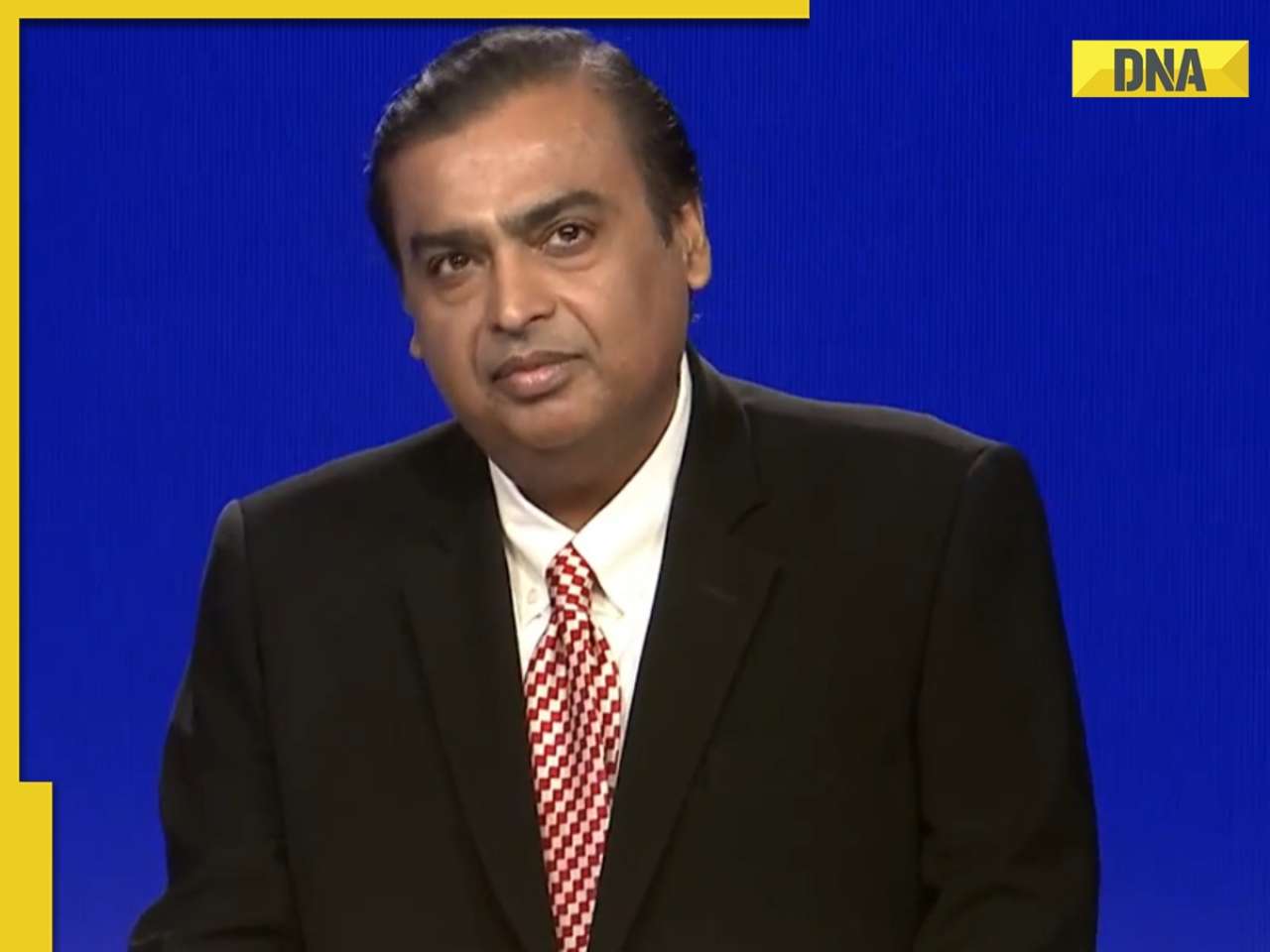

Anil Ambani’s Reliance Capital's lenders said the company will have to pay them Rs 9,650 crore by the said date.

