The benchmark index was positive for the second week straight hop that RBI may further cut rates.

The benchmark BSE Sensex extended its gains for the second straight week, surging 211 points to end at 25,838.14 on persistent buying mainly in Metal, Banking, Realty and Consumer Durable sectors on the hopes that the Reserve Bank of India (RBI) may further cut policy rates.

The Sensex gained in three out of the four sessions of the week. Persistent foreign capital inflows also boosted the market sentiment.

Positive macroeconomic data, including a cooling inflation, and a forecast of an above-normal monsoon this year, kindling hopes of a higher growth and more policy easing by the RBI, boosted market sentiment.

Wholesale price-based inflation in March remained in the negative zone for the 17th month in a row at -0.85% even as prices of some food articles, mainly pulses, turned costlier.

The Sensex resumed higher at 25,833.16 and rose to a 16 -week high of 26,080.07. But fell afterwards to 25,634.12 before ending the week at 25,838.14, still showing a gain of 211.39 points or 0.82%. It has gained by 1,164.30 points of 4.72% in two weeks.

The Sensex had last touched 26,166.52 on January 4, 2016, during the intra-day trade.

The NSE 50-share Nifty also rose by 48.85 points or 0.62% to close the week at 7,899.30 after touching 7,978.45 during the week. The Nifty has gained 344.10 points or 4.55% in two weeks.

The Nifty had last touched 7,979.30 on December 2, 2015.

The Stocks and Sectors

The second-largest IT services company, Infosys, rose by 3.57% after it posted 16.2% rise in net profit at Rs 3,597 crore for the March quarter.

However, TCS stock tumbled 4.20% after a US grand jury awarded Epic Systems $940 million (nearly 6253.585 crore) in damages against it and another group company Tata America International Corp in a trade secret lawsuit.

Banking stocks firmed up on reports that the RBI trimmed the list of companies required for bad loan provisioning.

Meanwhile, foreign portfolio investors (FPIs) and foreign institutional investors (FIIs) bought shares worth Rs 2,163.87 crore during the week as per Sebi's record including the provisional figure of April 22.

Stock markets remained closed on Tuesday, April 19, on account of 'Mahavir Jayanti'.

In the broader market, the BSE mid-cap index rose by 102.34 points or 0.94% to settle at 11,018.64 and the BSE small-cap index also rose by 135.82 points or 1.24% to end at 11,078.84. Both these indices outperformed the Sensex.

Among the S&P, BSE sector and industry indices, Metal rose 4.76%, followed by Realty 4.08%, Consumer Durables 2.07%, Capital Goods 1.01%, Power 0.81% and Oil & Gas 0.66%.

However, FMCG declined by 0.68% and Auto 0.26%.

From the 30-share Sensex pack, 17 stocks rose, while 13 ended lower during the week.

Major gains include: Axis Bank (7.69%), Tata Steel (6.37%), ICICI Bank (4.54%), NTPC (4.37%), SBIN (4.25%), Coal India (3.90%), Cipla (3.86%), Infosys (3.57%), Larsen (2.23%), Maruti (2.22%), Tata Motors (2.06%) HDFC (1.42%) and HDFC Bank (1.02%).

Major losses include: Wipro fell by 4.60% followed by Hero Motocoro 4.59%, Bhel 4.24%, TCS 4.20%, Reliance 2.51%, Bajaj Auto 2.31%, ITC 1.59%, Sun Pharma 1.39%, Hindunilever 1.25% and Adani ports 1.09%.

The total turnover at BSE and NSE rose to Rs 10,743.69 crore and Rs 75,491.52 crore, respectively, as against last weekend's level of Rs 8,967.91 crore and Rs 50,353.08 crore.

Forex

Snapping its last two-week losing streak against the American currency, the rupee recovered by 16 paise to close at 66.48 per dollar on fresh selling of dollars by banks and exporters on the back of fresh foreign capital inflows amid a persistent rise in the equity market.

