The MMRDA had originally planned to build a 101-storey tower on the plot, but has now allowed the builder to build as they wish.

In the country’s biggest land deal till date, Lodha Developers on Tuesday picked a 25,000 sq mt plot in Wadala for a mind-boggling Rs4,053 crore from the Mumbai Metropolitan Region Development Authority (MMRDA).

The developable space works out to 4.95 lakh sq mt, or 54 lakh sq ft. The plot has been leased for 65 years. The developer will pay the amount (with interest) over five years, which works out to Rs5,723 crore.

What makes the deal unique is that the MMRDA has given an unprecedented high FSI of 19.8 to the developer. Given the small size of the plot (25,000 sq mt), this means the developer could build a tower over 80 storeys high.

The land is part of the 46-hectare Wadala truck terminal, for which the MMRDA is the planning agency. The terminal has a global FSI of 4. The high FSI of 19.8 has been arrived at by adding FSI from open and unused plots.

Assuming a loading of 40%, it translates into saleable space of 75 lakh sq ft as proposed by the developer.

In 2008, a consortium led by the Delhi-based Business Park Town Planners (BPTP) bagged a 95-acre commercial plot in Noida for Rs5,006 crore from the Noida Authority, but the deal fell through as the developer was unable to make the payment.

The MMRDA had set a reserve price of Rs40,000 per sq mt for 25,000 sq mt (which adds up to Rs1,980 crore) of the Wadala plot.

But it got double the price.

The other bidders were Suntech Realty Ltd (Rs3,465.99 crore, or Rs70,002 per sq mt), India Bulls Real Estate (Rs3327.50 crore, or Rs67,222.42 per sq mt) and Gaurhari Estate Pvt Ltd (Dosti Developers; Rs2,251.99 crore, or Rs45,494.94 per sq mt)

Lodha will have to make the payment in five years. “The builder will be allowed to make telescopic payment,” said SVR Srinivas, additional metropolitan commissioner, MMRDA. This means the builder will have to make an upfront payment of 10%, which translates into Rs40.5 crore, pay 5% the same year, and then pay 10%, 15%, 20 % and 40% in the following years.

The MMRDA had originally planned to build a 101-storey tower on the plot, but has now allowed the builder to build as they wish.

“They can construct any number of buildings in the premises,” Srinivas said. Last year, the MMRDA received three bids for building the tower from Australian firm Hyder Consulting, Essar Realty in partnership with a Dubai-based firm, and Reliance Infrastructure partnering with a Chinese firm.

But the MMRDA was not happy with the offers and so decided to go for re-tendering.

The deal has sent shockwaves in the city’s realty market. HDFC chairman Deepak Parekh termed the price “ridiculous”.

Real estate experts believe sales, and in turn prices, will further dampen due to a situation of oversupply with many large developments underway in the neighbourhood.

“Importantly, it is to be seen whether the MMRDA or civic authorities allow the 75 lakh sq ft to be utilised on the very small plot area of 25,000 sq mt. We are not even counting problems like height restriction or open space requirements,” said the head of the land department section of a global real estate firm.

![submenu-img]() Ramesh Awasthi: Kanpur's 'Karma Yogi' - Know inspirational journey of 'common man' devoted for society

Ramesh Awasthi: Kanpur's 'Karma Yogi' - Know inspirational journey of 'common man' devoted for society![submenu-img]() Tovino Thomas accused of stopping his film Vazhakku's release by director Sanal Kumar Sasidharan: 'The agenda of...'

