The 50% hike in home loan rates in the last 18 months has not only dented realty sales, but also upset monthly budgets of existing home loan customers

Property rates are, of course, the most important consideration while buying a home, but home loan rates, too, play a significant role in the years that follow the purchase.

With 90 per cent of home loan customers opting for floating rates, their monthly budgets fluctuate in tandem with the quarter-by-quarter movement of the home loan rates. Interest rates have shot up by 50 per cent in the past 18 months — from just 8 per cent per annum in 2009-end to the current 12 per cent. This has not only affected the monthly budgets and savings plan of existing home loan customers, but also proved to be a deterring factor for aspiring home buyers.

Here are three real-life stories representative of the impact of the rising interest rates:

The Hopeful

Nerul-resident Prateek Deshpande, a sales professional who got married last year, is keen on buying a 1BHK apartment in Navi Mumbai. “Property prices are and interest rates are high; this is a bad time to take a decision,” says the 27-year-old, adding that unless one of the rates dips in the near future, he has to continue staying in the joint family and save up till he can afford to move out.

Prateek has a difficult choice to make — sign up for the high rates now or wait it out only to meet much higher rates in the years to come.

The hike in interest rates have also triggered a cascade effect, not only leading to an increase in the cost of the home loan, but also of construction, which is passed on to buyers. “These hikes have not made any impressive dent in inflation. Whatever difference we can see can be attributed to a high base effect and the tight monetary policy being followed, rather than to the hike in lending rates,” says Sanjay Dutt, CEO-Business, Jones Lang LaSalle India.

The Savvy Customer

Jyotirmoy Dwivedi, a 34-year-old operations manager at TCS, took a housing loan for Rs30 lakh early in 2010 to finance the acquisition of his Rs64 lakh 2BHK apartment at Mahavir Nagar, Kandivili. Signing up at a rate of just 8.5 per cent per annum — with a 2-year lock-in period to boot — the EMI of Rs26,000 was still something that Dwivedi was not comfortable with.

Just a few months into his new loan, Dwivedi pooled his resources to make a prepayment of Rs20 lakh and knock down the home loan to manageable proportions — with his EMI crashing to just Rs13,200, that too for a 10-year term. “It was a choice between investment or repayment of loan and after considering factors like rate of return and tax liabilities, it made sense to repay the loan,” says Dwivedi, who on hindsight got the timing perfect — for buying the property when the rates were lower and knocking of the loan before the high rates kicked in.

Dwivedi now deploys the home loan as a tax-saving tool, and plans to prepay the optimum principal component to maximise the tax savings every year. “I would definitely advise people with fat loans to look at part payments as soon as possible. It is a trade-off between how much you can afford to pay every month, vis-à-vis the benefit you are getting from that loan,” he says.

The Victim

Vashi-resident Anil Jacob had to gather funds from every avenue to put together his contribution for the Rs40 lakh-worth 2BHK flat in 2008, and still push the housing finance company to give the maximum amount that he was eligible for. The loan came with an EMI of Rs26,000, which the 42-year old planned to repay before he retired from his factory.

When the tide turned in mid-2010, Jacob got the first shock when the tenure of his loan increased from 15 years to 18 years over six months. “The housing finance company informed me that my EMI has been increased to Rs29,000 since my repayment period cannot be extended beyond my date of retirement,” says Jacob, who faced the prospect of paying a good Rs62 lakh by the time his loan was totally repaid by retirement.

With his monthly income stretched between the education of his two children and medical care for his parents, Jacob now faces the prospect of breaking his nest egg to keep the house running. “The market price of the flat has gone up to Rs75 lakh, but it means nothing till I don’t sell the flat,” says Jacob.

![submenu-img]() BMW i5 M60 xDrive launched in India, all-electric sedan priced at Rs 11950000

BMW i5 M60 xDrive launched in India, all-electric sedan priced at Rs 11950000![submenu-img]() This superstar was arrested several times by age 17, thrown out of home, once had just Rs 250, now worth Rs 6600 crore

This superstar was arrested several times by age 17, thrown out of home, once had just Rs 250, now worth Rs 6600 crore![submenu-img]() Meet Reliance’s highest paid employee, gets over Rs 240000000 salary, he is Mukesh Ambani’s…

Meet Reliance’s highest paid employee, gets over Rs 240000000 salary, he is Mukesh Ambani’s… ![submenu-img]() Meet lesser-known relative of Mukesh Ambani, Anil Ambani, has worked with BCCI, he is married to...

