Analysts say in a few years competition could jump to levels that could put pressure on Indian firms' room rates as they face-off with global giants.

Indian hotel chains, all set for an expansion drive, are likely to face stiff competition from well-known global chains that are aggressively making inroads into the widening domestic market.

Analysts say in a few years competition could jump to levels that could put pressure on Indian firms' room rates as they face-off with global giants, but will still manage to grow on rising demand for rooms in Asia's third-biggest economy.

"Market is certainly becoming a lot more competitive, which is actually a sign of maturity of the market," said Manav Thadani, managing director of hospitality consultancy HVS India.

"It will help in rates being more stabilized and better quality being offered. I think it's healthy for the market for more hotels to come in," he said.

India, with a population of more than 1 billion, has only about 104,000 rooms, according to government estimates. In comparison, New York City alone has more than 80,000 rooms.

A recovery in the global markets and a booming domestic market have pushed up business and leisure travel in the country, driving up demand for hotel rooms.

Demand for hotel rooms far outstrips supply in India, and this has attracted global players like Starwood Hotels & Resorts, Marriot International, Hyatt Hotels, InterContinental Hotels and Accor Hospitality.

Starwood is aiming to expand its local portfolio by 60 percent by 2013, while Hyatt has earmarked about one-fourth of its global pipeline for India. IHG has 41 hotels in the pipeline.

These hotel chains with multiple brands add to the already crowded space dominated by home-bred firms such as Indian Hotels Co, owner of Taj luxury chain; EIH, operator of Oberoi and Trident hotels; ITC and Hotel Leela Ventures.

"Unlike other markets in the world, India has got four strong domestic brands - Taj, Leela, ITC and Oberoi - which makes it that much more difficult for international brands to enter," said Nikhil Manchharam, vice president of acquisitions & development, Starwood Asia Pacific Hotels & Resorts.

"It's a much more competitive environment than other growing markets."

Undeterred by cut-throat competition, Indian firms have announced ambitious expansion plans for the country, where travel and tourism demand, according to the World Travel and Tourism Council, is expected to grow at 8.2% annually till 2019.

Indian Hotels plans to open properties in New Delhi, Bangalore, Hyderabad and Guwahati, while EIH is adding a property in Gurgaon under the Oberoi brand and two hotels in Hyderabad and Dehradun by 2012 under Trident.

Global chains are expanding under management contracts and hence moving faster than Indian peers who have lined up sizeable investments for expansions, said Sanjoy Pasricha, vice president sales and marketing at Hotel Leela, which is adding a property in New Delhi this year and another in Chennai next year.

"As companies which own, build and manage their hotels, our progress is obviously slower than international companies who take over hotels from builders and then can have eight hotels getting built simultaneously," Pasricha said.

India requires investments worth 600 billion rupees over the next five years to cope with the unmet demand for about 150,000 rooms, according to FICCI-Evalueserve.

"In India, there is room for everyone to grow," said Jan Smits, managing director of IHG Asia Australasia.

![submenu-img]() House of the Dragon season 2 trailer: Rhaenyra wages an unwinnable war against Aegon, Dance of the Dragons begins

House of the Dragon season 2 trailer: Rhaenyra wages an unwinnable war against Aegon, Dance of the Dragons begins![submenu-img]() Panchayat season 3 trailer: Jitendra Kumar returns as sachiv, Neena, Raghubir get embroiled in new political tussle

Panchayat season 3 trailer: Jitendra Kumar returns as sachiv, Neena, Raghubir get embroiled in new political tussle![submenu-img]() Apple partners up with Google against unwanted tracker, users will be alerted if…

Apple partners up with Google against unwanted tracker, users will be alerted if…![submenu-img]() Meet actress whose debut film was superhit, got married at peak of career, was left heartbroken, quit acting due to..