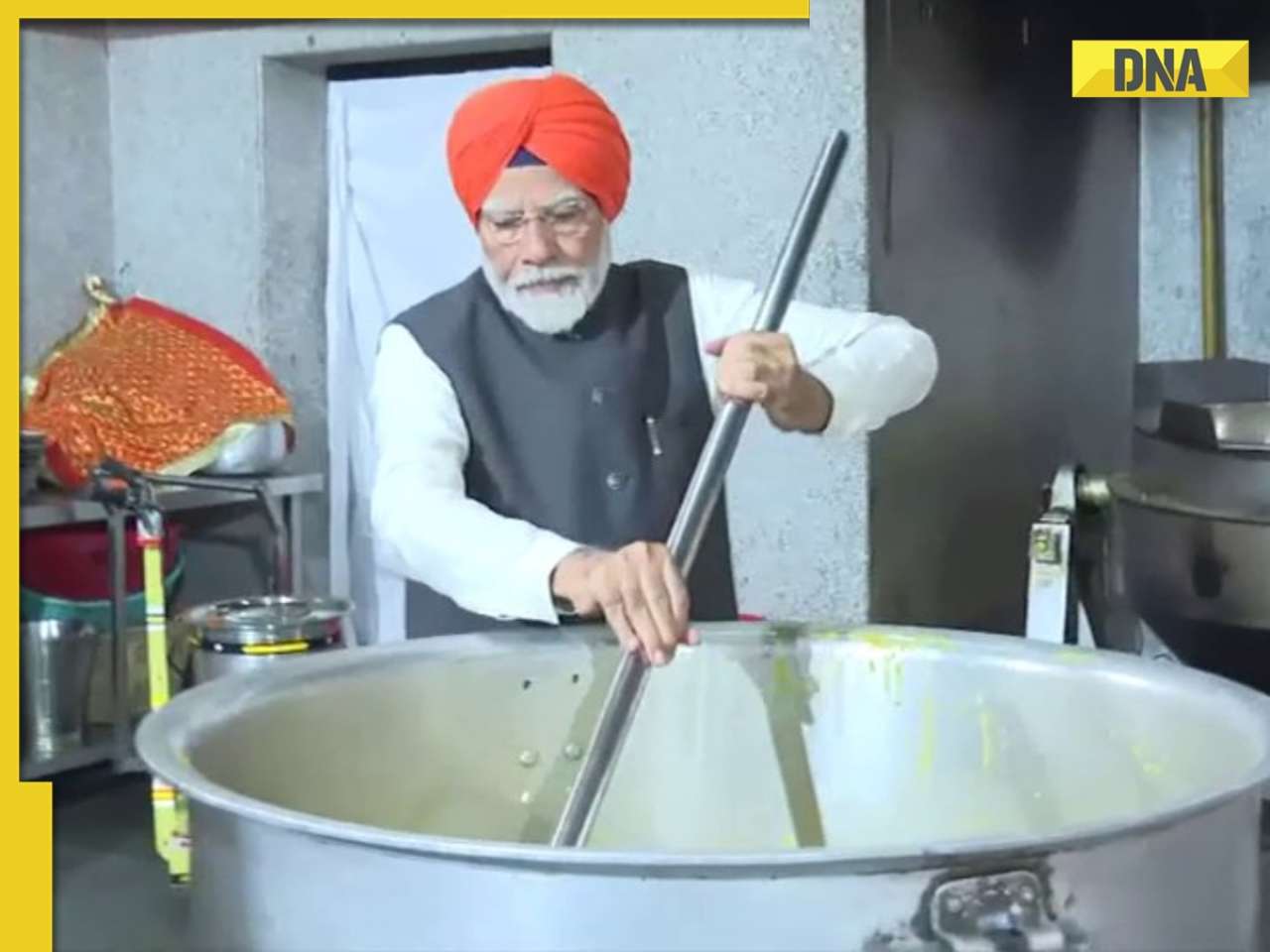

Tovino Thomas accused of stopping his film Vazhakku's release by director Sanal Kumar Sasidharan: 'The agenda of...'![submenu-img]() PM Modi wears turban, serves langar at Gurudwara Patna Sahib in Bihar, watch

PM Modi wears turban, serves langar at Gurudwara Patna Sahib in Bihar, watch![submenu-img]() Anil Ambani’s debt-ridden Reliance’s ‘buyer’ now waits for RBI nod, wants Rs 80000000000…

Anil Ambani’s debt-ridden Reliance’s ‘buyer’ now waits for RBI nod, wants Rs 80000000000…![submenu-img]() Man in bizarre jeans dances to Tinku Jiya in crowded metro, viral video makes internet furious

Man in bizarre jeans dances to Tinku Jiya in crowded metro, viral video makes internet furious![submenu-img]() Maharashtra Board HSC, SSC Results 2024: MSBSHSE class 10, 12 results soon at mahresult.nic.in, latest update here