Positive macroeconomic data, including a cooling inflation and a forecast of an above-normal monsoon this year, kindling hopes of a higher growth and more policy easing by RBI boosted the equity market as well as forex market.

The rupee resumed steady at 66.63 per dollar against last weekend's level of 66.64 per dollar at the Interbank Foreign Exchange (Forex) market and hovered in a wide range of 66.10 per dollar and 66.71 per dollar before concluding the week at 66.48 per dollar, showing a gain of 16 paise or 0.24%.

The domestic currency had dropped by 38 paise or 0.57% in previous two weeks.

In New York, the US dollar rose to its highest level against the yen in three weeks after a report said the Bank of Japan is considering expanding its negative rate policy to bank loans and could cut rates further.

The US dollar index, which measures the greenback against a basket of six major currencies, was up 0.52 percent at 95.087 after hitting a more than one-week high of 95.196.

Foreign portfolio investors (FPIs) and Foreign Institutional Investors (FIIs) bought shares net $296.71 million during the week as per the SEBI's record.

In forward market, the premium for dollar slipped on fresh receiving from exporters.

The benchmark six-month forward dollar premium payable in September fell to 192-194 paise from the last weekend's level of 198.5-200 and far-forward contracts maturing in March also declined to 385-387 from 397.5-398.5 paise previously.

The RBI fixed the reference rate for the dollar at 66.4925 and 75.1033 for the euro as against the last weekend's level of 66.4293 and the euro at 75.4637, respectively.

The rupee dipped further against the pound to close at 95.65 from the last weekend's level of 94.86, However, it gained against the euro to end at 74.91 from 75.32.

The domestic unit rose against the Japanese unit to finish at 60.08 per 100 yen from 60.96 last weekend's level.

![submenu-img]() BMW i5 M60 xDrive launched in India, all-electric sedan priced at Rs 11950000

BMW i5 M60 xDrive launched in India, all-electric sedan priced at Rs 11950000![submenu-img]() This superstar was arrested several times by age 17, thrown out of home, once had just Rs 250, now worth Rs 6600 crore

This superstar was arrested several times by age 17, thrown out of home, once had just Rs 250, now worth Rs 6600 crore![submenu-img]() Meet Reliance’s highest paid employee, gets over Rs 240000000 salary, he is Mukesh Ambani’s…

Meet Reliance’s highest paid employee, gets over Rs 240000000 salary, he is Mukesh Ambani’s… ![submenu-img]() Meet lesser-known relative of Mukesh Ambani, Anil Ambani, has worked with BCCI, he is married to...

Meet lesser-known relative of Mukesh Ambani, Anil Ambani, has worked with BCCI, he is married to...![submenu-img]() Made in just Rs 95,000, this film was a superhit, but destroyed lead actress' career, saw controversy over bold scenes

Made in just Rs 95,000, this film was a superhit, but destroyed lead actress' career, saw controversy over bold scenes![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() In pics: Arti Singh stuns in red lehenga as she ties the knot with beau Dipak Chauhan in dreamy wedding

In pics: Arti Singh stuns in red lehenga as she ties the knot with beau Dipak Chauhan in dreamy wedding![submenu-img]() Actors who died due to cosmetic surgeries

Actors who died due to cosmetic surgeries![submenu-img]() See inside pics: Malayalam star Aparna Das' dreamy wedding with Manjummel Boys actor Deepak Parambol

See inside pics: Malayalam star Aparna Das' dreamy wedding with Manjummel Boys actor Deepak Parambol ![submenu-img]() In pics: Salman Khan, Alia Bhatt, Rekha, Neetu Kapoor attend grand premiere of Sanjay Leela Bhansali's Heeramandi

In pics: Salman Khan, Alia Bhatt, Rekha, Neetu Kapoor attend grand premiere of Sanjay Leela Bhansali's Heeramandi![submenu-img]() Streaming This Week: Crakk, Tillu Square, Ranneeti, Dil Dosti Dilemma, latest OTT releases to binge-watch

Streaming This Week: Crakk, Tillu Square, Ranneeti, Dil Dosti Dilemma, latest OTT releases to binge-watch![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence

DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence![submenu-img]() DNA Explainer: What is India's stand amid Iran-Israel conflict?