Meet lesser-known relative of Mukesh Ambani, Anil Ambani, has worked with BCCI, he is married to...![submenu-img]() Made in just Rs 95,000, this film was a superhit, but destroyed lead actress' career, saw controversy over bold scenes

Made in just Rs 95,000, this film was a superhit, but destroyed lead actress' career, saw controversy over bold scenes![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() In pics: Arti Singh stuns in red lehenga as she ties the knot with beau Dipak Chauhan in dreamy wedding

In pics: Arti Singh stuns in red lehenga as she ties the knot with beau Dipak Chauhan in dreamy wedding![submenu-img]() Actors who died due to cosmetic surgeries

Actors who died due to cosmetic surgeries![submenu-img]() See inside pics: Malayalam star Aparna Das' dreamy wedding with Manjummel Boys actor Deepak Parambol

See inside pics: Malayalam star Aparna Das' dreamy wedding with Manjummel Boys actor Deepak Parambol ![submenu-img]() In pics: Salman Khan, Alia Bhatt, Rekha, Neetu Kapoor attend grand premiere of Sanjay Leela Bhansali's Heeramandi

In pics: Salman Khan, Alia Bhatt, Rekha, Neetu Kapoor attend grand premiere of Sanjay Leela Bhansali's Heeramandi![submenu-img]() Streaming This Week: Crakk, Tillu Square, Ranneeti, Dil Dosti Dilemma, latest OTT releases to binge-watch

Streaming This Week: Crakk, Tillu Square, Ranneeti, Dil Dosti Dilemma, latest OTT releases to binge-watch![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence

DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence![submenu-img]() DNA Explainer: What is India's stand amid Iran-Israel conflict?

DNA Explainer: What is India's stand amid Iran-Israel conflict?![submenu-img]() This superstar was arrested several times by age 17, thrown out of home, once had just Rs 250, now worth Rs 6600 crore

This superstar was arrested several times by age 17, thrown out of home, once had just Rs 250, now worth Rs 6600 crore![submenu-img]() Made in just Rs 95,000, this film was a superhit, but destroyed lead actress' career, saw controversy over bold scenes

Made in just Rs 95,000, this film was a superhit, but destroyed lead actress' career, saw controversy over bold scenes![submenu-img]() Meet 72-year-old who earns Rs 280 cr per film, Asia's highest-paid actor, bigger than Shah Rukh, Salman, Akshay, Prabhas

Meet 72-year-old who earns Rs 280 cr per film, Asia's highest-paid actor, bigger than Shah Rukh, Salman, Akshay, Prabhas![submenu-img]() This star, who once lived in chawl, worked as tailor, later gave four Rs 200-crore films; he's now worth...

This star, who once lived in chawl, worked as tailor, later gave four Rs 200-crore films; he's now worth...![submenu-img]() Tamil star Prasanna reveals why he chose series Ranneeti for Hindi debut: 'Getting into Bollywood is not...'

Tamil star Prasanna reveals why he chose series Ranneeti for Hindi debut: 'Getting into Bollywood is not...'![submenu-img]() IPL 2024: Virat Kohli, Rajat Patidar fifties and disciplined bowling help RCB beat Sunrisers Hyderabad by 35 runs

IPL 2024: Virat Kohli, Rajat Patidar fifties and disciplined bowling help RCB beat Sunrisers Hyderabad by 35 runs![submenu-img]() 'This is the problem in India...': Wasim Akram's blunt take on fans booing Mumbai Indians skipper Hardik Pandya

