New deposit rates of banks for one year has already been revised downwards to 7.5%, which is taxable for savers. Depositors, post-tax, earn 4.75%-5% in returns, barely managing to stay afloat with positive returns against an inflation rate of 5.4%. The RBI's view on inflation by March 2016 is 5.8%.

Since the beginning of the current calendar year, the Reserve Bank of India has undertaken several initiatives to bring down interest rates. It cut the repo by 125 basis points to 6.75% so far. Under repo, banks get funds from the RBI at 6.75% against government securities. The RBI's contention has however, been that banks need to to pass on 60 bps cut to borrowers. The RBI on several occasions have expressed its desire that the entire benefit of repo rate cut need to be passed on but banks have been reluctant as their cost of funds garnered in deposits remain high and they run the risk of a shrinkage in net interest margins. One year deposit rates which averages around 8% need to be brought down before cutting lending rates any further. They did bring down home loan rates to 9.5-9.7% from 10-10.25% after some persuasion from RBI. For any further cuts now on two conditions need to be fulfilled: i) inflation rates need to soften from the present 5.4% and ii) cost of funds raised through deposits need to be re-priced lower.

New deposit rates of banks for one year has already been revised downwards to 7.5%, which is taxable for savers. Depositors, post-tax, earn 4.75%-5% in returns, barely managing to stay afloat with positive returns against an inflation rate of 5.4%. The RBI's view on inflation by March 2016 is 5.8%.

What does a higher inflation mean to savers?

Inflation is a reduction in purchasing power of goods per unit of money. So when inflation is on an upswing, as the case is currently, and if it reaches RBI's estimate of 5.8%, there is every likelihood that bank deposits could yield negative returns. In other words, given the current rate of return on bank deposits, post tax, of 5%, savers were likely to end up with capital erosion.

Risk of bank deposits in a rising inflation rate scenario

There are two factors to bear in mind in such an environment; one, the rate of interest, which is now getting re-priced lower and second, the tax liabilities on interest income. Both the factors go against savers and it would be wise to scout for investments that will yield a gross return of at least 12.5% annually so that post tax, one remains hedged against inflation with a net return of 7.5%.

Options available for investors

Public sector undertakings keep tapping the market with various tax-free bond issues that eventually get listed on the bourses.

About a week ago, the National Highway Authority of India, which comes under the Ministry of Road Transport and Highway, raised Rs 10,000 crore through tax-free bonds of 7.6%. The paper now trades in the secondary market at an yield of 7%.

These tax-free government bonds come handy especially at a time when investments like real estate and gold have been on the decline. However, the only drawback of such investments is the liquidity and the interest received that needs to be re-invested in either a taxable instrument or a tax-free instrument for getting the benefit of compounding. In this case the tax free instruments may not be available all the time to deploy the interest rate earned. Besides exit options may be restricted due to the liquidity factor unless one agrees to a price at a slight discount.

Primary investors certainly stand to gain, more so, in a falling rate scenario where bond prices soars and offsets the interest rate dip thereby pushing up the net asset value. However, most retail investors may not know how to go about liquidating their assets and quite often end up paying a huge cost of liquidation.

Investing in Government bonds

Ten-year government bonds currently offer an yield of 7.77% (7.93% annualised), 30-year gives 8.1% (8.24% annualised) while one year treasury bills return 7% all of which is not feasible when the taxes are factored in along with the current inflation rate.

The above mentioned options are explored only when interest rates are poised downward. In such a scenario capital appreciation comes to the aid and offsets the fall in interest rates which again is largely on account of several factors the key being easing inflation rate and liquidity. The longer the maturity the steeper the price appreciates. Typically fund managers have the wherewithal to predict rate movements.

Options under the present conditions

Given the above mentioned 10-year yield of 7.77%, when compounded, effectively works out to be ~8%. Over a ten-year horizon, Rs 1,00000/- more than doubles to Rs 2,15,900. In the short term, of say three years, the credit quality is good as mutual funds often opt for papers that are high yielding. Fixed income schemes of mutual funds are able to churn portfolios between short and long term depending upon the views on interest rates and generate excess returns.

(Next week: Investing in equity funds)

![submenu-img]() Aamir Khan was unsure if censor board would clear Sarfarosh over mentions of Pakistan, ISI: 'If Advani ji can say...'

Aamir Khan was unsure if censor board would clear Sarfarosh over mentions of Pakistan, ISI: 'If Advani ji can say...'![submenu-img]() Gurucharan Singh missing case: Delhi Police questions TMKOC cast and crew, finds out actor's payments were...

