Under the new norms, the municipal authorities would need to have a strong financial track record and such bonds would be listed on stock exchanges.

To help the government's 'smart cities' programme, capital markets regulator Sebi on Wednesday notified new norms for listing and trading of municipal bonds on stock exchanges.

The move would allow authorities to mop-up funds, including for setting up smart cities, by raising money from the public and institutional investors.

Under the new norms, the municipal authorities would need to have a strong financial track record and such bonds would be listed on stock exchanges.

Conservative Indian investors mostly invest in fixed deposits, small saving schemes or gold.

Now, bonds issued by municipalities having good financial track record would be another alternative investment opportunity for them. Such bonds would provide reasonable return with less risk, which in turn may accelerate the capital markets.

Commonly known as 'muni bonds', these investment products are very popular among investors in many developed nations, especially the United States, where muni bonds have attracted investments totalling over US $500 billion and are among preferred avenues for household savings.

For issuing debt securities to public under the regulations, municipalities need not have negative net worth in any of the three immediately preceding financial years.

Besides, the authority should not have defaulted in repayment of debt securities or loans obtained from banks or financial institutions, during the last one year.

"The corporate municipal entity, its promoter, group company or director, should not have been named in the list of the willful defaulters published by the RBI or should not have defaulted of payment of interest or repayment of principal amount in respect of debt instruments issued by it to the public, if any," Sebi said in a notification.

An issuer making public issue of debt securities can only issue revenue bonds. The issuer should have obtained rating from at least one credit rating agency.

The revenue bonds would have a maximum tenure of thirty years or such period as specified by Sebi from time to time.

The issuer shall appoint at least one merchant banker.

The issuer would have to appoint a monitoring agency such as public financial institution or a scheduled commercial bank to monitor the earmarked revenue in the escrow account.

The issuer would have to decide the minimum subscription amount which it seeks to raise by issue of debt securities and disclose the same in the offer document.

The minimum subscription limit would not be less than 75% of the issue size.

In case of non-receipt of minimum subscription, all application money received in the public issue would be refunded to the applicants within 12 days from the date of closure of the issue.

However, in case of a delay by the issuer in making the refund, then the issuer would refund the subscription amount along with an annual interest of 10% for the delayed period.

With regard to disclosures, Sebi said that offer document would contain "true, fair and material disclosures, which are necessary for the subscribers of the revenue bonds to take an informed investment decision."

Sebi said that no issuer would make a public issue of revenue bonds unless a draft offer document has been filed with the designated stock exchange through the lead merchant banker.

"Provided that where an issuer has filed a shelf prospectus, not more than four public issuances shall be made through a single shelf prospectus during a financial year," Sebi noted.

The funds raised from public issue of debt securities would be used only for projects that are specified under objects in the offer document, it added.

The issuer would have to set up a separate project implementation cell and designate a project officer for monitoring the progress of the project.

"Issuer's contribution for each project shall not be less than 12% of the project costs, which shall be contributed from their internal resources or grants," Sebi noted.

In December last year, Sebi had floated draft norms for 'Issue and Listing of Debt Securities by Municipality' and had sought public comments till January 30.

While such bonds have been issued by various municipal authorities in the country, the total funds raised through them stand at only about Rs 1,353 crore.

The Bangalore Municipal Corporation was the first to issue a municipal bond of Rs 125 crore with a state guarantee in 1997.

However, access to capital market commenced in January, 1998, when the Ahmedabad Municipal Corporation (AMC) issued the first municipal bonds in the country without state government guarantee for financing infrastructure projects in the city.

Asset management companies raised Rs 100 crore through its public issue.

Among others, Hyderabad, Nashik, Visakhapatnam, Chennai and Nagpur municipal authorities have issued such bonds.

However, there is no provision as yet for listing and subsequent trading of muni bonds on stock exchanges in India.

As per guidelines of the Urban Development Ministry, only bonds carrying interest rate up to a maximum of 8% per annum shall be eligible for being notified as tax-free bonds.

Sebi's Corporate Bonds and Securitisation Advisory Committee was of the view that having a fixed rate of 8% might not attract investors.

![submenu-img]() Ramesh Awasthi: Kanpur's 'Karma Yogi' - Know inspirational journey of 'common man' devoted for society

Ramesh Awasthi: Kanpur's 'Karma Yogi' - Know inspirational journey of 'common man' devoted for society![submenu-img]() Tovino Thomas accused of stopping his film Vazhakku's release by director Sanal Kumar Sasidharan: 'The agenda of...'

