Generally, health insurance companies tie up with hospitals based on certain conditions. And these network hospitals provide cashless service to the policy holders.

Cashless mediclaim policies help reduces the burden of hospitalisation expenses. Generally, health insurance companies tie up with hospitals based on certain conditions. And these network hospitals provide cashless service to the policy holders. But, how do you ensure that your claims are not rejected? Here is a to-do list.

Planned hospitalisation

In case of an elective or planned hospitalisation, the customer is advised to take a pre-authorisation at least two days in advance. Pre-authorisation forms are available either from hospital or on third party administrators (TPA) website.

TPAs are representatives of the health insurance companies who settle claims under reimbursement as well as cashless scheme.

TPAs will approve the request for cashless claims.

The first part of the pre-authorisation form shall be filled by the patient. Establish correct and detailed information and submit the duly filled form to the insurance desk of the hospital for further verification. The latter part of the form should be filled by the attending doctor. It is better to follow up with the TPA or in- house service team of the insurance company for getting the status of your request for cashless mediclaim.

Emergency hospitalisation

In an emergency, try to inform the insurance company at the earliest. Customers are advised to carry their cashless card, policy number or the contact number of the insurance company with them. It is also important that the immediate family member such as spouse, siblings or parents is aware about your policy number and contact or toll free numbers relating to the health insurance policy. Start the procedure for getting cashless claims within 24 hours of hospitalisation.

Network hospitals

An updated list of network hospitals may be available on the website of insurers or concerned TPAs. Always check the nearest available network hospitals so that you can take a treatment from there in case of emergency. Karan Chopra, business head - retail business group, HDFC ERGO General Insurance Co Ltd, said, “We have 3800 network hospitals through which we offer cashless service to our customers. However, customer can opt to get treated outside this list if they prefer. In that case, they need to pay the hospital bills then claim for the reimbursement of medical bills later on.”

Declaration of pre-existing diseases

Proper declaration of pre-existing diseases should be done at the time of purchase of policy. It will help the policy holder to know about the exemptions specified by the insurance company. There is a possibility of rejecting the claim if the information provided on the pre-existing disease is insufficient in the pre-authorisation form.

Read policy document thoroughly

One should read the document thoroughly and be conversant with the policy terms and conditions and be aware of certain waiting period that may be applicable under the policy. Keep a check on the mails and SMS alerts sent by the insurance companies relating to your cashless policy.

Keep a check on the sum assured

Make sure that your sum assured is not exhausted for the particular year while making claims. “To avoid situations of medical expenses exceeding sum insured, it is better to have a continuous assessment of ones health risks. Besides, make sure that the person is adequately covered under the policy. On an average, people between the age group of 25 and 40 should have a cover of Rs2 to 3 lakh and for those who are above this age should get a cover of Rs3 to 5 lakh,” says TA Ramalingam, head-underwriting, Bajaj Allianz General Insurance.

Tariff

An insurance company, before tying up with a set of hospitals for providing cashless mediclaim, agrees on a tariff. Hence, the hospital will not charge any extra amount to the insured for the treatments. However, it is better to compare the tariff agreed by various companies to get a better deal.

“Our company agrees a particular tariff with the service providers to ensure the policy holders are not paying any additional amount . Hence the net work hospitals ensure the compliance by virtue of the relationship. This helps us to ensure that our customers avail complete benefit of a cashless mediclaim facility,” added Datta.

Preferred provider network service

Under preferred provider network (PPN), a customer gets certain added advantages specified by the insurance companies. “We offer discounted rates, inclusion of non-medical expenses and some value added services like discount in hospital expenses and consultations. There are more than 400 PPN serviced with us,” said Ramalingam of Bajaj Allianz General Insurance.

While making claims it is important to ensure that the disease, for which you are hospitalised, is covered under the policy and other terms and conditions specified under cashless facility.

“Customers should keep a record of all pre and post hospitalisation expenses, such as diagnostic tests and investigations, so that in case of queries or clarifications related to their claims these can be referred and dealt easily,” says Damien Marmion, chief executive officer, Max Bupa Health Insurance.

Sanjay Datta, head customer service, ICICI Lombard, GIC Ltd, said, “To make the customers aware, continuous exercise of educating them happens across the life cycle of the insured. Detailed information brochure is given to the customers as part of the policy kit. Welcome calls are made to the customer explaining the process. Series of mails sharing information is sent on a regular basis to the customers. All information regarding cashless mediclaim is also present on our website too.”

