The government has not given any official figure on how much revenues they would be able to collect from customs duty hike, but unofficial estimate puts it at close to around Rs 20,000 crore

After close inspection of the customs duty hike on some items in the Budget, importers and experts do not see the move furthering domestic manufacturing in the medium term.

They believe it could have been done for the twin purpose of shoring up government revenues and conveying a firm economic message to China – with whom relations are currently not the best – that India could go the same path as the US to hurt it economically.

"I was surprised at the explanation given (by finance minister Arun Jaitley) that this (raising customs duty) was being done to encourage manufacturing in India. Many of the products are branded and if someone wants to manufacture it locally, it would be a long process and would need huge scale. I will not set up a factory for tax rate arbitrage because what if that goes, then I will have to close down my factory. Therefore, I will wait and watch and see if this is a consistent policy," said an importer, who did not want to be named.

He, however, said that, in the long run, it was possible that the tax arbitrage accrued from a higher customs duty may promote domestic production. But that again, according to him, would need to be backed by a huge scale to make it viable.

Giving the example of footwear, he said China produced two lakh pairs of Nike per day in just one factory, which is then exported to various markets across the world. Of these, 5,000 pairs came to India.

"For footwear, you need gigantic volumes to make a factory viable. So, (Indian) manufacturers will have to set up gigantic factories. In China, one of factories where Nike manufactures footwear has a capacity to manufacture two lakh pairs per day. These are exported to various markets across the world. Of that, 5,000 pairs come to India. Will Nike set up a factory in India if customs duty is high to make 5,000 pairs per day? Not immediately. For now, people will have to pay more (for Nike shoes)," he said.

Footwear brands Nike, Adidas and Reebok have already announced a price hike after the Budget.

"This could have happened primarily to garner more revenues. Secondly, there are some of the products, where the customs have increased to essentially hit China economically. Quite a few products are typically Chinese imports into India, which the government now wants to be protectionist about because diplomatic relations with China has not been too great. They (government) want to convey a message to China that we can make it difficult for you to do business in India like the US," he said.

M S Mani, partner, Deloitte India, concurred with the importer's view.

"The customs duty increases made by the Union Budget would shore up the revenue collections for the year, which have been under pressure on account of less than expected goods and services tax (GST) revenues. Some of the products where the customs duties have been increased are associated with foreign brands, whose domestic market size may not be sufficient to justify manufacturing in India," he said.

The government has not given any official figure on how much revenues they would be able to collect from customs duty hike, but unofficial estimate puts it at close to around Rs 20,000 crore.

Some of the China-sensitive products that have seen an increase in customs duty in the Budget are silica used for telecom and optic fibre cables (up from nil to 5%), printed circuit boards used in mobile phone chargers (up from nil to 10%), assembly panel for LCD and LED TV (up from nil to 10%), tyres (up from 10% to 15%), footwear (up from 10% to 20%) and parts & accessories of mobile phones (up from 7.5% to 15%).

There are two types items on which customs have been raised. One, items such as components of cellular mobile phones, LCD and LED panel and others, for which there are no producers in India who have the technology to manufacture them. These have to be mostly imported. The other is items like perfumes, footwear, furniture, sunglasses and others that available locally but their premium brands are imported.

India's trade surplus with China, which has only been widening in favour of our neighbour over time, has been a cause of worry with the government.

Brahma Chellany, analyst of international geostrategic trends, in his recent tweet said it had doubled to Rs 500 crore a month from less than Rs 250 crore a month in 2014.

"After taking over India's top electronic payment firm Paytm, China's Alibaba gains control of India's top online grocer BigBasket. Meanwhile, China's trade surplus with India has jumped from less than Rs2.5 billion a month in 2014 to Rs5 billion a month," he tweeted.

THE CLAMPDOWN

- Silica used for cables – up from nil to 5%

- Printed circuit boards – up from nil to 10%

- Assembly panel for LCD – up from nil to 10%

![submenu-img]() BMW i5 M60 xDrive launched in India, all-electric sedan priced at Rs 11950000

BMW i5 M60 xDrive launched in India, all-electric sedan priced at Rs 11950000![submenu-img]() This superstar was arrested several times by age 17, thrown out of home, once had just Rs 250, now worth Rs 6600 crore

This superstar was arrested several times by age 17, thrown out of home, once had just Rs 250, now worth Rs 6600 crore![submenu-img]() Meet Reliance’s highest paid employee, gets over Rs 240000000 salary, he is Mukesh Ambani’s…

Meet Reliance’s highest paid employee, gets over Rs 240000000 salary, he is Mukesh Ambani’s… ![submenu-img]() Meet lesser-known relative of Mukesh Ambani, Anil Ambani, has worked with BCCI, he is married to...