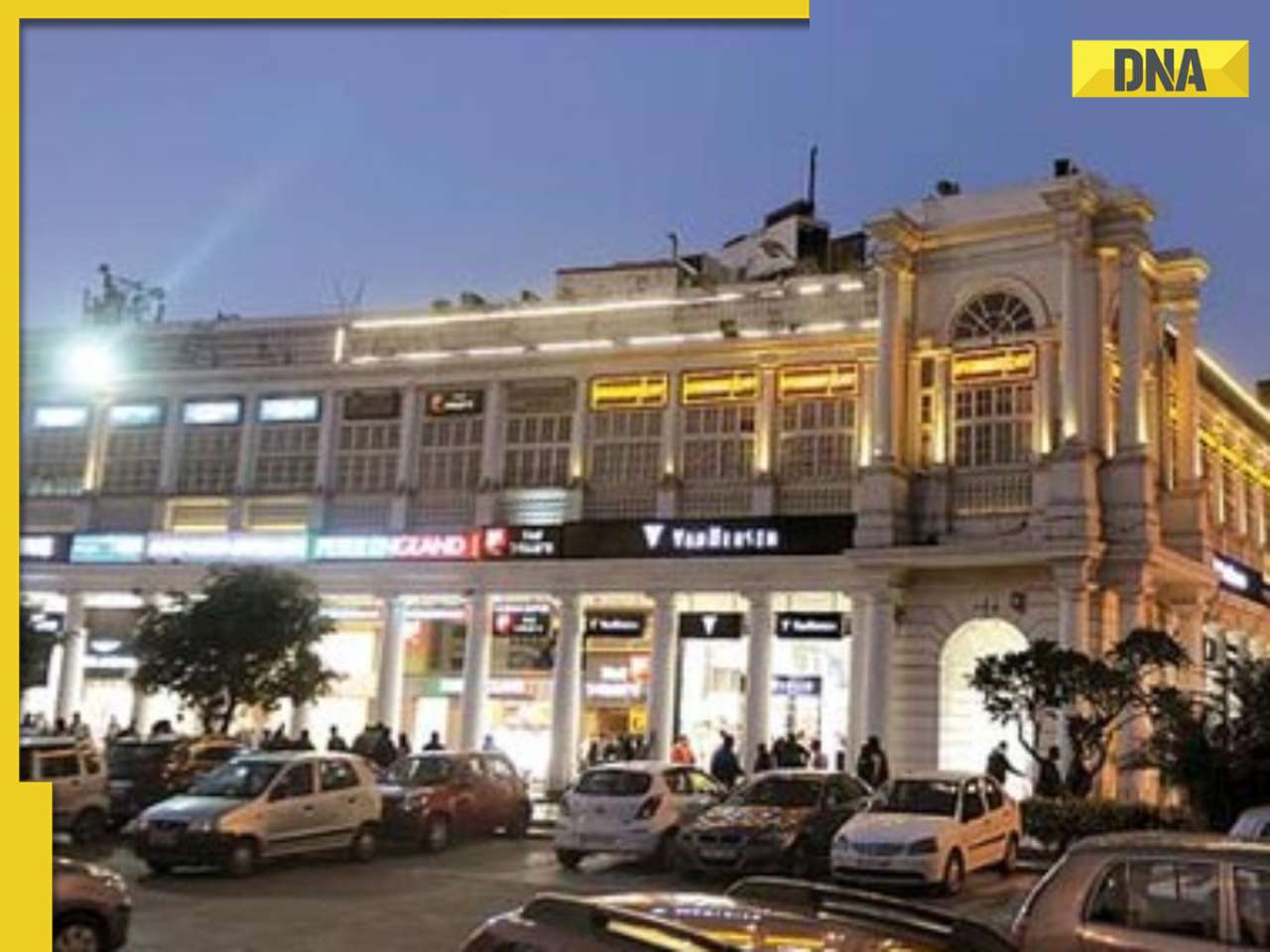

Meet actress whose debut film was superhit, got married at peak of career, was left heartbroken, quit acting due to..![submenu-img]() Who is the real owner of Delhi's Connaught Place and who collects rent from here?

Who is the real owner of Delhi's Connaught Place and who collects rent from here?![submenu-img]() Meet man who is 47, aspires to crack UPSC, has taken 73 Prelims, 43 Mains, Vikas Divyakirti is his...

