Recipient is usually covered for all expenses, including pre- and post-hospitalisation, but there are restrictions for donors

Top government officials and ministers have been in the news for undergoing an organ transplant. The ever-increasing cost of such procedures, easily running into lakhs, is what scares ordinary people. The rich can afford it, but can we? Yes, we can. Many people don't know that a medical/health insurance policy these days covers organ transplant expenses. Be, it kidney or liver or any other organ, health insurers are open to organ transplants. DNA Money spoke to health insurers about sum assured, claim process and other nitty-gritty such as donor expenses, pre and post hospitalisation spends, etc.

Coverage

Organ donation is the transplant of a biological organ or tissue from one individual, called the donor, to another, the recipient, that is, the person requiring the transplant. From a cost perspective, organ transplant procedures include pre-hospitalisation medicines and tests, in-patient hospitalisation for surgery and post-hospitalisation spends like medicines, diagnostic tests.

Organ transplant cover is offered as an inbuilt cover under health insurance policy or as an add-on, which provides coverage for both donor's and recipient's treatment-related expenses.

"It is always advisable to understand the scope of coverage to make the best use of your health insurance policy. A recipient gets cover for all the transplant-related expenses, including pre- and post-hospitalisation," said Nirmal Bhattacharya, chief–underwriter, Universal Sompo General Insurance.

It is important to understand the exact coverage. For instance, Cigna TTK's ProHealth Insurance and ProHealth Select covers the donor and the recipient. This means apart from insured person who is covered within the health insurance policy, it also covers the donor's in-patient hospitalisation expenses up to the full sum insured.

In Royal Sundaram's Lifeline and Family Plus policies, expenses for organ donation are covered without any sub-limit, said Nikhil Apte, chief product officer, product factory (health). Organ donor expenses to the extent of surgical procedures are covered, but pre- and post-hospitalisation expenses of the donor are not covered.

In the case of Star Health, organ donor expenses for organ transplantation, where the insured person is the recipient are payable, provided the claim for transplantation is payable and subject to the availability of the sum insured.

"Donor screening expenses and post-donation complications of the donor are not payable. This cover is subject to a limit," said Anand Roy, the company's executive director, and chief marketing officer.

ICICI Lombard's base hospitalisation product, Complete Health Insurance (CHI), offers donor expenses as an add-on cover. "Donor expenses are covered under the base plan for super top-up product – Health Booster. Both products cover hospitalisation expenses only, though the extent of cover varies for both products. Under CHI we have a maximum limit of Rs 50,000 and for Health Booster we cover up to the sum insured opted by the customer," said Sanjay Datta, chief - underwriting & claims, ICICI Lombard.

Some critical care policies of different companies cover major organ and bone marrow transplant. If an insured is diagnosed to be suffering from a covered critical illness, while the policy is in force, the sum assured money is paid in lumpsum or in installments.

In the benefit category, Cigna TTK offers Lifestyle Protection, Critical Care policy which covers major organs (heart, lung, liver, kidney, pancreas) and bone marrow transplant. "If an insured is diagnosed to be suffering with a covered critical illness while the policy is in force, a lump sum amount equal to the sum insured is paid at one go, or in instalments as opted by the policyholder post waiting and survival periods," said Jyoti Punja, chief operating officer and customer officer at Cigna TTK Health Insurance. However, this benefit does not cover expenses towards the donor when it comes to costs incurred to screen the right donor, direct or indirect costs to acquire the organ and any other medical treatment or complication in respect of the donor, consequent to harvesting, she added.

Costs

Organ transplants cost money. "It is not difficult to assume that Rs 10-20 lakh may be spent on a procedure,'' said Apte. Plus, post-hospitalisation costs can be an added burden of Rs 1-2 lakh. So, do remember that sum assured has to be a big amount for the policy to bear all the expenses. "If you have a Rs 5 lakh sum assured, it will be too little for an organ transplant in most cases," Apte added.

If the situation gets complicated, the post-hospitalisation costs can be a lot. Star Health's Roy said that post-surgery medication is covered, whilst the insured person is required to stay in hospital, and also up to the post hospitalisation period, allowed under the respective policy and the limits, if any.

