Emerging stocks fell to one-week lows on Tuesday, while currencies firmed marginally ahead of a widely-anticipated speech by U.S. President Donald Trump, although both asset classes were on track for hefty monthly gains.

Markets worldwide are on tenterhooks before Trump's first Congressional address, where he could provide detail on his spending and tax reform plans and may also accuse countries, especially China, of currency manipulation.

Lack of action so far on these issues has kept the dollar subdued and unleashed stock market bulls - MSCI's emerging equity index hit 19-month highs with 10 percent year-to-date gains at one point.

While the index is set for a second month of gains, some investors have retreated in the run-up to Trump speech.

"If our worst fears are confirmed (on protectionism) you can expect quite a correction in emerging markets," said Maarten-Jan Bakkum, investment strategist at NN Investment Partners who is neutral on emerging equities.

"Since the (Trump) inauguration, markets have priced out some of the protectionism risks...people are impatient to play the emerging markets theme as (economic) data has been so good."

Emerging equity funds have received $6.5 billion this year, and funds dedicated to Brazil and Russia have led inflows to country-specific emerging equity vehicles, according to data from Bank of America Merrill Lynch.

These flows have allowed emerging currencies to firm against the dollar, with the Russian rouble up 4 percent in its third month of gains, lifted also by robust oil prices.

The lira enjoyed its first month of gains since August , as Turkey's central bank raised funding rates to 10.5 percent.

Currencies in Asia, the region most vulnerable to greater U.S. protectionism, drifted off multi-month highs

The Indian rupee moved further off three-month highs before 1200 GMT data that is likely to show economic growth slowed to a three-year low of 6.4 percent in the Oct-Dec 2016 quarter due to a sweeping currency reform exercise.

In central Europe, Hungarian shares were the biggest movers with a 1.2 percent fall, led by a 3 percent decline in oil firm MOL which posted lower fourth quarter profits . The index may close in the red after four months of gains, having hit successive record highs.

The forint was flat against the euro before a central bank meeting that is expected to hold rates at 0.9 percent, despite rising inflation. ING Bank analysts said, however, this would not undermine the forint which remains close to recent five-week highs around 306.6 per euro.

"The (central bank) seems to be determined to keep monetary policy loose and should look through rising domestic inflation," ING told clients, noting Hungarian bond inflows thanks to robust risk appetite and the recent fall in German two-year yields.

"As both factors seem to be still in place, a limited euro/forint downtrend is likely to continue for a while yet. Euro/forint to re-test the 307 level," they added.

One of the gloomy spots was Nigeria, which failed to devalue the naira this month after raising expectations it was about to do so. Latest data showed the economy contracted 1.5 percent last year.

The naira slipped 1 percent in the six-month NDF market after central bank dollar sales on Monday, which banks offered on to retail clients at 375 per dollar - far weaker than official 305 per dollar rates. But it firmed 2.2 percent to 450 per dollar on the black market on Tuesday, a more than four-month high.

On bond markets, emerging sovereign dollar bonds' yield premia over Treasuries was at two-week lows around 312 basis points, having contracted 16 bps this month.

For GRAPHIC on emerging market FX performance 2017, see http://tmsnrt.rs/2e7eoml For GRAPHIC on MSCI emerging index performance 2017, see http://tmsnrt.rs/2dZbdP5