Anil Ambani, the younger brother of India’s richest man Mukesh Ambani, has been trending in the news for the past few weeks due to his massive deals. While the shares of Reliance Power continue to give returns through the stock market, Anil Ambani’s debt-ridden Reliance Capital struck an acquisition deal with Hinduja Group’s IndusInd International Holdings (IIHL). Anil Ambani’s Reliance Capital secured a buyout offer of Rs 9650 crore from Hinduja Group a few months ago. As per the reports, Hinduja Group is in talks to borrow Rs 8000 crore to acquire Anil Ambani’s Reliance Capital under the bankruptcy code. Now concerned over slow progress, the lenders of debt-ridden Reliance Capital (RCAP) have asked IIHL to expedite the process of obtaining necessary regulatory approvals and stick to the resolution plan deadline of May 27.

In a meeting with senior officials of IIHL, lenders to Anil Ambani’s Reliance said the company will have to pay them Rs 9,650 crore by the said date, a source said. It is noteworthy that the National Company Law Tribunal (NCLT), Mumbai, while approving the resolution plan on February 27, had directed IIHL to implement the resolution plan within 90 days i.e. by May 27. As per the approved resolution plan, IIHL will have to make an upfront payment of R 9,650 crore to the RCAP lenders.

According to sources, lenders expressed concern over the slow progress towards implementation of the RCAP resolution plan, as IIHL is yet to receive key IRDAI approvals on the resolution plan. IRDAI has raised several questions and concerns over the proposed corporate structure to transfer RCAP's insurance businesses to IIHL, and the company has not yet addressed those concerns.

IRDAI's approval is crucial for the transfer of insurance businesses of Reliance Capital i.e. Reliance General Insurance and Reliance Nippon Life Insurance to IIHL. The RBI approval for transfer of RCAP business to IIHL also expires on May 17. The approval given on 17 November was valid only for a period of six months.

In November 2021, the Reserve Bank superseded the board of Reliance Capital on governance issues and payment defaults by the Anil Dhirubhai Ambani Group company. The central bank had appointed Nageswara Rao Y as the administrator, who invited bids in February 2022 to take over the company.

(with inputs from PTI)

![submenu-img]() Ramesh Awasthi: Kanpur's 'Karma Yogi' - Know inspirational journey of 'common man' devoted for society

Ramesh Awasthi: Kanpur's 'Karma Yogi' - Know inspirational journey of 'common man' devoted for society![submenu-img]() Tovino Thomas accused of stopping his film Vazhakku's release by director Sanal Kumar Sasidharan: 'The agenda of...'