Meet man who is 47, aspires to crack UPSC, has taken 73 Prelims, 43 Mains, Vikas Divyakirti is his...![submenu-img]() IIT graduate gets job with Rs 100 crore salary package, fired within a year, he is now working as…

IIT graduate gets job with Rs 100 crore salary package, fired within a year, he is now working as…![submenu-img]() Goa Board SSC Result 2024: GBSHSE Class 10 results to be out today; check time, direct link here

Goa Board SSC Result 2024: GBSHSE Class 10 results to be out today; check time, direct link here![submenu-img]() CUET-UG 2024 scheduled for tomorrow postponed for Delhi centres; check new exam date here

CUET-UG 2024 scheduled for tomorrow postponed for Delhi centres; check new exam date here![submenu-img]() Meet man who lost eyesight at 8, bagged record-breaking job package at Microsoft, not from IIT, NIT, VIT, his salary is…

Meet man who lost eyesight at 8, bagged record-breaking job package at Microsoft, not from IIT, NIT, VIT, his salary is…![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Ananya Panday stuns in unseen bikini pictures in first post amid breakup reports, fans call it 'Aditya Roy Kapur's loss'

Ananya Panday stuns in unseen bikini pictures in first post amid breakup reports, fans call it 'Aditya Roy Kapur's loss'![submenu-img]() Remember Harsh Lunia? Just Mohabbat child star, here's how former actor looks now, his wife is Bollywood's popular...

Remember Harsh Lunia? Just Mohabbat child star, here's how former actor looks now, his wife is Bollywood's popular...![submenu-img]() Mother's Day 2024: Bollywood supermoms who balance motherhood, acting, and run multi-crore businesses

Mother's Day 2024: Bollywood supermoms who balance motherhood, acting, and run multi-crore businesses![submenu-img]() Rocky Aur Rani's Golu aka Anjali Anand shocks fans with drastic weight loss without gym, says fitness secret is...

Rocky Aur Rani's Golu aka Anjali Anand shocks fans with drastic weight loss without gym, says fitness secret is...![submenu-img]() In pics: Ram Charan gets mobbed by fans during his visit to Pithapuram for ‘indirect campaign’ for uncle Pawan Kalyan

In pics: Ram Charan gets mobbed by fans during his visit to Pithapuram for ‘indirect campaign’ for uncle Pawan Kalyan![submenu-img]() Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?

Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() House of the Dragon season 2 trailer: Rhaenyra wages an unwinnable war against Aegon, Dance of the Dragons begins

House of the Dragon season 2 trailer: Rhaenyra wages an unwinnable war against Aegon, Dance of the Dragons begins![submenu-img]() Panchayat season 3 trailer: Jitendra Kumar returns as sachiv, Neena, Raghubir get embroiled in new political tussle

Panchayat season 3 trailer: Jitendra Kumar returns as sachiv, Neena, Raghubir get embroiled in new political tussle![submenu-img]() Meet actress whose debut film was superhit, got married at peak of career, was left heartbroken, quit acting due to..

Meet actress whose debut film was superhit, got married at peak of career, was left heartbroken, quit acting due to..![submenu-img]() 'Ek actress 9 log saath leke...': Farah Khan criticises entourage culture in Bollywood

'Ek actress 9 log saath leke...': Farah Khan criticises entourage culture in Bollywood![submenu-img]() Bollywood’s 1st multi-starrer had 8 stars, makers were told not to cast Kapoors; not Sholay, Nagin, Shaan, Jaani Dushman

Bollywood’s 1st multi-starrer had 8 stars, makers were told not to cast Kapoors; not Sholay, Nagin, Shaan, Jaani Dushman![submenu-img]() Who is the real owner of Delhi's Connaught Place and who collects rent from here?

Who is the real owner of Delhi's Connaught Place and who collects rent from here?![submenu-img]() Viral video: Chinese artist's flaming 'stairway to heaven' stuns internet, watch