Maharashtra Board HSC, SSC Results 2024: MSBSHSE class 10, 12 results soon at mahresult.nic.in, latest update here![submenu-img]() Meet IIT-JEE topper who passed JEE Advanced with AIR 1, decided to drop out of IIT due to…

Meet IIT-JEE topper who passed JEE Advanced with AIR 1, decided to drop out of IIT due to…![submenu-img]() Meet IPS Idashisha Nongrang, who became Meghalaya's first woman DGP

Meet IPS Idashisha Nongrang, who became Meghalaya's first woman DGP![submenu-img]() CBSE Results 2024: CBSE Class 10, 12 results date awaited, check latest update here

CBSE Results 2024: CBSE Class 10, 12 results date awaited, check latest update here![submenu-img]() Meet man, who was denied admission in IIT due to blindness, inspiration behind Rajkummar Rao’s film, now owns...

Meet man, who was denied admission in IIT due to blindness, inspiration behind Rajkummar Rao’s film, now owns...![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Remember Harsh Lunia? Just Mohabbat child star, here's how former actor looks now, his wife is Bollywood's popular...

Remember Harsh Lunia? Just Mohabbat child star, here's how former actor looks now, his wife is Bollywood's popular...![submenu-img]() Mother's Day 2024: Bollywood supermoms who balance motherhood, acting, and run multi-crore businesses

Mother's Day 2024: Bollywood supermoms who balance motherhood, acting, and run multi-crore businesses![submenu-img]() Rocky Aur Rani's Golu aka Anjali Anand shocks fans with drastic weight loss without gym, says fitness secret is...

Rocky Aur Rani's Golu aka Anjali Anand shocks fans with drastic weight loss without gym, says fitness secret is...![submenu-img]() In pics: Ram Charan gets mobbed by fans during his visit to Pithapuram for ‘indirect campaign’ for uncle Pawan Kalyan

In pics: Ram Charan gets mobbed by fans during his visit to Pithapuram for ‘indirect campaign’ for uncle Pawan Kalyan![submenu-img]() Streaming This Week: Yodha, Aavesham, Murder In Mahim, Undekhi season 3, latest OTT releases to binge-watch

Streaming This Week: Yodha, Aavesham, Murder In Mahim, Undekhi season 3, latest OTT releases to binge-watch![submenu-img]() Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?

Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() Tovino Thomas accused of stopping his film Vazhakku's release by director Sanal Kumar Sasidharan: 'The agenda of...'

