Stage is set for the launch of a nationwide Goods and Services Tax (GST) at midnight on Friday amid protests from opposition parties who see hardships to small businesses in pushing through the biggest economic reform without preparations.

First proposed in 2003, the idea of GST was bogged down for years in bipartisan debate, with political parties in government trying to push it and those in opposition dragging it down. Before Modi came to power three years ago, his party was not particularly in favour of the GST.

Here's all you need to know

About the event

► Prime Minister Narendra Modi will at midnight unveil the new tax regime replacing overnight the messy mix of more than a dozen state and central levies built up over seven decades, with a one national GST unifying the country's $2 trillion economy and 1.3 billion people into a common market.

► President Pranab Mukherjee, who had originally moved the Constitution Amendment bill for bringing GST way back in 2011 when he was the finance minister in the previous UPA regime, will be present alongside eminent personalities at the historic Central-hall of Parliament.

► Unlike the last midnight event held in 1997 on the occasion of golden jubilee of the Independence at a special session of Parliament, it will be a gala event at the circular -shaped hall that has been loaned for the launch of the historic reform.

► Former Prime Ministers Manmohan Singh and H D Deva Gowda too have been invited.

Who will attend the event

► Opposition parties TMC, Congress and Left see undue haste in the implementation, causing hardships for millions of tiny neighbourhood shops that don't even use a calculator. They have decided to boycott the gala event.

► Walking a tightrope, the JD(U) has left it to its MPs to decide whether they want to attend the GST launch event in Parliament tomorrow or not.

Appeal by Finance Minister Arun Jaitley

► Finance Minister Arun Jaitley has made a last minute appeal to Opposition to reconsider their decision saying the landmark indirect tax reform was a result of a joint decision and they cannot run away from it now.

What is GST?

► GST is a single tax on the supply of goods and services, right from the manufacturer to the consumer.

►Credits of input taxes paid at each stage will be available in the subsequent stage of value addition, which makes GST essentially a tax only on value addition at each stage.

► The final consumer will thus bear only the GST charged by the last dealer in the supply chain, with set-off benefits at all the previous stages.

How will it help

► GST will simplify a web of taxes, regulations and border levies by subsuming an array of central and state levies including excise duty, service tax and VAT.

► It is expected to gradually re-shape India's business landscape, making the world's fastest-growing major economy an easier place to do business.

► GST has been dubbed as the most significant economic reform since BJP government came to power in 2014 and is expected to add as much as 2 percentage points to the GDP growth rate besides raising government revenues by widening the tax net.

Taxation

► Over 1,200 items have been put in four broad tax categories.

► The GST Council finalised four tax rates of 5%, 12%, 18% and 28% to apply on services including telecom, insurance, hotels and restaurants under the biggest tax reform since the Independence.

► The rates are in line with those finalised for goods.

► Unbranded food staples including vegetables, milk, eggs and flour will be exempt from GST, along with health and education services. Tea, edible oils, sugar, textiles and baby formula will attract a 5 per cent tax.

Who are exempt

► Businesses with turnover of up to Rs 20 lakh are exempt from GST and hence registration is not mandatory, traders and manufacturers are preferring to get themselves registered so that the input tax credit can be passed on in the supply chain.

► The 15-digit provisional ID would work as the Goods and Services Taxpayer Identification Number (GSTIN).

How does GST impact businesses?

To remove the cascading effect of taxes, which is currently faced by businesses, GST will allow input tax credit claims at every stage of goods supply. This was not available earlier.

The cost of transportation and storage of goods or logistics cost is also expected to become more affordable as it has been brought under the 5 per cent GST rate instead of the current 15 per cent tax bracket. This should help businesses focus on delivery and better service of goods. To claim tax rebates, businesses will have to source goods from registered vendors. This will help streamline business efficiencies.

(With agency inputs)

![submenu-img]() BMW i5 M60 xDrive launched in India, all-electric sedan priced at Rs 11950000

BMW i5 M60 xDrive launched in India, all-electric sedan priced at Rs 11950000![submenu-img]() This superstar was arrested several times by age 17, thrown out of home, once had just Rs 250, now worth Rs 6600 crore

This superstar was arrested several times by age 17, thrown out of home, once had just Rs 250, now worth Rs 6600 crore![submenu-img]() Meet Reliance’s highest paid employee, gets over Rs 240000000 salary, he is Mukesh Ambani’s…

Meet Reliance’s highest paid employee, gets over Rs 240000000 salary, he is Mukesh Ambani’s… ![submenu-img]() Meet lesser-known relative of Mukesh Ambani, Anil Ambani, has worked with BCCI, he is married to...