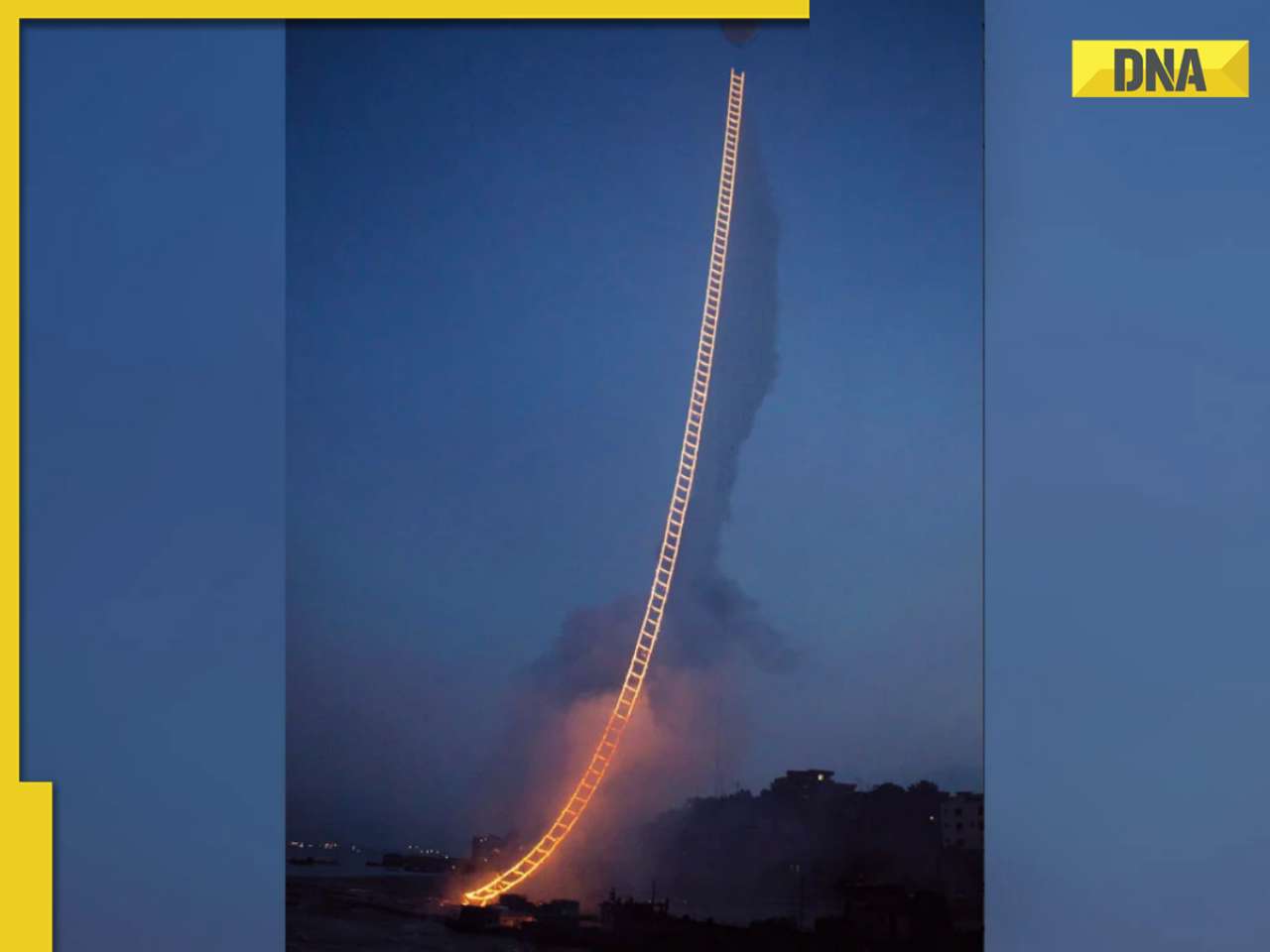

Viral video: Chinese artist's flaming 'stairway to heaven' stuns internet, watch![submenu-img]() Video: White House plays 'Sare Jahan Se Achha Hindustan Hamara" at AANHPI heritage month celebration

Video: White House plays 'Sare Jahan Se Achha Hindustan Hamara" at AANHPI heritage month celebration![submenu-img]() Viral video: Bear rides motorcycle sidecar in Russia, internet is stunned

Viral video: Bear rides motorcycle sidecar in Russia, internet is stunned![submenu-img]() Driver caught on camera running over female toll plaza staff on Delhi-Meerut expressway, watch video

Driver caught on camera running over female toll plaza staff on Delhi-Meerut expressway, watch video

)

)

)

)

)

)