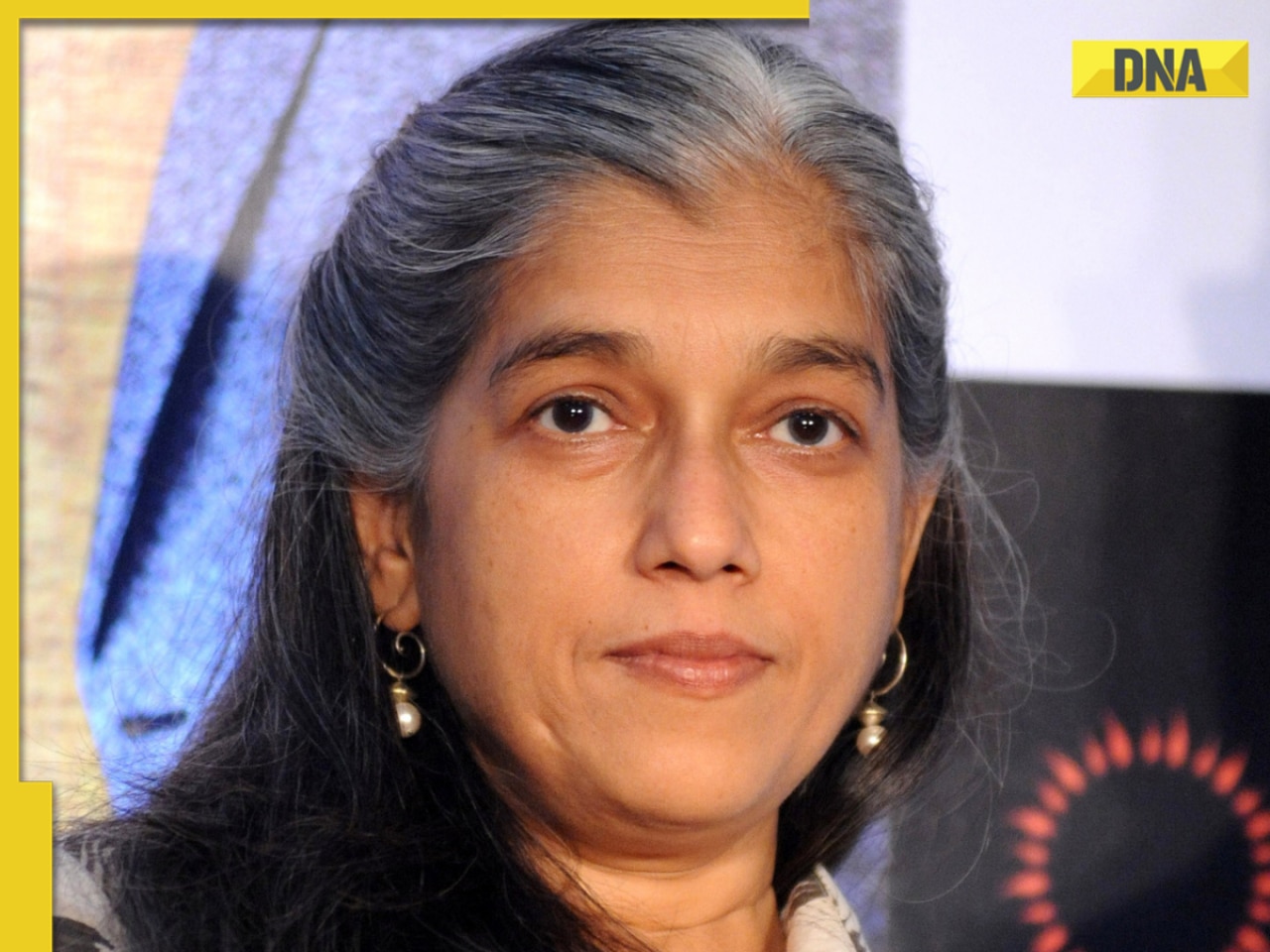

Tovino Thomas accused of stopping his film Vazhakku's release by director Sanal Kumar Sasidharan: 'The agenda of...'![submenu-img]() Ratna Pathak Shah calls Guru Dutt and Bimal Roy's films 'offensive', says, 'women are constantly...'

Ratna Pathak Shah calls Guru Dutt and Bimal Roy's films 'offensive', says, 'women are constantly...'![submenu-img]() Shreyas Talpade recalls how he felt bad when his film Kaun Pravin Tambe did not release in theatres: 'It deserved...'

Shreyas Talpade recalls how he felt bad when his film Kaun Pravin Tambe did not release in theatres: 'It deserved...'![submenu-img]() Anup Soni slams his deepfake video from Crime Patrol, being used to promote IPL betting

Anup Soni slams his deepfake video from Crime Patrol, being used to promote IPL betting![submenu-img]() Real story that inspired Heeramandi: The tawaif who helped Gandhi fight British Raj, was raped, abused, died in...

