Sensex hit a three-week high of 28,179.

Domestic stocks took on more strength on positive cues from Europe as the benchmark Sensex rallied nearly 102 points to hit a three-week high of 28,179 ahead of a crucial meeting between the government and top management of banks on NPAs. But caution set in after some key banks are due to announce their earnings from Tuesday onwards.

The global markets ruled higher on Monday on expectations that China will unveil fresh economy-boosting measures. Buying across the board led by oil and gas, banks and auto stocks carried forward the momentum. The 30-share Sensex opened higher and settled at 28,179.08, a gain of 101.90 points, or 0.36%.

The gauge had lost 53 points on Friday due to heightened prospects of a US rate hike. The NSE 50-share closed up 15.90 points, or 0.18%, at 8,708.95. "Early sluggishness was wiped off on positive cues from European markets and after PSU banks added further gains ahead of a meeting of senior management of banks today to discuss the bad loans issue in specific sectors, including steel, power and infrastructure," said Anand James, Chief Market Strategist, Geojit BNP Paribas Financial Services.

Buying picked up here after Asian shares climbed to two-week highs and European shares advanced in their early deals as investors focused on fresh economic data and corporate earnings, brokers said. According to global financial services major American Merrill Lynch, there is room for a 50 bps rate cut by the Reserve Bank over the next few months, with 25 bps each likely in February and April. Investors remained cautious ahead of a key week for quarterly results for companies such as HDFC Bank, Axis Bank and a few more.

Stocks of automakers evoked good buying support on hopes of pick-up in demand during the festive and wedding season. State-owned ONGC emerged as the star performer and closed up by 4.61% after the company said its board will on Thursday consider issuing a bonus share to increase liquidity ahead of government disinvestment. Other big gainers were Tata Motors, ICICI Bank, Coal India, Lupin, SBI, HDFC, Maruti Suzuki and M&M, rising by up to 2.67%.

Foreign portfolio investors net sold shares worth Rs 272.91 crore last Friday, provisional data showed. The BSE oil and gas index jumped the most by gaining 1.67%, followed by PSU (1.54%), auto (0.84 %), banking (0.60%) and metal (0.20%). The broader market offered a mixed trend, with BSE small-cap up 0.52% and mid-cap shedding 0.13%. Asian stocks ended higher as China's Shanghai Composite climbed 1.21% to the highest close since January 8 amid optimism that the government will boost infrastructure spend and speed up overhaul of state-owned companies.

Hong Kong's Hang Seng was up 0.98% and Japan's Nikkei 0.29 %. Key indices in Europe like France CAC, Germany's DAX and the UK's FTSE all firmed up. Data showed that Eurozone flash services PMI for October climbed to 9-month high of 53.5 and Eurozone flash manufacturing PMI for October rose to 30-month high at 53.3. "... with more banks' earnings scheduled from tomorrow onwards, caution emerged, capping gains. Markets are also following the dollar's strength ahead of the Fed rate decision and US presidential elections," added James.

Wipro fell by over 3% after the company posted a 7.6% drop in its second quarter net profit and expects revenues in the ongoing quarter to be impacted by a "mixed demand environment".

Bharti Airtel and Idea Cellular stocks fell up to 3.75 % after regulator TRAI last week recommended a total penalty of Rs 3,050 crore on incumbent players for denying interconnect facility to newcomer Reliance Jio Infocomm. Idea Cellular is scheduled to report September-quarter results later in the day. In the 30-share Sensex constituents, 14 ended higher and 16 lower. The market breadth turned positive as 1,685 stocks ended in the green, 1,164 closed in the red while 225 ruled steady. The total turnover on BSE amounted to Rs 3,396.82 crore, higher than turnover of Rs 3,200.73 crore registered during the previous trading session.