Meet lesser-known relative of Mukesh Ambani, Anil Ambani, has worked with BCCI, he is married to...![submenu-img]() Made in just Rs 95,000, this film was a superhit, but destroyed lead actress' career, saw controversy over bold scenes

Made in just Rs 95,000, this film was a superhit, but destroyed lead actress' career, saw controversy over bold scenes![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() In pics: Arti Singh stuns in red lehenga as she ties the knot with beau Dipak Chauhan in dreamy wedding

In pics: Arti Singh stuns in red lehenga as she ties the knot with beau Dipak Chauhan in dreamy wedding![submenu-img]() Actors who died due to cosmetic surgeries

Actors who died due to cosmetic surgeries![submenu-img]() See inside pics: Malayalam star Aparna Das' dreamy wedding with Manjummel Boys actor Deepak Parambol

See inside pics: Malayalam star Aparna Das' dreamy wedding with Manjummel Boys actor Deepak Parambol ![submenu-img]() In pics: Salman Khan, Alia Bhatt, Rekha, Neetu Kapoor attend grand premiere of Sanjay Leela Bhansali's Heeramandi

In pics: Salman Khan, Alia Bhatt, Rekha, Neetu Kapoor attend grand premiere of Sanjay Leela Bhansali's Heeramandi![submenu-img]() Streaming This Week: Crakk, Tillu Square, Ranneeti, Dil Dosti Dilemma, latest OTT releases to binge-watch

Streaming This Week: Crakk, Tillu Square, Ranneeti, Dil Dosti Dilemma, latest OTT releases to binge-watch![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence

DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence![submenu-img]() DNA Explainer: What is India's stand amid Iran-Israel conflict?

DNA Explainer: What is India's stand amid Iran-Israel conflict?![submenu-img]() This superstar was arrested several times by age 17, thrown out of home, once had just Rs 250, now worth Rs 6600 crore

This superstar was arrested several times by age 17, thrown out of home, once had just Rs 250, now worth Rs 6600 crore![submenu-img]() Made in just Rs 95,000, this film was a superhit, but destroyed lead actress' career, saw controversy over bold scenes

Made in just Rs 95,000, this film was a superhit, but destroyed lead actress' career, saw controversy over bold scenes![submenu-img]() Meet 72-year-old who earns Rs 280 cr per film, Asia's highest-paid actor, bigger than Shah Rukh, Salman, Akshay, Prabhas

Meet 72-year-old who earns Rs 280 cr per film, Asia's highest-paid actor, bigger than Shah Rukh, Salman, Akshay, Prabhas![submenu-img]() This star, who once lived in chawl, worked as tailor, later gave four Rs 200-crore films; he's now worth...

This star, who once lived in chawl, worked as tailor, later gave four Rs 200-crore films; he's now worth...![submenu-img]() Tamil star Prasanna reveals why he chose series Ranneeti for Hindi debut: 'Getting into Bollywood is not...'

Tamil star Prasanna reveals why he chose series Ranneeti for Hindi debut: 'Getting into Bollywood is not...'![submenu-img]() IPL 2024: Virat Kohli, Rajat Patidar fifties and disciplined bowling help RCB beat Sunrisers Hyderabad by 35 runs

IPL 2024: Virat Kohli, Rajat Patidar fifties and disciplined bowling help RCB beat Sunrisers Hyderabad by 35 runs![submenu-img]() 'This is the problem in India...': Wasim Akram's blunt take on fans booing Mumbai Indians skipper Hardik Pandya

