- Home

- Latest News

![submenu-img]() Viral video: Woman tries to cook omelette on road, internet is not happy

Viral video: Woman tries to cook omelette on road, internet is not happy![submenu-img]() RCB cancels practice, press meet after threat to Virat Kohli's security ahead of IPL 2024 eliminator: Report

RCB cancels practice, press meet after threat to Virat Kohli's security ahead of IPL 2024 eliminator: Report ![submenu-img]() Meet Indian-origin man, IIT alumnus who is world's second-highest paid CEO, his salary per day is...

Meet Indian-origin man, IIT alumnus who is world's second-highest paid CEO, his salary per day is...![submenu-img]() RBI approves Rs 2.11 lakh crore dividend payout to Indian govt for 2023-24

RBI approves Rs 2.11 lakh crore dividend payout to Indian govt for 2023-24![submenu-img]() Mozz Guard Mosquito Zapper Reviews (Zap Guardian): Side effects, ingredients benefits, price

Mozz Guard Mosquito Zapper Reviews (Zap Guardian): Side effects, ingredients benefits, price

- Election 2024

- Webstory

- IPL 2024

- Education

![submenu-img]() IIT graduate builds Rs 1057990000000 company, leaves to get a job, now working as a….

IIT graduate builds Rs 1057990000000 company, leaves to get a job, now working as a….![submenu-img]() Indian Air Force Agniveervayu Recruitment 2024: Registration starts today, know eligibility, steps to apply

Indian Air Force Agniveervayu Recruitment 2024: Registration starts today, know eligibility, steps to apply![submenu-img]() Meet woman who was married at 16, faced domestic abuse, did odd jobs as single mom, became IAS officer, is posted at...

Meet woman who was married at 16, faced domestic abuse, did odd jobs as single mom, became IAS officer, is posted at...![submenu-img]() Maharashtra HSC 12th 2024: Result declared, know how to check

Maharashtra HSC 12th 2024: Result declared, know how to check![submenu-img]() Meet man who topped IIT-JEE, studied at IIT Bombay, then went to MIT, now is...

Meet man who topped IIT-JEE, studied at IIT Bombay, then went to MIT, now is...

- DNA Verified

![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

- Her DNA

- Photos

![submenu-img]() AI models show bikini style for perfect beach holiday this summer

AI models show bikini style for perfect beach holiday this summer![submenu-img]() Laapataa Ladies actress Chhaya Kadam ditches designer clothes, wears late mother's saree, nose ring on Cannes red carpet

Laapataa Ladies actress Chhaya Kadam ditches designer clothes, wears late mother's saree, nose ring on Cannes red carpet![submenu-img]() Urvashi Rautela mesmerises in blue celestial gown, her dancing fish necklace steals the limelight at Cannes 2024

Urvashi Rautela mesmerises in blue celestial gown, her dancing fish necklace steals the limelight at Cannes 2024![submenu-img]() Kiara Advani attends Women In Cinema Gala in dramatic ensemble, netizens say 'who designs these hideous dresses'

Kiara Advani attends Women In Cinema Gala in dramatic ensemble, netizens say 'who designs these hideous dresses'![submenu-img]() Influencer Diipa Büller-Khosla looks 'drop dead gorgeous' in metallic structured dress at Cannes 2024

Influencer Diipa Büller-Khosla looks 'drop dead gorgeous' in metallic structured dress at Cannes 2024

- DNA Explainers

![submenu-img]() DNA Explainer: Why was Iranian president Ebrahim Raisi, killed in helicopter crash, regarded as ‘Butcher of Tehran’?

DNA Explainer: Why was Iranian president Ebrahim Raisi, killed in helicopter crash, regarded as ‘Butcher of Tehran’?![submenu-img]() DNA Explainer: Why did deceased Iranian President Ebrahim Raisi wear black turban?

DNA Explainer: Why did deceased Iranian President Ebrahim Raisi wear black turban?![submenu-img]() Iran President Ebrahim Raisi's death: Will it impact gold, oil prices and stock markets?

Iran President Ebrahim Raisi's death: Will it impact gold, oil prices and stock markets?![submenu-img]() Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?

Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

- Entertainment

![submenu-img]() Watch: Kapil Sharma's daughter complains as paps click her photos in viral video, says 'papa aapne kaha tha ki...'

Watch: Kapil Sharma's daughter complains as paps click her photos in viral video, says 'papa aapne kaha tha ki...'![submenu-img]() Watch: Anil Kapoor hijacks The Great Indian Kapil Show, Farah Khan reveals which actor is 'most kanjoos' in Bollywood

Watch: Anil Kapoor hijacks The Great Indian Kapil Show, Farah Khan reveals which actor is 'most kanjoos' in Bollywood![submenu-img]() Manoj Bajpayee reveals why Anurag Kashyap didn’t work with him for 14 years: ‘My career was going down, he didn’t...'

Manoj Bajpayee reveals why Anurag Kashyap didn’t work with him for 14 years: ‘My career was going down, he didn’t...'![submenu-img]() Sanjay Dutt quits Welcome 3 after fallout with Akshay Kumar? Report says he walked out after first day because...