Typically, you may require a medical care window of 60-180 days after transplant. ICICI Lombard covers the pre- and post-hospitalisation expenses of the recipient up to sum insured opted for 30 and 60 days respectively under CHI, and 60 and 90 days respectively under Health Booster. Royal Sundaram's Lifeline (top-end 'elite' plan) covers pre- and post-hospitalisation expenses for 60-180 days. All such covers are up to the sum assured.

Often, post-transplant, immunity is lowered via immunosuppressant medications. Plus, regular diagnostic costs are conducted to monitor health. This can be both for the donor and the recipient. Universal Sompo's Bhattacharya said that, unlike an insured recipient, there are certain restrictions on the part of cover for donors, and this varies from insurer to insurer.

"Mostly, expenses related to pre- and post-hospitalisation or any other medical treatment for the donor consequent on the harvesting or any other costs directly or indirectly associated with the acquisition of the donor's organ are not covered under the policy subject to terms and conditions," he pointed out.

There are also different factors to consider:

Firstly, organ transplant is a well-planned process and gives you enough time to make a correct assessment of costs. Post-operation period is very delicate. For post-hospitalisation expenses, maintain bills and records for insurance reimbursement.

Secondly, when you plan for the costs, include the donor expenses. "Always do the transplant in a network hospital. It will be cashless," said Apte.

Thirdly, do take care that organ transplant is not a result of a pre-existing disease This is because, for pre-existing disease insurance claims, there is often a two to four-year waiting period. If you suppress facts while buying the insurance policy, insurers will check all medical records and ultimately get to know you lied --- leading to claim rejection.

Fourthly, genuine insurance claims (and not due to pre-existing ailments) are payable after 30-45 days.

CONDITIONS FOR COVERAGE:

- Organ transplant costs can be between Rs 10-20 lakh

- Organ transplant cover is offered as an inbuilt cover under health insurance policy or as an add-on

- Check if policy covers both donor's and recipient's treatment related expenses

- Recipient may get cover for all the transplant-related expenses, including pre and-post hospitalisation

- Unlike an insured recipient, there are certain restrictions on the part of cover for donors, and this may vary from insurers to insurers

![submenu-img]() BMW i5 M60 xDrive launched in India, all-electric sedan priced at Rs 11950000

BMW i5 M60 xDrive launched in India, all-electric sedan priced at Rs 11950000![submenu-img]() This superstar was arrested several times by age 17, thrown out of home, once had just Rs 250, now worth Rs 6600 crore

This superstar was arrested several times by age 17, thrown out of home, once had just Rs 250, now worth Rs 6600 crore![submenu-img]() Meet Reliance’s highest paid employee, gets over Rs 240000000 salary, he is Mukesh Ambani’s…

Meet Reliance’s highest paid employee, gets over Rs 240000000 salary, he is Mukesh Ambani’s… ![submenu-img]() Meet lesser-known relative of Mukesh Ambani, Anil Ambani, has worked with BCCI, he is married to...

Meet lesser-known relative of Mukesh Ambani, Anil Ambani, has worked with BCCI, he is married to...![submenu-img]() Made in just Rs 95,000, this film was a superhit, but destroyed lead actress' career, saw controversy over bold scenes

Made in just Rs 95,000, this film was a superhit, but destroyed lead actress' career, saw controversy over bold scenes![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() In pics: Arti Singh stuns in red lehenga as she ties the knot with beau Dipak Chauhan in dreamy wedding

In pics: Arti Singh stuns in red lehenga as she ties the knot with beau Dipak Chauhan in dreamy wedding![submenu-img]() Actors who died due to cosmetic surgeries

Actors who died due to cosmetic surgeries![submenu-img]() See inside pics: Malayalam star Aparna Das' dreamy wedding with Manjummel Boys actor Deepak Parambol