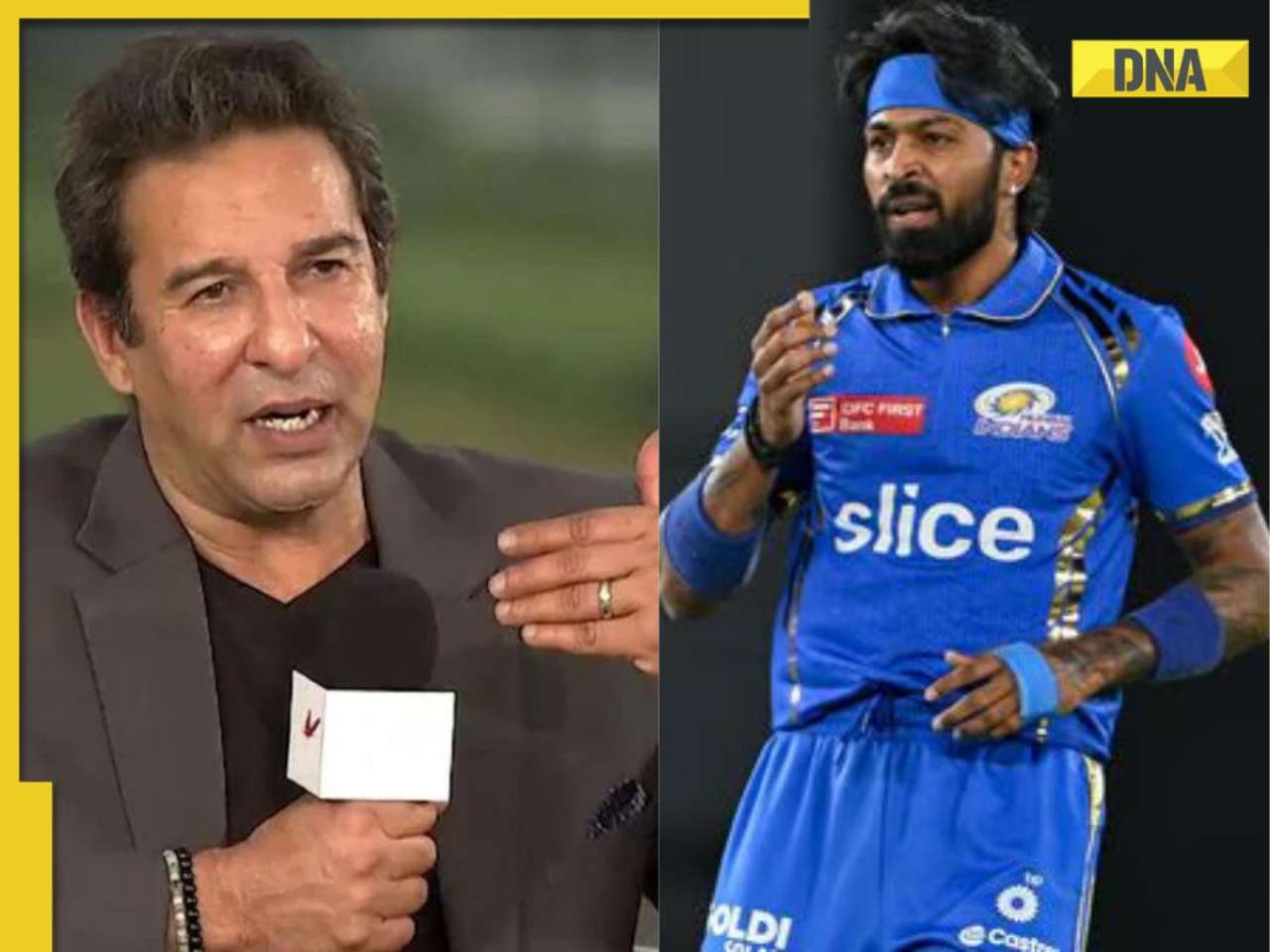

'This is the problem in India...': Wasim Akram's blunt take on fans booing Mumbai Indians skipper Hardik Pandya![submenu-img]() KKR vs PBKS, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

KKR vs PBKS, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() KKR vs PBKS IPL 2024 Dream11 prediction: Fantasy cricket tips for Kolkata Knight Riders vs Punjab Kings

KKR vs PBKS IPL 2024 Dream11 prediction: Fantasy cricket tips for Kolkata Knight Riders vs Punjab Kings![submenu-img]() IPL 2024: KKR star Rinku Singh finally gets another bat from Virat Kohli after breaking previous one - Watch

IPL 2024: KKR star Rinku Singh finally gets another bat from Virat Kohli after breaking previous one - Watch![submenu-img]() Viral video: Teacher's cute way to capture happy student faces melts internet, watch

Viral video: Teacher's cute way to capture happy student faces melts internet, watch![submenu-img]() Woman attends online meeting on scooter while stuck in traffic, video goes viral

Woman attends online meeting on scooter while stuck in traffic, video goes viral![submenu-img]() Viral video: Pilot proposes to flight attendant girlfriend before takeoff, internet hearts it

Viral video: Pilot proposes to flight attendant girlfriend before takeoff, internet hearts it![submenu-img]() Pakistani teen receives life-saving heart transplant from Indian donor, details here

Pakistani teen receives life-saving heart transplant from Indian donor, details here![submenu-img]() Viral video: Truck driver's innovative solution to beat the heat impresses internet, watch

Viral video: Truck driver's innovative solution to beat the heat impresses internet, watch

)

)

)

)

)

)