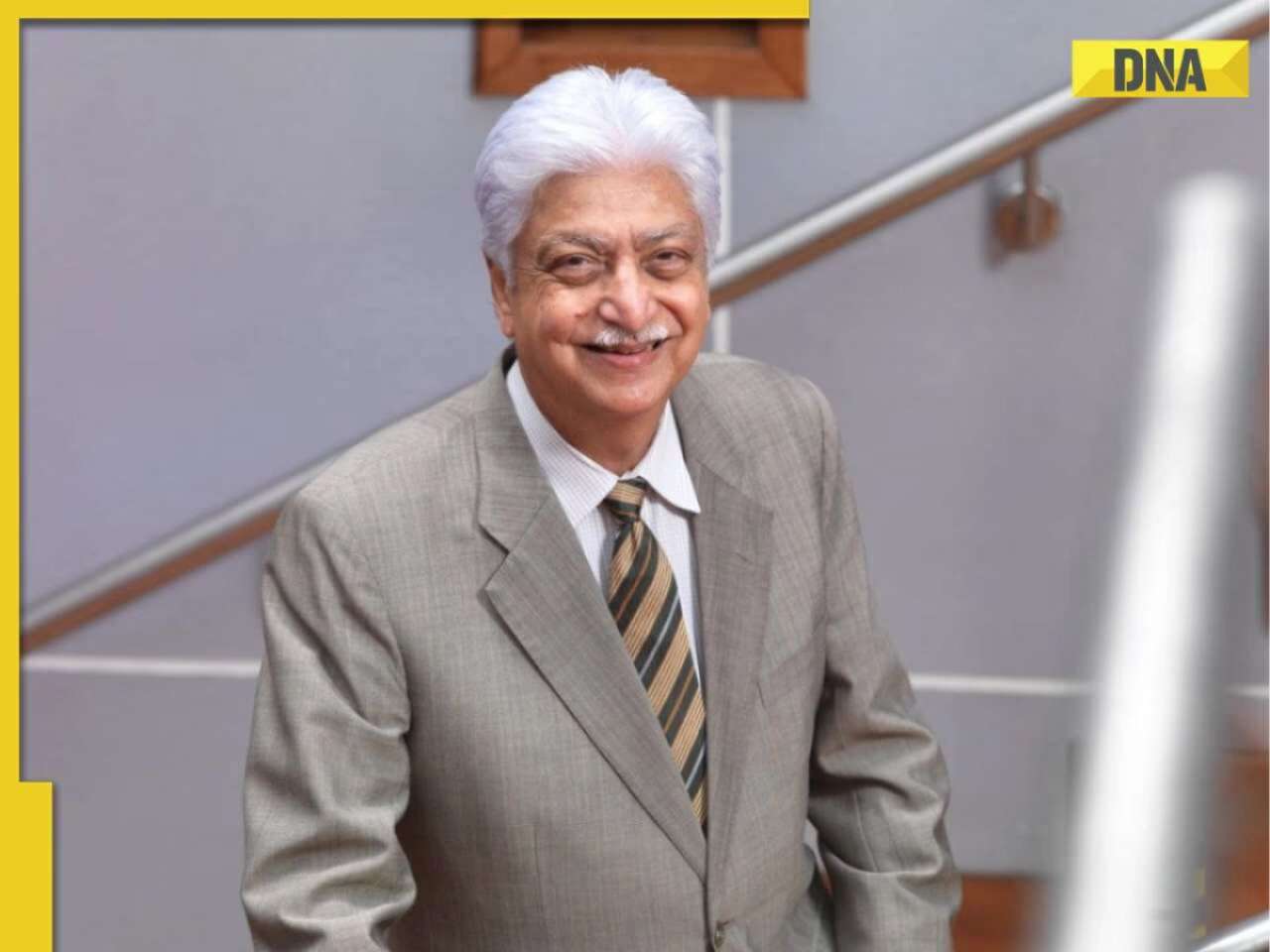

![submenu-img]() Azim Premji may acquire majority stake in this bank from…

Azim Premji may acquire majority stake in this bank from…![submenu-img]() Meet schoolmates who quit high-paying jobs to start their own business, invested Rs 1 lakh, now worth Rs…

Meet schoolmates who quit high-paying jobs to start their own business, invested Rs 1 lakh, now worth Rs…![submenu-img]() Meet daughter of cleaning contractor who cleared UPSC exam in first attempt, secured AIR...