See inside pics: Malayalam star Aparna Das' dreamy wedding with Manjummel Boys actor Deepak Parambol ![submenu-img]() In pics: Salman Khan, Alia Bhatt, Rekha, Neetu Kapoor attend grand premiere of Sanjay Leela Bhansali's Heeramandi

In pics: Salman Khan, Alia Bhatt, Rekha, Neetu Kapoor attend grand premiere of Sanjay Leela Bhansali's Heeramandi![submenu-img]() Streaming This Week: Crakk, Tillu Square, Ranneeti, Dil Dosti Dilemma, latest OTT releases to binge-watch

Streaming This Week: Crakk, Tillu Square, Ranneeti, Dil Dosti Dilemma, latest OTT releases to binge-watch![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence

DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence![submenu-img]() DNA Explainer: What is India's stand amid Iran-Israel conflict?

DNA Explainer: What is India's stand amid Iran-Israel conflict?![submenu-img]() This superstar was arrested several times by age 17, thrown out of home, once had just Rs 250, now worth Rs 6600 crore

This superstar was arrested several times by age 17, thrown out of home, once had just Rs 250, now worth Rs 6600 crore![submenu-img]() Made in just Rs 95,000, this film was a superhit, but destroyed lead actress' career, saw controversy over bold scenes

Made in just Rs 95,000, this film was a superhit, but destroyed lead actress' career, saw controversy over bold scenes![submenu-img]() Meet 72-year-old who earns Rs 280 cr per film, Asia's highest-paid actor, bigger than Shah Rukh, Salman, Akshay, Prabhas

Meet 72-year-old who earns Rs 280 cr per film, Asia's highest-paid actor, bigger than Shah Rukh, Salman, Akshay, Prabhas![submenu-img]() This star, who once lived in chawl, worked as tailor, later gave four Rs 200-crore films; he's now worth...

This star, who once lived in chawl, worked as tailor, later gave four Rs 200-crore films; he's now worth...![submenu-img]() Tamil star Prasanna reveals why he chose series Ranneeti for Hindi debut: 'Getting into Bollywood is not...'

Tamil star Prasanna reveals why he chose series Ranneeti for Hindi debut: 'Getting into Bollywood is not...'![submenu-img]() IPL 2024: Virat Kohli, Rajat Patidar fifties and disciplined bowling help RCB beat Sunrisers Hyderabad by 35 runs

IPL 2024: Virat Kohli, Rajat Patidar fifties and disciplined bowling help RCB beat Sunrisers Hyderabad by 35 runs![submenu-img]() 'This is the problem in India...': Wasim Akram's blunt take on fans booing Mumbai Indians skipper Hardik Pandya