Meet lesser-known relative of Mukesh Ambani, Anil Ambani, has worked with BCCI, he is married to...![submenu-img]() Made in just Rs 95,000, this film was a superhit, but destroyed lead actress' career, saw controversy over bold scenes

Made in just Rs 95,000, this film was a superhit, but destroyed lead actress' career, saw controversy over bold scenes![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() In pics: Arti Singh stuns in red lehenga as she ties the knot with beau Dipak Chauhan in dreamy wedding

In pics: Arti Singh stuns in red lehenga as she ties the knot with beau Dipak Chauhan in dreamy wedding![submenu-img]() Actors who died due to cosmetic surgeries

Actors who died due to cosmetic surgeries![submenu-img]() See inside pics: Malayalam star Aparna Das' dreamy wedding with Manjummel Boys actor Deepak Parambol

See inside pics: Malayalam star Aparna Das' dreamy wedding with Manjummel Boys actor Deepak Parambol ![submenu-img]() In pics: Salman Khan, Alia Bhatt, Rekha, Neetu Kapoor attend grand premiere of Sanjay Leela Bhansali's Heeramandi

In pics: Salman Khan, Alia Bhatt, Rekha, Neetu Kapoor attend grand premiere of Sanjay Leela Bhansali's Heeramandi![submenu-img]() Streaming This Week: Crakk, Tillu Square, Ranneeti, Dil Dosti Dilemma, latest OTT releases to binge-watch

Streaming This Week: Crakk, Tillu Square, Ranneeti, Dil Dosti Dilemma, latest OTT releases to binge-watch![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence

DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence![submenu-img]() DNA Explainer: What is India's stand amid Iran-Israel conflict?

DNA Explainer: What is India's stand amid Iran-Israel conflict?![submenu-img]() This superstar was arrested several times by age 17, thrown out of home, once had just Rs 250, now worth Rs 6600 crore

This superstar was arrested several times by age 17, thrown out of home, once had just Rs 250, now worth Rs 6600 crore![submenu-img]() Made in just Rs 95,000, this film was a superhit, but destroyed lead actress' career, saw controversy over bold scenes

Made in just Rs 95,000, this film was a superhit, but destroyed lead actress' career, saw controversy over bold scenes![submenu-img]() Meet 72-year-old who earns Rs 280 cr per film, Asia's highest-paid actor, bigger than Shah Rukh, Salman, Akshay, Prabhas

Meet 72-year-old who earns Rs 280 cr per film, Asia's highest-paid actor, bigger than Shah Rukh, Salman, Akshay, Prabhas![submenu-img]() This star, who once lived in chawl, worked as tailor, later gave four Rs 200-crore films; he's now worth...

This star, who once lived in chawl, worked as tailor, later gave four Rs 200-crore films; he's now worth...![submenu-img]() Tamil star Prasanna reveals why he chose series Ranneeti for Hindi debut: 'Getting into Bollywood is not...'

Tamil star Prasanna reveals why he chose series Ranneeti for Hindi debut: 'Getting into Bollywood is not...'![submenu-img]() IPL 2024: Virat Kohli, Rajat Patidar fifties and disciplined bowling help RCB beat Sunrisers Hyderabad by 35 runs