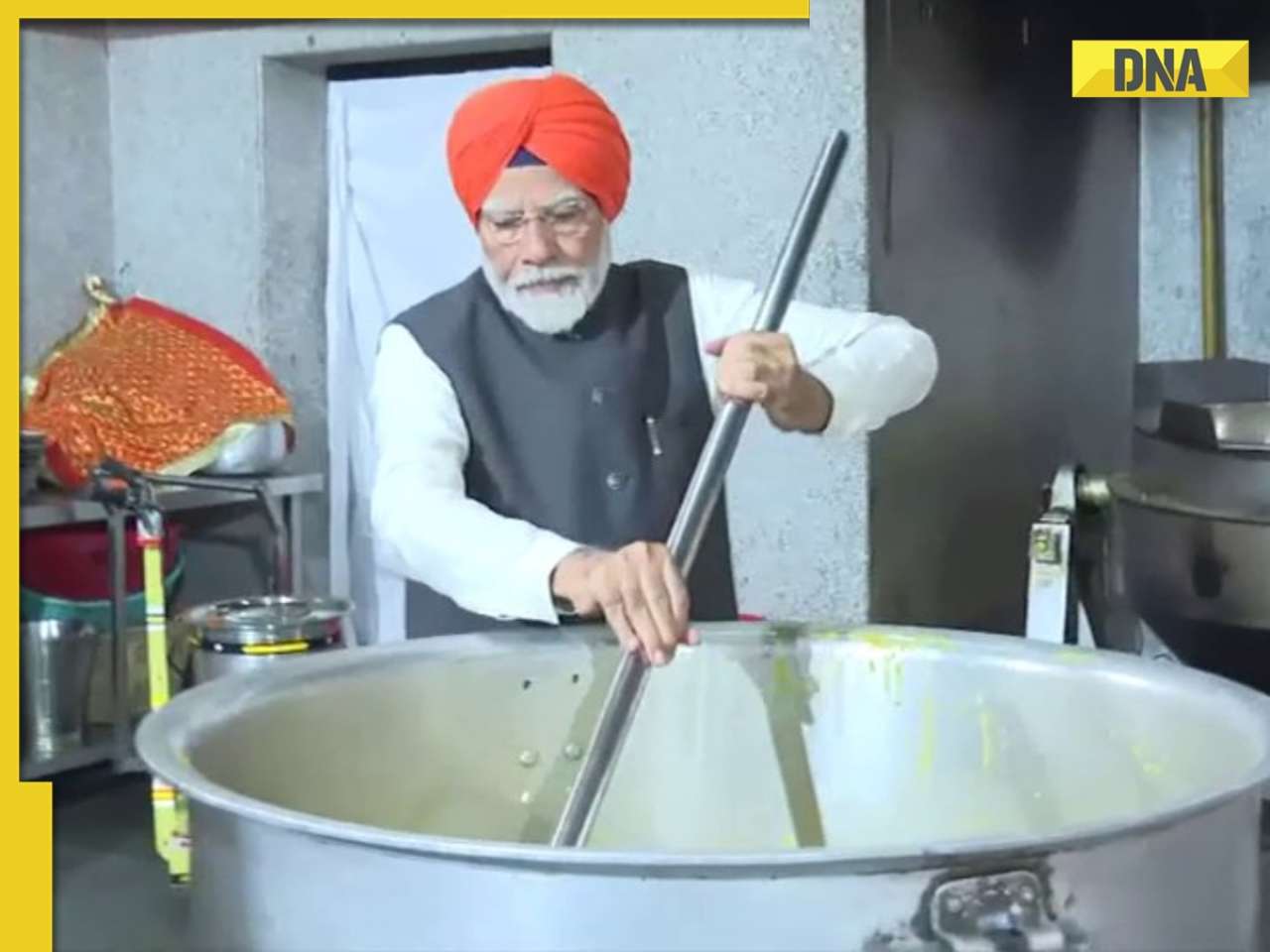

Tovino Thomas accused of stopping his film Vazhakku's release by director Sanal Kumar Sasidharan: 'The agenda of...'![submenu-img]() PM Modi wears turban, serves langar at Gurudwara Patna Sahib in Bihar, watch

PM Modi wears turban, serves langar at Gurudwara Patna Sahib in Bihar, watch![submenu-img]() Anil Ambani’s debt-ridden Reliance’s ‘buyer’ now waits for RBI nod, wants Rs 80000000000…

Anil Ambani’s debt-ridden Reliance’s ‘buyer’ now waits for RBI nod, wants Rs 80000000000…![submenu-img]() Man in bizarre jeans dances to Tinku Jiya in crowded metro, viral video makes internet furious

Man in bizarre jeans dances to Tinku Jiya in crowded metro, viral video makes internet furious![submenu-img]() Maharashtra Board HSC, SSC Results 2024: MSBSHSE class 10, 12 results soon at mahresult.nic.in, latest update here

Maharashtra Board HSC, SSC Results 2024: MSBSHSE class 10, 12 results soon at mahresult.nic.in, latest update here![submenu-img]() Meet IIT-JEE topper who passed JEE Advanced with AIR 1, decided to drop out of IIT due to…

Meet IIT-JEE topper who passed JEE Advanced with AIR 1, decided to drop out of IIT due to…![submenu-img]() Meet IPS Idashisha Nongrang, who became Meghalaya's first woman DGP

Meet IPS Idashisha Nongrang, who became Meghalaya's first woman DGP![submenu-img]() CBSE Results 2024: CBSE Class 10, 12 results date awaited, check latest update here

CBSE Results 2024: CBSE Class 10, 12 results date awaited, check latest update here![submenu-img]() Meet man, who was denied admission in IIT due to blindness, inspiration behind Rajkummar Rao’s film, now owns...