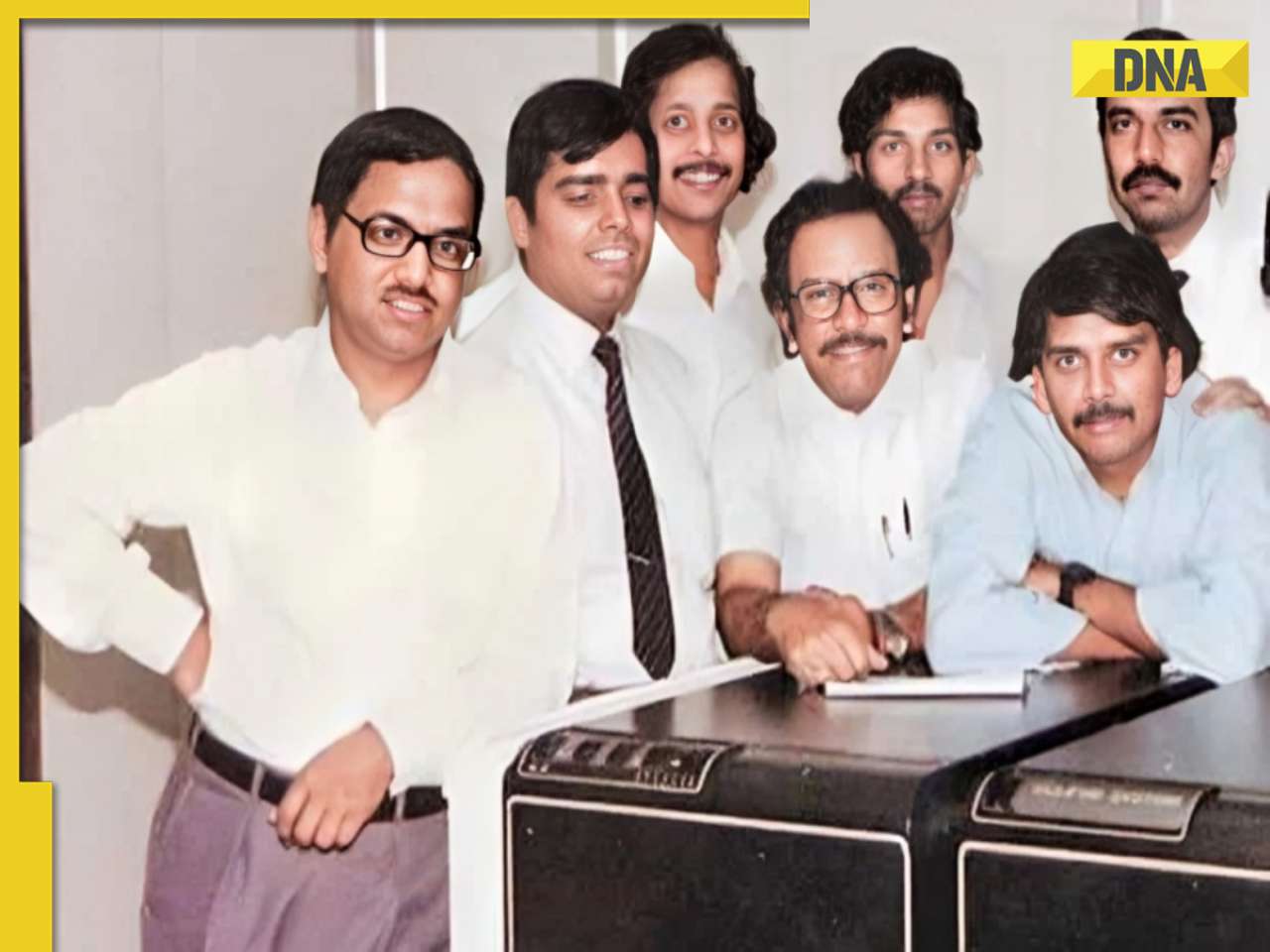

Meet daughter of cleaning contractor who cleared UPSC exam in first attempt, secured AIR...![submenu-img]() Meet man who was first employee of Infosys, it's not Narayana Murthy, Nandan Nilekani, SD Shibulal

Meet man who was first employee of Infosys, it's not Narayana Murthy, Nandan Nilekani, SD Shibulal![submenu-img]() Sobhita Dhulipala opens up about facing ‘casual objectification’: ‘I have been told so many times to…’