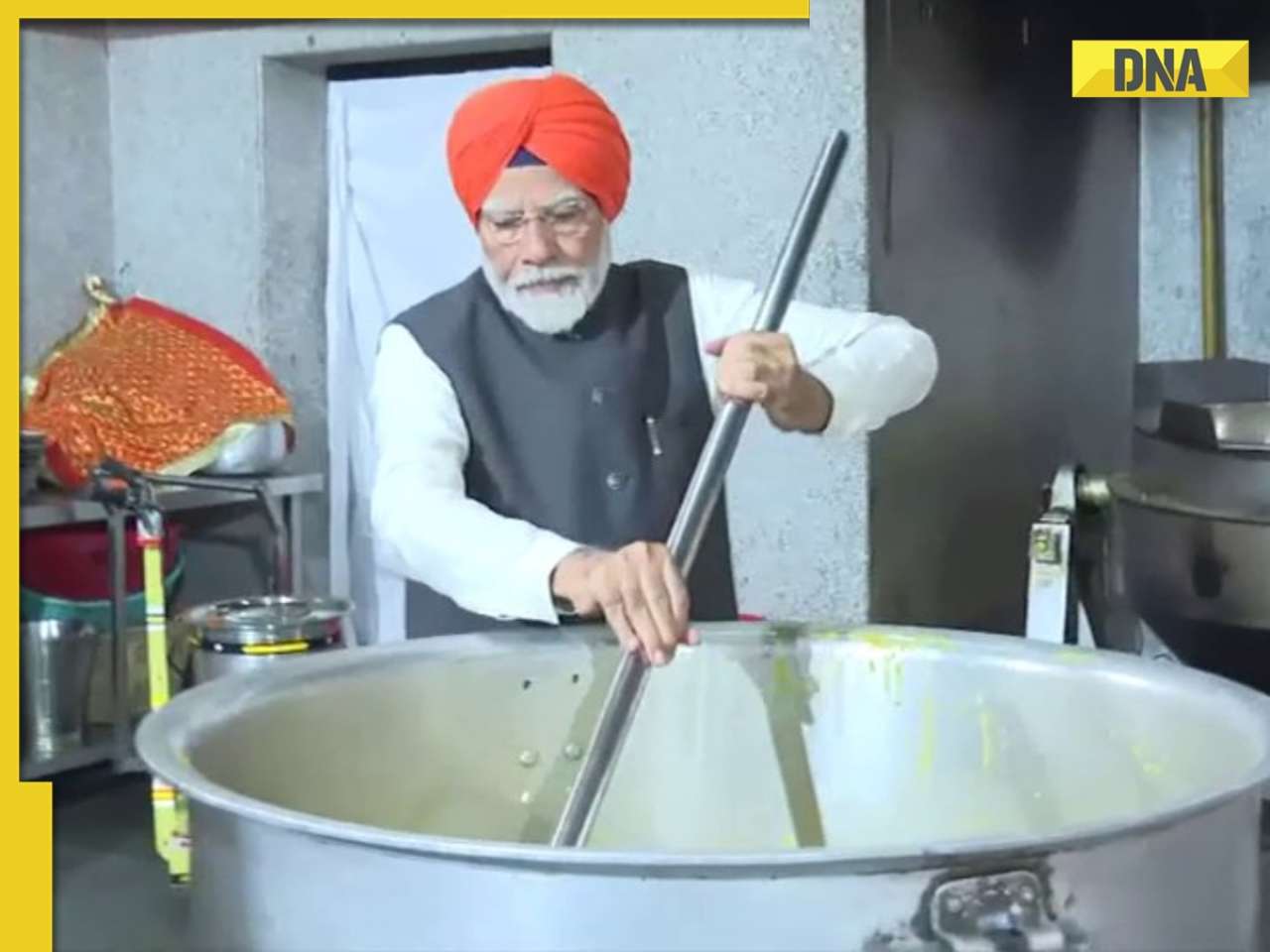

Tovino Thomas accused of stopping his film Vazhakku's release by director Sanal Kumar Sasidharan: 'The agenda of...'![submenu-img]() PM Modi wears turban, serves langar at Gurudwara Patna Sahib in Bihar, watch

PM Modi wears turban, serves langar at Gurudwara Patna Sahib in Bihar, watch![submenu-img]() Anil Ambani’s debt-ridden Reliance’s ‘buyer’ now waits for RBI nod, wants Rs 80000000000…

Anil Ambani’s debt-ridden Reliance’s ‘buyer’ now waits for RBI nod, wants Rs 80000000000…![submenu-img]() Man in bizarre jeans dances to Tinku Jiya in crowded metro, viral video makes internet furious