Gurucharan Singh missing case: Delhi Police questions TMKOC cast and crew, finds out actor's payments were...![submenu-img]() 'You all are scaring me': Preity Zinta gets uncomfortable after paps follow her, video goes viral

'You all are scaring me': Preity Zinta gets uncomfortable after paps follow her, video goes viral![submenu-img]() Viral video: Influencer dances with gun in broad daylight on highway, UP Police reacts

Viral video: Influencer dances with gun in broad daylight on highway, UP Police reacts![submenu-img]() Family applauds and cheers as woman sends breakup text, viral video will make you laugh

Family applauds and cheers as woman sends breakup text, viral video will make you laugh![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Mother's Day 2024: Bollywood supermoms who balance motherhood, acting, and run multi-crore businesses

Mother's Day 2024: Bollywood supermoms who balance motherhood, acting, and run multi-crore businesses![submenu-img]() Rocky Aur Rani's Golu aka Anjali Anand shocks fans with drastic weight loss without gym, says fitness secret is...

Rocky Aur Rani's Golu aka Anjali Anand shocks fans with drastic weight loss without gym, says fitness secret is...![submenu-img]() In pics: Ram Charan gets mobbed by fans during his visit to Pithapuram for ‘indirect campaign’ for uncle Pawan Kalyan

In pics: Ram Charan gets mobbed by fans during his visit to Pithapuram for ‘indirect campaign’ for uncle Pawan Kalyan![submenu-img]() Streaming This Week: Yodha, Aavesham, Murder In Mahim, Undekhi season 3, latest OTT releases to binge-watch

Streaming This Week: Yodha, Aavesham, Murder In Mahim, Undekhi season 3, latest OTT releases to binge-watch![submenu-img]() Aamir Khan, Naseeruddin Shah, Sonali Bendre celebrate 25 years of Sarfarosh, attend film's special screening

Aamir Khan, Naseeruddin Shah, Sonali Bendre celebrate 25 years of Sarfarosh, attend film's special screening![submenu-img]() Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?

Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() Aamir Khan was unsure if censor board would clear Sarfarosh over mentions of Pakistan, ISI: 'If Advani ji can say...'

Aamir Khan was unsure if censor board would clear Sarfarosh over mentions of Pakistan, ISI: 'If Advani ji can say...'![submenu-img]() Gurucharan Singh missing case: Delhi Police questions TMKOC cast and crew, finds out actor's payments were...

Gurucharan Singh missing case: Delhi Police questions TMKOC cast and crew, finds out actor's payments were...![submenu-img]() 'You all are scaring me': Preity Zinta gets uncomfortable after paps follow her, video goes viral

'You all are scaring me': Preity Zinta gets uncomfortable after paps follow her, video goes viral![submenu-img]() First Indian film to be insured was released 25 years ago, earned five times its budget, gave Bollywood three stars