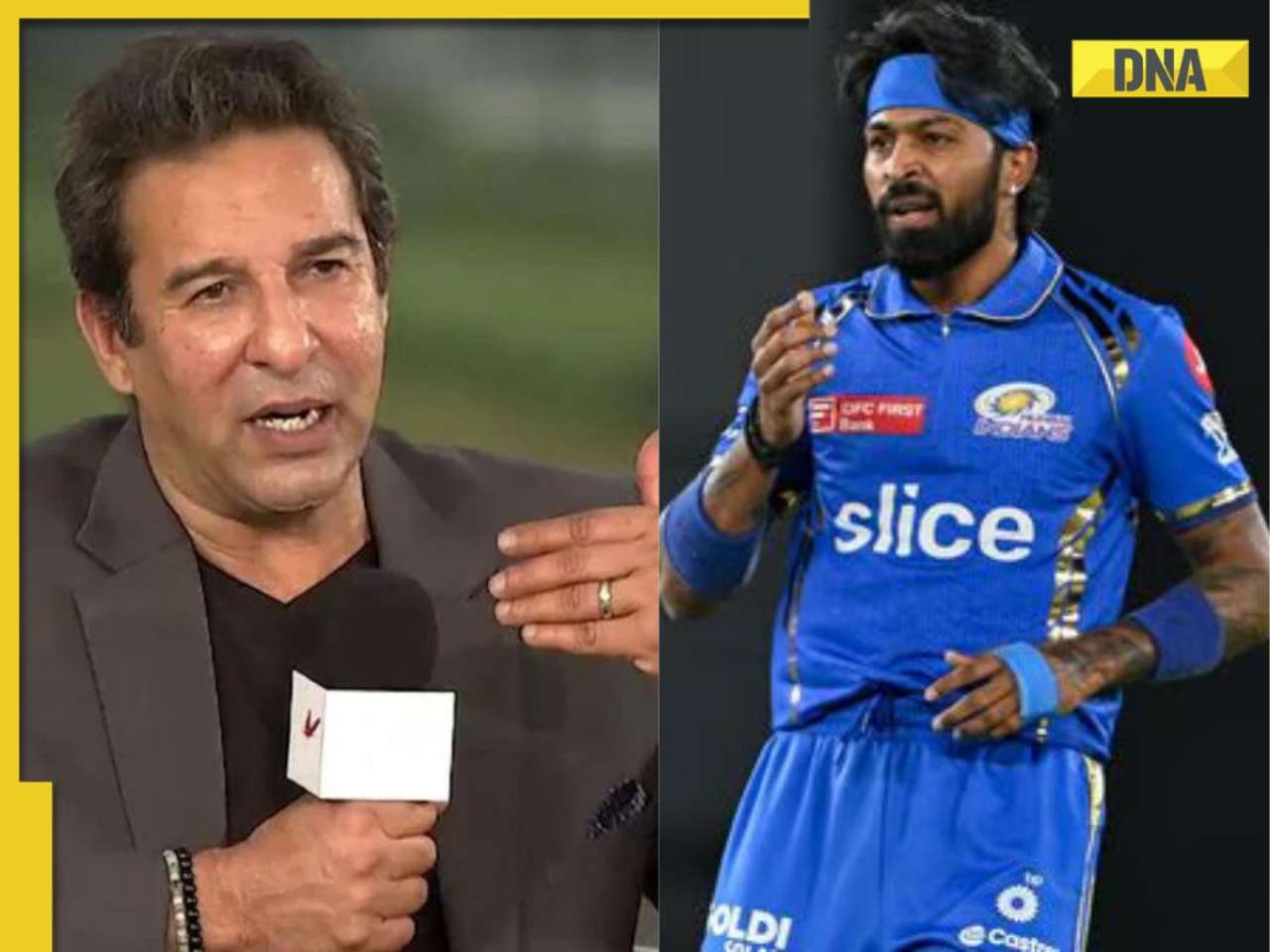

IPL 2024: Virat Kohli, Rajat Patidar fifties and disciplined bowling help RCB beat Sunrisers Hyderabad by 35 runs![submenu-img]() 'This is the problem in India...': Wasim Akram's blunt take on fans booing Mumbai Indians skipper Hardik Pandya

'This is the problem in India...': Wasim Akram's blunt take on fans booing Mumbai Indians skipper Hardik Pandya![submenu-img]() KKR vs PBKS, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

KKR vs PBKS, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() KKR vs PBKS IPL 2024 Dream11 prediction: Fantasy cricket tips for Kolkata Knight Riders vs Punjab Kings

KKR vs PBKS IPL 2024 Dream11 prediction: Fantasy cricket tips for Kolkata Knight Riders vs Punjab Kings![submenu-img]() IPL 2024: KKR star Rinku Singh finally gets another bat from Virat Kohli after breaking previous one - Watch

IPL 2024: KKR star Rinku Singh finally gets another bat from Virat Kohli after breaking previous one - Watch![submenu-img]() Viral video: Teacher's cute way to capture happy student faces melts internet, watch

Viral video: Teacher's cute way to capture happy student faces melts internet, watch![submenu-img]() Woman attends online meeting on scooter while stuck in traffic, video goes viral

Woman attends online meeting on scooter while stuck in traffic, video goes viral![submenu-img]() Viral video: Pilot proposes to flight attendant girlfriend before takeoff, internet hearts it

Viral video: Pilot proposes to flight attendant girlfriend before takeoff, internet hearts it![submenu-img]() Pakistani teen receives life-saving heart transplant from Indian donor, details here

Pakistani teen receives life-saving heart transplant from Indian donor, details here![submenu-img]() Viral video: Truck driver's innovative solution to beat the heat impresses internet, watch

Viral video: Truck driver's innovative solution to beat the heat impresses internet, watch

)

)

)

)

)

)

)