Man in bizarre jeans dances to Tinku Jiya in crowded metro, viral video makes internet furious![submenu-img]() Maharashtra Board HSC, SSC Results 2024: MSBSHSE class 10, 12 results soon at mahresult.nic.in, latest update here

Maharashtra Board HSC, SSC Results 2024: MSBSHSE class 10, 12 results soon at mahresult.nic.in, latest update here![submenu-img]() Meet IIT-JEE topper who passed JEE Advanced with AIR 1, decided to drop out of IIT due to…

Meet IIT-JEE topper who passed JEE Advanced with AIR 1, decided to drop out of IIT due to…![submenu-img]() Meet IPS Idashisha Nongrang, who became Meghalaya's first woman DGP

Meet IPS Idashisha Nongrang, who became Meghalaya's first woman DGP![submenu-img]() CBSE Results 2024: CBSE Class 10, 12 results date awaited, check latest update here

CBSE Results 2024: CBSE Class 10, 12 results date awaited, check latest update here![submenu-img]() Meet man, who was denied admission in IIT due to blindness, inspiration behind Rajkummar Rao’s film, now owns...

Meet man, who was denied admission in IIT due to blindness, inspiration behind Rajkummar Rao’s film, now owns...![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Remember Harsh Lunia? Just Mohabbat child star, here's how former actor looks now, his wife is Bollywood's popular...

Remember Harsh Lunia? Just Mohabbat child star, here's how former actor looks now, his wife is Bollywood's popular...![submenu-img]() Mother's Day 2024: Bollywood supermoms who balance motherhood, acting, and run multi-crore businesses

Mother's Day 2024: Bollywood supermoms who balance motherhood, acting, and run multi-crore businesses![submenu-img]() Rocky Aur Rani's Golu aka Anjali Anand shocks fans with drastic weight loss without gym, says fitness secret is...

Rocky Aur Rani's Golu aka Anjali Anand shocks fans with drastic weight loss without gym, says fitness secret is...![submenu-img]() In pics: Ram Charan gets mobbed by fans during his visit to Pithapuram for ‘indirect campaign’ for uncle Pawan Kalyan

In pics: Ram Charan gets mobbed by fans during his visit to Pithapuram for ‘indirect campaign’ for uncle Pawan Kalyan![submenu-img]() Streaming This Week: Yodha, Aavesham, Murder In Mahim, Undekhi season 3, latest OTT releases to binge-watch

Streaming This Week: Yodha, Aavesham, Murder In Mahim, Undekhi season 3, latest OTT releases to binge-watch![submenu-img]() Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?

Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() Tovino Thomas accused of stopping his film Vazhakku's release by director Sanal Kumar Sasidharan: 'The agenda of...'

Tovino Thomas accused of stopping his film Vazhakku's release by director Sanal Kumar Sasidharan: 'The agenda of...'![submenu-img]() Ratna Pathak Shah calls Guru Dutt and Bimal Roy's films 'offensive', says, 'women are constantly...'

Ratna Pathak Shah calls Guru Dutt and Bimal Roy's films 'offensive', says, 'women are constantly...'![submenu-img]() Shreyas Talpade recalls how he felt bad when his film Kaun Pravin Tambe did not release in theatres: 'It deserved...'

Shreyas Talpade recalls how he felt bad when his film Kaun Pravin Tambe did not release in theatres: 'It deserved...'![submenu-img]() Anup Soni slams his deepfake video from Crime Patrol, being used to promote IPL betting

Anup Soni slams his deepfake video from Crime Patrol, being used to promote IPL betting![submenu-img]() Real story that inspired Heeramandi: The tawaif who helped Gandhi fight British Raj, was raped, abused, died in...

Real story that inspired Heeramandi: The tawaif who helped Gandhi fight British Raj, was raped, abused, died in...![submenu-img]() Man in bizarre jeans dances to Tinku Jiya in crowded metro, viral video makes internet furious

Man in bizarre jeans dances to Tinku Jiya in crowded metro, viral video makes internet furious![submenu-img]() Lift collides with roof in Noida society after brakes fail, 3 injured

Lift collides with roof in Noida society after brakes fail, 3 injured![submenu-img]() Zomato CEO Deepinder Goyal invites employees' moms to office for Mother's Day celebration, watch

Zomato CEO Deepinder Goyal invites employees' moms to office for Mother's Day celebration, watch![submenu-img]() This clip of kind woman feeding rotis to stray cows will bring tears of joy to your eyes, watch

This clip of kind woman feeding rotis to stray cows will bring tears of joy to your eyes, watch![submenu-img]() Viral video: Seagull swallows squirrel whole in single go, internet is stunned

Viral video: Seagull swallows squirrel whole in single go, internet is stunned

)

)

)

)

)

)

)