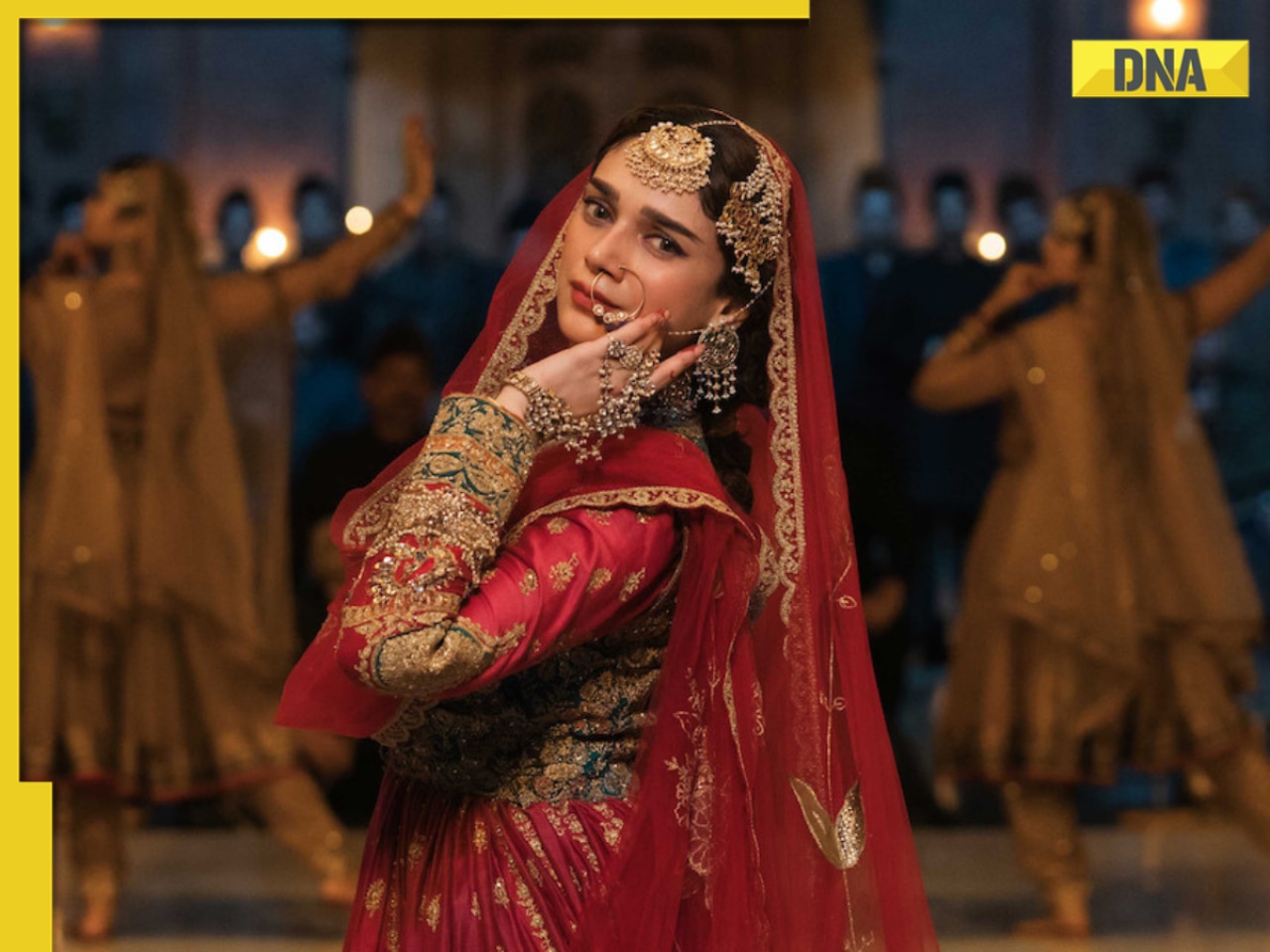

Real story that inspired Heeramandi: The tawaif who helped Gandhi fight British Raj, was raped, abused, died in...![submenu-img]() Man in bizarre jeans dances to Tinku Jiya in crowded metro, viral video makes internet furious

Man in bizarre jeans dances to Tinku Jiya in crowded metro, viral video makes internet furious![submenu-img]() Lift collides with roof in Noida society after brakes fail, 3 injured

Lift collides with roof in Noida society after brakes fail, 3 injured![submenu-img]() Zomato CEO Deepinder Goyal invites employees' moms to office for Mother's Day celebration, watch

Zomato CEO Deepinder Goyal invites employees' moms to office for Mother's Day celebration, watch![submenu-img]() This clip of kind woman feeding rotis to stray cows will bring tears of joy to your eyes, watch

This clip of kind woman feeding rotis to stray cows will bring tears of joy to your eyes, watch![submenu-img]() Viral video: Seagull swallows squirrel whole in single go, internet is stunned

Viral video: Seagull swallows squirrel whole in single go, internet is stunned

)

)

)

)

)

)