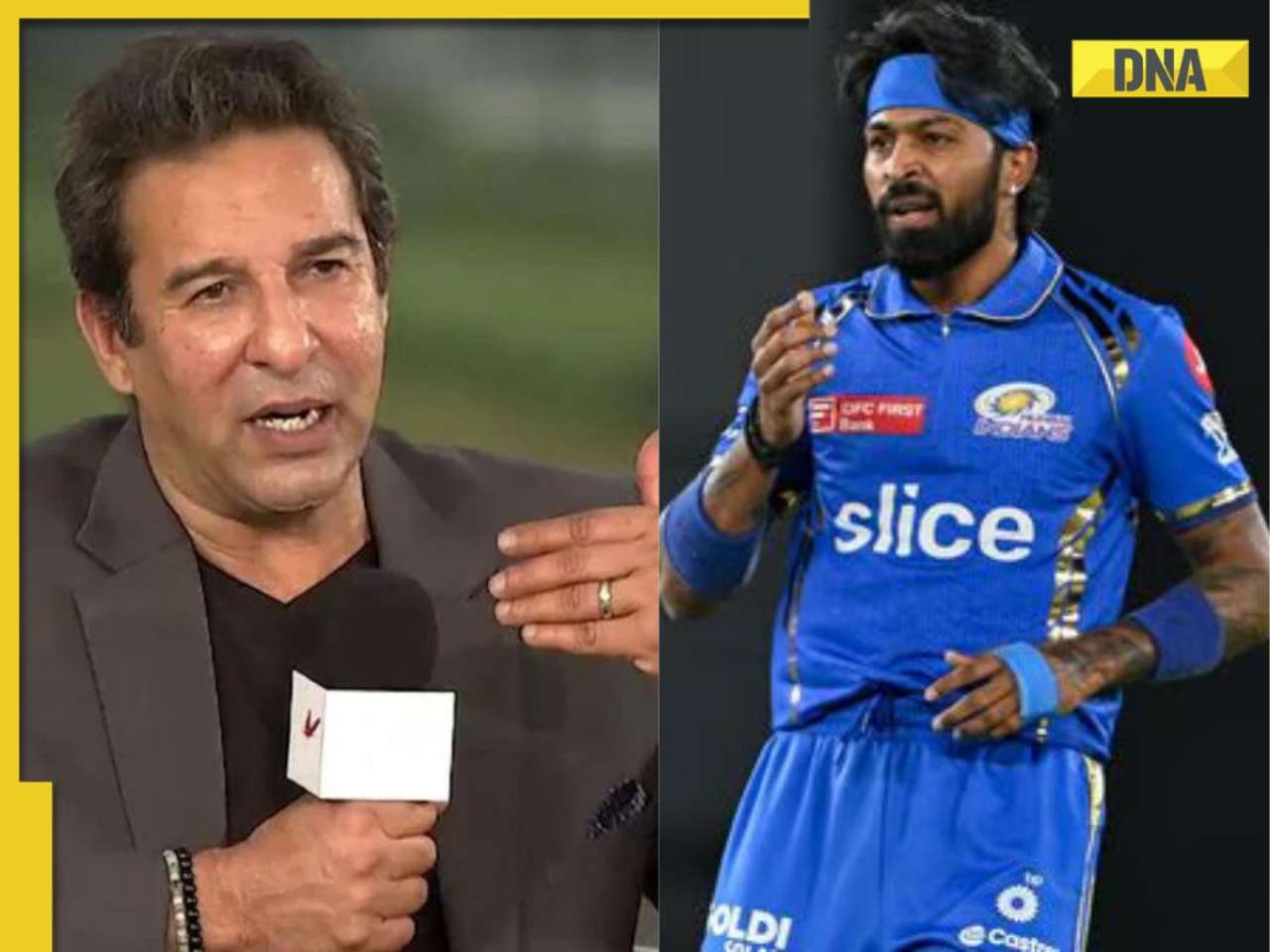

'This is the problem in India...': Wasim Akram's blunt take on fans booing Mumbai Indians skipper Hardik Pandya![submenu-img]() KKR vs PBKS, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

KKR vs PBKS, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() KKR vs PBKS IPL 2024 Dream11 prediction: Fantasy cricket tips for Kolkata Knight Riders vs Punjab Kings

KKR vs PBKS IPL 2024 Dream11 prediction: Fantasy cricket tips for Kolkata Knight Riders vs Punjab Kings![submenu-img]() IPL 2024: KKR star Rinku Singh finally gets another bat from Virat Kohli after breaking previous one - Watch

IPL 2024: KKR star Rinku Singh finally gets another bat from Virat Kohli after breaking previous one - Watch![submenu-img]() Viral video: Teacher's cute way to capture happy student faces melts internet, watch

Viral video: Teacher's cute way to capture happy student faces melts internet, watch![submenu-img]() Woman attends online meeting on scooter while stuck in traffic, video goes viral

Woman attends online meeting on scooter while stuck in traffic, video goes viral![submenu-img]() Viral video: Pilot proposes to flight attendant girlfriend before takeoff, internet hearts it

Viral video: Pilot proposes to flight attendant girlfriend before takeoff, internet hearts it![submenu-img]() Pakistani teen receives life-saving heart transplant from Indian donor, details here

Pakistani teen receives life-saving heart transplant from Indian donor, details here![submenu-img]() Viral video: Truck driver's innovative solution to beat the heat impresses internet, watch

Viral video: Truck driver's innovative solution to beat the heat impresses internet, watch

)

)

)

)

)

)

)

)

)