For CENTRAL EUROPE market report, see

For TURKISH market report, see

For RUSSIAN market report, see) Emerging Markets Prices from Reuters Equities Latest Net Chg % Chg % Chg

on year

Morgan Stanley Emrg Mkt Indx 938.95 -1.37 -0.15 +8.89

Czech Rep 955.55 -3.06 -0.32 +3.68

Poland 2190.19 -20.07 -0.91 +12.44

Hungary 32539.50 -332.61 -1.01 +1.68

Romania 8026.17 +16.22 +0.20 +13.28

Greece 643.72 -1.65 -0.26 +0.01

Russia 1108.31 -8.98 -0.80 -3.82

South Africa 44198.12 -264.63 -0.60 +0.67

Turkey 87595.59 -169.82 -0.19 +12.10

China 3242.66 +14.00 +0.43 +4.48

India 28750.02 -62.86 -0.22 +7.98

Currencies Latest Prev Local Local

close currency currency

% change % change

in 2017

Czech Rep 27.02 27.01 -0.03 -0.04

Poland 4.32 4.31 -0.12 +2.03

Hungary 307.59 307.43 -0.05 +0.40

Romania 4.51 4.51 -0.02 +0.52

Serbia 123.72 123.82 +0.08 -0.30

Russia 57.96 58.11 +0.26 +5.70

Kazakhstan 312.79 311.79 -0.32 +6.67

Ukraine 27.18 27.04 -0.52 -0.66

South Africa 12.99 13.00 +0.09 +5.71

Kenya 103.05 103.25 +0.19 -0.66

Israel 3.67 3.66 -0.10 +4.96

Turkey 3.61 3.61 -0.12 -2.31

China 6.87 6.87 -0.03 +1.07

India 66.74 66.69 -0.07 +1.81

Brazil 3.11 3.11 -0.00 +4.65

Mexico 19.94 19.90 -0.21 +3.89

Debt Index Strip Spd Chg %Rtn Index

Sov'gn Debt EMBIG 334 -3 .02 7 65.03 1

All data taken from Reuters at 09:51 GMT. Currency percent change calculated from the daily U.S. close at 2130 GMT.

(This article has not been edited by DNA's editorial team and is auto-generated from an agency feed.)

![submenu-img]() Ramesh Awasthi: Kanpur's 'Karma Yogi' - Know inspirational journey of 'common man' devoted for society

Ramesh Awasthi: Kanpur's 'Karma Yogi' - Know inspirational journey of 'common man' devoted for society![submenu-img]() Tovino Thomas accused of stopping his film Vazhakku's release by director Sanal Kumar Sasidharan: 'The agenda of...'