![submenu-img]() BMW i5 M60 xDrive launched in India, all-electric sedan priced at Rs 11950000

BMW i5 M60 xDrive launched in India, all-electric sedan priced at Rs 11950000![submenu-img]() This superstar was arrested several times by age 17, thrown out of home, once had just Rs 250, now worth Rs 6600 crore

This superstar was arrested several times by age 17, thrown out of home, once had just Rs 250, now worth Rs 6600 crore![submenu-img]() Meet Reliance’s highest paid employee, gets over Rs 240000000 salary, he is Mukesh Ambani’s…

Meet Reliance’s highest paid employee, gets over Rs 240000000 salary, he is Mukesh Ambani’s… ![submenu-img]() Meet lesser-known relative of Mukesh Ambani, Anil Ambani, has worked with BCCI, he is married to...

Meet lesser-known relative of Mukesh Ambani, Anil Ambani, has worked with BCCI, he is married to...![submenu-img]() Made in just Rs 95,000, this film was a superhit, but destroyed lead actress' career, saw controversy over bold scenes

Made in just Rs 95,000, this film was a superhit, but destroyed lead actress' career, saw controversy over bold scenes![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() In pics: Arti Singh stuns in red lehenga as she ties the knot with beau Dipak Chauhan in dreamy wedding

In pics: Arti Singh stuns in red lehenga as she ties the knot with beau Dipak Chauhan in dreamy wedding![submenu-img]() Actors who died due to cosmetic surgeries

Actors who died due to cosmetic surgeries![submenu-img]() See inside pics: Malayalam star Aparna Das' dreamy wedding with Manjummel Boys actor Deepak Parambol

See inside pics: Malayalam star Aparna Das' dreamy wedding with Manjummel Boys actor Deepak Parambol ![submenu-img]() In pics: Salman Khan, Alia Bhatt, Rekha, Neetu Kapoor attend grand premiere of Sanjay Leela Bhansali's Heeramandi

In pics: Salman Khan, Alia Bhatt, Rekha, Neetu Kapoor attend grand premiere of Sanjay Leela Bhansali's Heeramandi![submenu-img]() Streaming This Week: Crakk, Tillu Square, Ranneeti, Dil Dosti Dilemma, latest OTT releases to binge-watch

Streaming This Week: Crakk, Tillu Square, Ranneeti, Dil Dosti Dilemma, latest OTT releases to binge-watch![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence

DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence![submenu-img]() DNA Explainer: What is India's stand amid Iran-Israel conflict?

DNA Explainer: What is India's stand amid Iran-Israel conflict?![submenu-img]() This superstar was arrested several times by age 17, thrown out of home, once had just Rs 250, now worth Rs 6600 crore

This superstar was arrested several times by age 17, thrown out of home, once had just Rs 250, now worth Rs 6600 crore![submenu-img]() Made in just Rs 95,000, this film was a superhit, but destroyed lead actress' career, saw controversy over bold scenes

Made in just Rs 95,000, this film was a superhit, but destroyed lead actress' career, saw controversy over bold scenes![submenu-img]() Meet 72-year-old who earns Rs 280 cr per film, Asia's highest-paid actor, bigger than Shah Rukh, Salman, Akshay, Prabhas

Meet 72-year-old who earns Rs 280 cr per film, Asia's highest-paid actor, bigger than Shah Rukh, Salman, Akshay, Prabhas![submenu-img]() This star, who once lived in chawl, worked as tailor, later gave four Rs 200-crore films; he's now worth...

This star, who once lived in chawl, worked as tailor, later gave four Rs 200-crore films; he's now worth...![submenu-img]() Tamil star Prasanna reveals why he chose series Ranneeti for Hindi debut: 'Getting into Bollywood is not...'

Tamil star Prasanna reveals why he chose series Ranneeti for Hindi debut: 'Getting into Bollywood is not...'![submenu-img]() IPL 2024: Virat Kohli, Rajat Patidar fifties and disciplined bowling help RCB beat Sunrisers Hyderabad by 35 runs