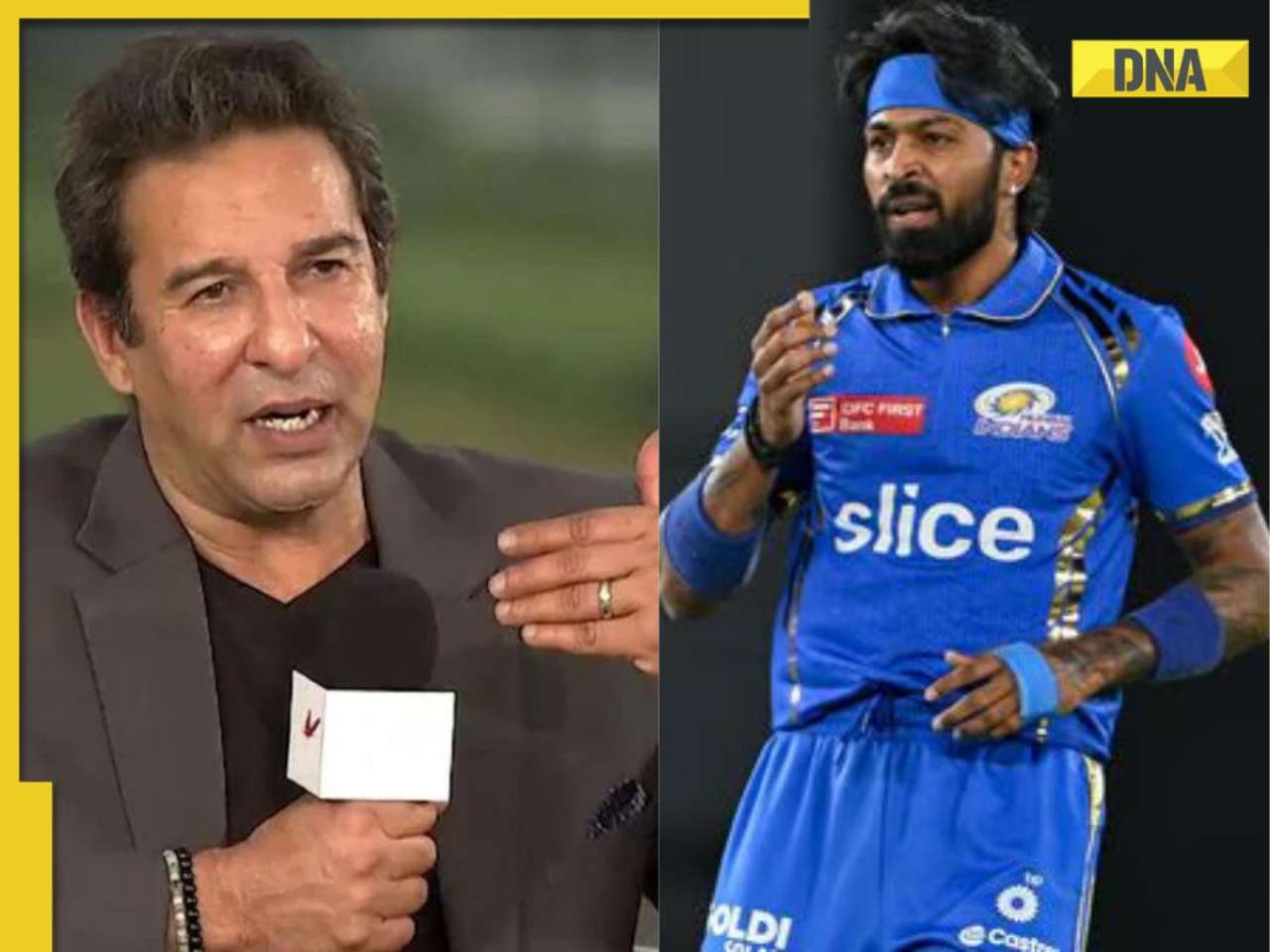

'This is the problem in India...': Wasim Akram's blunt take on fans booing Mumbai Indians skipper Hardik Pandya![submenu-img]() KKR vs PBKS, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

KKR vs PBKS, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() KKR vs PBKS IPL 2024 Dream11 prediction: Fantasy cricket tips for Kolkata Knight Riders vs Punjab Kings

KKR vs PBKS IPL 2024 Dream11 prediction: Fantasy cricket tips for Kolkata Knight Riders vs Punjab Kings![submenu-img]() IPL 2024: KKR star Rinku Singh finally gets another bat from Virat Kohli after breaking previous one - Watch

IPL 2024: KKR star Rinku Singh finally gets another bat from Virat Kohli after breaking previous one - Watch![submenu-img]() Viral video: Teacher's cute way to capture happy student faces melts internet, watch

Viral video: Teacher's cute way to capture happy student faces melts internet, watch![submenu-img]() Woman attends online meeting on scooter while stuck in traffic, video goes viral

Woman attends online meeting on scooter while stuck in traffic, video goes viral![submenu-img]() Viral video: Pilot proposes to flight attendant girlfriend before takeoff, internet hearts it

Viral video: Pilot proposes to flight attendant girlfriend before takeoff, internet hearts it![submenu-img]() Pakistani teen receives life-saving heart transplant from Indian donor, details here

Pakistani teen receives life-saving heart transplant from Indian donor, details here![submenu-img]() Viral video: Truck driver's innovative solution to beat the heat impresses internet, watch

Viral video: Truck driver's innovative solution to beat the heat impresses internet, watch

)

)

)

)

)

)

)