Sanjay Dutt quits Welcome 3 after fallout with Akshay Kumar? Report says he walked out after first day because...![submenu-img]() Allu Arjun enjoys lunch with wife Sneha at dhaba; fans hail his ‘simplicity’ despite Pushpa success

Allu Arjun enjoys lunch with wife Sneha at dhaba; fans hail his ‘simplicity’ despite Pushpa success

- Viral News

![submenu-img]() Viral video: Woman tries to cook omelette on road, internet is not happy

Viral video: Woman tries to cook omelette on road, internet is not happy![submenu-img]() Groom saves bride from unexpected milk bath during haldi ceremony, viral video melts internet

Groom saves bride from unexpected milk bath during haldi ceremony, viral video melts internet![submenu-img]() Viral video captures epic showdown between two king cobras, watch who wins

Viral video captures epic showdown between two king cobras, watch who wins![submenu-img]() Viral video: Woman's 'Senorita' dance steals hearts during RCB vs CSK match in Bengaluru, watch

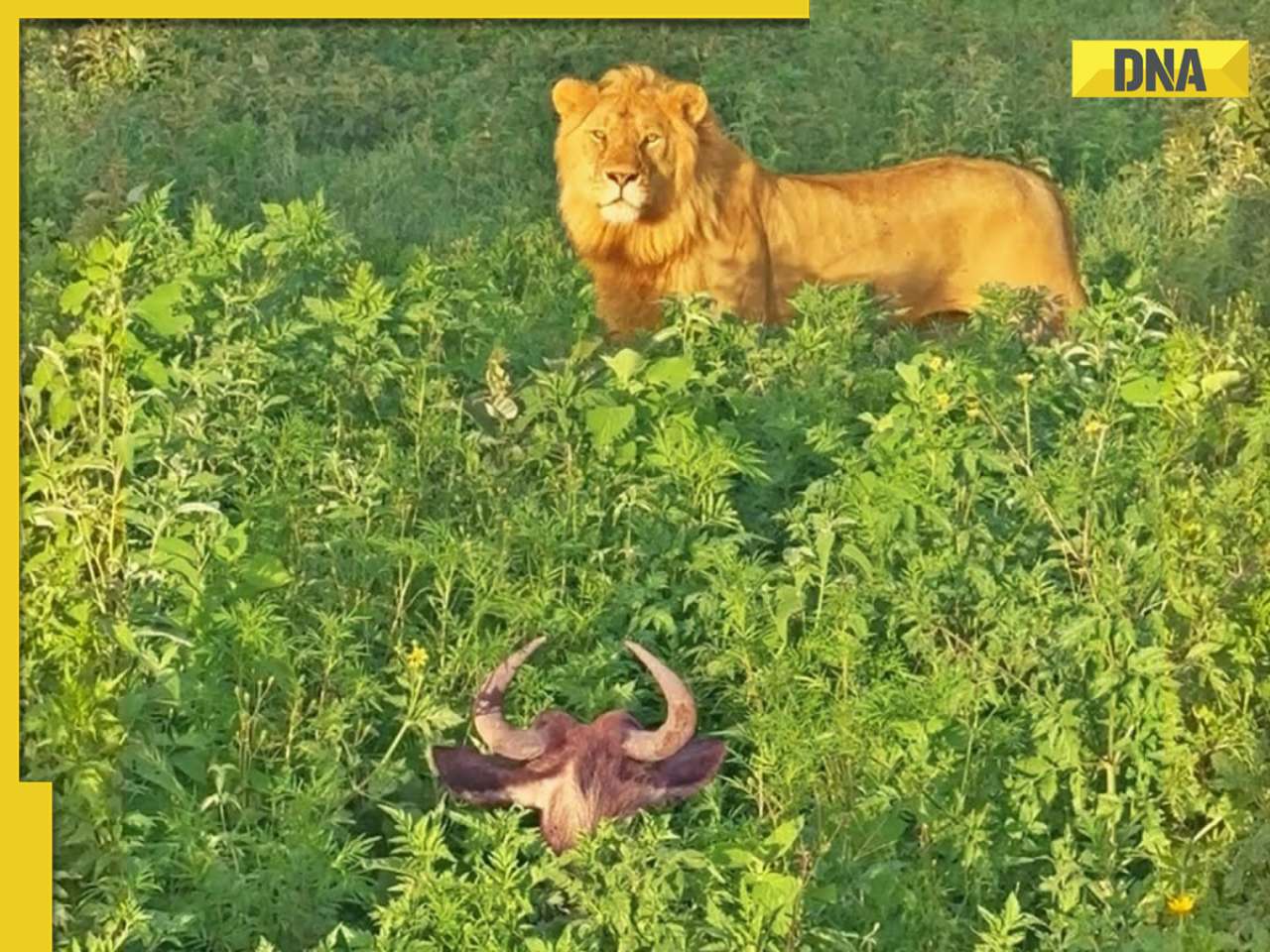

Viral video: Woman's 'Senorita' dance steals hearts during RCB vs CSK match in Bengaluru, watch ![submenu-img]() Viral video: Lion's terrifying ambush on napping wildebeest stuns internet, watch

Viral video: Lion's terrifying ambush on napping wildebeest stuns internet, watch

)

)

)

)

)

)

)