Sobhita Dhulipala opens up about facing ‘casual objectification’: ‘I have been told so many times to…’![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Streaming This Week: Heeramandi, Shaitaan, Manjummel Boys, latest OTT releases to binge-watch

Streaming This Week: Heeramandi, Shaitaan, Manjummel Boys, latest OTT releases to binge-watch![submenu-img]() Remember Ayesha Kapur? Michelle from Black, here's how actress, nutrition coach, entrepreneur looks after 19 years

Remember Ayesha Kapur? Michelle from Black, here's how actress, nutrition coach, entrepreneur looks after 19 years![submenu-img]() Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'

Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'![submenu-img]() In pics: Arti Singh stuns in red lehenga as she ties the knot with beau Dipak Chauhan in dreamy wedding

In pics: Arti Singh stuns in red lehenga as she ties the knot with beau Dipak Chauhan in dreamy wedding![submenu-img]() Actors who died due to cosmetic surgeries

Actors who died due to cosmetic surgeries![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence

DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence![submenu-img]() Sobhita Dhulipala opens up about facing ‘casual objectification’: ‘I have been told so many times to…’

Sobhita Dhulipala opens up about facing ‘casual objectification’: ‘I have been told so many times to…’![submenu-img]() Meet actress, who debuted with Aamir Khan's film, now winning hearts in Heeramandi; know her connection to Preity Zinta

Meet actress, who debuted with Aamir Khan's film, now winning hearts in Heeramandi; know her connection to Preity Zinta![submenu-img]() Meet engineer-turned-actor, who quit high-paying job for acting, struggled to get Rs 200; became superstar, now earns…

Meet engineer-turned-actor, who quit high-paying job for acting, struggled to get Rs 200; became superstar, now earns… ![submenu-img]() This film bombed at box office, earned less than Rs 2 crore, Shraddha Kapoor was first choice, director quit filmmaking

This film bombed at box office, earned less than Rs 2 crore, Shraddha Kapoor was first choice, director quit filmmaking![submenu-img]() India's biggest flop lost Rs 250 crore, derailed 2 stars; worse than Adipurush, Shamshera, Ganapath, Laal Singh Chaddha

India's biggest flop lost Rs 250 crore, derailed 2 stars; worse than Adipurush, Shamshera, Ganapath, Laal Singh Chaddha![submenu-img]() IPL 2024: Venkatesh Iyer, Mitchell Starc power Kolkata Knight Riders to 24-run win over Mumbai Indians

IPL 2024: Venkatesh Iyer, Mitchell Starc power Kolkata Knight Riders to 24-run win over Mumbai Indians![submenu-img]() RCB vs GT IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

RCB vs GT IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() RCB vs GT IPL 2024 Dream11 prediction: Fantasy cricket tips for Royal Challengers Bengaluru vs Gujarat Titans

RCB vs GT IPL 2024 Dream11 prediction: Fantasy cricket tips for Royal Challengers Bengaluru vs Gujarat Titans![submenu-img]() Australia dethrone India to become No. 1 ranked test team after annual rankings update

Australia dethrone India to become No. 1 ranked test team after annual rankings update![submenu-img]() Watch: MS Dhoni's heartfelt gesture for CSK's 103-yr-old superfan wins internet, video goes viral

Watch: MS Dhoni's heartfelt gesture for CSK's 103-yr-old superfan wins internet, video goes viral![submenu-img]() Viral video: Man transports huge wardrobe on bike, internet is stunned

Viral video: Man transports huge wardrobe on bike, internet is stunned![submenu-img]() Mother polar bear cuddles with her cub, viral video will melt your heart

Mother polar bear cuddles with her cub, viral video will melt your heart![submenu-img]() Viral video: Girl's 'Choli Ke Piche' dance performance at college fest divides internet, watch

Viral video: Girl's 'Choli Ke Piche' dance performance at college fest divides internet, watch![submenu-img]() Video: Cobra mother's protective instincts go viral as she guards nest of eggs, watch

Video: Cobra mother's protective instincts go viral as she guards nest of eggs, watch![submenu-img]() Die-hard Virat Kohli fan displays love for 'Namma RCB' at graduation ceremony in US, video goes viral

Die-hard Virat Kohli fan displays love for 'Namma RCB' at graduation ceremony in US, video goes viral

)

)

)

)

)

)

)