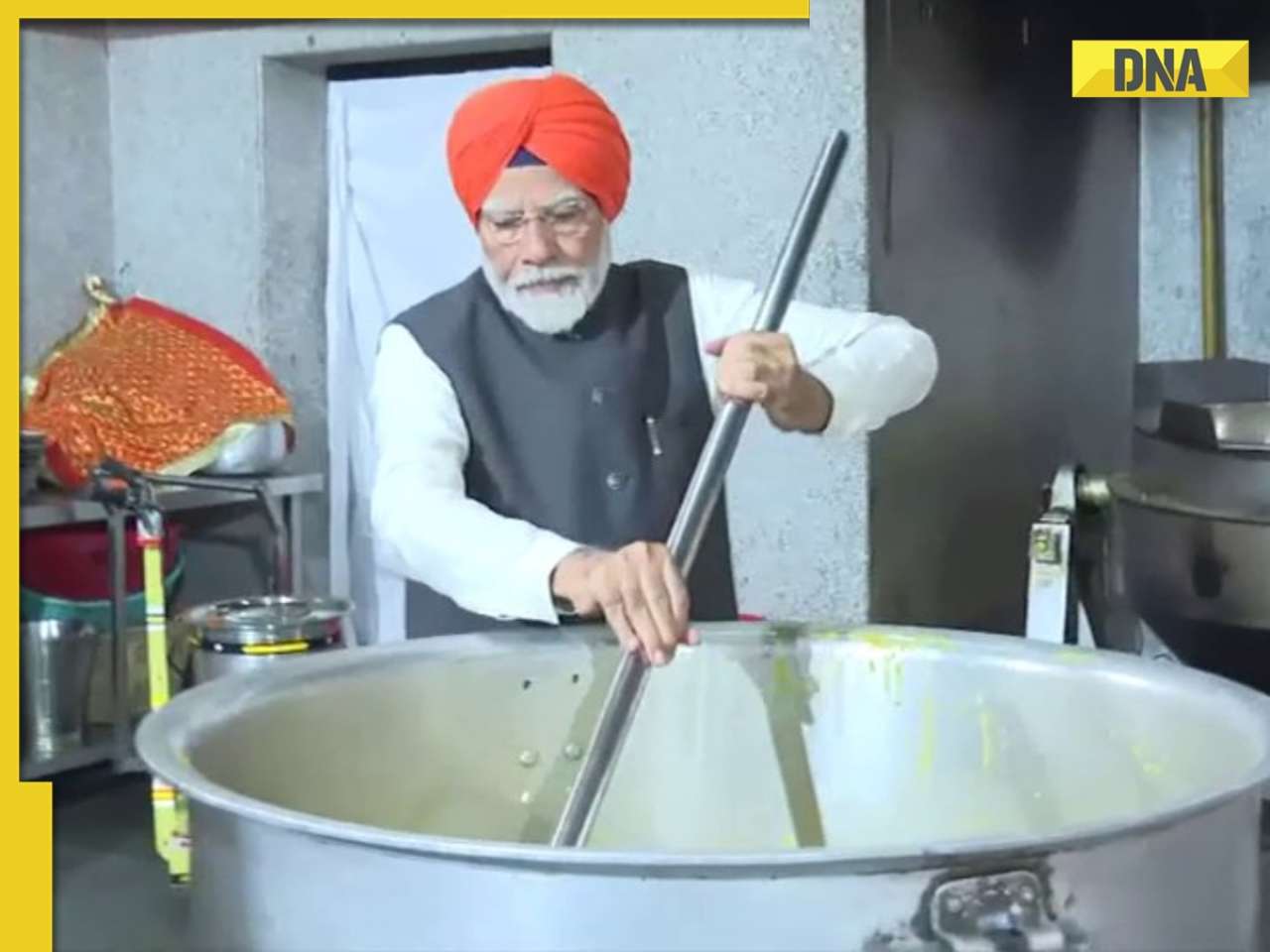

Tovino Thomas accused of stopping his film Vazhakku's release by director Sanal Kumar Sasidharan: 'The agenda of...'![submenu-img]() PM Modi wears turban, serves langar at Gurudwara Patna Sahib in Bihar, watch

PM Modi wears turban, serves langar at Gurudwara Patna Sahib in Bihar, watch![submenu-img]() Anil Ambani’s debt-ridden Reliance’s ‘buyer’ now waits for RBI nod, wants Rs 80000000000…

Anil Ambani’s debt-ridden Reliance’s ‘buyer’ now waits for RBI nod, wants Rs 80000000000…![submenu-img]() Man in bizarre jeans dances to Tinku Jiya in crowded metro, viral video makes internet furious

Man in bizarre jeans dances to Tinku Jiya in crowded metro, viral video makes internet furious![submenu-img]() Maharashtra Board HSC, SSC Results 2024: MSBSHSE class 10, 12 results soon at mahresult.nic.in, latest update here

Maharashtra Board HSC, SSC Results 2024: MSBSHSE class 10, 12 results soon at mahresult.nic.in, latest update here![submenu-img]() Meet IIT-JEE topper who passed JEE Advanced with AIR 1, decided to drop out of IIT due to…

Meet IIT-JEE topper who passed JEE Advanced with AIR 1, decided to drop out of IIT due to…![submenu-img]() Meet IPS Idashisha Nongrang, who became Meghalaya's first woman DGP

Meet IPS Idashisha Nongrang, who became Meghalaya's first woman DGP![submenu-img]() CBSE Results 2024: CBSE Class 10, 12 results date awaited, check latest update here

CBSE Results 2024: CBSE Class 10, 12 results date awaited, check latest update here![submenu-img]() Meet man, who was denied admission in IIT due to blindness, inspiration behind Rajkummar Rao’s film, now owns...