DNA Explainer: What is India's stand amid Iran-Israel conflict?![submenu-img]() This superstar was arrested several times by age 17, thrown out of home, once had just Rs 250, now worth Rs 6600 crore

This superstar was arrested several times by age 17, thrown out of home, once had just Rs 250, now worth Rs 6600 crore![submenu-img]() Made in just Rs 95,000, this film was a superhit, but destroyed lead actress' career, saw controversy over bold scenes

Made in just Rs 95,000, this film was a superhit, but destroyed lead actress' career, saw controversy over bold scenes![submenu-img]() Meet 72-year-old who earns Rs 280 cr per film, Asia's highest-paid actor, bigger than Shah Rukh, Salman, Akshay, Prabhas

Meet 72-year-old who earns Rs 280 cr per film, Asia's highest-paid actor, bigger than Shah Rukh, Salman, Akshay, Prabhas![submenu-img]() This star, who once lived in chawl, worked as tailor, later gave four Rs 200-crore films; he's now worth...

This star, who once lived in chawl, worked as tailor, later gave four Rs 200-crore films; he's now worth...![submenu-img]() Tamil star Prasanna reveals why he chose series Ranneeti for Hindi debut: 'Getting into Bollywood is not...'

Tamil star Prasanna reveals why he chose series Ranneeti for Hindi debut: 'Getting into Bollywood is not...'![submenu-img]() IPL 2024: Virat Kohli, Rajat Patidar fifties and disciplined bowling help RCB beat Sunrisers Hyderabad by 35 runs

IPL 2024: Virat Kohli, Rajat Patidar fifties and disciplined bowling help RCB beat Sunrisers Hyderabad by 35 runs![submenu-img]() 'This is the problem in India...': Wasim Akram's blunt take on fans booing Mumbai Indians skipper Hardik Pandya

