciplined bowling help RCB beat Sunrisers Hyderabad by 35 runs

IPL 2024: Virat Kohli, Rajat Patidar fifties and disciplined bowling help RCB beat Sunrisers Hyderabad by 35 runs![submenu-img]() 'This is the problem in India...': Wasim Akram's blunt take on fans booing Mumbai Indians skipper Hardik Pandya

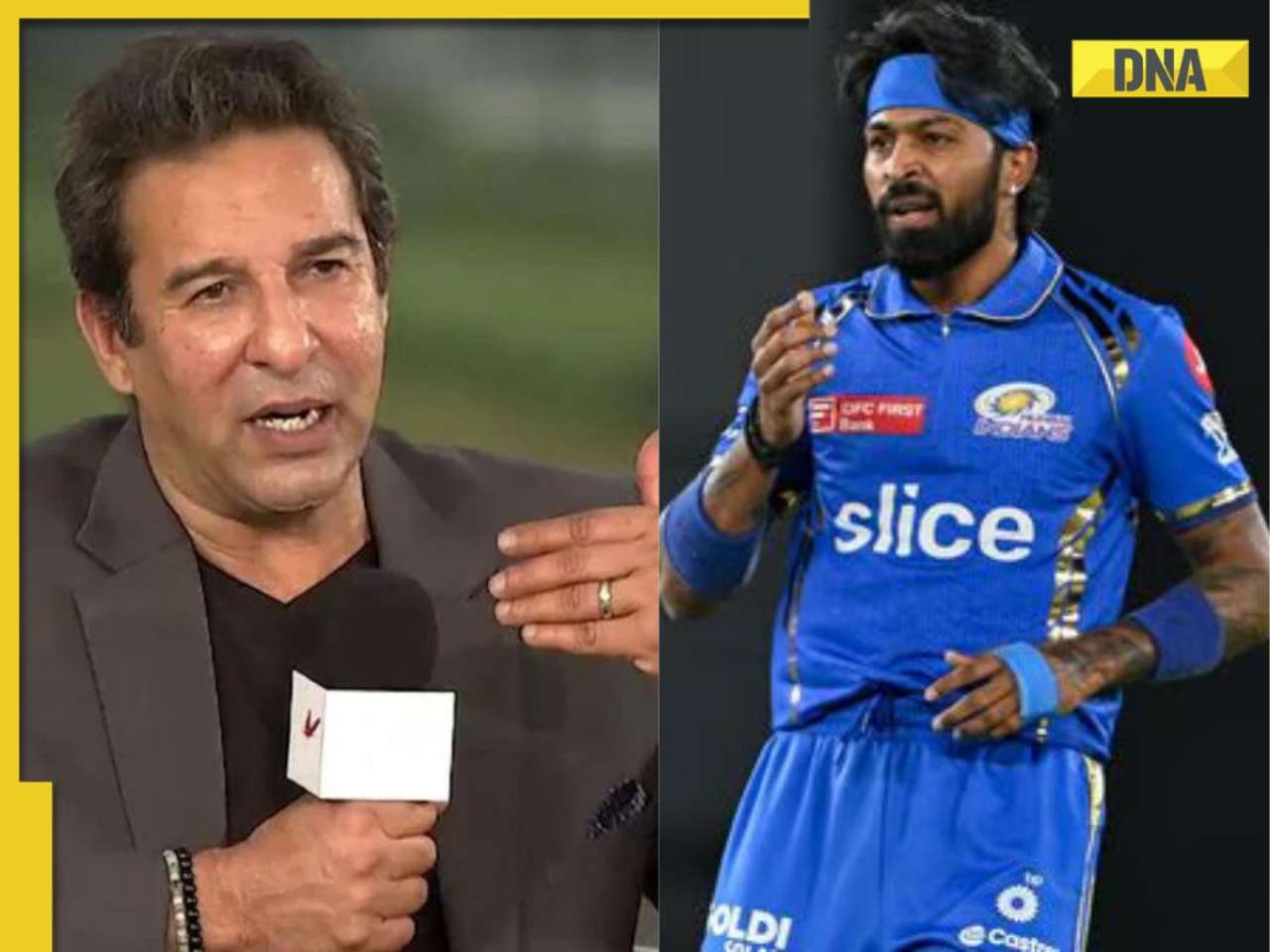

'This is the problem in India...': Wasim Akram's blunt take on fans booing Mumbai Indians skipper Hardik Pandya![submenu-img]() KKR vs PBKS, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

KKR vs PBKS, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() KKR vs PBKS IPL 2024 Dream11 prediction: Fantasy cricket tips for Kolkata Knight Riders vs Punjab Kings

KKR vs PBKS IPL 2024 Dream11 prediction: Fantasy cricket tips for Kolkata Knight Riders vs Punjab Kings![submenu-img]() IPL 2024: KKR star Rinku Singh finally gets another bat from Virat Kohli after breaking previous one - Watch

IPL 2024: KKR star Rinku Singh finally gets another bat from Virat Kohli after breaking previous one - Watch![submenu-img]() Viral video: Teacher's cute way to capture happy student faces melts internet, watch

Viral video: Teacher's cute way to capture happy student faces melts internet, watch![submenu-img]() Woman attends online meeting on scooter while stuck in traffic, video goes viral

Woman attends online meeting on scooter while stuck in traffic, video goes viral![submenu-img]() Viral video: Pilot proposes to flight attendant girlfriend before takeoff, internet hearts it

Viral video: Pilot proposes to flight attendant girlfriend before takeoff, internet hearts it![submenu-img]() Pakistani teen receives life-saving heart transplant from Indian donor, details here

Pakistani teen receives life-saving heart transplant from Indian donor, details here![submenu-img]() Viral video: Truck driver's innovative solution to beat the heat impresses internet, watch

Viral video: Truck driver's innovative solution to beat the heat impresses internet, watch

)

)

)

)

)

)

)