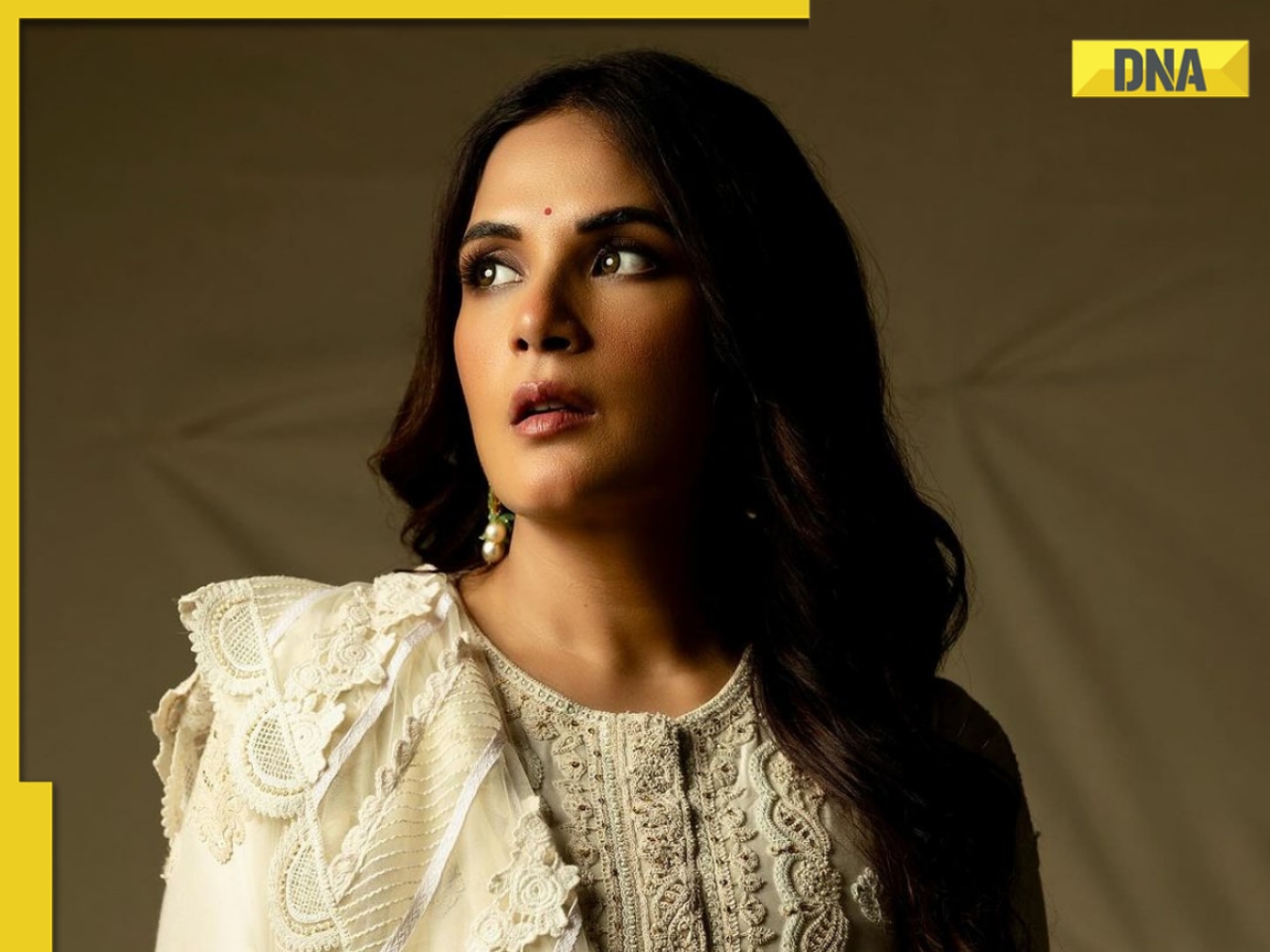

First Indian film to be insured was released 25 years ago, earned five times its budget, gave Bollywood three stars![submenu-img]() Mother’s Day Special: Mom-to-be Richa Chadha talks on motherhood, fixing inequalities for moms in India | Exclusive

Mother’s Day Special: Mom-to-be Richa Chadha talks on motherhood, fixing inequalities for moms in India | Exclusive![submenu-img]() Kolkata Knight Riders become first team to qualify for IPL 2024 playoffs after thumping win over Mumbai Indians

Kolkata Knight Riders become first team to qualify for IPL 2024 playoffs after thumping win over Mumbai Indians![submenu-img]() IPL 2024: This player to lead Delhi Capitals in Rishabh Pant's absence against Royal Challengers Bengaluru

IPL 2024: This player to lead Delhi Capitals in Rishabh Pant's absence against Royal Challengers Bengaluru![submenu-img]() RCB vs DC IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

RCB vs DC IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() CSK vs RR IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

CSK vs RR IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() RCB vs DC IPL 2024 Dream11 prediction: Fantasy cricket tips for Royal Challengers Bengaluru vs Delhi Capitals

RCB vs DC IPL 2024 Dream11 prediction: Fantasy cricket tips for Royal Challengers Bengaluru vs Delhi Capitals![submenu-img]() Viral video: Influencer dances with gun in broad daylight on highway, UP Police reacts

Viral video: Influencer dances with gun in broad daylight on highway, UP Police reacts![submenu-img]() Family applauds and cheers as woman sends breakup text, viral video will make you laugh

Family applauds and cheers as woman sends breakup text, viral video will make you laugh![submenu-img]() Man grabs snake mid-lunge before it strikes his face, terrifying video goes viral

Man grabs snake mid-lunge before it strikes his face, terrifying video goes viral![submenu-img]() Viral video: Man wrestles giant python, internet is scared

Viral video: Man wrestles giant python, internet is scared![submenu-img]() Viral video: Delhi University girls' sizzling dance to Haryanvi song sets the internet ablaze

Viral video: Delhi University girls' sizzling dance to Haryanvi song sets the internet ablaze

)

)

)

)

)

)

)