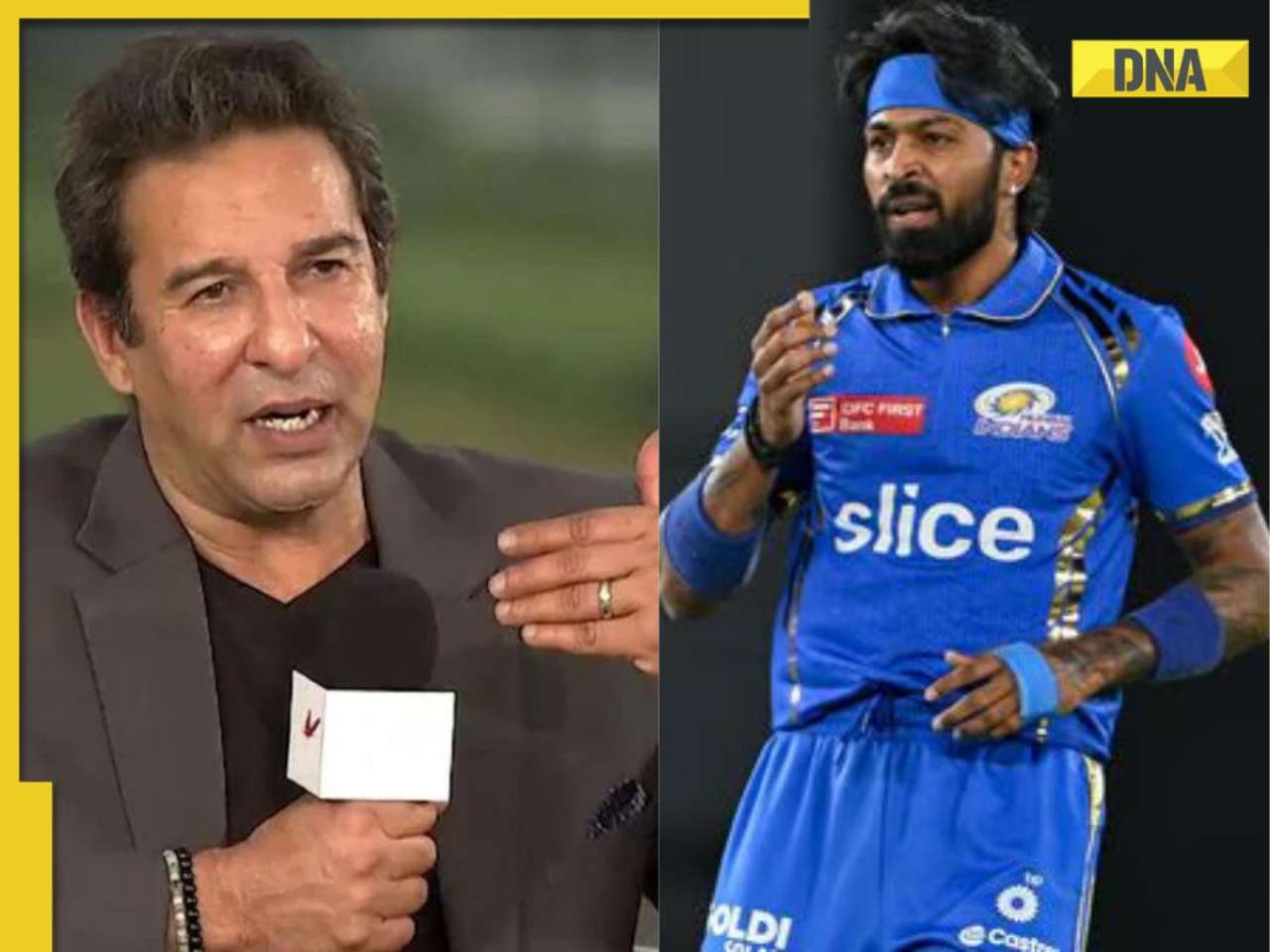

'This is the problem in India...': Wasim Akram's blunt take on fans booing Mumbai Indians skipper Hardik Pandya![submenu-img]() KKR vs PBKS, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

KKR vs PBKS, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() KKR vs PBKS IPL 2024 Dream11 prediction: Fantasy cricket tips for Kolkata Knight Riders vs Punjab Kings

KKR vs PBKS IPL 2024 Dream11 prediction: Fantasy cricket tips for Kolkata Knight Riders vs Punjab Kings![submenu-img]() IPL 2024: KKR star Rinku Singh finally gets another bat from Virat Kohli after breaking previous one - Watch

IPL 2024: KKR star Rinku Singh finally gets another bat from Virat Kohli after breaking previous one - Watch![submenu-img]() Viral video: Teacher's cute way to capture happy student faces melts internet, watch

Viral video: Teacher's cute way to capture happy student faces melts internet, watch![submenu-img]() Woman attends online meeting on scooter while stuck in traffic, video goes viral

Woman attends online meeting on scooter while stuck in traffic, video goes viral![submenu-img]() Viral video: Pilot proposes to flight attendant girlfriend before takeoff, internet hearts it

Viral video: Pilot proposes to flight attendant girlfriend before takeoff, internet hearts it![submenu-img]() Pakistani teen receives life-saving heart transplant from Indian donor, details here

Pakistani teen receives life-saving heart transplant from Indian donor, details here![submenu-img]() Viral video: Truck driver's innovative solution to beat the heat impresses internet, watch

Viral video: Truck driver's innovative solution to beat the heat impresses internet, watch

)

)

)

)

)

)

)