Meet man, who was denied admission in IIT due to blindness, inspiration behind Rajkummar Rao’s film, now owns...![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Remember Harsh Lunia? Just Mohabbat child star, here's how former actor looks now, his wife is Bollywood's popular...

Remember Harsh Lunia? Just Mohabbat child star, here's how former actor looks now, his wife is Bollywood's popular...![submenu-img]() Mother's Day 2024: Bollywood supermoms who balance motherhood, acting, and run multi-crore businesses

Mother's Day 2024: Bollywood supermoms who balance motherhood, acting, and run multi-crore businesses![submenu-img]() Rocky Aur Rani's Golu aka Anjali Anand shocks fans with drastic weight loss without gym, says fitness secret is...

Rocky Aur Rani's Golu aka Anjali Anand shocks fans with drastic weight loss without gym, says fitness secret is...![submenu-img]() In pics: Ram Charan gets mobbed by fans during his visit to Pithapuram for ‘indirect campaign’ for uncle Pawan Kalyan

In pics: Ram Charan gets mobbed by fans during his visit to Pithapuram for ‘indirect campaign’ for uncle Pawan Kalyan![submenu-img]() Streaming This Week: Yodha, Aavesham, Murder In Mahim, Undekhi season 3, latest OTT releases to binge-watch

Streaming This Week: Yodha, Aavesham, Murder In Mahim, Undekhi season 3, latest OTT releases to binge-watch![submenu-img]() Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?

Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() Tovino Thomas accused of stopping his film Vazhakku's release by director Sanal Kumar Sasidharan: 'The agenda of...'