Meet man, who was denied admission in IIT due to blindness, inspiration behind Rajkummar Rao’s film, now owns...![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Remember Harsh Lunia? Just Mohabbat child star, here's how former actor looks now, his wife is Bollywood's popular...

Remember Harsh Lunia? Just Mohabbat child star, here's how former actor looks now, his wife is Bollywood's popular...![submenu-img]() Mother's Day 2024: Bollywood supermoms who balance motherhood, acting, and run multi-crore businesses

Mother's Day 2024: Bollywood supermoms who balance motherhood, acting, and run multi-crore businesses![submenu-img]() Rocky Aur Rani's Golu aka Anjali Anand shocks fans with drastic weight loss without gym, says fitness secret is...

Rocky Aur Rani's Golu aka Anjali Anand shocks fans with drastic weight loss without gym, says fitness secret is...![submenu-img]() In pics: Ram Charan gets mobbed by fans during his visit to Pithapuram for ‘indirect campaign’ for uncle Pawan Kalyan

In pics: Ram Charan gets mobbed by fans during his visit to Pithapuram for ‘indirect campaign’ for uncle Pawan Kalyan![submenu-img]() Streaming This Week: Yodha, Aavesham, Murder In Mahim, Undekhi season 3, latest OTT releases to binge-watch

Streaming This Week: Yodha, Aavesham, Murder In Mahim, Undekhi season 3, latest OTT releases to binge-watch![submenu-img]() Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?

Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() Tovino Thomas accused of stopping his film Vazhakku's release by director Sanal Kumar Sasidharan: 'The agenda of...'

Tovino Thomas accused of stopping his film Vazhakku's release by director Sanal Kumar Sasidharan: 'The agenda of...'![submenu-img]() Ratna Pathak Shah calls Guru Dutt and Bimal Roy's films 'offensive', says, 'women are constantly...'

Ratna Pathak Shah calls Guru Dutt and Bimal Roy's films 'offensive', says, 'women are constantly...'![submenu-img]() Shreyas Talpade recalls how he felt bad when his film Kaun Pravin Tambe did not release in theatres: 'It deserved...'

Shreyas Talpade recalls how he felt bad when his film Kaun Pravin Tambe did not release in theatres: 'It deserved...'![submenu-img]() Anup Soni slams his deepfake video from Crime Patrol, being used to promote IPL betting

Anup Soni slams his deepfake video from Crime Patrol, being used to promote IPL betting![submenu-img]() Real story that inspired Heeramandi: The tawaif who helped Gandhi fight British Raj, was raped, abused, died in...

Real story that inspired Heeramandi: The tawaif who helped Gandhi fight British Raj, was raped, abused, died in...![submenu-img]() Man in bizarre jeans dances to Tinku Jiya in crowded metro, viral video makes internet furious

Man in bizarre jeans dances to Tinku Jiya in crowded metro, viral video makes internet furious![submenu-img]() Lift collides with roof in Noida society after brakes fail, 3 injured

Lift collides with roof in Noida society after brakes fail, 3 injured![submenu-img]() Zomato CEO Deepinder Goyal invites employees' moms to office for Mother's Day celebration, watch

Zomato CEO Deepinder Goyal invites employees' moms to office for Mother's Day celebration, watch![submenu-img]() This clip of kind woman feeding rotis to stray cows will bring tears of joy to your eyes, watch

This clip of kind woman feeding rotis to stray cows will bring tears of joy to your eyes, watch![submenu-img]() Viral video: Seagull swallows squirrel whole in single go, internet is stunned

Viral video: Seagull swallows squirrel whole in single go, internet is stunned

)

)

)

)

)

)

)