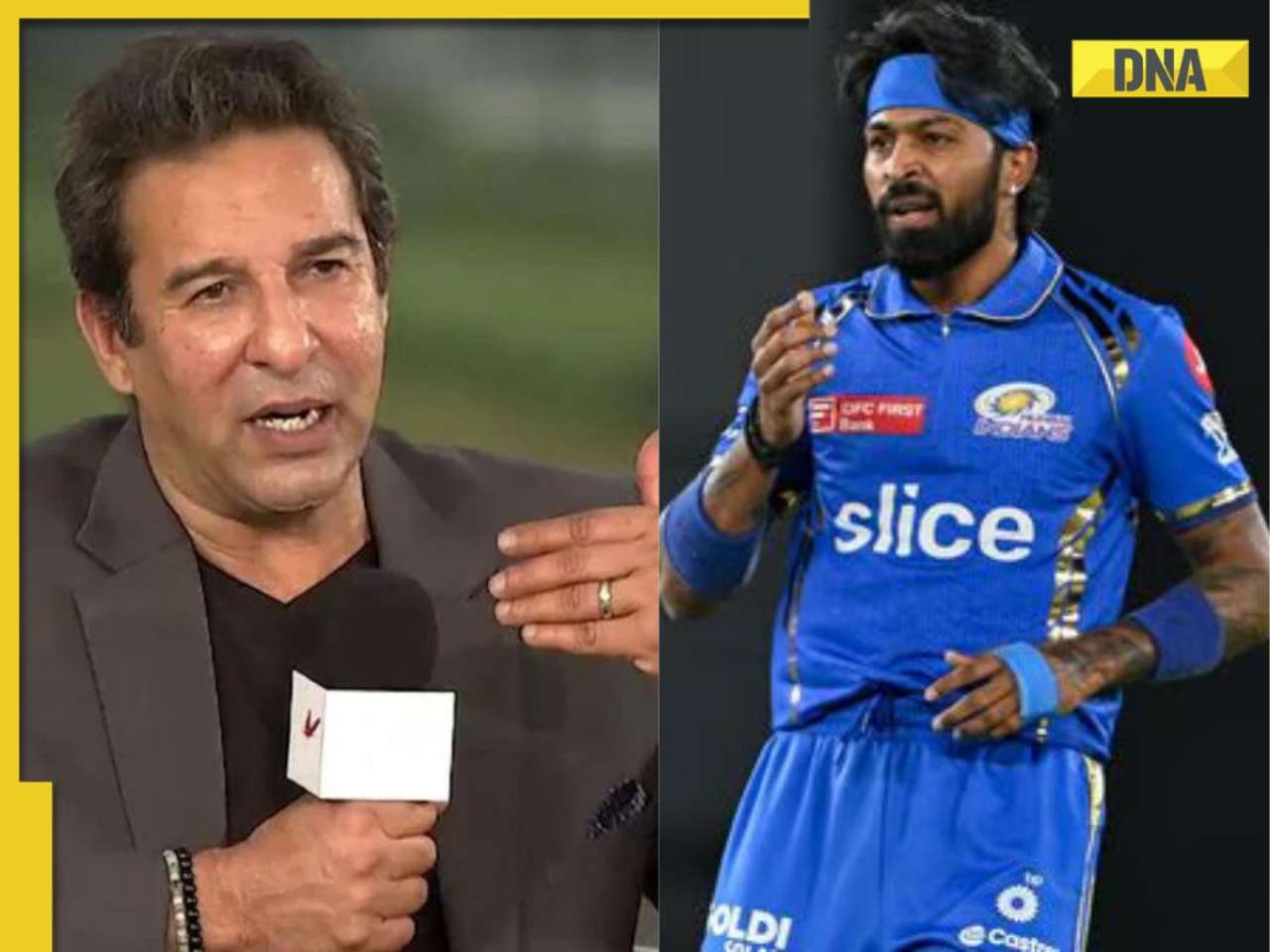

IPL 2024: Virat Kohli, Rajat Patidar fifties and disciplined bowling help RCB beat Sunrisers Hyderabad by 35 runs![submenu-img]() 'This is the problem in India...': Wasim Akram's blunt take on fans booing Mumbai Indians skipper Hardik Pandya

'This is the problem in India...': Wasim Akram's blunt take on fans booing Mumbai Indians skipper Hardik Pandya![submenu-img]() KKR vs PBKS, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

KKR vs PBKS, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() KKR vs PBKS IPL 2024 Dream11 prediction: Fantasy cricket tips for Kolkata Knight Riders vs Punjab Kings

KKR vs PBKS IPL 2024 Dream11 prediction: Fantasy cricket tips for Kolkata Knight Riders vs Punjab Kings![submenu-img]() IPL 2024: KKR star Rinku Singh finally gets another bat from Virat Kohli after breaking previous one - Watch

IPL 2024: KKR star Rinku Singh finally gets another bat from Virat Kohli after breaking previous one - Watch![submenu-img]() Viral video: Teacher's cute way to capture happy student faces melts internet, watch

Viral video: Teacher's cute way to capture happy student faces melts internet, watch![submenu-img]() Woman attends online meeting on scooter while stuck in traffic, video goes viral

Woman attends online meeting on scooter while stuck in traffic, video goes viral![submenu-img]() Viral video: Pilot proposes to flight attendant girlfriend before takeoff, internet hearts it

Viral video: Pilot proposes to flight attendant girlfriend before takeoff, internet hearts it![submenu-img]() Pakistani teen receives life-saving heart transplant from Indian donor, details here

Pakistani teen receives life-saving heart transplant from Indian donor, details here![submenu-img]() Viral video: Truck driver's innovative solution to beat the heat impresses internet, watch

Viral video: Truck driver's innovative solution to beat the heat impresses internet, watch

)

)

)

)

)

)