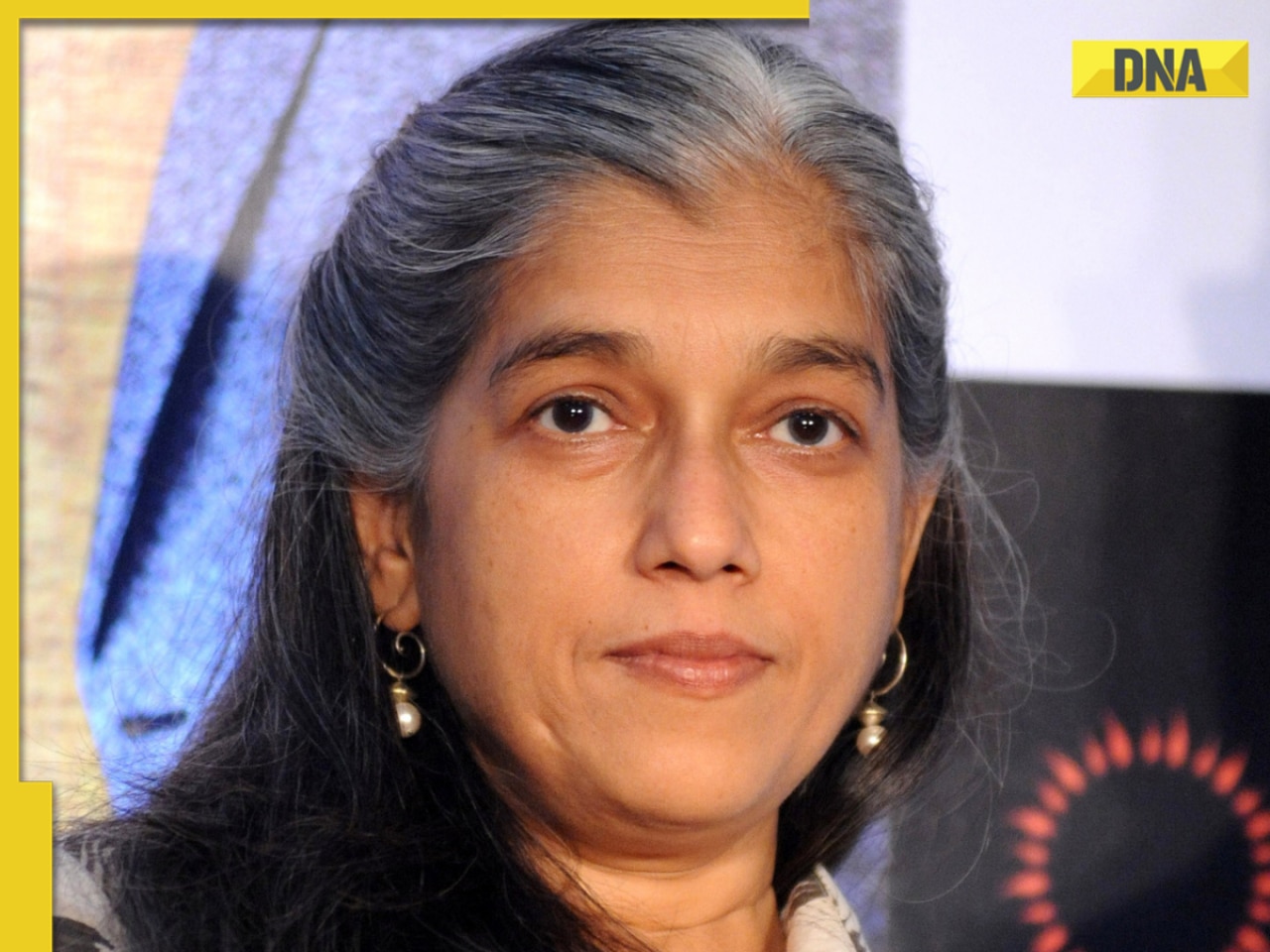

Tovino Thomas accused of stopping his film Vazhakku's release by director Sanal Kumar Sasidharan: 'The agenda of...'![submenu-img]() Ratna Pathak Shah calls Guru Dutt and Bimal Roy's films 'offensive', says, 'women are constantly...'

Ratna Pathak Shah calls Guru Dutt and Bimal Roy's films 'offensive', says, 'women are constantly...'![submenu-img]() Shreyas Talpade recalls how he felt bad when his film Kaun Pravin Tambe did not release in theatres: 'It deserved...'

Shreyas Talpade recalls how he felt bad when his film Kaun Pravin Tambe did not release in theatres: 'It deserved...'![submenu-img]() Anup Soni slams his deepfake video from Crime Patrol, being used to promote IPL betting

Anup Soni slams his deepfake video from Crime Patrol, being used to promote IPL betting![submenu-img]() Real story that inspired Heeramandi: The tawaif who helped Gandhi fight British Raj, was raped, abused, died in...

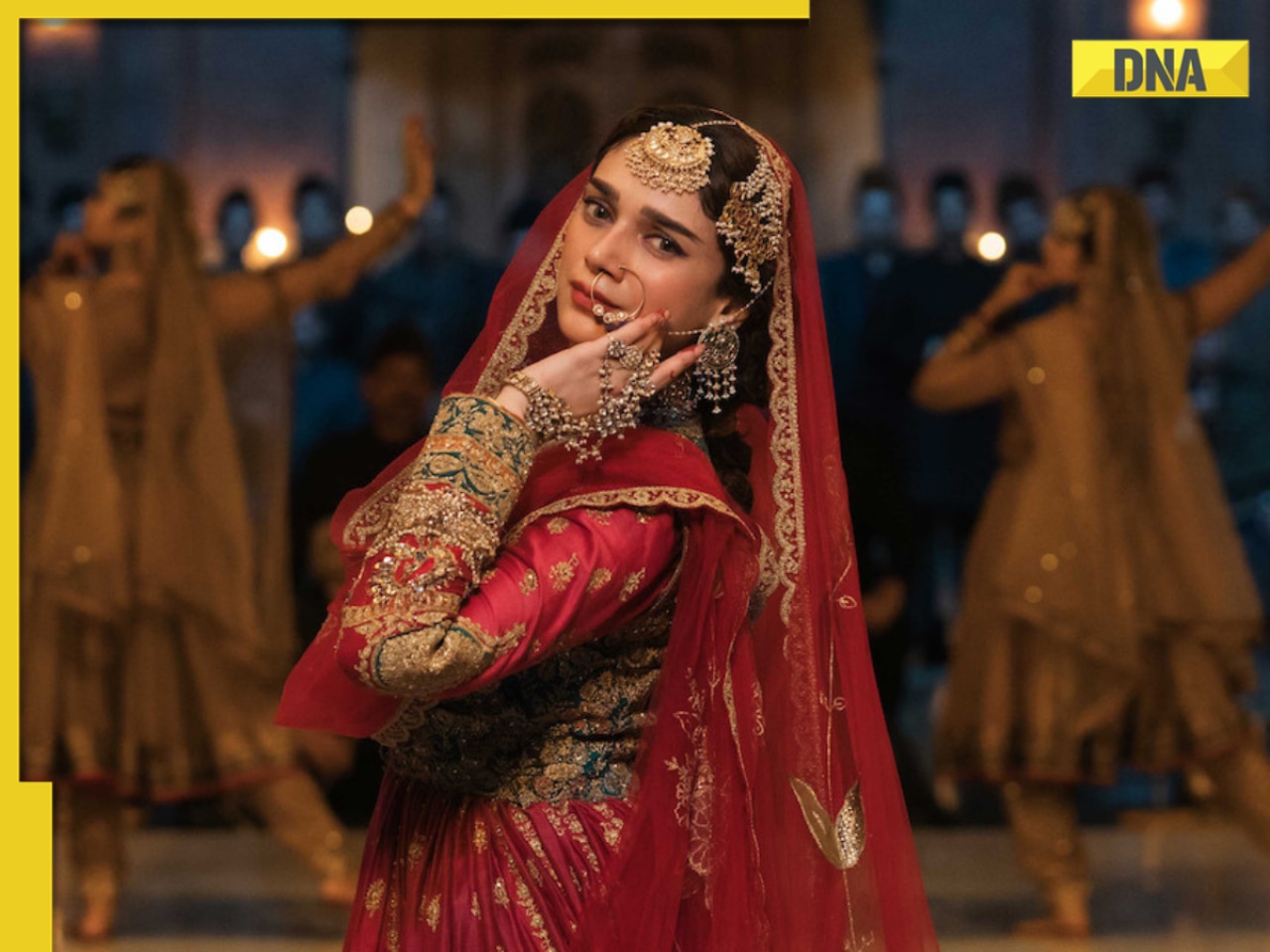

Real story that inspired Heeramandi: The tawaif who helped Gandhi fight British Raj, was raped, abused, died in...![submenu-img]() Man in bizarre jeans dances to Tinku Jiya in crowded metro, viral video makes internet furious

Man in bizarre jeans dances to Tinku Jiya in crowded metro, viral video makes internet furious![submenu-img]() Lift collides with roof in Noida society after brakes fail, 3 injured

Lift collides with roof in Noida society after brakes fail, 3 injured![submenu-img]() Zomato CEO Deepinder Goyal invites employees' moms to office for Mother's Day celebration, watch

Zomato CEO Deepinder Goyal invites employees' moms to office for Mother's Day celebration, watch![submenu-img]() This clip of kind woman feeding rotis to stray cows will bring tears of joy to your eyes, watch

This clip of kind woman feeding rotis to stray cows will bring tears of joy to your eyes, watch![submenu-img]() Viral video: Seagull swallows squirrel whole in single go, internet is stunned

Viral video: Seagull swallows squirrel whole in single go, internet is stunned

)

)

)

)

)

)